Rising Inflation in Singapore March 22, 2022

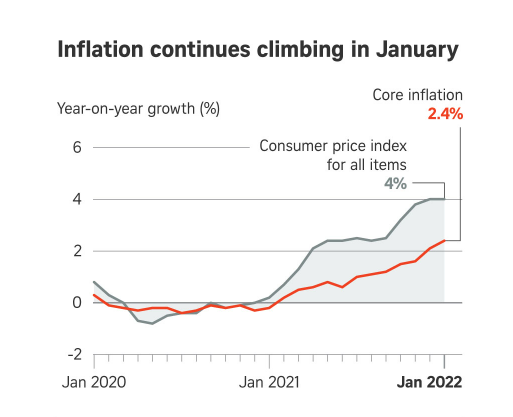

Core inflation in Singapore in January 2022 was reported to have increased to 2.4 per cent on a year-on-year basis. This is the highest level of core inflation seen in Singapore for more than nine years.

Core inflation excludes private transport and accommodation costs as these tend to be more volatile due to policy changes.

The Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI) have said that the higher core inflation was due to rapidly rising prices of food, electricity and gas and a slower rate of decline in the prices of other goods, such as retail items.

Core inflation in December 2021 also registered an increase on a year-on-year basis, to 2.1 per cent up from 1.6 per cent in November 2021.

Data released by MAS and MTI showed that this was largely due to a sharp increase in the costs of services, especially the increase in airfares which is due to the higher costs of travel on Vaccinated Travel Lanes (VTLs).

Headline, or overall inflation, which is measured by the Consumer Price Index (CPI), increased from 3.8 per cent in November 2021, to 4 per cent in December 2021, which is the highest level of overall inflation since February 2013 at 4.9 per cent. There was no change to headline inflation in January 2022, when it remained at 4 percent.

Response from MAS and the S$NEER

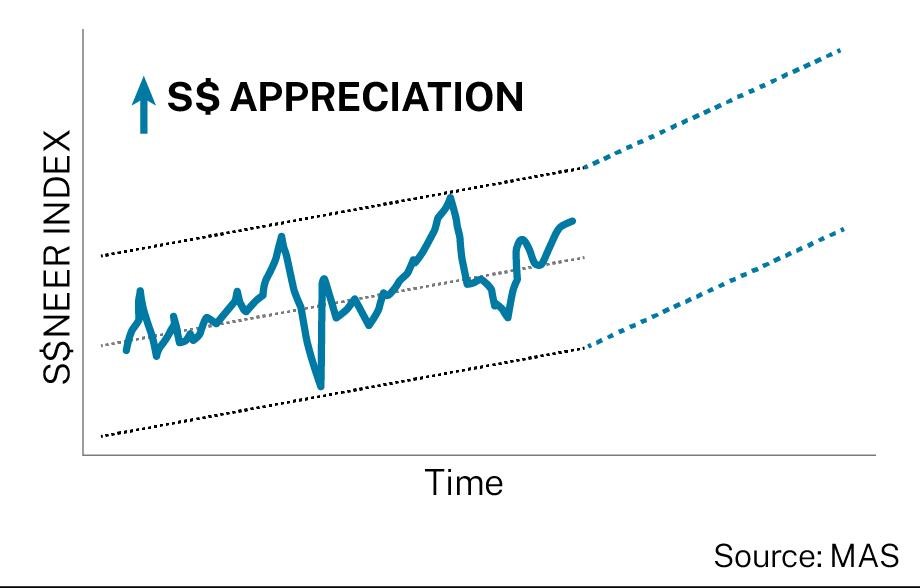

Just a day after the data on inflation for December 2021 was released in late January 2022, MAS announced that it would tighten monetary policy by “slightly raising” the rate of appreciation of the Sing dollar nominal effective exchange rate (S$NEER) policy band.

By steepening the slope of the S$NEER policy band, it will allow the Singapore dollar to appreciate more quickly and make imports cheaper. This will help to insulate the population from any drastic increase in the price of goods and services and keep inflation under control.

MAS also said that it had made this unexpected move to tighten monetary policy as the inflation outlook had shifted higher since October 2021 due to recovering global demand and persistent supply issues. It predicted that core inflation would continue to increase in 2022 due to “rapidly accumulating” external and domestic cost pressure.

While most countries’ central banks administer monetary policy mainly by adjusting interest rates, monetary policy in Singapore is exercised by MAS through adjustments made to S$NEER over time, to ensure that inflation in Singapore does not go out of control. This is because the exchange rate has a greater impact on inflation than interest rates in a small and open economy like Singapore.

S$NEER is the exchange rate of the Singapore dollar against a trade-weighted basket of the currencies of countries which are Singapore’s main trading partners. This basket is constantly re-assessed and amended from time to time in accordance with Singapore’s changing trade patterns and is never revealed to the public to avoid speculation.

MAS conducts its monetary policy by allowing the S$NEER to float within an unspecified policy band. It will intervene by buying or selling Singapore dollars in the foreign exchange market should it veer out of this band. It can also change the slope, width and midpoint of the band, and these changes are usually announced at two policy meetings which are held in April and October each year.

1) Changing the slope

Changing the slope of the band is the most common adjustment made by MAS and is typically done during periods of high inflation. By changing the slope of the band, this alters the speed at which the Singapore dollar is allowed to appreciate against the trade weighted basket of currencies. Hence, when MAS steepens the slope, as it did in January 2022, the Singapore dollar appreciates faster, and this makes imports cheaper. Conversely, when MAS flattens the slope, the Singapore dollar will appreciate slower, making imports more expensive.

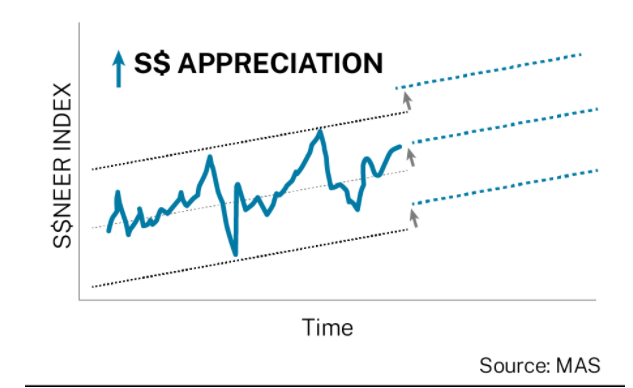

2) Re-centring the band

MAS may re-centre the band by shifting the entire band upwards or downwards. Clearly, this is a more significant change to monetary policy and would only be considered if there is a sudden, drastic, and fundamental change in the outlook of the economy. Such adjustments will usually result in a faster and greater impact on the Singapore dollar. It is possible for a re-centring to be done after, or together with a change in the slope of the policy band.

One instance of the band shifting downwards happened in 2009, after the 2008 global financial crisis caused Singapore’s economy to go into recession. By shifting the band downwards, this would technically weaken the Singapore dollar and make exports cheaper, which would help to increase their competitiveness.

3) Widening the band

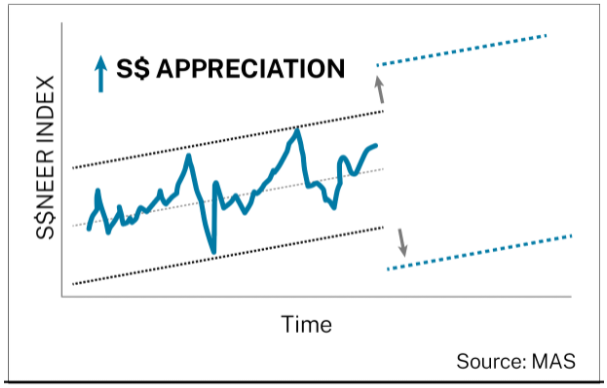

By increasing or decreasing the width of the band, MAS can increase or decrease the space within which the Singapore dollar can fluctuate. Hence, as MAS indicates, when the band is widened, “it allows more room for market-determined movements in the S$NEER”.

Changes in the width are typically executed during periods of increased uncertainty in the geopolitical space or in financial markets. For example, the width was increased in 2001, after the September 11 terror attacks in the United States.

Outlook for inflation

MAS and MTI have forecast core inflation to continue to increase in the near term, and it is expected to hit 3 per cent before easing in the second half of 2022. They have also forecast core inflation for the whole of 2022 to register at an average of between 2 and 3 per cent, with headline or overall inflation to register between 2.5 per cent and 3.5 per cent. Both MAS and MTI have also said that global inflation has risen and should continue to stay elevated until the later part of this year. This is due to increased geopolitical tension and tighter supply conditions that will place upward pressure on crude oil prices.

In Singapore, transportation bottlenecks and labour shortages in her major trading partners will keep inflation elevated in the near term. However, they are also expected to moderate in the second half of the year. MAS and MTI have noted that there is still upside risk to inflation from any potential shocks due to COVID-19 or any geopolitical conflicts, such as the Ukraine crisis, that may affect global supply chains.

The domestic labour market in Singapore is also expected to tighten considerably. This should lead to higher wages, and these cost increases will lead to higher services prices as private consumption recovers slowly.

In the recently announced Budget 2022, the changes to foreign worker policies will also be expected to cause the labour market to tighten further, while the impending GST increases in 2023 and 2024 may result in increased demand for big ticket items as consumers try to beat the hike in the GST rate.

MAS is largely expected to continue to tighten monetary policy in its next monetary policy meeting in April this year if there are no signs of inflation slowing down in the near term. This will most likely be done by increasing the slope of the policy band slightly, as done in January 2022. Although it is unlikely that MAS will do so, it may also consider shifting the policy band upwards to strengthen the Singapore dollar.

Explore a myriad of useful features including Trading View chartings to conduct technical analysis, stock analytics from our in-house research analysts, and more available for you anytime and anywhere to elevate you as a better trader.

Reference:

- [1]https://www.todayonline.com/singapore/most-economists-expect-core-inflation-stay-above-2-2022-after-prices-rose-fastest-pace-9-years-1824986

- [2]https://www.channelnewsasia.com/business/core-inflation-cpi-singapore-mas-consumer-price-developments-2514376

- [3]https://www.businesstimes.com.sg/government-economy/singapore-core-inflation-rises-further-to-24-in-january-headline-inflation-flat

- [4]https://www.straitstimes.com/business/economy/core-inflation-up-24-in-jan-highest-since-sept-2012-as-food-electricity-costs-rise

- [5]https://www.straitstimes.com/business/economy/singapore-to-review-2022-inflation-forecasts-as-consumer-prices-rise-to-new-highs-in-december

- [6]https://www.channelnewsasia.com/singapore/singapore-core-inflation-cpi-december-2021-review-2022-forecast-2455511

- [7]https://www.businesstimes.com.sg/government-economy/bt-explains-the-3-ways-that-mas-might-change-exchange-rate-policy

- [8]https://www.todayonline.com/singapore/explainer-why-did-mas-unexpectedly-tighten-singapores-monetary-policy-during-pandemic

- [9]https://www.channelnewsasia.com/business/mas-tighten-monetary-policy-cycle-what-it-means-singaporeans-2457641

- [10]https://www.channelnewsasia.com/business/mas-singdollar-raise-rate-appreciation-policy-band-2457216

- [11]https://www.mas.gov.sg/monetary-policy/Singapores-Monetary-Policy-Framework/faqs/section-2#S02.1

- [12]https://www.channelnewsasia.com/business/sneer-and-its-slope-width-and-centre-questions-about-singapores-monetary-policy-856746

- [13]https://www.todayonline.com/singapore/not-rappers-name-what-sneer-and-how-it-used-monetary-policy

- [14]https://www.mas.gov.sg/news/consumer-price-developments/2022/consumer-price-developments-in-january-2022

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Ming Jie

Investment Specialist

Phillip Investor Centre (Holland Drive)

Ming Jie is an Investment Specialist at Phillip Investor Centre (Holland Drive) and specialises in providing investment advisory services to retail clients, with a focus on helping clients to build and manage unit trust portfolios that can help to achieve their investment objectives. He joined Phillip Securities in 2017 and graduated from University of London with an external honours degree in Economics and Finance.

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry! ![[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close](https://www.poems.com.sg/wp-content/uploads/2024/03/Valerie-Lim-LI-X-SMART-Park-Article-300x157.jpg) [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close

[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close  Deciphering the Updates: Understanding the latest CPF Changes

Deciphering the Updates: Understanding the latest CPF Changes