Safeguarding Your Health and Wealth November 12, 2020

Are you adequately covered?

How do you plan to ensure you have sufficient health coverage and not over-commit or under-commit? We share with you a simple formula for calculating your protection needs.

True Story

My colleague, who is in his prime of 40 years old, was hospitalised on 7 July 2020. Prior to that, he had experienced some tightness in his chest twice, over the period March to May 2020. He went to the accident and emergency department more than once and took ECG tests twice, X-Rays twice and even a COVID -19 swab. He was discharged after doctors found no abnormalities.

On 7 July, he suddenly felt extreme pain and tightness in his right chest, hand numbness and slight hand trembles. The pain spread to his back after a while. At 6am, he was rushed to the hospital.

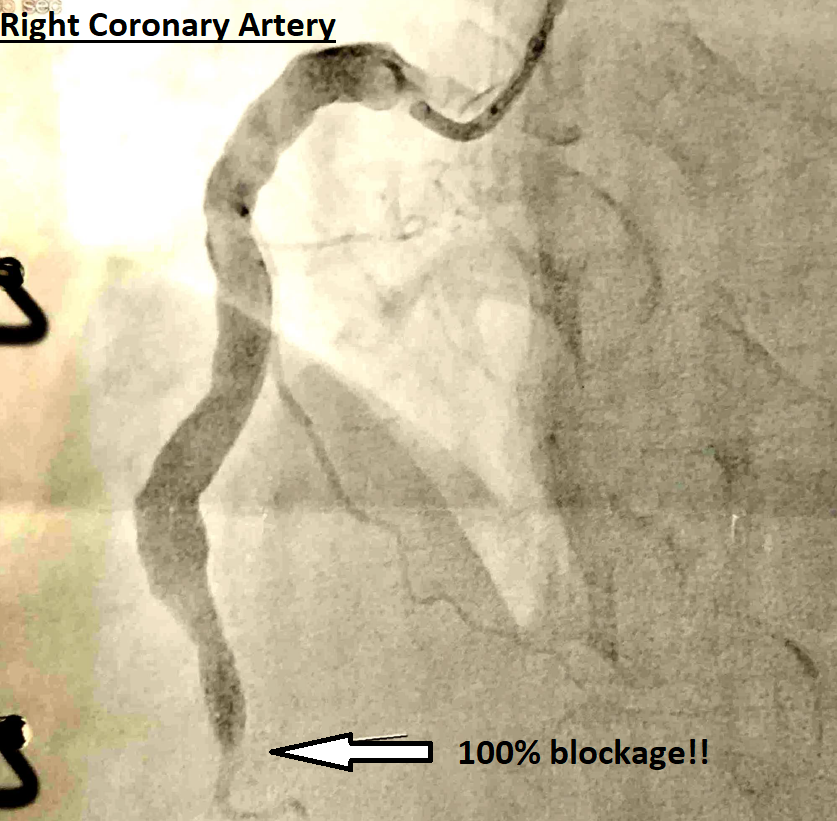

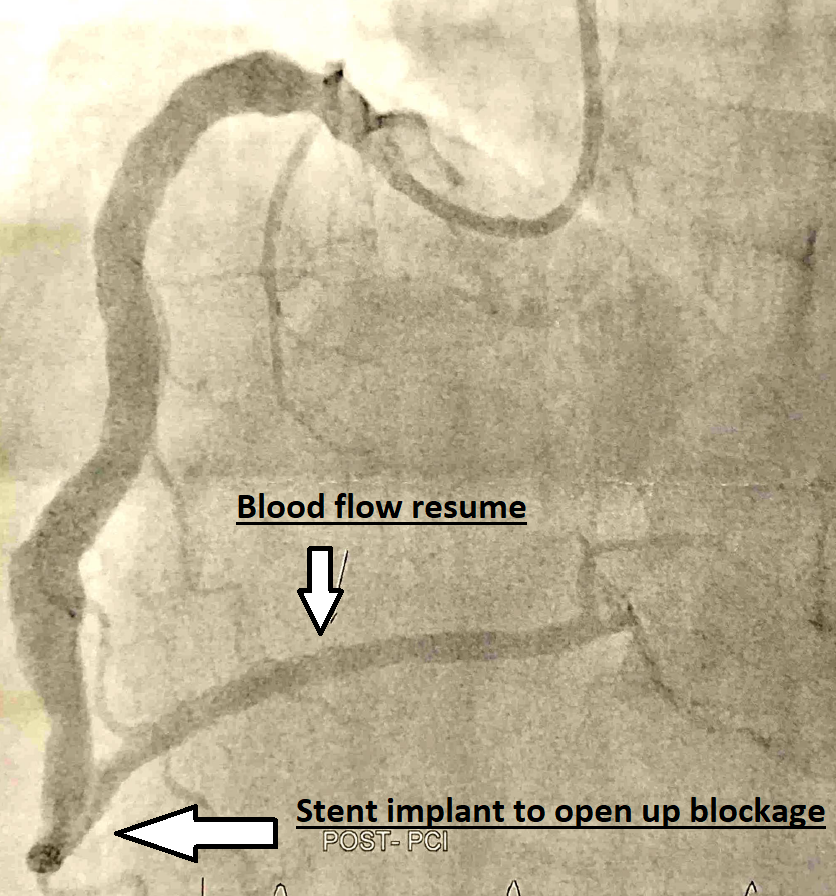

After detailed checks, he was told that his right coronary artery had a 100% blockage! The doctors immediately operated on him, to do ballooning to allow his blood flow to resume. A picture of his blockage and another of his stent implant were shared by my colleague.

He was shocked that he had heart attack at his age despite regular exercises. He shared that it was likely that during the lockdown, he had exercised less and worked longer hours at home. He might have been sitting in front of his laptop for more than eight hours per day.

Effects of Prolonged Sitting

Not only are we seated eight hours for our daily work, we may continue to sit on our sofas after work to watch television or trade on US markets in the wee hours of the night. The table1 below shows some of the effects of prolonged sitting:

| What happens | What it means |

| You could easily become obese. |

| You have an 18% higher risk of dying from a heart attack or stroke. |

| There’s a 91% greater chance you’ll end up with Type II diabetes. |

| Your risk of dying from these cancers increases by 17%. |

| You’ll not just be uncomfortable, you might even get injured when you finally move. You could also develop life-threatening deep vein thrombosis. |

| You’ll tend to get depressed. You’ll also be less productive. |

| You’ll die sooner than later! |

Source: https://www.healthhub.sg/live-healthy/763/the-nudge-to-budge-why-you-should-step-out-of-that-chair

Cardiovascular disease: is it genetic?

During our September webinar with Dr Ong Sea Hing, Dr Ong talked about heart attacks and their causes. There are five main risk factors at play: a family history of heart disease, diabetes, tobacco smoking, hypertension and high cholesterol.

Which is the biggest factor? Dr Ong shared in an article3 that ‘I believe the family history, the genetic one, is the strongest one, the one we cannot control but the other four we can. We sometimes call these 5 the “royal flush” in jest.’

Singapore Statistics

| Every day, 17 people die from cardiovascular disease (heart disease and stroke) in Singapore. Cardiovascular disease accounted for 29.2% of all deaths in 2018. This means that almost 1 out of 3 deaths in Singapore is due to heart disease or stroke.PRINCIPAL CAUSES OF DEATHSource: Ministry Of Health |

Healthy Lifestyle, Healthy Protection

To have a healthy lifestyle, it is important for you to start simple exercises that will not only disrupt your work schedule but also improve your blood circulation. You may consider some of the simple stretches4 below.

Source: https://www.shape.com.sg/health/simple-desk-exercises-you-can-do-office/

Source: https://www.shape.com.sg/health/simple-desk-exercises-you-can-do-office/

What does healthy protection mean?

While you take care of your health through healthy lifestyle and eating habits, preparing yourself financially for unforeseen circumstances is equally important.

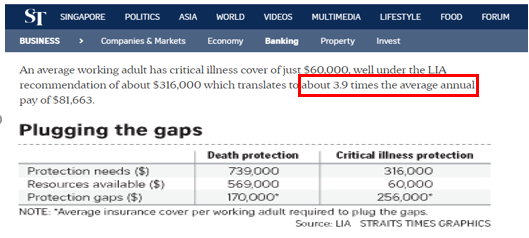

According to a survey by the Life Insurance Association (LIA)5 Singapore in 2017, the protection gap* for individual working adults for death coverage is S$170,000 and critical illness coverage gap, S$256,000. A simple recommendation for the coverage amount for critical illness protection is 3.9 times your average annual income.

*The insurance protection gap is the difference between the resources you’ll need and the resources you have available in the event of an unfortunate event. (https://www.income.com.sg/blog/what-is-a-protection-gap)

#The critical illness protection gap is the shortfall in the amount of money you should be providing to meet the financial needs of you and your family before you are able to return to work. (https://www.lia.org.sg/tools-and-resources/insurance-calculator-intro/#:~:text=The%20Critical%20Illness%20protection%20gap,much%20additional%20insurance%20you%20need)

When planning for protection coverage, we do not wish to over-budget, neither do we want to be under-covered or under-protected.

We have a 3-step process for you to arrive at the right amount.

Step 1 – BUDGET

We have a simple equation for you to find out your own budget that can be used for protection needs.

Fixed expenses refer to daily spending or fixed debts that need to be paid on a routine basis. They include food allowances, transport allowances, home loans, study loans, car loans, credit card loans, children’s allowances, parents’ allowances, charity and many more.

If your monthly surplus is negative, it’s time to relook at your finances and cut down on unnecessary expenses. You shouldn’t be spending more than what you earn!

Step 2 – TIME HORIZON

After identifying your monthly surplus, divide it into Short, Medium and Long Term allocations. The time horizons vary for individuals. We usually define short term as less than five years, medium term as 5-20 years and the long term as retirement age.

Map your own time horizon accordingly.

Step 3 – LIFE GOALS

After you have determined your budget (based on monthly surplus) and time horizon, you will need to identify your life goals. Write down these goals according to the number of years you hope to take to achieve them.

You may refer to the table for illustration.

| Short Term (<5 years) | Medium Term (5-20 years) | Long Term (>20 years-retirement) |

| Travel (cruises to nowhere) | Baby’s education | Retirement |

| Further study (a degree) | Buy an HDB flat | Legacy |

| Buy a car | Hospital bills |

With the table, ask yourself, what are the percentages to set aside for the short, medium and long terms?

| Short Term (<5 years) | Medium Term (5-20 years) | Long Term (>20 years-retirement) |

| Travel (cruises to nowhere) | Baby’s education | Retirement |

| Further study (a degree) | Buy an HDB flat | Legacy |

| Buy a car | Hospital bills |

Allocating your budget

| 30% | 40% | 30% |

After working out your allocations, you will know how much to set aside for your various time horizons and goals.

What’s next?

Great! Now that you have some concrete ideas, the next step is to identify the protection plans you need.

As protection plans are long term that are meant to cover unforeseen circumstances while you work hard for your life goals, the budgets for your death, total permanent disability and critical illness coverage will be drawn from your medium or long-term allocations. We do not buy protection plans to aim to invest but we definitely aim to protect our life goals.

PhillipCapital represents more than 14 life insurers and we will be able to help you uncover the most suitable coverage. Various companies offer unique features to meet the needs of various buyers. Their plans range from term and critical illness plans, universal life plans to endowment and retirement plans.

Let us do the comparison for you and help you find your ideal plan!

References:

1. https://www.healthhub.sg/live-healthy/763/the-nudge-to-budge-why-you-should-step-out-of-that-chair

2. https://www.moh.gov.sg/resources-statistics/singapore-health-facts/principal-causes-of-death

3. https://www.thedailystar.net/lifestyle/interview/news/words-cardiologist-dr-ong-sea-hing-1781215

4. https://www.shape.com.sg/health/simple-desk-exercises-you-can-do-office/

5. https://www.lia.org.sg/media/1332/protection-gap-study-report-2017.pdf

6. http://www.healthdata.org/sites/default/files/files/policy_report/2019/GBD_2017_Singapore_Report.pdf

7. http://www.nus.edu.sg/uhc/resources/articles/details/7-reasons-to-stop-sitting-for-long-periods

8. https://www.straitstimes.com/business/banking/working-adults-have-inadequate-cover-if-critical-illness-strikes-says-study

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Seah Ley Boon (Relationship Manager, Ang Mo Kio PIC) & James Chow (Branch Manager, Holland Drive PIC)

Ley Boon specialises in protection and retirement planning for customers and had been in this industry for about 7 years. Being a Relationship Manager at Ang Mo Kio PIC, she believes in adequate protection based on Needs Analysis and to invest with an objective in mind. James Chow is an experienced Branch Manager at Holland Drive who has vast knowledge in investment and protection needs and has been servicing Phillip Securities clients for more than 10 years.

Mooncakes: The Hidden Environmental Cost of Gifting

Mooncakes: The Hidden Environmental Cost of Gifting  Factor-Based (Smart-Beta) ETFs: How They Work, Selection Criteria, and Practical Uses for Singapore Investors

Factor-Based (Smart-Beta) ETFs: How They Work, Selection Criteria, and Practical Uses for Singapore Investors  What is an Active ETF?

What is an Active ETF?  100% Spenders in Singapore: How to Break Free from Living Paycheck to Paycheck

100% Spenders in Singapore: How to Break Free from Living Paycheck to Paycheck