Should You Consider Index Investing? January 26, 2023

There has always been a debate in the investing community about whether active or passive investing generates higher returns for investors in the long run.

In 2007, Warren Buffet, one of the most successful investors in the world, entered a bet with funds-of-hedge funds firm Protege Partners, that an index fund could “beat” an active manager. The bet in question was for the S&P 500 to outperform a portfolio of five funds-of-hedge funds, over a period of 10 years, from 1 Jan 2008 to 31 Dec 2017 based on performance measured on the basis net of fees, costs and expenses.

At the end of the period, the five funds-of-hedge funds had an average return of a mere 36.3% net of fees over the above stated 10-year period while the S&P index fund had a return of 125.8%.

Warren Buffet, a firm believer of index funds, once said the following in one Berkshire Hathaway shareholder letter:

That being said, let us dig deeper to see if an average investor is really better off doing index investing.

What is Index Investing

Index investing is a passive investment technique that attempts to generate returns similar to a broad market index.[1] Globally, the Standard and Poor’s 500 (S&P 500) is undoubtedly the most well-known index. However, here in Singapore, many are also familiar with the Straits Times Index (STI).

Index investing can be done through the investment in Exchange-Traded Funds (ETFs), Unit Trusts or even Contract for Differences (CFDs), which aim to track and match the performance of the underlying index as closely as possible.

Benefits of Index Investing

1. Track record in outperforming stock picking

Source: Yahoo Finance [2]

Source: Yahoo Finance [2]

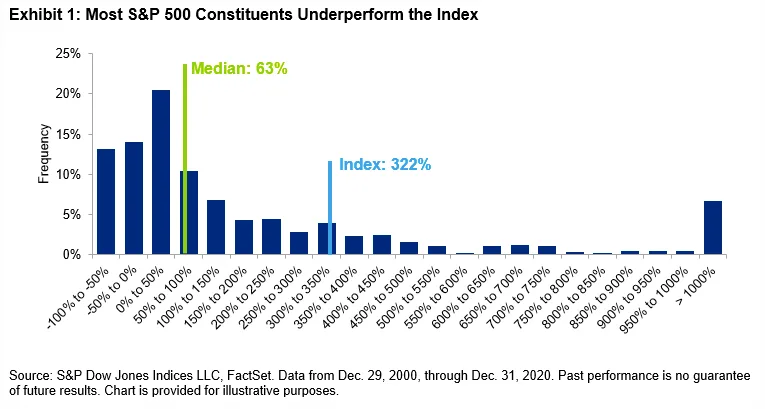

Stock-picking is not easy, as proven with the data accumulated over the past 20 years as shown in the chart above. We see a mere 22% of stocks in the S&P 500 outperforming the index from 2000 to 2020. During the period of measurement, the S&P 500 gained 322% while the median stock rose by just 63%.

Theories might imply that markets are transparent and information is readily accessible to all investors. However, reality largely differs from theory and does not always play out according to theory. Markets are not necessarily a level playing field. Investment research analysts get access to the senior management insight, have conversations with industry experts, helping to piece together a more cogent, mosaic understanding of a stock.

This does not mean that retail investors like you or I can’t beat the market through good, solid stock picking. What it means essentially, is that it will require really hard work to achieve this and it is highly unlikely for your average joes to beat the markets consistently.

As such, it is important for the average retail investor to have adequate exposure to a cheap market index fund before having a go at stock picking.

2. Requires relatively little financial knowledge

Investing in index funds is relatively easier than building a portfolio on your own. Building a portfolio on your own often requires the knowledge on how to interpret balance sheets of companies you might be planning to invest in.

In addition, you will have to burn extra hours, doing extensive research into the companies you are looking to invest in. You will also have to monitor their performance continuously and keeping up with the latest news about them in order to determine if they are still worth investing in.

3. Diversification

As the saying goes, “don’t put all of your eggs in one basket”. By buying into an index, it helps to spread your risks across the stocks within your index, minimising the risk of over concentration of your funds in a single company. This will reduce the likelihood of you losing some or all of your money.

Did you know that diversifying your portfolio can also increase your overall returns? Let’s look at the example below.

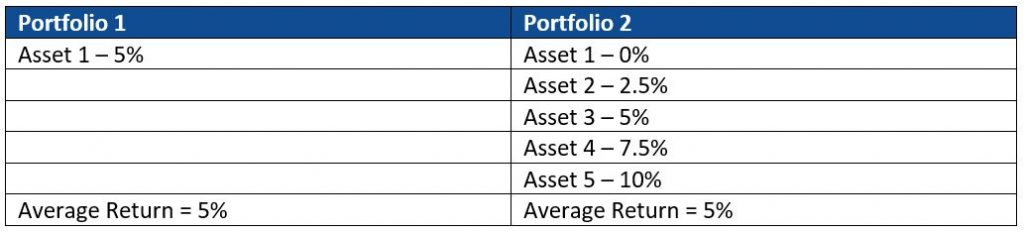

Example of 2 portfolios:

- Portfolio 1 contains 1 asset only, with an annual return of 5% per year.

- Portfolio 2 contains 5 different assets, each with a different annual return but the same average return rate of 5% per year.

Source: Capital19 [3]

Source: Capital19 [3]

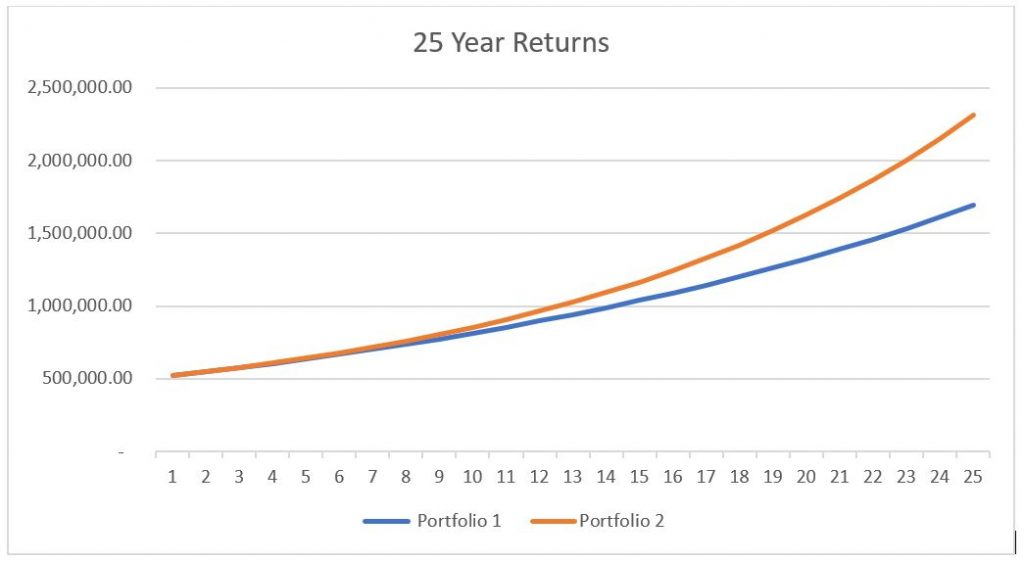

Over a 25-year period, you would expect these two portfolios to have the same return since each has the same average annual return of 5%. However, with the power of compounding, reality plays out relatively differently.

Source: Capital19 [3]

Source: Capital19 [3]

While both portfolios started with the same investment amount of $500,000,

- Portfolio 1 ended with $1,693,177

- Portfolio 2 ended with $2,317,334

Portfolio 2 will benefit from compounding more than portfolio 1 as the higher compounding in asset 4 (7.5%) and asset 5 (10%) will more than offset the lower compounding in asset 1 (0%) and asset 2 (2.5%).

4. Low cost and capital

Purchasing every stock in an index at its given component weight is the most complete way to ensure that a portfolio will achieve the same risk and return profile as the benchmark itself. However, depending on the index, this can be time-consuming and costly to implement.

For instance, to replicate the S&P 500 index, an investor would need to accumulate positions in each of the 500 companies inside the index. For the Russell 2000, there would need to be 2000 different positions.

Gaining exposure via an index fund or index CFD provides a cost-effective route to investing in a portfolio of stocks. Not only do you save the hassle of rebalancing your portfolio, you would also save a substantial amount of money in the form of lower overall fees as the cost of buying and selling individual stocks tend to pile up for retail investors who are likely to trade lower contract sizes.

Ways to Gain Exposure to an Index

There are 2 main ways to gain exposure to an index, via:

1. an index fund2. an index CFD

Index funds

There are hundreds of different indexes you can track using index funds. The most popular index is the S&P 500, which includes 500 of the top companies in the US stock market. Here are some top indexes, broken down by the part of the market they cover:

- Large US stocks: S&P 500, Dow Jones Industrial Average, Nasdaq Composite

- Small US stocks: Russell 2000, S&P SmallCap 600

- International stocks: MSCI EAFE, MSCI Emerging Markets

- Bonds: Bloomberg Barclays Global Aggregate Bond

In addition to these broad indexes, you can find:

- sector indexes that are tied to specific industries

- country indexes that target stocks in single nations

- style indexes that emphasise fast-growing companies

- value-priced stocks

- other indexes that limit their investments based on their own filtering systems

Some examples of index funds that you can consider:

- Vanguard 500 Index Fund ETF (NYSEMKT:VOO)

- Tracks the S&P 500 index; $4 annual cost for a $10,000 investment

- Vanguard Total Stock Market Index Fund Admiral Shares (NasdaqMutFund:VTSAX)

- Tracks index of US stocks of all sizes; $4 annual cost for a $10,000 investment

- Vanguard Total International Stock ETF (NASDAQ:VXUS)

- Tracks index of global stocks, excluding the US; $11 annual cost for $10,000 investment

- SPDR Straits Times Index ETF (SGX: ES3)

- Tracks the performance of the Straits Times Index which consist of leading companies in Singapore

Index CFDs

Another way to gain exposure to an index is via index CFDs. A Contract for Difference contract (CFD) is an agreement between two parties to exchange the difference in value between the opening and closing of the contract. CFDs allow you to participate in the price movement of an underlying asset without actually owning or taking physical delivery of it.

Index CFD allows investors to track and trade the underlying index such as the Hong Kong Index and S&P 500 index although prices might differ from actual index levels.

CFDs are leveraged products that are traded on margin. This means that you are only required to put up a fraction of the contract value as margin to open a position, instead of paying the full value of the underlying asset. However, do note that trading on margin is a double-edged sword as it has the potential to amplify both your profits and/or losses by the same magnitude.

Lastly, it is also important to note that there are finance charges involved for CFD positions held overnight. For example, assuming that you’ve bought one contract of US Tech 100 Index US$5 CFD at an index level of 11,700.

Value of 1 Index Point: US$5

Contract Size: US$5 x Index Level x Quantity

Margin Requirement: 5%

Initial Contract Value: US$5 x 11,700 x 1 = US$58,500

Initial Capital: U$58,500 x 5% = US$2,925

As such, in the above example, instead of putting up an initial contract value of US$58,500, you would only need to put up an initial capital of US$2,925 using CFDs.

However, US$2,925 might be a significant sum for some retail investors, especially for those who may have just started out. As such, you can also consider mini contracts such as US Tech 100 Index US$1 CFD, which are only one-fifth of the contract value in the above example, since the value of 1 index point is only US$1. Using the same price as the above example, the contract specifications of a US Tech 100 Index US$1 CFD is as follows:

Value of 1 Index Point: US$ 1

Contract Size: US$ 1 x Index Level x Quantity

Margin Requirements 5%

Initial Contract Value: US$ 1 x 11,700 x 1 = US$ 11,700

Initial Capital: US$ 11,700 x 5% = US$ 585

PhillipCFD offers a wide range of World Indices CFD, allowing index traders to diversify across various markets. You can find the different types of World indices CFD available here.

Special Announcement

PhillipCFD is currently having a Chinese New Year promotion for new or existing POEMS clients who opt into CFD for the first time where you get to enjoy a FREE PlayMade Drink and up to S$88 in CFD Trade Rebates.

That’s not all, you also get to stand a chance to win a 3D2N Staycation Giveaway at One°15 Marina Sentosa Cove when you fund and trade with us!

To read more about this promotion and how to opt into CFD, click here.

How to Get Started With POEMS

As the pioneer of Singapore’s online trading, POEMS’s award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges.

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here (terms and conditions apply).

We hope that you have found value reading this article. If you do not have a POEMS account, you may visit here to open one with us today.

Lastly, investing in a community is much more fun. You will get to interact with us and other seasoned investors who are generous in sharing their experience and expertise.

In this community, you will be exposed to quality educational materials, stock analysis to help you apply the concepts, unwrap the mindset of seasoned investors, and even post questions.

We look forward to sharing more insights with you in our growing and enthusiastic Telegram community. Join us now!

For enquiries, please email us at cfd@phillip.com.sg.

Reference:

- [1] https://www.investopedia.com/terms/i/index-investing.asp

- [2] https://finance.yahoo.com/news/one-stat-shows-how-hard-it-is-to-pick-market-beating-stocks-231312491.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAJfNwDaIYn8ZMQOOMuKar9o1NlpuAU4hwNc1Qzb1rdKG8UhVoqFxHGiYYcq_jH-k3_PIrPiiSjGVmfDy3zVKijI3cDL3z9NPj2PEZBp8vKCe5UeG3TgV_KSdn4Bs7Px5jKjBPOPg1Xx3Ct0v9_5h_6eiTKwJ8urkt4wdXoSz6waQ

- [3] https://capital19.com/investing-in-us-stocks/the-benefits-of-diversification/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Jeremy Chua

Dealing

Jeremy graduated from Nanyang Technological University with a Bachelor’s Degree in Business and is a member of the largest dealing team in Phillip Securities. He strongly believes in the importance of staying invested in the financial markets and evaluates stocks using fundamentals to make informed investment decisions.

In his free time, he enjoys researching on market events and disruptive investment themes to generate new investment ideas for the short and long term.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile