The Rise of Netflix amid the COVID-19 pandemic December 14, 2021

Introduction

2020 took the world by surprise, and countries scrambled to curb the insurgence of COVID-19. Many believed that vaccines would be “the” way to eradicate this virus and allow our lives to return to a pre-COVID norm. However, things took a different turn. Despite vaccination rates seeing an uptrend in 2021, mutations of the COVID-19 virus continue to ravage the world with more cases each day.

Many sectors such as tourism have born the brunt of this pandemic.

According to the United Nations World Tourism Organization, international tourist arrivals fell by 72% in 2020. And companies around the world have faltered as they are unable to cope with the massive decline in their revenues.

However, the pandemic has put the spotlight on companies such as Netflix which offer over-the-top media services globally.

Netflix’s Financials

According to Netflix’s 2020 annual report, the company has seen a rapid increase in paid memberships amounting to a total of 204 million accounts so far, compared with 160 million in 2019. This indicates that there were a total of around 44 million paid membership subscriptions in 2020 alone.

This has resulted in a 24% YoY growth of US$5 billion to US$ 25 billion in revenue, as compared with US$20 billion in 2019. Furthermore, there was an astounding 76% YoY growth in operating income from US$2.6 billion in 2019 to US$4.6 billion in 2020.

In addition, earnings per share have also seen an increase in 2020 as compared with 2019, from US$4.26 to US$6.26.

The icing on the cake was when Netflix managed to achieve positive free cash flow of an estimated US$1.9 billion in 2020, after years of negative free cash flow.

Growth Potential in APAC

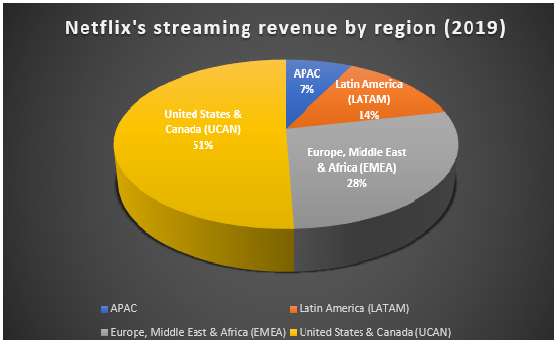

Figure 1: Netflix’s streaming revenue in 2019 by region

Now, let’s look at the streaming revenues of Netflix by region.

As shown in Figure 1, revenues from the United States & Canada (UCAN) region in 2019 were reported to be US$10.05 billion, which makes up 51% of its total streaming revenue. The Asia Pacific (APAC) region on the other hand, accounted for the lowest share of its total streaming revenue of US $2.79 billion, which makes up 7%.

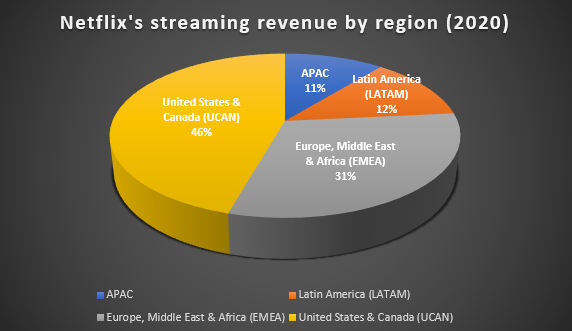

Figure 2: Netflix’s streaming revenue in 2020 by region

In 2020, all regions managed to record an increase in their streaming revenues.

However, the APAC region saw the largest increase in terms of streaming revenues YoY as compared with other regions, as it recorded a whopping 61% increase to US$2.37 billion. This huge jump was evidently significant as APAC now makes up 11% of the total streaming revenue of Netflix.

In contrast, the UCAN and Latin America (LATAM) regions saw only an increase of 14% and 13% respectively.

The APAC region is home to about 60% of the world’s population, with an estimated 4.3 billion people. This suggests that there is more room for Netflix to grow in the APAC region.

1. Rise in Global Popularity of Asian Shows

Netflix exclusive programmes such as the recent Korean hit drama series “Squid Game’” has gained global popularity.

Currently, the show tops Netflix’s global rankings, and is the first Korean series to claim the No. 1 spot in US’ Netflix history.

This is an incredible feat which could potentially spur the production of more Asian series by Netflix in the coming years. This could likely also attract more membership subscriptions for their streaming services in the APAC region.

If Netflix fully capitalises on the APAC region, this could be one of the main driving factors to increase its streaming revenues in the years to come.

2. Netflix’s Stock Price

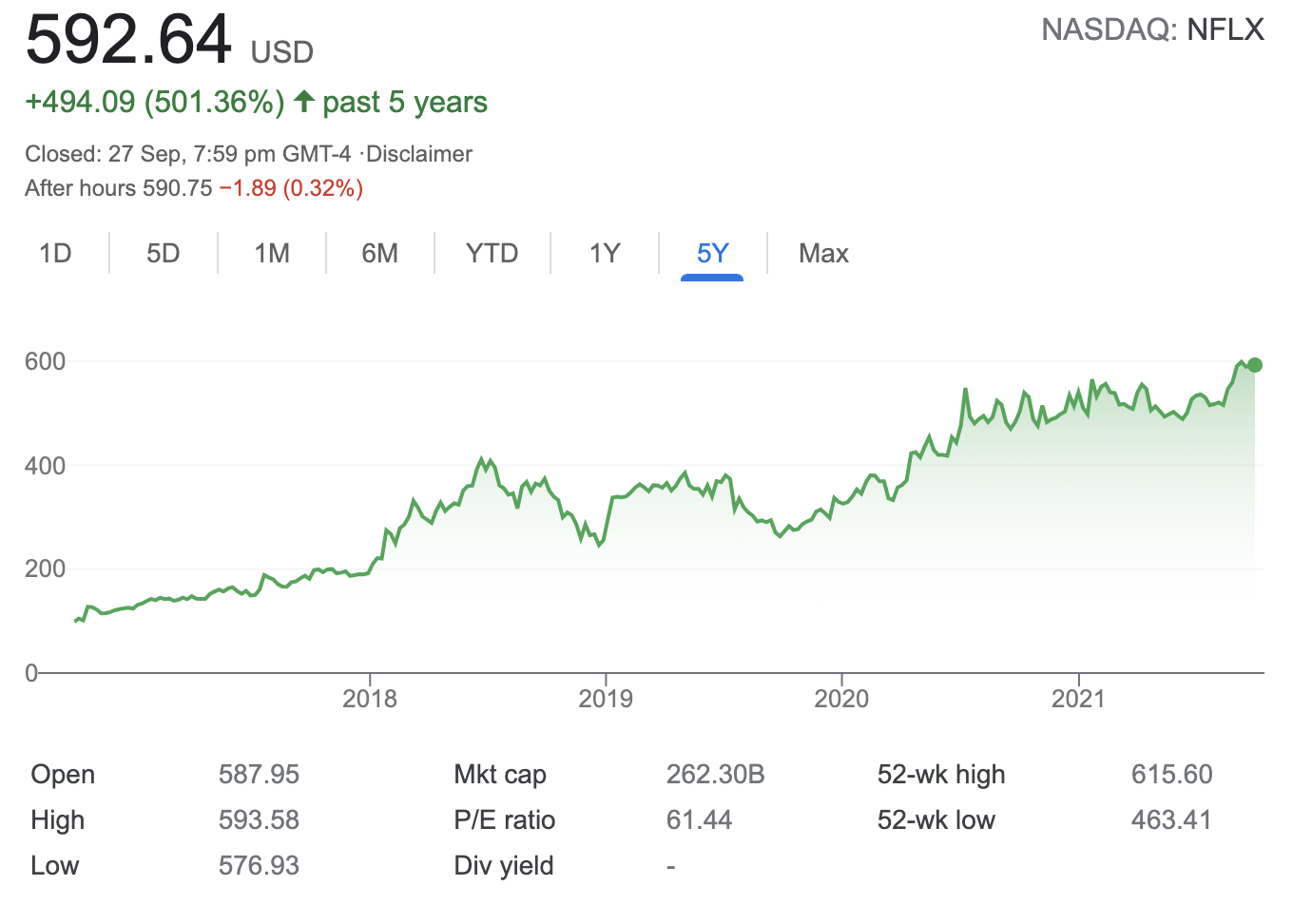

Figure 3. Netflix’s stock price from 2016 to present

Despite global markets plummeting due to the COVID-19 pandemic in 2020, Netflix’s stock price has seen a steady increase.

At the beginning of 2020, Netflix’s stock price was at US$325.90. At the end of 2020, Netflix’s stock price had surged to US$540.73. In just one year, Netflix’s stock price had surged 65.9%, which was a tremendous achievement.

As the battle against the virus continues, people around the world have been confined to their homes with no access to their usual forms of entertainment. And when movie theaters, nightclubs, bars, and other entertainment outlets were forced to close at the peak of the COVID-19 pandemic, people desperately searched for alternative entertainment that is accessible from within their homes.

Online streaming platforms were perfect for their needs, and Netflix witnessed a surge in demand for its services which possibly contributed to the increase in its stock price.

Although we possibly saw the worst of COVID-19 in 2020, the battle is far from being over with the resurgence of new variants.

So we foresee that a relatively extended period might be needed before we can return to pre-COVID times. Therefore, the demand for home entertainment services such as Netflix will continue to grow.

3. Netflix’s Competitors

As online streaming services become a lucrative market, many other competitors are also venturing into this space.

One of them is Disney+ owned by Walt Disney.

Disney+ also provides video on-demand over-the-top streaming services similar to Netflix. And it also hasexclusive shows such as “Wanda Vision”.

Since its inception, Disney+ has managed to gather a total of 73.3 million membership subscriptions, raking in an estimated US$4.5 billion in revenue in 2020. Therefore, the battle for supremacy in this online entertainment space is between the 2 giants: Netflix and Disney+.

However, what gives Netflix the edge over Disney+ is its range of shows.

Disney+ only provides shows such as the Marvel series while Netflix provides a huge plethora of programmes thatcater to different regions around the world.

For example, in Singapore, we are able to watch local films such as “Long long time ago”. Therefore, this could likely attract more Asian users to subscribe to Netflix instead of Disney+.

Conclusion

All in all, Netflix has scored a homerun by widening its range to include more regionalised content, as compared to content skewed mainly to American audiences. And it has also managed to procure exclusives like “Squid Game”, which have proved to be extremely successful. Given the uncertainties in the battle against the COVID-19 virus, we see an increasing demand and potential for Netflix to grow in the coming years.

Reference

- https://www.businessofapps.com/data/disney-plus-statistics/

- https://www.annualreports.com/HostedData/AnnualReports/PDF/NYSE_DIS_2020.pdf

- https://www.channelnewsasia.com/commentary/netflix-television-coronavirus-covid-19-quarantine-lockdown-tv-936666

- https://www.bloomberg.com/news/articles/2021-09-27/top-netflix-hit-squid-game-provides-spark-for-korean-stocks

- https://finance.yahoo.com/quote/NFLX/?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAEMkMdCSM7V-rcY0NWQJTmgOZdP_Yutm5AVytpVpMaZUtLRZaDBp5BZQUGc0pk7o_SDE2DWWWqTUqMRJIbwvYxkWL7LK7N0bXR2mEuhs9UVeSrAF3NAdOocakrbWZ6z243LS9QuVO6V_6ONAZHkyOvnl1Viw7lrHEJ_r15cO9bp1

- https://s22.q4cdn.com/959853165/files/doc_financials/2020/ar/13481_002_Web_BMK.pdf

- https://s22.q4cdn.com/959853165/files/doc_financials/2020/ar/8f311d9b-787d-45db-a6ea-38335ede9d47.pdf

- https://ir.netflix.net/financials/annual-reports-and-proxies/default.aspx

- https://www.unwto.org/impact-assessment-of-the-covid-19-outbreak-on-international-tourism

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Alvin Teo

Equities Dealer

Toa Payoh Phillip Investor Centre

Alvin Teo graduated from Nanyang Technological University with a Bachelor’s Degree in Economics. Coming from an Economics background, he strongly believes in the importance of understanding the macroeconomic policies before making investment decisions. Alvin started investing in Singapore equities at the age of 21 and thus, he has relevant experience in the Singapore market.

Mooncakes: The Hidden Environmental Cost of Gifting

Mooncakes: The Hidden Environmental Cost of Gifting  Factor-Based (Smart-Beta) ETFs: How They Work, Selection Criteria, and Practical Uses for Singapore Investors

Factor-Based (Smart-Beta) ETFs: How They Work, Selection Criteria, and Practical Uses for Singapore Investors  What is an Active ETF?

What is an Active ETF?  100% Spenders in Singapore: How to Break Free from Living Paycheck to Paycheck

100% Spenders in Singapore: How to Break Free from Living Paycheck to Paycheck