The Ultimate Guide to Trading and Investing in Stocks Listed on HKEX January 7, 2021

Have you ever felt pangs of disappointment when you find a perfect trade on the Hong Kong Stock Exchange, only to realise you cannot afford the capital outlay?

I have! I often had to deal with this sinking feeling when I first started trading back in my university days.

Fun fact: Did you know? The Hong Kong Stock Exchange finished 2020 as the second-biggest IPO market globally! [1]

Well, good news for you!

Our newly launched Micro HK CFD Trading for the Hong Kong Stock Exchange will help you circumvent the issue of capital outlay and lot sizes!

What is Micro HK CFD Trading?

Micro HK CFD Trading is the same as trading your favourite Hong Kong counters. The only difference is, you are not subject to the minimum board lot size requirement.

With Micro HK CFD Trading, you can purchase a single unit – one share in stock-trading terms – and take advantage of more frequent market gyrations!

Read on to learn more about the advantages of Micro HK CFD Trading!

Micro HK CFD Trading vs HK Equity Trading

| Micro HK CFD Trading2 | HK Equity Trading3 | |

| Minimum Size | From one unit onwards. Only for selected HK CFD counters | 1 board lot. Size varies according to counter |

| Commission Rate | From HK$50* | From HK$100 or 0.08% to 0.25% |

| Margin | From 10%* | N/A |

| Trading Direction | Trade in either direction. Long or short | Long only |

| Additional Fees | GST: 7%Finance charges apply for positions held overnight | GST: 7%Stamp duty: 0.1%CCASS fee: 0.002%, min HK$2, max HK$100Transaction levy: 0.0027% |

| Market Spread | No additional spread | |

Benefits of Micro HK CFD Trading

1. Roll and compound that snowball earlier!

With Micro HK CFD Trading, you can invest in the counters of your choice without fretting about minimum lot sizes! No counter would be too expensive and out of your reach.

Picture this. You wish to own Tencent Holdings, the owner of WeChat and the platform that connects the most of China. Assuming Tencent is trading at HK$500 a share with a minimum board lot size of 100, you would need a minimum of S$8,500 to enter into this position.

But with Micro HK CFD Trading, you can buy even a single unit! What’s even better is that CFDs allow you to trade on margin. You would only need to fork out a 10% initial margin for that single share!

Example 1 illustrates how Micro HK CFD Trading may assist you.

Example 1

| Trading Tencent using Micro HK CFD Trading with CFDs | Trading Tencent using conventional equity trading |

| Cost to buy minimum 1 Tencent CFD:HK$500*10% (margin) = HK$50Cost to buy 20 units:20 x HK$50 = HK$1,000 | Cost to buy minimum 1 board lot (100 shares):100 x HK$500 = HK$50,000 (~S$8,600) |

| Minimum commission: HK$50Additional charges:*Finance charges apply if you hold the positions overnight.** GST applies | Minimum commission: HK$100Additional charges:Stamp duty (0.1%, rounded up to nearest HK$): HK$50,000 x 0.1% = HK$50CCASS fee (0.002%, min HK$2, max HK$100): HK$2* GST applies |

Table 2: Comparison between equity trading and CFDs (for illustration purposes only)

In Example 1, your initial HK$1,000 outlay will not be sufficient to purchase one board lot of 100 Tencent shares. But by using CFDs, you will be able to purchase 20 contracts of Tencent CFDs.

2. Diversification with the help of contract value sizing

With Micro HK CFD Trading, you can diversify your portfolio! This is due to your ability to determine and manage the size of your positions on individual counters even with limited capital.

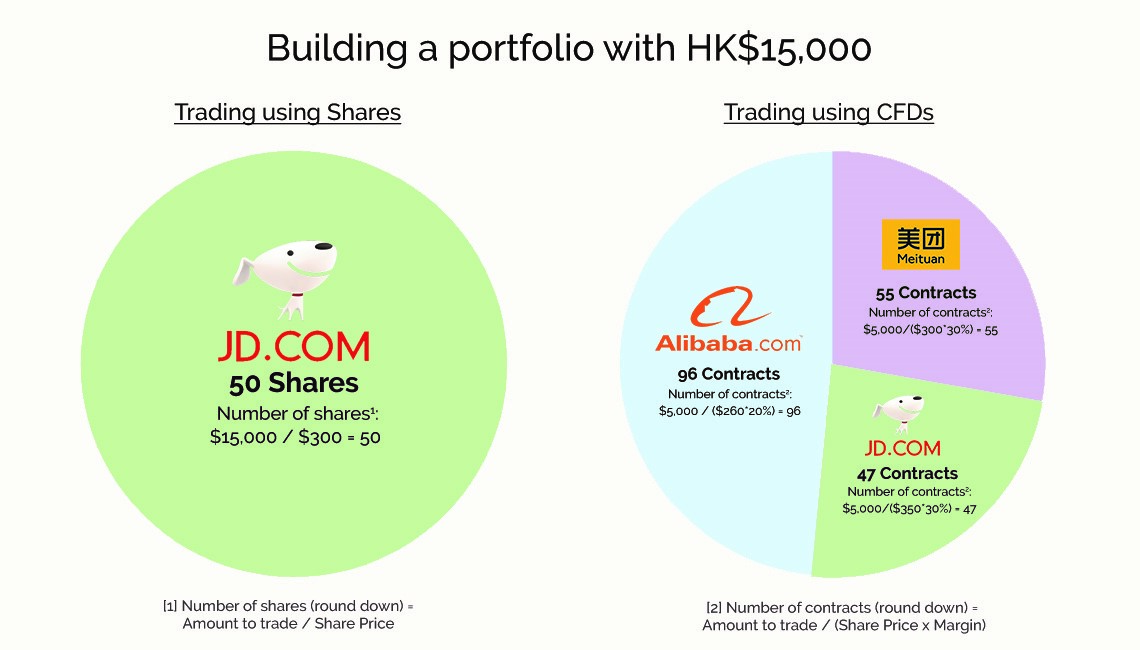

Figure 1 below illustrates how a trader can gain exposure to certain counters using both equity trading and CFD trading.

Mike, the trader, has HK$15,000 or about S$2,500 of capital to trade.

After doing his homework, Mike decides to take positions on Alibaba (HKG:9988), Meituan (HKG:3690) and JD.com (HKG:9618). However, to trade JD.com using conventional equity trading, he would need to buy a minimum board lot of 50 shares. Assuming JD.com (HKG:9618) trades at HK$300 per share, his capital of HK$15,000 is just enough for a minimum board lot of 50 shares.

However, with the assistance of Micro HK CFD Trading, Mike can take positions on all three of his selected counters and achieve greater diversification with his capital outlay!

3. Corporate-action entitlements

Clients who hold long positions on equity CFDs are entitled to dividends, stock splits, stock consolidation, rights issues etc. With Micro HK CFD Trading, those who hold long positions are entitled to the quantities rounded down as fractional shares are not catered for.

For short positions, certain corporate actions may require clients to liquidate their holdings one day before the ex-dividend dates. Additionally, clients will be required to liquidate their positions for those corporate actions that PhillipCapital does not cater for.

For more information, please check out our CFD information sheet.

4. Hedge your portfolio against rising uncertainties with CFDs

Contrary to popular opinion, Contracts for Differences (CFDs) are not just for technical traders. Long-term investors can utilise CFDs to hedge their positions against unforeseen events and uncertainties. When investors foresee rising uncertainty and volatility in the market, they can enter into CFD contracts to hedge their positions.

CFD World Indices and Commodities are ideal hedging tools for equities. This is due to their cost effectiveness and correlations.

One can use CFDs as a hedge in the following two possible scenarios:

1) When the price of your existing position has already moved / is moving against you.

2) When you anticipate future gains in your existing positions to be marginal due to increasingly negative market sentiment.

For an illustration of how to use CFDs for hedging, check out the bottom of this article.

5. Odd lot sizes at board lot prices

There may be occasions when corporate actions leave clients with additional odd lot shares. These odd lot shares are traded at a lower price than in the board lot market due to their lower liquidity. This is disadvantageous for clients when they do decide to liquidate their odd lot shares. Additionally, clients cannot liquidate their odd lot shares directly on POEMS but are required to call in to place their orders via the dealing desk. These trades are subject to broker-assisted commission rates.

With Micro HK CFD Trading, you can trade selected HK counters in odd lot sizes at the original board lot prices on POEMS. Micro HK CFD Trading thus provides much more flexibility and convenience than buying shares directly.

Micro HK CFD Trading available for selected HK Equity CFDs, with reduced minimum commissions!

From 4 January 2021 to 31 December 2021, trade selected Hong Kong Equity CFD counters from one unit onwards, with reduced minimum commissions of HK$50.

No sign-up necessary. All you have to do is to make the qualifying HK Equity CFD trades during the promotion period and the lowered commission rates will apply to you. It’s that simple!

For a full list of HK Equity CFD counters available for this promotion, please refer here.

Reference:

- 1 https://www.scmp.com/business/companies/article/3090404/hong-kong-and-shanghai-locked-tight-race-be-2020s-top-ipo-venue

- 2 Full list of Micro HK CFD Trading counters available here

- 3 For full details of Hong Kong stocks offered by POEMS, please refer here

- 4 T&Cs apply. Promotion details for Micro HK CFD Trading can be found here

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Brigitte Fang Shu'En

Dealer

Brigitte is a dealer for Contracts for Differences (CFD) who is an avid lover of trading Asian markets and aspire to trade the European markets one day. She has experience trading intraday in both the Hong Kong and Singapore markets. Prior to joining PhillipCapital, she studied Quantitative Finance in National University of Singapore. In her free time, Brigitte enjoys reading books on trading and following the latest market news on HK IPOs.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile