Top 2 Reasons You Should Grab the Gold Now March 30, 2020

“If you don’t own gold, you know neither history nor economics” ~ Ray Dalio, founder of the Bridgewater Associates, the world’s largest hedge fund

Looking for security amidst volatile and uncertain times? In the current market situation brought about by covid-19 pandemic, we have seen gold’s strength in portfolio hedging and preservation and may be worthwhile adding to your investment portfolio.

In this article, I will attempt to share with you the benefits of owning gold as a form of diversification and my insights about how gold behaves with respect to the MSCI World Index in turbulent times.

1) Hedging

“The Markets generally are unpredictable, so that one has to have different scenarios. The idea that you can actually predict what’s going to happen contradicts my way of looking at the Market”

Instead of trying to predict Mr Market’s next move or the arrival of a crisis, a more productive approach is to implement defensive strategies to hedge against uncertainties and turbulence. Generally, investor and central banks view gold as a global store of value, and often use it as an effective hedge against currencies.

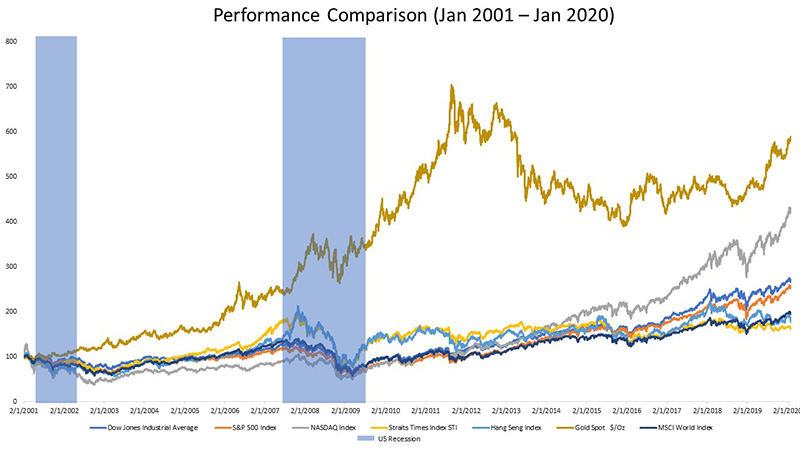

The relation between gold and world indices has always fascinated me. Therefore, I decided to compare how gold has performed with regards to the MSCI World Index. The MSCI World Index is a market cap weighted index of 1643 companies throughout developed markets of the World[1]. How was the relationship between gold and the MSCI World Index during the last 6 business contraction cycles in the US? Let’s find out below!

| Period | Gold Start (USD/oz) | Gold End (USD/oz) | Change (%) | MSCI Start | MSCI End | Change(%) |

|---|---|---|---|---|---|---|

| 11/1973 – 03/1975 | 100.80 | 178.16 | 76.75 | 125.49 | 97.51 | -22.30 |

| 01/1980 – 07/1980 | 559.50 | 614.25 | 9.79 | 131.1 | 146.63 | 11.85 |

| 07/1981 – 11/1982 | 422.00 | 436 | 3.32 | 153.25 | 148.92 | -2.83 |

| 07/1990 – 03/1991 | 357.4 | 355.65 | -0.49 | 522.96 | 504.26 | -3.85 |

| 03/2001 – 11/2001 | 265.65 | 274.4 | 3.29 | 1137.19 | 997.93 | -12.25 |

| 12/2007 – 06/2009 | 794.3 | 926.5 | 16.64 | 1604.06 | 750.86 | -53.19 |

| Mean | 18.22 | -16.02 |

Figure 1: Gold Performance w.r.t the MSCI World Index during the last 6 business contraction cycles in the US [2]

Figure 2: Gold Performance w.r.t the MSCI World Index during the last six business contraction cycles in the US (Bar Chart Variation of Figure 1)

Lo and behold, during times of high uncertainty such as the crash of the Bretton Woods System (1973-1974 Stock Market Crash) and the financial crisis of 2007-2008, gold saw the largest increase of 76.75% and 16.64% respectively.

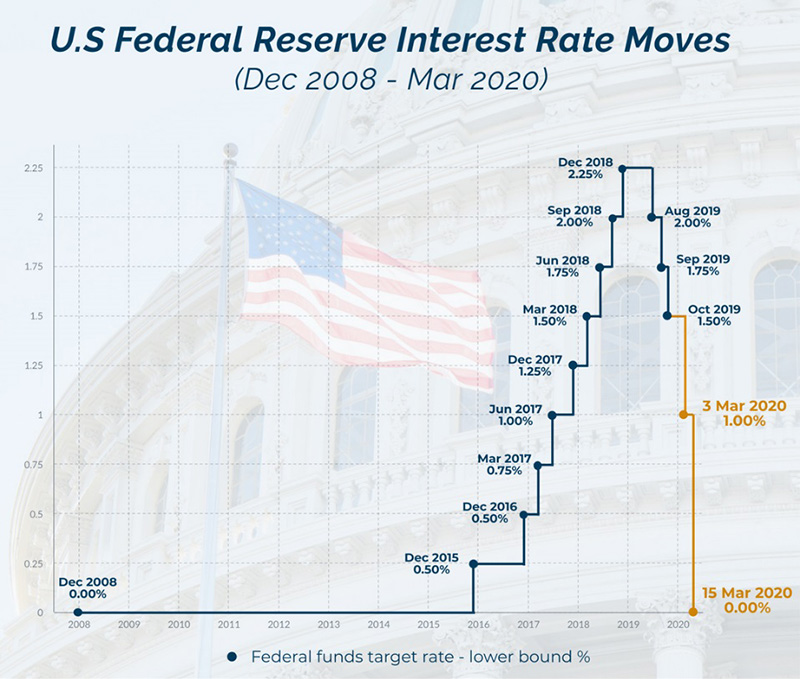

In macro-economic theory, during recession, central banks across the world will cut interest rates to provide stimulus to the economy. On Black Monday, also known as the Stock Market Crash of 1987, the Fed decided to cut interest rates. Its benchmark rate was 7.25%, so a 50 basis cut was not especially significant. In 2000 when the US economy entered recession, the Fed’s benchmark rate was 6.5%. During the “Great Recession” that started in late 2007, the Fed’s benchmark rate was 5.25%. Therefore, there was room for further rate cuts. On 4 March 2020, the Fed slashed interest rates by 50 basis points to 1.25%. This may give the US economy very little room to cut rates in the event that the US economy enters a recession. At the time of writing this article, the Federal Reserve further reduced the Fed rate to 0 to 0.25%. Will the U.S. see negative interest rates like Switzerland and Japan? [3]

Figure 3: U.S Federal Reserve Interest Rates [4]

Turbulent times like this encourage investors to shift their funds to safe haven assets such as gold and high yield instruments. This has thus resulted in a surge of prices in both gold and defensive stocks. Bridgewater Associates, the world-renowned hedge fund founded by Macroeconomic Investor Ray Dalio increased its SPDR Gold Shares to 579,692 in Q4 2019. This is a 20% increased as compared to the same period in Q4 2017. [5][6][7] Sandler Capital Management, touted as one of the best stock-picking funds in 2019, also increased its stake in the SPDR Gold Trust by nearly $38 million USD. This is an increase of 180%[8].

2) Investment

In my opinion, gold has a place in every investor’s portfolio. I decided to investigate gold’s return with respect to the other indices. According to Figure 4, gold moved in line with equities during the bull market, providing higher capital gains then the indices sampled in Figure 4. During the period of January 2001 towards the end of 2019, Spot Gold recorded a CAGR of 9.53% which outperformed the 3.61% CAGR recorded by MSCI World Index.

However, in bear markets, based on Figures 1, 2 and 4, gold had an inverse correlation with the respective indices. Therefore, this supports our above-mentioned analysis that gold acts as an effective hedging tool.

Figure 4: Gold Performance Comparison with respective indices (Jan 2001 – Jan 2020) [9]

When is the right time to buy gold?

Finding the right opportunity to incorporate gold in your portfolio can be tricky! We encourage all readers to include gold during the inception of their portfolios. This is because buying gold during crisis may be too late for hedging as prices may have already been factored in.

How do I take a position in gold?

If I want to take a position in gold, does that mean that I have to head down to the nearest jewellery shop to purchase it? Where can I store my precious metals?

The good news is you do not need to own physical gold to take a position in gold. Here are some investment products that you can consider based on your investment profile:

- Speculation:

- CFD

CFD allows you to long or short Gold with just 20% margin and participate in the price movement of the underlying Spot Gold directly with minimal capital and costs. Besides Spot Gold, CFD also offers other gold-related securities such as gold miners and various ETFs. - Futures

With more than six types of gold futures being offered at PhillipCapital, you may participate in the short-term price fluctuations of the respective futures contract. Futures contracts can also be initiated with initial margins. - Gold Miners ETFs

VanEck Vectors Gold Miners ETFs replicate the price and performance of the NYSE Arca Gold Miners Index (GDMNTR), which tracks the overall performance of the gold mining companies. Purchasing an ETF provides diversified exposure to all the gold miners. VanEck Vectors Junior Gold Miners ETF tracks the overall performance of small-capitalized companies that are involved in gold mining. These ETFs may provide leveraged exposure to gold price movements.[10]

- CFD

- Hedging/Investment

- Unit Trust

Gold-related unit trusts funds are managed by professional fund managers, with combinations such as commodities, gold miners, cash and other components that are engineered by the managers to maximise the performance of the funds in the long run. PhillipCapital offers up to 10 gold-related unit trust funds from different issuers. You can invest in gold with the flexibility of settling in cash or Supplementary Retirement Scheme (SRS), depending on the settlement conditions of each fund. - Exchange Traded Fund (ETF)

With ETF, investors can involve themselves in gold bullion market through trading or holding securities on various regulated stock exchanges in a cost-efficient way. SPDR Gold Shares are one of the popular ETF being listed in several exchanges and one of the most liquid listed Gold ETFs.

- Unit Trust

Conclusion

We have come to the end of this article! I sincerely hope that by reading this article you will have a better understanding of hedging and the benefits of owning gold.

If you’re interested in trading gold and silver, here is the list of CFDs that we offer:

If you have any questions on trading or investing, feel free to drop us an email at cfd@phillip.com.sg and we will be glad to assist you through your investment journey. There are also FREE CFD seminars that you can attend to learn more about this derivative product. Be sure to check out our other gold articles too.

- [1] https://www.msci.com/documents/10199/149ed7bc-316e-4b4c-8ea4-43fcb5bd6523

- [2] https://www.nber.org/cycles.html

- [3] https://www.cnbc.com/2020/03/15/federal-reserve-cuts-rates-to-zero-and-launches-massive-700-billion-quantitative-easing-program.html

- [4] https://www.federalreserve.gov/monetarypolicy/openmarket.htm

- [5] https://www.bridgewater.com/

- [6] https://sec.report/Document/0001140361-18-007141/

- [7] https://sec.report/Document/0001567619-20-003264/

- [8] https://www.cnbc.com/2019/08/20/a-top-performing-hedge-fund-is-making-a-big-bet-on-gold.html

- [9] Bloomberg: Gold Performance Comparison with respective indices (Jan 2001 – Jan 2020)

- [10] https://www.vaneck.com/etf/equity/gdx/overview/

About the author

Lee Yong Shern

Dealer

Yong Shern is a passionate CFD dealer who has always aspired to discover trading opportunities via a blend of different research methodologies. Yong Shern is experienced in both trading and research in various financial products. These products include equities, indices, commodities and forex trading.In his free time, Yong Shern enjoys following the latest market news with the aim of helping clients navigate through various market conditions.