Top 5 Mistakes that Investors and Traders Make October 13, 2022

This article will examine and discuss common mistakes investors and traders make and how to avoid them.

For this article, I have interviewed traders who consistently generate profits to find out what they are doing right to be in the top 10% of the trading community.

Given my position as a Contract-For-Difference (CFD) dealer, I have observed certain interesting patterns and behaviors from the orders our traders and investors make. For a start, the quote “You can take the person out of the Stone Age, not the Stone Age out of the person” comes to mind.

What is the difference between an investor and a trader? I will touch on a few differences between them such as the time duration they hold an asset and the assumptions they make.

Traders tend to hold positions, ranging from a few seconds to a month or two depending on their strategy. They also tend to focus on short-term price movements and aim to profit off it, while investors tend to have a longer time horizon, ranging from years to decades.

Legendary value Investor Warren Buffet once said: “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

Another major difference is strategy. Traders tend to focus on Technical Analysis and price data, while investors focus more on the Fundamental Analysis of a business.

Technical Analysis focuses on identifying trends, momentum, patterns and price data, while fundamental analysis looks into the financials of a business and its future profitability and cash flow.

Top traders tend to rely on both Technical and Fundamental Analysis.

Despite the differences between an investor and a trader, there are some common execution-related behaviours that both investors and traders do that cost them dearly.

Given today’s advances in technology, with easy access to information and advanced strategies, anyone with a smartphone is able to view large amounts of live information, financial statements and even multiple technical indicators on the go.

This is way more than what the market participants in the past had access to, yet 70-80% of traders today lose money every quarter[1], like the traders 30 years ago[2].

Furthermore, based on my observation, it does not matter if the trader is a surgeon or director of a company. The reason why traders are not profiting is not due to a lack of technical skills, information or strategy. It is due to their execution.

With that in mind, here are some common bad execution habits that both traders and investors subconsciously indulge in:

1. Holding on to losses while quick to take profits – Loss aversion

Be it traders or investors, the basic human instinct is to do whatever it takes to prevent losses. Studies have shown that loss aversion is hardwired into our behaviour. The mentality of avoiding losses dates back to the stone age, where humans were low risk takers[3] to ensure survival.

Loss aversion has turned some short-horizon traders into long-term “investors”.

However, any successful trader or investor will tell you that loss aversion does more harm than good to your portfolio, as it is based on emotions and instinct, rather than logic and strategy. This behavior can be seen in investors and traders who tend to be quick in taking profits, but hesitant in cutting losses.

It is observed that traders do not like to realise losses, and shift their stop-loss levels so often that they might as well not have a stop-loss level at all. The mentality of “never closing a position in the red” and refusing to cut losses, ultimately pushes traders and investors into making irrational decisions and blinds them to better opportunities.

Traders and investors should note down their strategies and the reasons for creating the position, so that every time they want to shift their stop loss or take action, they can remember to make sure their actions are aligned to their strategy.

2. Natural behavior towards risk vs reward

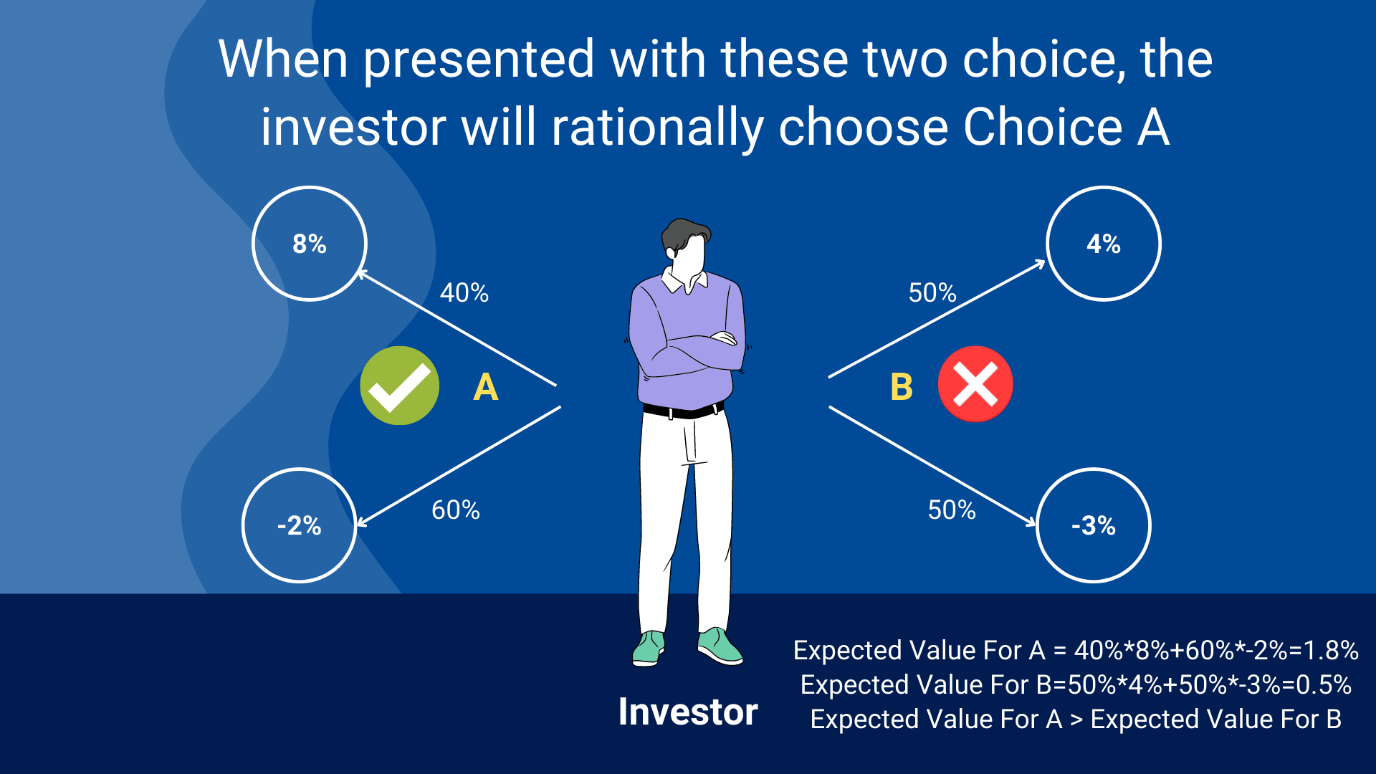

The concept of risk vs reward, is one taught in schools and universities, where a rational person will always choose the best outcome based on the pros and cons of his situation and only choose to take on a risk if there is positive expected value. Below is an illustration:

Assuming the investor is rational, he or she should always pick A as the expected value of A is greater than the expected value of B. However, if we change the parameters slightly like the diagram below:

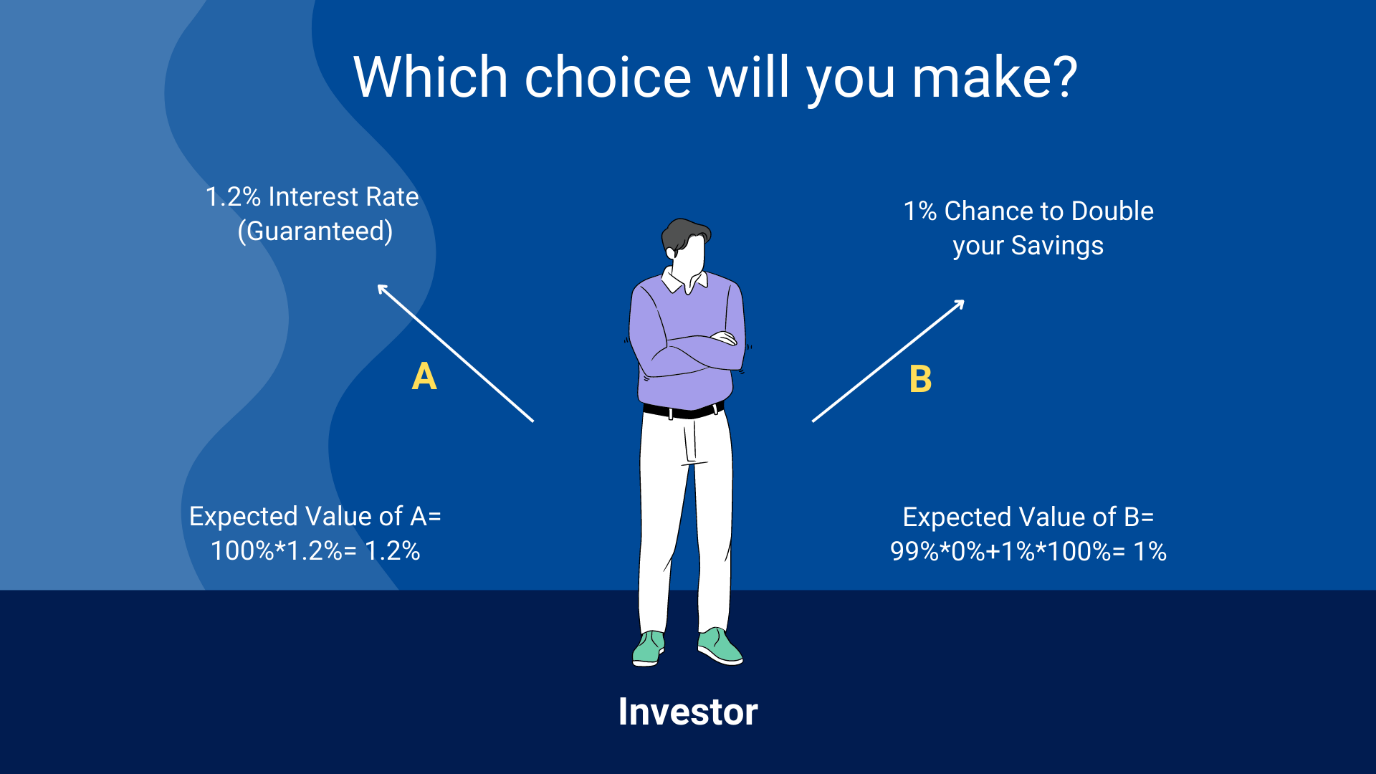

Most investors will choose Option B and take their chances over the 1.2% guaranteed interest rate. Even though 1% chance is highly unlikely, the allure of doubling your savings is too strong. However, a rational person will pick Option A as the expected value of A is higher than the expected value of B.

Studies have shown that people tend to overestimate probability to give themselves a sense of hope[4], more perceived value is given to options with extremely small probability, but a potential of enormous payout. This is usually seen in gamblers and lottery ticket buyers. It is inbuilt into our inner bias, but should we use such an approach towards investing / trading?

Before traders and investor decide to purchase an asset in the hope of generating huge gains, do more due diligence to ensure that the risk vs reward is as good as it seems. More likely, the majority of such assets do not produce a good risk adjusted result just like lotteries.

3. The constant need to do something

The Fear Of Missing Out (FOMO) is something traders and investors face regularly. With information so readily available through news and phone Apps, market participants are bombarded with excessive analysis ranging from technical and fundamental ones. Furthermore, financial news outlets tend to constantly highlight “hot stocks”, “hot trends” (COVID-19 Stocks by CNBC[5]) and “success stories”, with headline news and selective information meant to entice market participants to get in on the action.

Feeling the need to touch your portfolio or trade while watching the news can be very costly as it is usually driven by emotions and hurried decisions. Most of the time, the headlines only show news that is extremely positive or extremely negative, such as the crypto bull market during the pandemic.

Crypto “analysts” were raising price targets constantly and took bad news as good news and vice versa[6]. Traders and investors who had FOMO jumped on the bandwagon without fully understanding the underlying risks and got burned.

Investors and traders need to be wary of information from all sources as an increasing amount of online news is generated using Artificial Intelligence (AI)[7]. Furthermore, news outlets tend to invite bull guest presenters on a positive market day and bear guest presenters on a negative market day, to fit the narrative.

Market participants should be aware of current financial news, but refer to their strategy before committing to any action. Most of the time, for a long-term investor, a large proportion of financial news is just short-term noise and does not warrant any action.

4. Market is at an all-time high, how to buy?

This question is often tossed around the investing community when the market is experiencing a bull run. Below is a table listing the number of all-time highs recorded in a particular year from 1991 to September 2022:

| S&P 500 Number of All-Time Highs (1991 – Sep 2022) | |||

| Year | No. All-Time Highs | Year | No. All-Time Highs |

| Sep-22 | 0 | 2006 | 0 |

| 2021 | 70 | 2005 | 0 |

| 2020 | 33 | 2004 | 0 |

| 2019 | 36 | 2003 | 0 |

| 2018 | 19 | 2002 | 0 |

| 2017 | 62 | 2001 | 0 |

| 2016 | 18 | 2000 | 4 |

| 2015 | 10 | 1999 | 35 |

| 2014 | 53 | 1998 | 47 |

| 2013 | 45 | 1997 | 45 |

| 2012 | 0 | 1996 | 39 |

| 2011 | 0 | 1995 | 77 |

| 2010 | 0 | 1994 | 5 |

| 2009 | 0 | 1993 | 16 |

| 2008 | 0 | 1992 | 18 |

| 2007 | 9 | 1991 | 22 |

If investors did not invest during all-time highs, they would have missed out on the bull run of 1991-2000 and the bull run of 2013 to 2021. During those years, all-time highs were hit from the lows of 4 (in 2000) times to 77 (1995) times; and also the bull run from 2013 to 2021, which gave a return of ~220%.

This shows that just because markets are at all-time highs, does not mean they are un-investable, as other factors such as valuations and the macro-environment need to be taken in to consideration.

5. Letting the ups and downs affect trading, investing and day to day life

In the life of a trader and investor, market volatility can either be your friend or your worst enemy. There are going to be days when you do well and days when you do badly. Losses are part of the journey in trading and investing. With changes in portfolio value, market participants tend to get emotional and assume bad behavior patterns, such as increasing the trade amount when they are in the red, while decreasing trade amount when they are in the green. Furthermore, some market participants may see their lives negatively impacted, as they are constantly worried about their positions and losses.

Traders who fall into this category tend to spiral downwards and incur more losses as their judgment is clouded by emotions and irrational thoughts.

Traders and investors need to understand that losses are part of the game. It is better not to perform any action than to make a decision based on emotions, as more often than not, it will harm your portfolio. Traders can decrease trading size to better handle their emotions during trading, and progressively increase trading size when they are comfortable.

In conclusion, while trading and investing strategies are important and essential, this is only half of the battle. Market participants with sophisticated models and back-tested strategies also fall prey to execution flaws.

To be able to execute the strategies is as important as the strategies themselves.

After interviewing successful traders, here are a few tips and pointers that make them different.

Once they have a strategy that they have back-tested, they will enter into positions only when the set-up is right, exercising discipline and patience.

They then set a predetermined stop-loss for proper risk management but have different “take profit levels” to enjoy potentially higher gains.

Set a predetermined loss amount, and once hit, take a break ranging from 10 minutes to a day off to recover emotionally and mentally. Then, review your setup before attempting to trade again.

Ultimately, trading and investing might not be for everyone as it can take an emotional toll. However, with the right community support and experience, trading and investing can be both fun and rewarding.

Reference:

- [1] https://markets.businessinsider.com/news/stocks/if-you-re-day-trading-you-will-probably-lose-money-here-s-why-1030667770

- [2] https://www.financemagnates.com/forex/analysis/how-behavioural-analytics-is-shaking-up-the-retail-trading-world/

- [3] https://hbr.org/1998/07/how-hardwired-is-human-behavior

- [4] https://www.abc15.com/news/state/lottery-psychology-why-do-people-take-chances-even-though-winning-is-so-rare

- [5] https://www.cnbc.com/world/

- [6] https://www.moneycontrol.com/msite/wazirx-cryptocontrol-articles/the-bull-run-in-the-crypto-market-isnt-over-yet-here-are-5-reasons-why/

- [7] https://www.nytimes.com/2019/02/05/business/media/artificial-intelligence-journalism-robots.html

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Sam Hei Tung, Dealing

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile