Top Traded US Stocks on POEMS in June 2021 July 23, 2021

The following list some of the top traded US stocks, not in any order of ranking, by our POEMS clients along with major news announced on the stocks in the month of June.

At a glance:

- The month of June was volatile for all three major indices following the release of higher-than-estimated ADP non-farm payrolls, which shows data collected from private enterprises, FOMC statements and the Fed Funds rate, all of which spooked inflation fears. All three major indices dipped in the first half of the month before recovering in the second half.

- Fed Funds rates are unchanged but there has been a shift in the Fed’s economic projections. The Fed now indicates not one but two interest-rate hikes in 2023.

- Bears also beat a dramatic retreat1 on the back of a consistent strong economic recovery.

The three US major indices – Dow Jones, S&P 500 and Nasdaq Composite – retreated in the first half of the month. The Dow dropped by 3.79% from 34,584.19 points to a low of 33,271.93 points, the S&P 500 shed 1.24% from 4,216.52 to 4,164.40 while Nasdaq Composite gave up 2.03% from 13,829.06 to a low of 13,548.93. The declines were spooked by tapering fears caused by inflation, when ADP non-farm jobs rose 978K, 51.63% better than the estimate of 645K at the start of the month of June. However, the fears diminished when the non-farm employment change was released 2 days later after the release of ADP non-farm payroll, a change at 559K, 13.33% below the estimate of 645K.

Towards the middle of the month, the Fed kept its Fed Funds rate unchanged at 0.25%. However, the FOMC projects that there will be two rate hikes in 2023 after possible tapering. Following an initial knee-jerk reaction, all three major indices managed to recover.

The Dow closed at 34,502.52, S&P 500 at 4,343.53 and Nasdaq Composite at 14,503.95 – a recovery of 3.70%, 3.20% and 7.05% respectively from their month lows. This could be due to the Fed’s indication that it will maintain its easy monetary policy for now. Tapering may also be out of the picture in the short term as the FOMC meeting remained inconclusive on this.

We have included technical charts for all the 10 counters. Charts are analysed on different time frames. The charts are for your information only and the support and resistance levels discussed are solely based on our dealers’ views. The technical charts should not be constituted as buy or sell recommendations and investors/traders are advised to do their own due diligence before making any trade.

Here are some of June’s top traded US stocks on Phillip’s Online Electronic Mart System (POEMS), based on gross market value traded.

Coinbase Global Inc (NASDAQ: COIN)

Coinbase went from an astonishing opening price of US$304 to a closing price of US$236.54, a 22.19% drop in the month of May. This followed an announcement by Elon Musk, an outspoken supporter of bitcoins who have invested US$1.5bn in the cryptocurrency2, that Tesla (NASDAQ: TSLA) was no longer accepting bitcoins as payment. He reasoned that mining bitcoins is too harsh on the environment3. Shortly after, he reversed his position and said Tesla would accept bitcoin payments again once mining becomes more energy-efficient4. In June, COIN hovered between US$210 and US$250. Its drop mirrored the market’s overall consolidation due to uncertainties over the big dropped in May5.

There might be potential for COIN to rally again on the back of approval to offer crypto custody services in Germany. This might allow COIN to expand its market to generate more sales. Together with MicroStrategy (MSTR.US) who added US$489mn of bitcoins to its balance sheet,6 the stocks of companies like COIN which deal with cryptocurrencies may be supported.

Technical Analysis:

Status: Neutral

Support: US$208.00-212.00

Resistance: US$248.25-252.10

Range-bound

Citigroup (NYSE: C)

Citi started dropping from a high of US$80.29 in June. This could be due to its resistance level at the price of US$80, as seen in 2018 and 2020. Citi dropped from that price as investors might have decided to take profits.

Later in the month, it dwindled further to US$67.13, down 16.39% from its high. This was after a warning from Mark Mason, Chief Financial Officer, that trading revenues may disappoint in Q2 2021 as trading activities moderated.7

However, Citi managed to rebound to close at US$70.89, a 5.6% increase from its low as the Fed allowed banks to resume dividends and shares buyback previously restricted during the COVID-19 pandemic.8 The news gave investors cheer on the whole financial sector.

Technical Analysis:

Status: Neutral

Support: US$67.13-67.61

Resistance: US$71.32-71.60

Range-bound.

Plug Power Inc (NASDAQ: PLUG)

PLUG managed to touch US$36.04 on 30 June 2021, up 17.04% from an opening price of US$31.10. This might be credited to a report on the fuel-cell market, which projects that the market will reach US$14.6bn by 20279, up 5,451% from 2020. The USD$263million estimated market size10 may have encouraged investors to look at fuel-cell companies like PLUG.

Later in the month, news that the US has returned to the Paris Climate Agreement and the Biden administration’s push for greener energy infrastructure led to interest in hydrogen fuel-cell companies like PLUG.11 US support for the Paris Agreement is crucial, as the US is one of the top carbon emitters globally. Hydrogen fuel cells are part of clean energy and investors are hoping that PLUG may benefit from a potential increase in business and earnings.

Technical Analysis:

Status: Neutral

Support: US$28.88-29.05

Resistance: US$34.67-35.20

Range-bound

Clean Energy Fuels Corp (NASDAQ: CLNE)

In the same industry as PLUG is Clean Energy. Clean should benefit from the report on the fuel-cell sector as well, that global sales could rise to US$14.6bn by 2027.12 Clean Energy’s shares were up 27.03% from their opening price of US$7.99 to close at US$10.15.

Clean’s prospects have brightened on the back of a 5-year agreement it just signed with Amazon to provide renewable natural gas. The second piece of good news is Chevron’s US$20mn investment in the company.13 Both the companies are big boys in their industries and the partnerships are expected generate more revenue for Clean to fund its expansion.

Technical Analysis:

Status: Technical Sell below US$10.30

Support: US$7.48-7.87

Resistance: US$10.29-10.52

Bearish market structure

Xpeng Inc (NYSE: XPEV)

Xpeng rallied 31.81% from its opening price of US$33.70 to US$44.42 in June. This followed its announcement that it delivered 13,340 vehicles in Q1 2021, a 487% jump from the previous year’s 2,27114, fuelling confidence in Xpeng’s outlook.

Its President, Brian Gu, was also positive that Q2 sales could exceed the company’s delivery targets as demand for Chinese EVs remains strong.15 To support its growth ambitions, Xpeng raised US$1.8bn from a Hong Kong dual primary listing recently. It started trading on 7 July 2021. The funds raised could potentially be used a war chest for further growth. Its dual listings mean Xpeng can raise funds both on the HKEX and NYSE.

Technical Analysis:

Status: Neutral

Support: US$39.65-40.20

Resistance: US$45.23-45.75

Range-bound

Sundial Growers Inc. (NASDAQ: SNDL)

Sundial is a legal cultivator and distributor of cannabis in Canada. It came into the spotlight this month thanks to Reddit. The stock opened at US$1.03, before a short squeeze pushed it up to US$$1.49. It closed the month at US$$0.94.

For the first time, Sundial managed to report a positive adjusted EBITDA in Q2. This marked an important corporate milestone. The profits came from streamlining its business and cutting costs.

However, the declines in its gross revenue over the quarters are worrying. Sundial may be losing market share as it has slashed its sales and marketing costs by nearly half. Another risk is the recent change in its products19. It has changed its core business from selling marijuana to cannabis. Moving forward, Sundial will need to figure out ways to establish its foothold in the new market.

Although Sundial’s consumers are mainly based in Canada, it is widely expected to expand to the US. There is growing support for cannabis legalisation at the federal-government level in the US.2021 This brings hope that there will opportunities for growth in the cannabis industry.

Technical Analysis:

Status: Technical Sell below US$1.00

Support: US$0.823-0.845

Resistance: US$1.00-1.04

Range-bound

Tilray Inc. (NASDAQ: TLRY)

Another weed company made popular by Reddit is Tilray. Its share price was driven up at the beginning of June to a high of US$23.04. Between opening at US$17.13 and closing at US$18.08, Tilray yielded a gain of around 5.5%.

Tilray recently merged with another pot company to form the world’s largest weed company by revenue.22 Similar to Sundial, Tilray has benefited from budding support for legalising cannabis in the US. Legalisation means more sales.

As the merger was recent, there is not much data to prove if it is actually beneficial. However, the merger did give birth to a new medical cannabis brand, Symbios23. This new product line is aimed at providing a more comprehensive line of products to medical patients. With a growing cannabis market24 and the new line of product, Tilray is worth keeping an eye on.

Technical Analysis:

Status: Technical Sell below US$16.68

Support: US$14.85-15.02

Resistance: US$16.69-16.98

Bearish movement into immediate support

Fuelcell Energy Inc. (NASDAQ: FCEL)

Fuelcell Energy develops fuel cells for use as alternative fuel. In June, the stock surged to a high of US$$12.62 before crashing to US$8.43. The fall could be blamed on a surprise dip in its Q2 revenue25. The market was expecting a loss per share of 5 cents but Fuelcell’s loss came in at 6 cents.

Nonetheless, alternative fuels are gaining traction as ESG grows in importance26. Clean energy will be highly sought after as firms look for ways to reduce carbon footprints. President Biden’s aim to cut greenhouse gas pollution by 203027 should further stimulate the industry.

The risk now lies in Fuelcell’s ability to sustain its business. Current infrastructure works on traditional fossil fuels. Converting and upgrading infrastructure that runs on clean energy require resources and years of development. Investors are likely to question if Fuelcell is able to tide through till the mass adoption of alternative fuels.

Technical Analysis:

Status: Technical Buy above US$8.00

Support: US$7.82-8.03

Resistance: US$9.29-9.43

As long as its immediate support holds, share price could be range-bound towards its immediate resistance above.

Torchlight Energy Resources. (NASDAQ: MMAT)

Torchlight Energy (TRCH) merged with Meta Materials (MMAT) on 26 June 2021. TRCH will undertake a reverse stock split of 1 for 2, followed by a change in its corporate name and stock ticker28. From 28 June 2021, the company will trade under the name of Meta Materials Inc.

Torchlight is another popular meme stock that had a roller-coaster month. Its lowest point in June was at US$5.80, after the stock hit a high of US$21.70. Investing in meme stocks entails high risk as their share prices may rise and fall equally quickly.

After the merger, management intends to move away from oil and gas to developing high-performance functional materials and nanocomposites29. Nanotechnology is the next new thing, with its global market expected to reach US$70.7bn by 202630. Nanomaterials can be used in multiple industries, including construction, healthcare and agriculture31. This implies substantial growth potential. Downside lies with research and development capabilities. Torchlight risks lagging the other firms if its R&D is weak. However, looking at the 64 pending global patents it has filed for, its R&D capability should not be much of a concern.

Technical Analysis:

Status: Technical Sell below US$6.30

Support: US$4.32-4.79

Resistance: US$7.76-7.96

Bullish market structure into support, more potential down moves once below

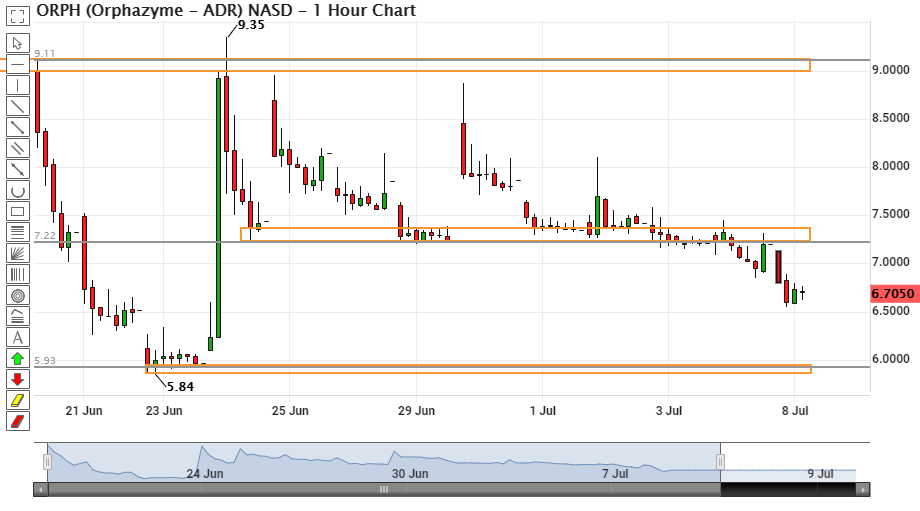

ORPHAZYME – ADR (NASDAQ: ORPH)

Orphazyme was one of the more volatile stocks in our list. Wall Street Bets subscribers led a short squeeze on the stock in June, fuelling a surge to a 52-week high of US$$77 on 10 June 2021. Like most meme stocks after the squeeze, Orphazyme crashed to around US$10 over the next few days.

On 15 June 2021, one of Orphazyme’s major shareholders liquidated his shares. This gave rise to hopes of a potential merger32 and its shares broke out of their US$10 range.

Gains from the rumours were soon erased by the US Food and Drug Administration’s (FDA) rejection of Orphazyme’s key drug candidate for a metabolic disease, Niemann Pick C.33. With no other projects to back its prospects, Orphazyme had to cut its revenue forecasts.

Investing in biopharmaceutical firms entails a considerable level of risk. In the sector, failure rates on inventions are 85-95%34. Risks are compensated if the drugs take off, in which case investments can possibly grow 200-300% in a single day. Investors are advised to assess their risk appetites before investing in such stocks.

Technical Analysis:

Status: Technical Buy above US$7.35

Support: US$5.84-6.00

Resistance: US$7.22-7.35

Range-bound

References:

1. http://www.marctomarket.com/2021/06/fed-pushes-on-open-door-and-dollars.html

2. https://www.cnbc.com/2021/02/08/tesla-buys-1point5-billion-in-bitcoin.html

3. https://www.cnbc.com/2021/05/19/the-crypto-collapse-heres-whats-behind-bitcoins-sudden-drop.html

4. https://www.businessinsider.com/elon-musk-bitcoin-tesla-payment-green-energy-environment-2021-6#:~

5. https://www.moneycontrol.com/news/business/cryptocurrency/cryptocurrency-coinbase-shares-hovering-around-222-mark-near-all-time-low-7075011.html

6. https://www.fool.com/investing/2021/06/28/why-shares-of-coinbase-microstrategy-grayscale-and/

7. https://www.zacks.com/stock/news/1723186/citigroup-c-shares-down-on-soft-q2-trading-revenue-outlook

8. https://finance.yahoo.com/video/dividends-buybacks-back-track-132745353.html

9. https://www.fool.com/investing/2021/05/26/why-clean-energy-stocks-are-up-today/

10. https://www.marketsandmarkets.com/Market-Reports/fuel-cell-market-348.html

11. https://www.investors.com/news/plug-stock-plug-power-earnings-q1-2021/

12. https://www.fool.com/investing/2021/05/26/why-clean-energy-stocks-are-up-today/

13. https://www.fool.com/investing/2021/06/11/clean-energy-fuels-buy-at-the-high/

14. https://finance.yahoo.com/news/xpeng-quarterly-revenue-jumps-6x-120718701.html

15. https://finance.yahoo.com/news/xpeng-expects-meet-beat-sales-005654863.html

19. https://www.fool.com/investing/2021/06/26/5-heavily-short-sold-stocks-avoid-like-the-plague/

20. https://www.forbes.com/sites/roberthoban/2021/06/13/amazons-support-for-marijuana-is-the-missing-link-for-legalization/

21. https://www.cnbc.com/2021/06/28/supreme-court-justice-clarence-thomas-says-federal-marijuana-laws-may-be-outdated-.html

22. https://www.marketwatch.com/story/tilray-and-aphria-merger-closes-and-creates-worlds-biggest-weed-company-by-revenue-11620064759

23. https://www.businesswire.com/news/home/20210608005394/en/Tilray-Announces-Launch-of-New-Medical-Cannabis-Brand-Symbios

24. https://www.businesswire.com/news/home/20210608005394/en/Tilray-Announces-Launch-of-New-Medical-Cannabis-Brand-Symbios

25. https://www.investors.com/news/fcel-stock-fuelcell-energy-earnings-q2-2021/

26. https://www.bloomberg.com/news/articles/2021-02-10/the-490-billion-boom-in-esg-shows-no-signs-of-slowing-green-insight

27. https://www.whitehouse.gov/briefing-room/statements-releases/2021/04/22/fact-sheet-president-biden-sets-2030-greenhouse-gas-pollution-reduction-target-aimed-at-creating-good-paying-union-jobs-and-securing-u-s-leadership-on-clean-energy-technologies/

28. https://www.nasdaqtrader.com/TraderNews.aspx?id=ECA2021-118

29. https://irdirect.net/prviewer/release_only/id/4763528

30. https://www.globenewswire.com/news-release/2021/06/23/2251603/0/en/Global-Nanotechnology-Market-to-Reach-70-7-Billion-by-2026.html

31. https://blog.agchemigroup.eu/the-risks-and-rewards-of-investing-in-nanotechnology/

32. https://www.fool.com/investing/2021/06/16/heres-why-orphazyme-shares-rocketed-higher-on-wedn/

33. https://www.reuters.com/business/healthcare-pharmaceuticals/orphazyme-revises-annual-outlook-after-fda-review-2021-06-18/

34. https://neweuropeaneconomy.com/energy/biotech-investment-returns-risks-and-research/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Jonah Sim Hong Chee

Dealer

Jonah Sim is a US Equity Dealer in the Global Markets Team and specializing in US and Canadian markets. He graduated from University of Essex with a Bachelor Degree in Banking and Finance.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile