US Election 2020: Impact of Tax Policies on Your Investments October 9, 2020

This article is part of the US Election series brought to you by POEMS. #USElection2020.

What this report is about:

- Biden has proposed higher corporate taxes while Trump says he will maintain low taxes

- A Trump win is potentially positive for markets given his loose monetary and corporate tax policies

- A Biden win is potentially positive for consumer discretionary, infrastructure and clean-energy sectors

- Whether Biden or Trump, gain exposure to selected investment themes via ETFs and CFDs

Did you know that the US presidential election outcome could have seismic effects on US foreign policy and global financial markets?

Each presidential candidate has his own political agenda, policy proposals and campaign promises. The policies proposed by the eventual winner could benefit certain industries and sectors while hurting others. Recall that after Donald Trump’s victory over Hilary Clinton in the 2016 election, big pharmaceutical stocks rallied as Clinton had threatened to curb drug- price increases. [1]

Elections this year will revolve around a central theme: Covid-19. The ongoing pandemic has affected the livelihood of millions of Americans and hit countless industries. As we approach D-Day, market volatility is expected to increase. In the lead-up to elections, the POEMS team is rolling out a series of articles on some of the political views of Biden and Trump and their potential impact on financial markets. In this article, we will be looking at their tax and financial-policy propositions.

Corporate Tax

Corporate tax levied on a company’s profit affects business costs. An increase in corporate tax rates will reduce the profits of businesses.

On the other hand, corporate income tax is the third-largest source of federal tax revenue in the US. This money can be redirected to the building of infrastructure or support of other public services. In return, businesses can benefit from the country’s infrastructure development or other public policies.

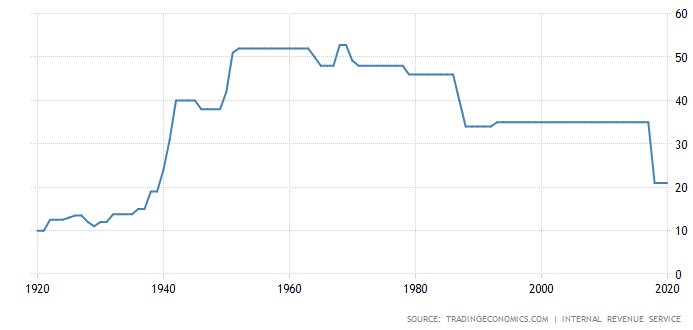

Figure 1: US corporate tax rates over the years

Figure 1: US corporate tax rates over the years

Corporate Alternative Minimum Tax (AMT)

Corporates are required to calculate their tax liabilities under two sets of rules: Regular Tax Liability and Tentative Alternative Minimum Tax (AMT). When their tentative AMT is higher than their regular tax, AMT is imposed. The purpose of AMT is to prevent companies from escaping their tax liabilities by using certain corporate tax preferences. The latter include research and experiment credits, work opportunity credits and welfare-to-work credits.

Minimum Wage

Minimum wage in the US is set by the US labour law as well as state and local laws. Employers generally have to pay workers the highest minimum wage prescribed by federal, state and local law. Since 2009, the federal minimum wage has remained at US$7.25 an hour.

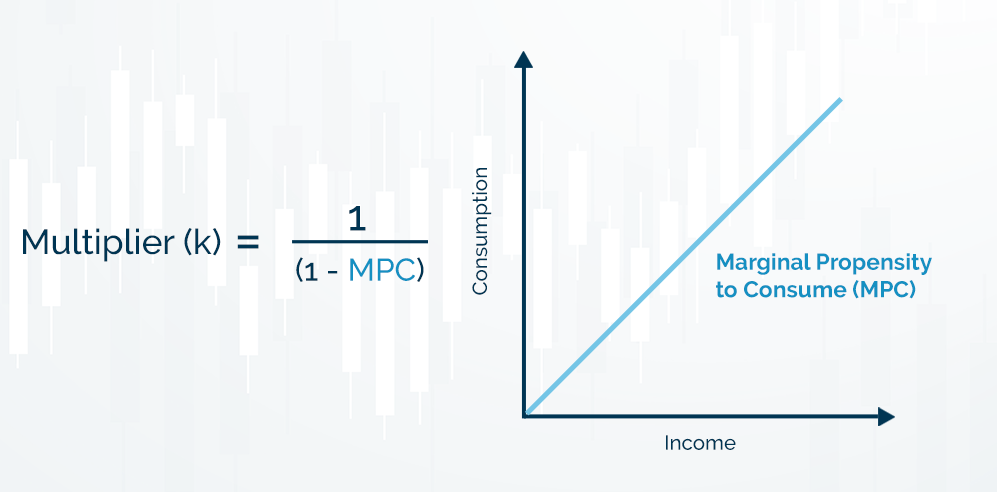

Higher wages increase household disposable income, which generally encourages higher consumer spending. The injection of extra income that leads to more spending typically has multiplier effects on the economy.

How does one measure the multiplier effect? The general formula for calculating the multiplier uses marginal propensities:

1 / (1 – MPC)

Marginal propensity to consume (MPC) is the proportion of an increase in income that gets spent on consumption.

Figure 2: Marginal Propensity to Consume (MPC)

Figure 2: Marginal Propensity to Consume (MPC)

Low-income workers will most likely have a higher MPC, as most of their basic needs remain unsatisfied. As such, increments in their income tend to be spent on meeting those needs. All else being equal, raising the minimum wage will most likely result in higher consumer spending.

Finance Sector

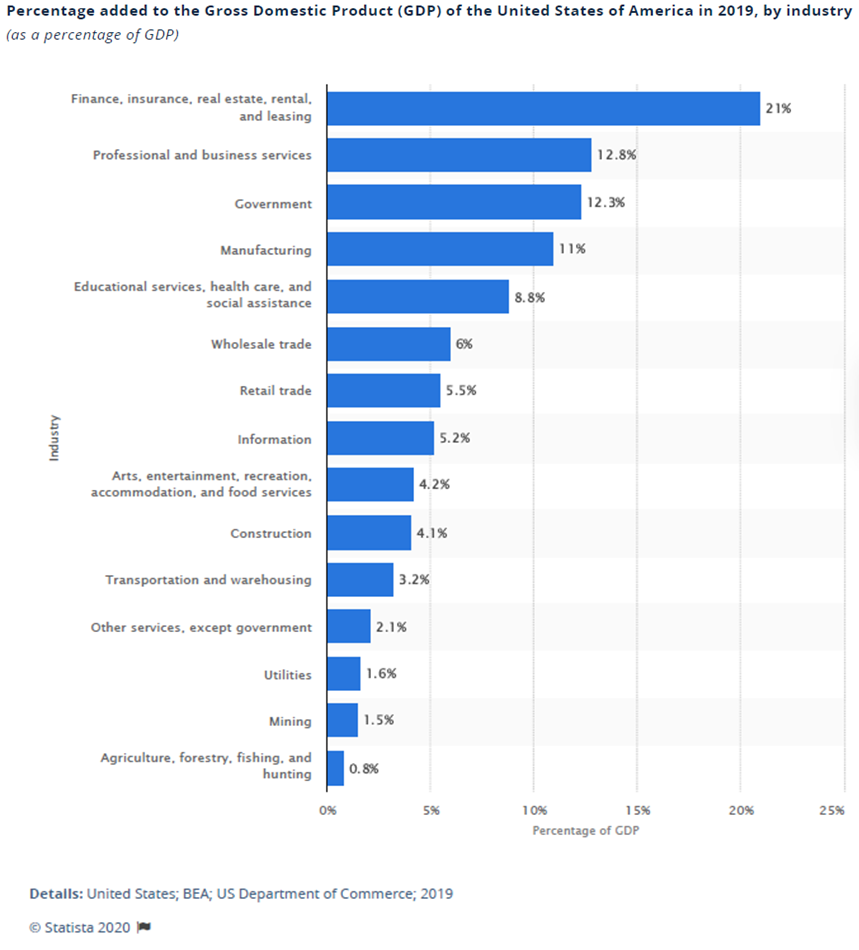

The financial sector is a key pillar of the economy. Firms and institutions in this sector provide financial services to both commercial and retail clients. Categorised in this sector in the US are banks, investment companies, insurance companies and real-estate firms. A stable economy requires a healthy financial sector, as the sector provides loans for businesses to expand, grants mortgages to homebuyers and issues insurance policies to protect companies, people and assets. It also helps individuals build up savings for retirement and provides employment to millions of people. In 2019, this sector added 21% to the US Gross Domestic Product[2].

Figure 3: Industry contributions to US Gross Domestic Product (GDP) by percentage in 2019

Figure 3: Industry contributions to US Gross Domestic Product (GDP) by percentage in 2019

| Current | Trump | Biden | |

| Corporate Tax | After the 2017 tax cuts and Jobs Act of 2017, corporate tax rate has been reduced from 35% to 21%. | Keep corporate tax around 21% | Increase corporate tax to 28% and use the money to upgrade infrastructure and shift towards a clean-energy future. |

| Impact on businesses | Favourable for all businesses as they will have more cash on hand for business expansion, dividend payouts and stock buybacks. These are positive for share prices. | Businesses would have less cash for business expansion, dividend payouts and stock buybacks. Less positive for share prices.However, businesses operating in the infrastructure and clean energy sectors are likely to benefit. | |

| Corporate AMT (Alternative Minimum Tax) | Removed after the 2017 tax cuts and Jobs Act of 2017. | Preserve status quo | Reinstate corporate AMT |

| Impact on businesses | Businesses to continue to benefit from corporate tax preferences, which reduce their tax liabilities. | Businesses using certain corporate tax preferences would have to face their tax liabilities.Less positive for share prices as businesses have less cash for business expansion, dividend payouts and stock buybacks. | |

| Minimum Wage | Federal minimum wage is US$7.25. Employers generally have to pay workers the highest minimum wage as prescribed by federal, state, and local law. | Trump has flopped on his federal minimum wage and does not have a clear direction or decision on this. | Supports raising the national minimum wage to US$15 an hour from US$7.25. |

| Impact on businesses | No clear plan. | A higher minimum wage would increase business costs and reduce profitability. Some businesses would be able to transfer their higher costs back to consumers.Higher minimum wage policies mainly focus on lower-income workers. With higher disposable income and a higher MPC, these workers are likely to spend more on lifestyle. Businesses in consumer discretionary could be one of the beneficiaries. | |

| Finance sector | Under Trump, regulators rolled back a major Obama-era reform known as the Dodd Frank Wall Street Reform and Consumer Protection Act.Easier for banks to invest in venture capital, hedge funds and private equity. | Preserve status quo. Anticipate more Wall Street-friendly regulations | Anticipate stronger financial regulations. Biden has proposed strengthening oversight of consumer lending through credit cards and regulating interest rates.He also wants the Consumer Financial Protection Bureau to crack down on abusive or deceptive lending and make borrowing costs transparent. |

| Impact on businesses | Finance sector to continue to benefit from friendly regulations. | With stronger regulation, operation costs for finance sector would increase, affecting profitability.Furthermore, there could be less business expansion, dividend playouts and stock buybacks from an increase in corporate taxes. This would weigh on the sector.However, the sector may also benefit from higher loan demand from the infrastructure and clean-energy sectors. |

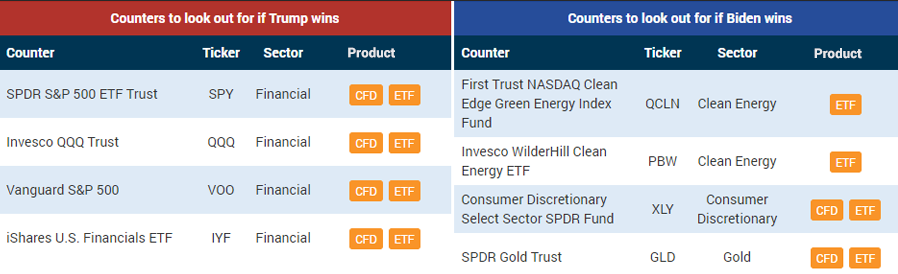

Gain Exposure with ETFs and CFDs on POEMS

Does it matter to you who wins the election? Yes, as our above discussion suggests.

Have a calculated guess on who could win but not sure which counters to buy?

Why not just gain exposure to selected investment themes via ETFs or CFDs? POEMS offers the following thematic ETFs and CFDs.

Source: POEMS US Election 2020 page

Source: POEMS US Election 2020 page

With higher market volatility expected towards Election Day, you can consider using CFDs to hedge your portfolio positions.

Contrary to popular opinion, Contracts for Differences (CFDs) are not just for technical traders. Long-term investors can utilise them to hedge against unforeseen events and uncertainties effectively.

World Indices CFDs and Commodity CFDs are hedging tools for equities amid rising uncertainty and volatility in markets. This is due to their correlations.

One can use CFDs as a hedge in the following two scenarios:

1) When the prices of your existing positions have already moved or are moving against you.

2) When you anticipate future gains in your existing positions to be marginal due to increasingly negative market sentiment.

For a detailed example of how to use CFDs for hedging, check out our example at the bottom of this article.

Before you decide, it is important to know which assets to use to hedge.

Assets that have a positive correlation with your positions are used as an opposing hedge (short). Assets with a negative correlation with your positions are used as a same-side hedge (long). Therefore, you need to select the right assets to hedge your existing position. However, do note that it is not possible to perform a perfect hedge due to correlational factors and positional sizes.

“History doesn’t repeat itself, but it does rhyme.”

Mark Twain

Thank you for following us so far! We sincerely hope that after reading the above, you will gain a better understanding of the policies of the US presidential candidates and their potential impact on financial markets.

Stay tuned for our next US Presidential Election series, which will feature our take on the technology sector!

Till next time, folks!

Reference:

1. https://www.businessinsider.com/stock-market-futures-election-2016-results-2016-11

2. https://www.statista.com/statistics/248004/percentage-added-to-the-us-gdp-by-industry/

3. https://www.taxpolicycenter.org/briefing-book/how-does-corporate-income-tax-work

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mike Ong

Senior Dealer

Mike is a member of the largest dealing team that specialises in Equities, ETFs, CFDs & Bonds, and manages >50,000 client accounts in Phillip Securities. He believes in investing long-term for passive income and evaluates stocks using fundamentals. He is currently the chief editor of the HQ education series that aims to equip clients with tools and skillsets to make better investing and trading decisions.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile