Weekly Updates 24/4/23 – 28/4/23 April 24, 2023

This weekly update is designed to help you stay informed and relate economic and company earnings to potentially value-add your CFD (Contract For Difference) trading via hedging (risk reducing). This article should be used for educational purposes only and not as financial advice. We urge all traders to carry out your own due diligence before submitting trades.

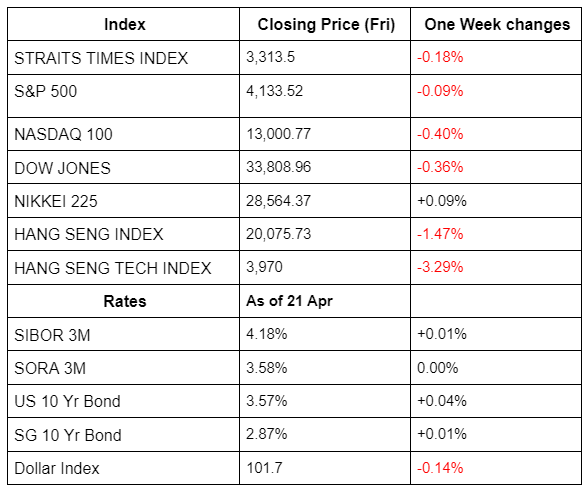

Recap for last week (17 Apr 2023 – 21 Apr 2023)

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

Last week, most indices from Hang Seng Tech index to S&P500 started the week strong but fell towards the end of the week. Macro data from China looks promising, however Tesla’s earnings on Wednesday set a negative sentiment for the EV market and indices as a whole. Hong Kong indices fell even further due to China funds withdrawing funds out of Hong Kong markets. Market participants need to recognize short term shocks vs long term shocks and adjust their portfolio accordingly.

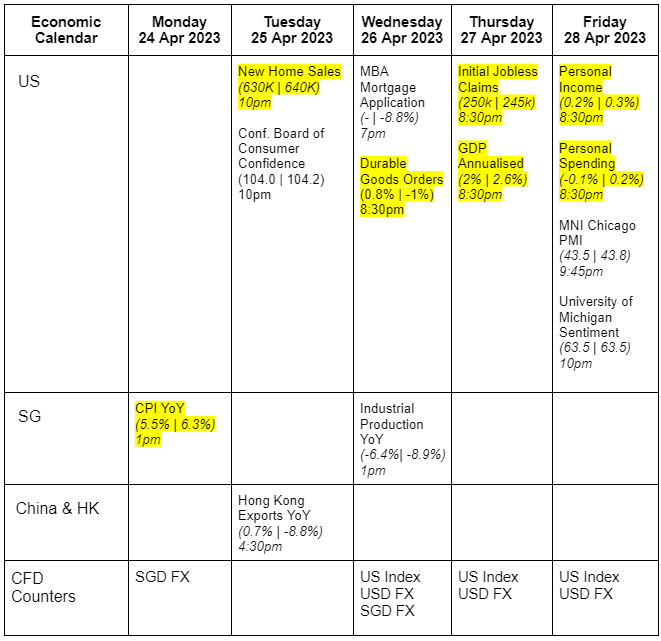

Updates for the week (24 Apr 2023 – 28 Apr 2023)

This week’s economic calendar focuses on CPI data from Singapore which is set to decrease, furthermore the US is set to release more housing market data (new home sales, mortgage application), GDP data, data on US consumers and the usual employment data. Market participants and analysts are starting to pay closer attention to employment data as last week’s employment data is starting to show cracks in the US workforce. Market participants are mixed on how this may affect the interest rate plans for the Fed for 2023.

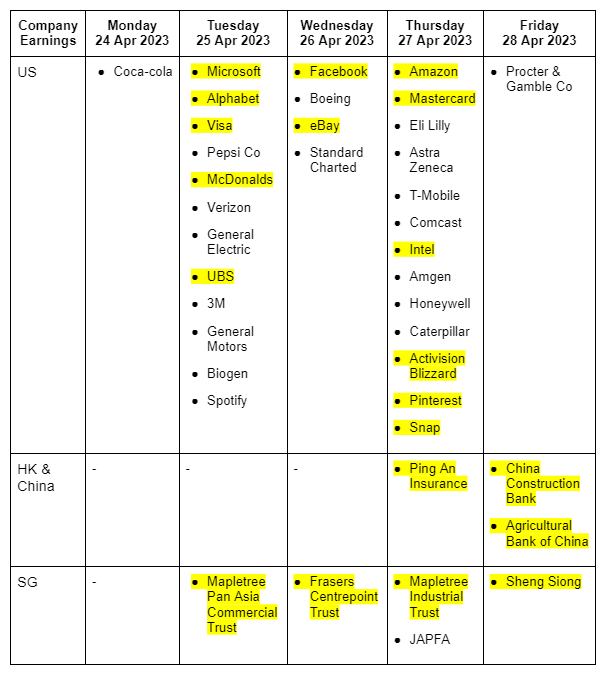

This week’s corporate earnings releases are packed. With the majority of the FAANG stocks releasing earnings in the middle of the week. Market participants have a barrage of corporate information heading their way. Investors should pay more attention to FAANG’s performance and forward guidance, as this will set the tone for most of the other companies. As FAANG still holds ~20% of the S&P 500.

If you hold equity positions in these stocks, you can hedge your positions using CFDs to mitigate the risk of disappointing earnings releases.

For those looking to speculate or capitalize on the increased volatility, CFDs provide leverage and ease of going long and short across a broad range of products available.

Nasdaq Index, what’s next? – Anabelle (CFD Hedger)

Trade Set-up:

- Looking at Nasdaq Index, we first noticed a continuous upwards trend since the start of this year

- We next noticed consolidation (shown in red box) since March till present date, signalling a possible stop to the upwards trend. The start of consolidation happens to coincide with the collapse of Silicon Vally Bank (10th March) and the bought over of Credit Suisse by UBS which happened subsequently.

Trade Execution:

- While traders may want to continue trading within this consolidation range, it might also be worth noting that this could be the start of a downwards trend once prices break out of 12,850 (marked by the second resistance line that has been tested thrice over the past year hence proving to be quite strong).

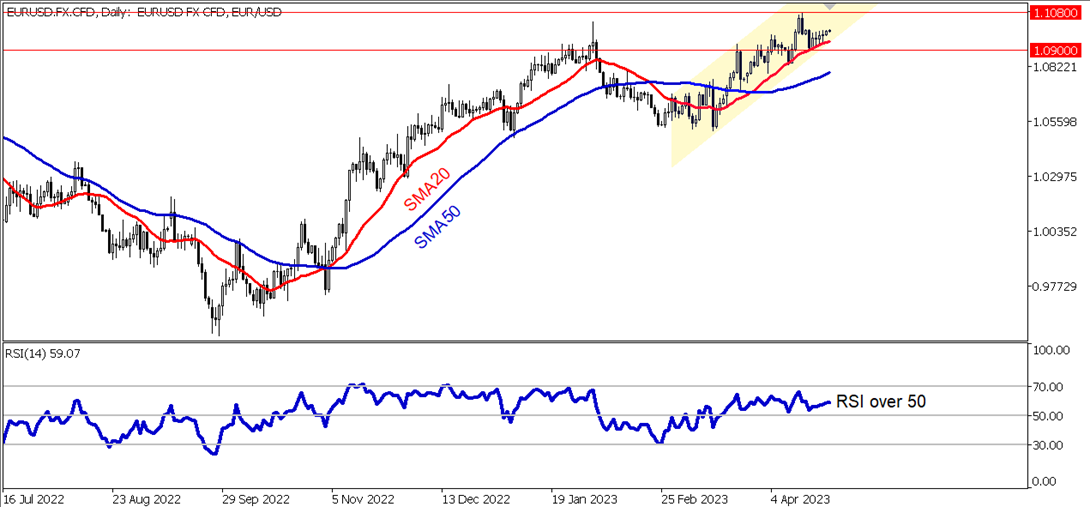

EUR/USD looks set to break high

Trade Set-up:

- The EUR has continued to outperform other G10 currencies. The EUR is benefitting from the easing of last year’s negative terms of trade shock, as well as ECB President’s pledge to stay the course in raising rates “significantly” at a steady pace. The incoming economic data flow from the euro-zone is continuing to surprise to the upside although not as strongly as at the start of this year. The better than expected growth outlook for the euro-zone economy is putting pressure on the ECB to raise rates further.

- Fears over a sharper growth slowdown have also been eased by the quick action taken by the Swiss authorities to deal with concerns over the health of Credit Suisse that have helped reduce financial stability risks in Europe.

- After the uptrend was confirmed with the SMA20 crossing the SMA50 from below, it had a sustained push higher, represented by an upward channel, before retreating from the resistance from the previous high at the 1.1080 handle.

Trade Execution:

- The RSI, currently sitting above 50, supports the potential breakout above the 1.1080 handle. This could represent buy opportunities for investors. Investors should look out for the RSI for indications that the pair could be “Overbought”.

- Should EUR/USD breakout from the channel to the downside, expected around the 1.0900 handle, buyers could leverage these levels to stop out further losses.

If you have any feedback or questions, feel free to email us at samht@phillip.com.sg or onishathyeyn@phillip.com.sg or cfd@phillip.com.sg.

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Sam Hei Tung (Dealing) and Onisha Thye (Dealing)

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Onisha is a dealer at the CFD Dealing Desk. She graduated from Monash University with a double major in finance and econometrics. Her natural curiosity for finance is what drove her to be in this field as she is fascinated by all the possibilities and opportunities that are available to grow one’s wealth, either through trading or investment.