Weekly Updates 5/6/23 – 9/6/23 June 5, 2023

This weekly update is designed to help you stay informed and relate economic and company earnings to potentially value-add your CFD (Contract For Difference) trading via hedging (risk reducing). This article should be used for educational purposes only and not as financial advice. We urge all traders to carry out your own due diligence before submitting trades.

Recap for last week (29 May 2023 – 2 June 2023)

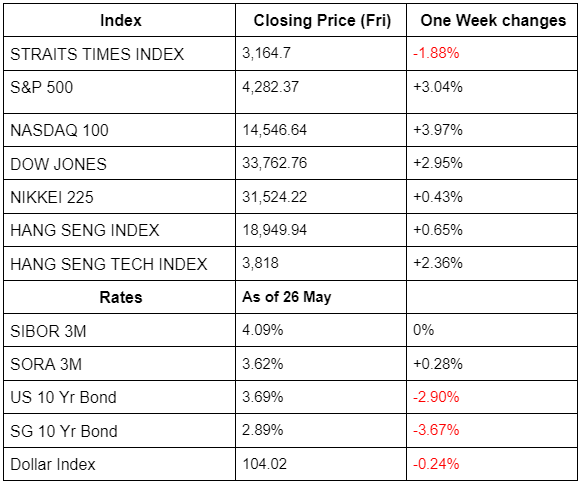

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

With Non-Farm payroll being above expectations, analysts and market participants are pricing in a potential soft landing. However, economists and analysts are still split on how the Federal reserve will do to interest rates in the upcoming Fed meeting in June and July. There was more confirmation on the US debt ceiling deal between the two parties. Hang Seng and Hong Kong tech rallied on Friday due to a potential stimulus package from the China government to stimulate the economy.

Updates for the week (5 June 2023 – 9 June 2023)

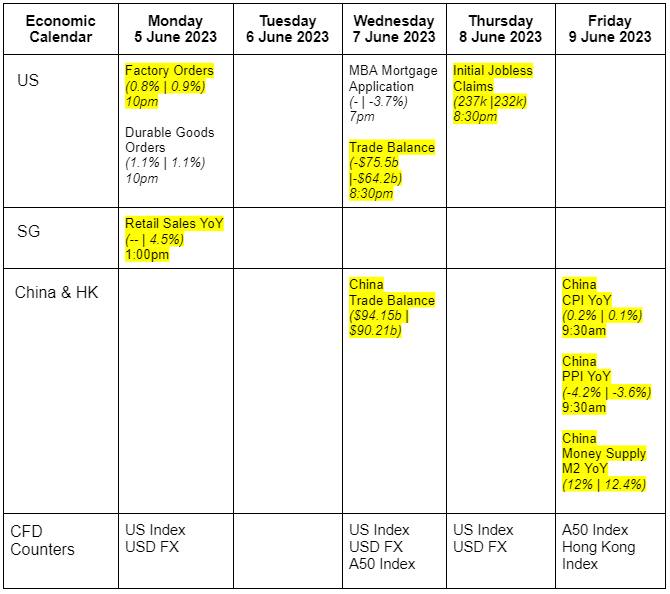

The data below showing the economic releases read as “Analyst’s estimate/ Consensus | Previous data”.

This week’s upcoming economic releases mainly focuses on Factory Orders data and jobless claims data coming out of the US and Trade, CPI, PPI and Money Supply data coming out of China. Market participants are more focused on the interest rate talks coming out of the Fed as the upcoming Fed FOMC meeting will be on 13-14 June. Data coming out of China will give us more information on the strength of the China market after the reopening. As recent China data has not shown the level of strength that analysts are looking for.

The corporate earning releases for the upcoming week will be focused on EV maker Nio, travel booking company Trip.com and Covid favorites DocuSign. Given the recent price wars and volatility in the EV space, Nio’s earnings release may potentially result in huge price movements (both up and down). Trip.com will give us a glimpse in the post-Covid travel industry world, and forward guidance for the rest of the year.

If you hold equity positions in these stocks, you can hedge your positions using CFDs to mitigate the risk of disappointing earnings releases.

For those looking to speculate or capitalize on the increased volatility, CFDs provide leverage and ease of going long and short across a broad range of products available.

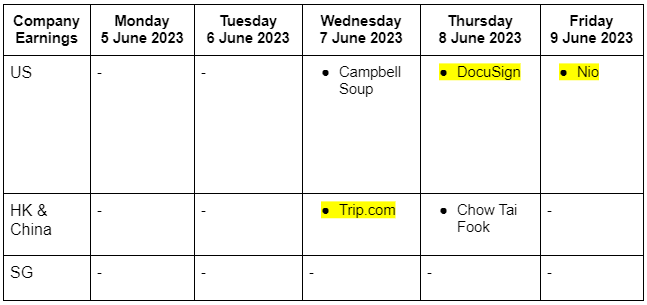

Trading the S&P500 amidst uncertainty

Trade Set-up:

- From the chart above, we note prices for S&P 500 to be above Tenken-sen, Kijun-sen and the ichimoku cloud which signify a bullish trend. With the decision to raise the US debt ceiling being finalized, we see the positive impact it has on the market.

- However, with plenty of earnings announcements coming along in the following weeks, we may still experience periods of volatility.

Trade Execution:

- Traders may take advantage of the current bullish trend and trade along until the appearance of possible trend reversals such as prices falling below Tenken-sen and Kijun-sen, or a thick ichimoku cloud.

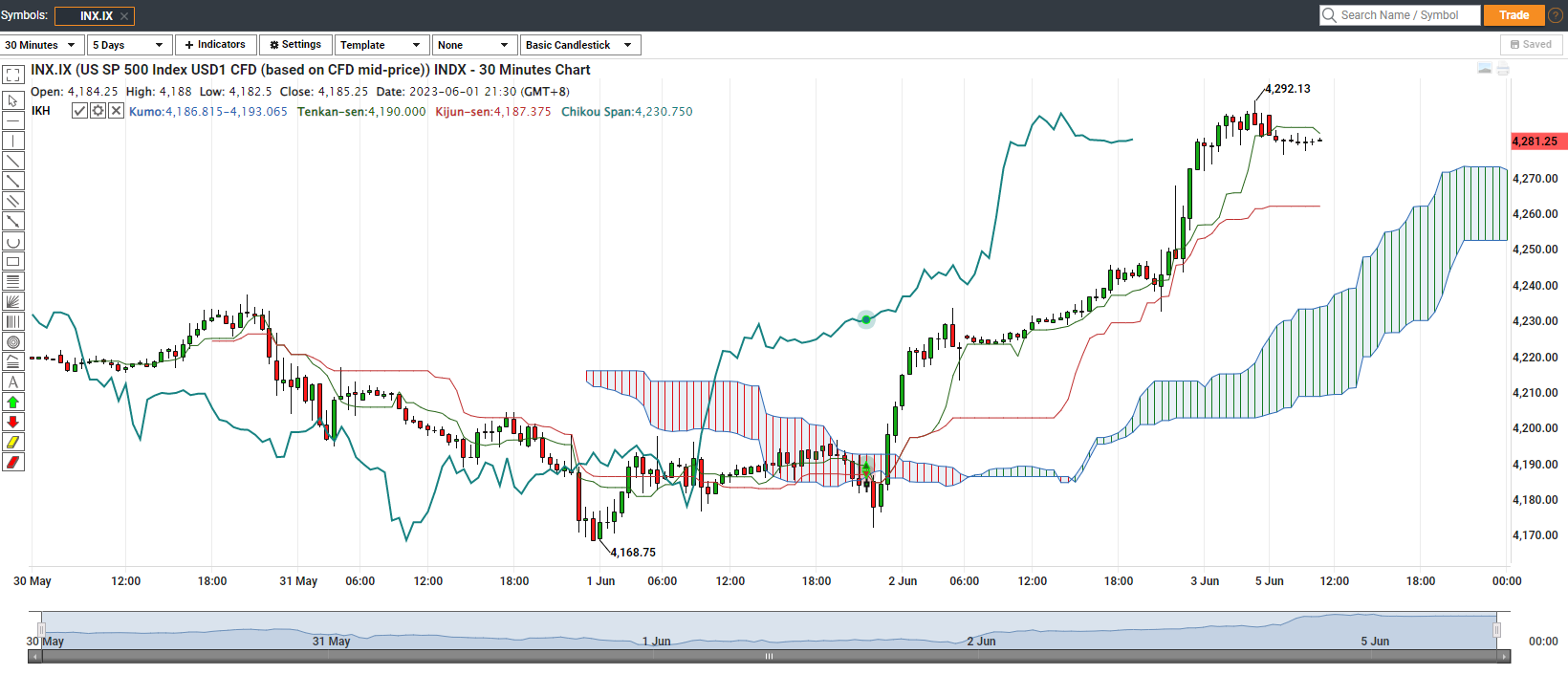

GBPJPY hits year to date (YTD) high

Trade Set-up:

- GBP/JPY surges to year-to-date (YTD) high amid positive market sentiment. Expectations of a dovish Fed and resolution of the US debt-ceiling renewed strength to higher risk currencies.

- However, despite the overall upward trend with the faster SMA20 crossing over the SMA50 back in March, the technical outlook suggests the pair is potentially overbought with the RSI indicator expressly crossing over the 70 level. This is in-line with the outlook of Pound fundamentally as the Bank of England (BOE) appears hesitant for further rate hikes as they hope the upcoming data releases, suggesting either a weaker economy or slower inflation, will give them room to pause.

Trade Execution:

- Technically, GBP/JPY appears overbought and as well hitting stiff resistance at the 175 handle. Traders may look to sell above the 175 handle while keeping their protective stop losses closer at the 176 handle.

- Traders who are already in long positions should look to exit levels above the 175 handle.

If you have any feedback or questions, feel free to email us at samht@phillip.com.sg or onishathyeyn@phillip.com.sg or cfd@phillip.com.sg.

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Sam Hei Tung (Dealing) and Onisha Thye (Dealing)

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Onisha is a dealer at the CFD Dealing Desk. She graduated from Monash University with a double major in finance and econometrics. Her natural curiosity for finance is what drove her to be in this field as she is fascinated by all the possibilities and opportunities that are available to grow one’s wealth, either through trading or investment.