Weekly Updates 7/8/23 – 11/8/23 August 7, 2023

This weekly update is designed to help you stay informed and relate economic and company earnings to potentially value-add your CFD (Contract For Difference) trading via hedging (risk reducing). This article should be used for educational purposes only and not as financial advice. We urge all traders to carry out your own due diligence before submitting trades.

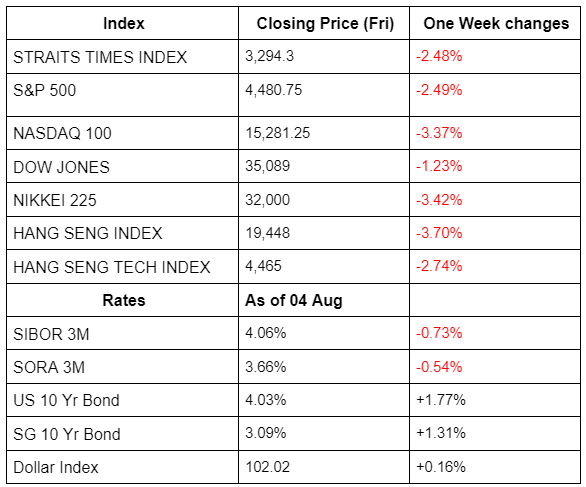

Recap for last week (31 Jul 2023 – 04 Aug 2023)

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

*These prices are taken based on the previous Monday’s opening price and the preceding Friday’s closing price.

Last week’s market action revolved around Fed announcing a raise in interest rate by 0.25%, up to a 5.5% level which is the highest level as compared to the past 22 years. This shows that the Fed is standing on strong ground in battling inflation given that the year on year data of consumer prices are expected to still be increasing. As we seen that the hike has derailed the short-term bull run in all of the indexes.

Updates for the week (07 Aug 2023 – 11 Aug 2023)

The data below showing the economic releases read as “Analyst’s estimate/ Consensus | Previous data”.

This week’s macro news mainly focuses on the inflation data from the US and China. Given that interest rate has a delayed effect on the market, if US CPI YoY remains higher than the Fed’s long term target rate of 2%, the Fed might still continue to hike interest rate. However, with some contradicting sentiment from the PPI Final demand MoM is expected to rise, thus many investors are still on the sideline. For China, with the weakened demand from China’s trading partners, market participants are expecting China Trade Balance to fall further which supported by the evidence of falling exports to European Union by 12.92%. The weak exports and rising risk of deflation all points to slowing growth momentum in China.

This week’s corporate earnings release are mostly from retail brands ranging from travel industry to e-commerce to consumer staples. From the US, we have a mixture of companies releasing their earnings but most investors are laying their eyes on Alibaba group since the major restructuring in March this year. On the other hand, with recent hot topics revolving around green energy, investors are paying attention to Li Auto to gauge the demand for EVs as there were dramatic price cuts earlier this year. Many consumers played a wait-and-see attitude as they expects further discounts from EVs producers, thus with Li Auto earnings provide investors a forward guidance.

If you hold equity positions in these stocks, you can hedge your positions using CFDs to mitigate the risk of disappointing earnings releases.

For those looking to speculate or capitalize on the increased volatility, CFDs provide leverage and ease of going long and short across a broad range of products available.

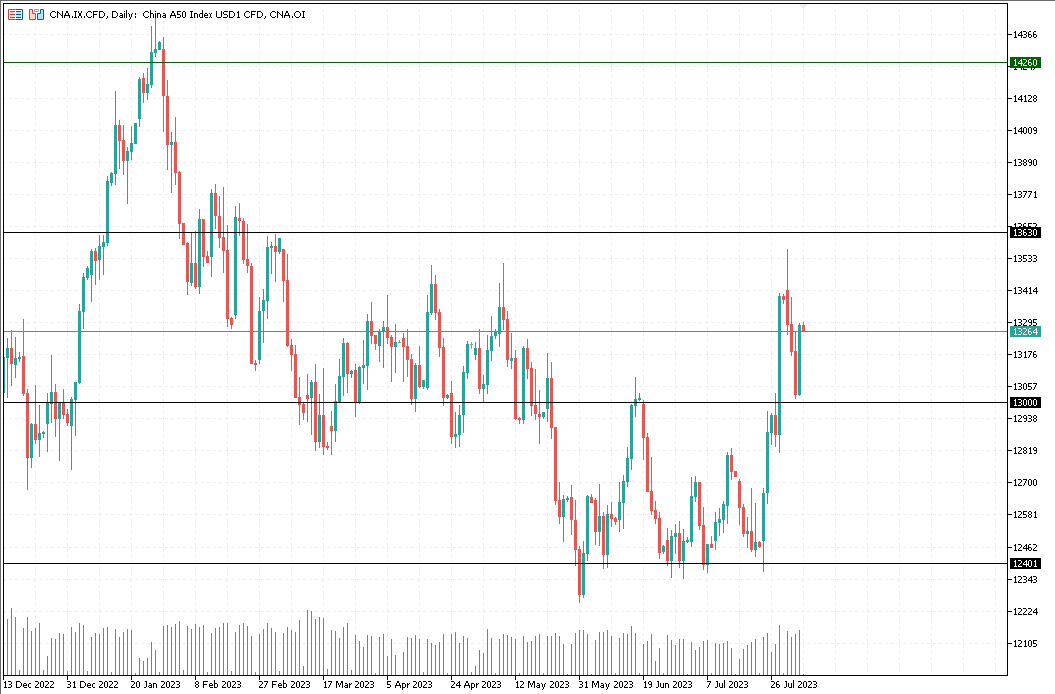

China A50 Index: Possible Up-trend – by Jun Yuan

Key Entry Price Pivot(s):

- 13,300

Recommended Trade:

- Long above 13300, take profit at 13630/14260, stop loss at 13000

Alternative Case:

- Short below 13000, take profit 12400, stop loss at 13300

Remarks:

- China A50 Index had recently broken out the downtrend channel.

- On 02 Aug 2023, China A50 Index pulled back and found a support at 13000. A strong bullish bar formed the next day.

- We could potentially look to take a long trade on the China A50 Index since a strong bullish bar has already formed at the support level to continue the uptrend moving ahead.

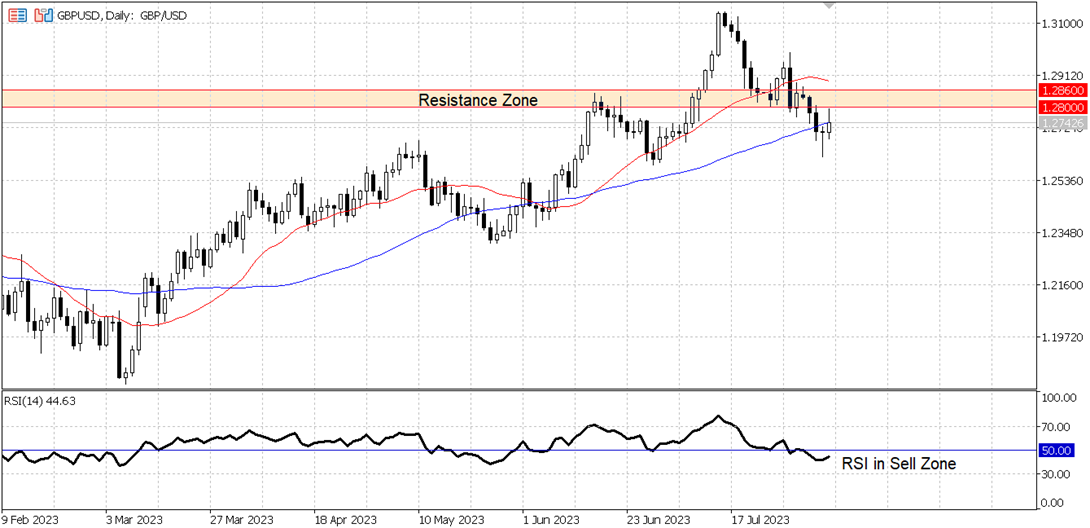

GBP/USD approaches 1.2800 as US Dollar remains under pressure

Recommended Trade:

- For short term trade, stay Long above 1.2700 handle, take profit at 1.2850, stop loss at 1.2670.

Alternative Case:

- For longer term trade, short after price action pulls back to above 1.2800 handle, take profit at 1.2550, stop loss at 1.2880.

Remarks:

- GBP/USD climbed toward 1.2800 on Friday supported by a weaker US Dollar across the board. The pair is still down for the week but it is off weekly lows, largely supported by a soft US jobs data report spurring speculations the Fed might end its tightening cycle.

- Technical analysis indicates potential for short-term gains but highlights the importance of 1.2800 resistance. Last Thursday’s price action formed a doji (point of indecision), but Friday’s bullish candlestick remains shy of completing a ‘morning-star’ bullish candlestick pattern, which could indicate further gains in the near term.

If you have any feedback or questions, feel free to email us at samht@phillip.com.sg or onishathyeyn@phillip.com.sg or cfd@phillip.com.sg.

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs.

Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information. Investments are subject to investment risks.

The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated.

The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange.

You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low.

Clients are advised to understand the nature and risks involved in margin trading. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.

About the author

Sam Hei Tung (Dealing) and Onisha Thye (Dealing)

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Onisha is a dealer at the CFD Dealing Desk. She graduated from Monash University with a double major in finance and econometrics. Her natural curiosity for finance is what drove her to be in this field as she is fascinated by all the possibilities and opportunities that are available to grow one’s wealth, either through trading or investment.