Why Alibaba’s Valuation is Overlooked January 3, 2025

Smart money often chases obvious targets. While traditional stalwarts like Apple and Microsoft often dominate the spotlight and command constant attention, leaving extraordinary opportunities hidden in plain sight, non-traditional players such as Alibaba emerges as one of the market’s most compelling yet overlooked value plays.

Market sentiment often fails to capture the full picture. Conventional metrics and index movements dominate investment conversations, creating a myopic view that misses transformative opportunities. The disconnect between Alibaba’s fundamental strength and current market valuation tells a fascinating story of untapped potential.

Seasoned investors recognise that exceptional returns demand looking beyond the obvious. This analysis cuts through market noise to reveal why Alibaba deserves serious consideration. We will dissect the company’s robust business model, examine its overlooked value drivers, and demonstrate why portfolio managers fixated solely on traditional blue-chip stocks risk missing a rare opportunity for strategic diversification.

Therefore, is Alibaba purely a value trap or genuine undervaluation? Let’s find out!

Understanding Alibaba’s Core Business Model

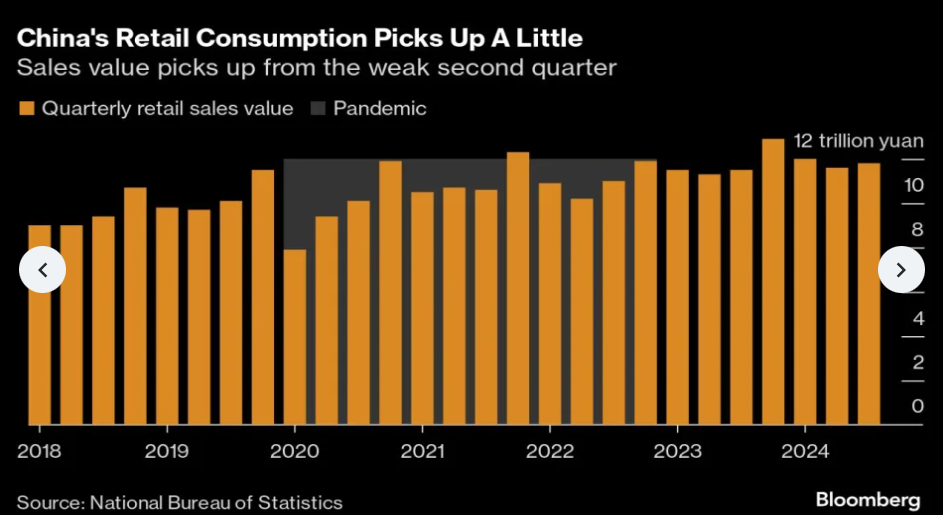

Source: Bloomberg

Source: Bloomberg

Alibaba’s evolution has been nothing short of transformative. From its humble beginnings as a B2B platform in 1999, the company has engineered China’s largest e-commerce ecosystem, churning in revenues in excess of USD 33 billion in the latest quarter. With a bold ambition to reach over 1 billion annual active consumers by the end of 2024, Alibaba’s strategic growth remains unmatched1.

Evolution of Alibaba’s ecosystem

Alibaba’s expansion is marked by strategic brilliance at every stage. Taobao’s launch revolutionised consumer behaviour in China, while Tmall’s introduction captured the premium retail market. Today, Alibaba stands as a testament to ecosystem mastery, encompassing:

- E-commerce titans, Taobao and Tmall

- Cutting-edge cloud computing infrastructure

- Alipay’s digital payment dominance

- Cainiao’s sophisticated logistics network

These services collectively position Alibaba as a one-stop solutions platform, catering to both Chinese and international merchants and consumers. But has the company truly succeeded in creating a seamless, self-sustaining ecosystem?

Revenue Streams and Market Positioning

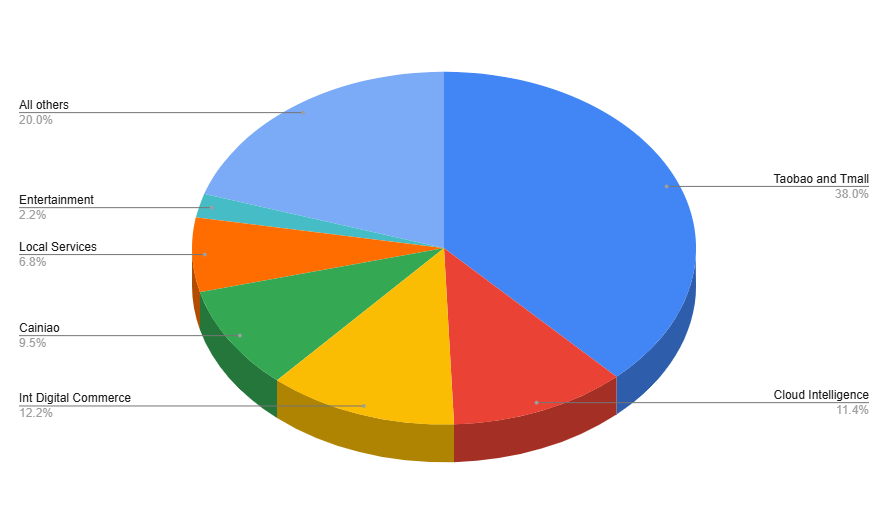

Source: Alibaba Q22024 Report

Source: Alibaba Q22024 Report

Alibaba’s numbers reveal the breadth of its operations. Domestic e-commerce retail powers a majority of its business2, while Cloud computing, together with logistics services and international ecommerce also contribute a significant portion of its income source.

Strategic diversification elevates Alibaba beyond traditional e-commerce boundaries. The company’s seven distinct segments generate a combined USD 139 billion in fiscal year 2024, showcasing a business model that defies simple categorisation.

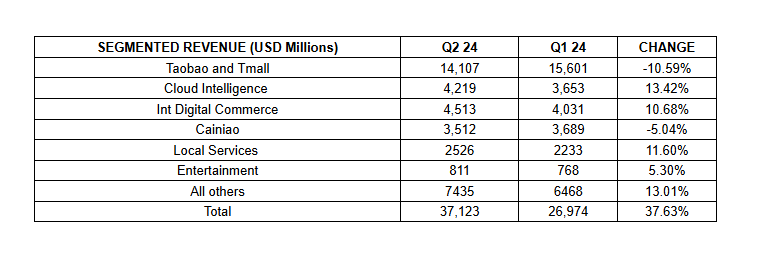

Source: Alibaba Q22024 Report

Source: Alibaba Q22024 Report

However, if we take a closer look at Alibaba’s latest 2Q2024 (fiscal year 2025) revenues, we note that the revenues for its largest contributors, Taobao and TMall dipped by 10% quarter-on-quarter.

This dip reflects intensifying competition from both domestic players like JD.com and international challengers such as Shopee, which have aggressively pursued client acquisition strategies.

Analysing Current Market Valuation Metrics

Price-to-Earnings (P/E) Ratio Analysis

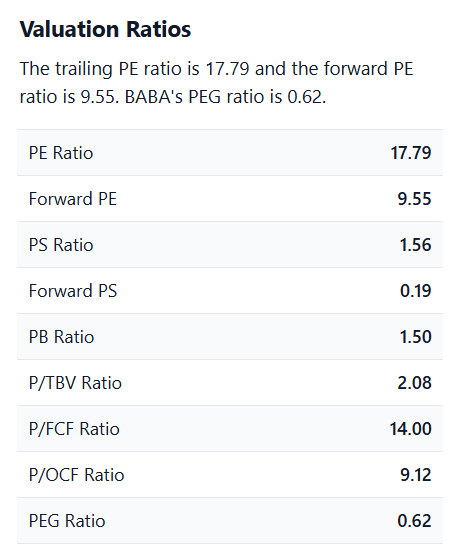

Source: Stockanalysis.com

Source: Stockanalysis.com

Data speaks volumes. Alibaba commands a trailing P/E ratio of 17.79, while its forward P/E ratio sits at an even more compelling value of 9.553. Market disconnect becomes apparent when we compare these figures to the MSCI Emerging Markets Index’s forward P/E of 15.254. The PE provides an indication that the current share price of Alibaba is fairly priced to date.

Despite these metrics suggesting fair pricing, investor reluctance remains high. This hesitance likely stems from the competitive pressures Alibaba faces, which cast uncertainty over its future growth trajectory.

Book Value Considerations

Balance sheet strength emerges through critical metrics:

- Current Book Value per Share: USD 555

- Price-to-Book Ratio: 1.53

- Book Value Growth Rate (5-year average): 13.7% per year

- Debt-to-Equity Ratio: 19.30%

Alibaba is also trading close to its Book Value and has a low debt-to-equity ratio, indicating a healthy balance sheet, with current market valuation close to its asset valuation.

However, despite these strong fundamentals, investors appear to be focused mainly on the company’s growth prospects rather than the company’s strong financial health.

Therefore, it is important to discern if the market could be wrong in the long term and whether Alibaba could navigate itself out of the intense competition in the long run.

Cash Flow Valuation Metrics

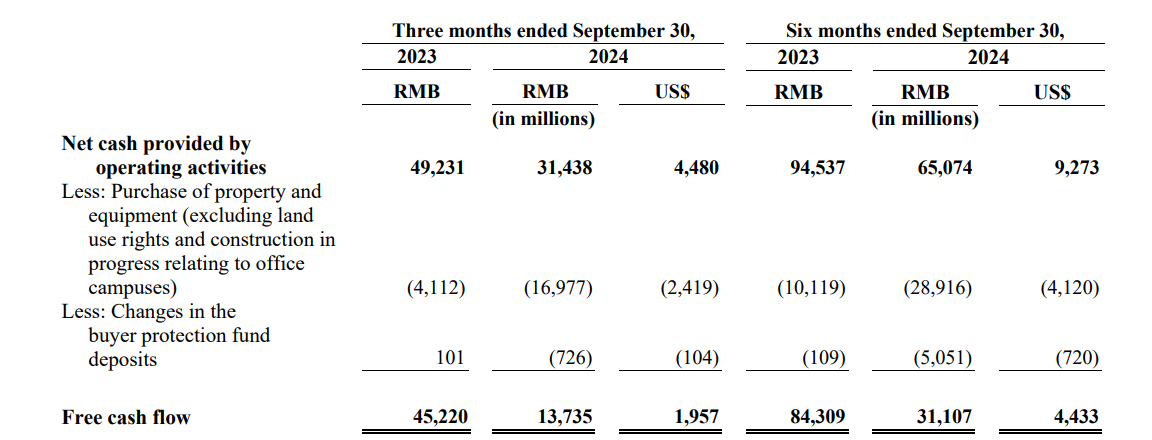

Source: Alibaba Group website

Source: Alibaba Group website

Cash flow figures affirm Alibaba’s capacity for long-term value creation. For Q2 2024:

- Operating Cash Flow: USD 4.48 billion(3 months) and USD 9.2 billion (6 months)6

- Capital Expenditures: -USD 2.4 billion (3 months) and USD 4.1 billion (6 months)

- Free Cash Flow: USD 1.9 billion (3 months)and USD 4.4 billion (6 months)

With a 6-month capital expenditure-to-revenue ratio of just 6%, Alibaba’s operations demonstrate efficiency and low reinvestment requirements. The free cash flow of USD 4.4 billion over six months supports the argument that Alibaba could evolve into a cash-generating powerhouse in the long run.

Further bolstering this outlook is the Enterprise Value to EBITDA ratio of 8.79, which highlights Alibaba’s potential for significant upside, especially considering its market dominance and diversified growth strategies.

Regulatory Environment and Risk Assessment

The regulatory environment in China has undergone profound changes in recent years, with Alibaba at the centre of the storm. Alibaba’s three-year ‘rectification’ journey marks a watershed moment in Chinese corporate governance7, transforming both company operations and investor perceptions.

Chinese Regulatory Landscape

Alibaba’s billion dollar antitrust fine8 sent shockwaves throughout the global markets but also marked a turning point. The State Administration of Market Regulation’s recent praise for Alibaba’s compliance efforts9 signals a potential new chapter in corporate-regulatory relations, opening doors for renewed corporate growth.

Global Compliance Challenges

Outside China, Alibaba faces a host of regulatory challenges:

- European GDPR compliance demands

- Cross-border data protection mandates

- Intensified financial oversight and heightened scrutiny from global regulators10

In the US, regulatory hurdles include stringent audit requirements and semiconductor export restrictions. These challenges test Alibaba’s strategic agility, but its adaptability in managing global complexities positions it well for future growth.11

Impact on Valuation Multiples

Alibaba’s market capitalisation experienced a 72% decline following November 2020’s anti-monopoly rules. This drop has yet to see a strong recovery due to increased competition in its business landscape since 2020.

However, amidst these challenges lies opportunities.

The Chinese authorities have recently shifted focus toward bolstering private sector confidence, signalling potential for multiple expansion. Experienced market participants understand the significance of regulatory clarity—it often acts as a precursor to value recovery.

Growth Catalysts and Future Prospects

Alibaba’s growth trajectory is driven by three pivotal catalysts. These initiatives represent untapped potential, yet the market has been slow to recognise their transformative implications.

1. Cloud Computing Expansion

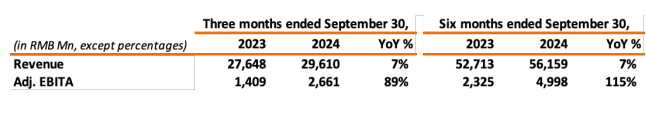

Source: Alibaba Group Website

Source: Alibaba Group Website

Alibaba Cloud stands as a testament to strategic execution. With USD 8 billion in revenue for the six months ending September 2024, cloud operations now account for 11.3% of total sales.12 This growth signifies Alibaba’s transition from a pure e-commerce entity to a tech powerhouse, highlighting its technological dominance.

2. International Market Penetration

Alibaba’s global ambitions materialise through strategic investments in infrastructure. Data centres in key locations, such as Mexico, Malaysia & South Korea, Thailand, and the Philippines, represent more than simple expansion—they demonstrate Alibaba’s localisation strategy.13

By tailoring mobile-first architectures to markets with high smartphone penetration, Alibaba ensures adoption and relevance in diverse regions. This level of precision showcases its adaptability and global reach.

3. Technology Innovations Pipeline

Innovation defines Alibaba’s technological DNA. The Qwen AI model is reshaping competitive landscapes14, while strategic partnerships with giants like Nvidia are accelerating advancements in autonomous mobility.

With 300,000 customers already utilising its Model Studio platform, Alibaba is on an exponential adoption trajectory, setting the stage for future growth. The continued drop in data storage and computing costs positions the company to capitalise on multiple expanding markets.

Conclusion and Intrinsic Valuation

Market wisdom often hides in plain sight. Alibaba exemplifies this reality– a sprawling digital empire encompassing e-commerce, cloud computing, and financial technology, yet undervalued by current market prices that fail to fully appreciate its potential. With a forward P/E ratio of 9.5x, robust free cash flow generation, and fortress-like cash reserves, Alibaba paints a clear picture of financial resilience and strength.

The regulatory storms have cleared, revealing a brighter horizon. Meanwhile, Alibaba’s cloud computing dominance and its international market penetration promise exponential growth opportunities ahead.

Emerging market exposure does not need to compromise fundamental strength. Alibaba’s technological arsenal – from cutting-edge AI initiatives to strategic global expansion – forges a unique value proposition. Fortune favours the bold. Alibaba offers a unique opportunity—beyond the usual suspects of market attention, it stands poised to deliver exceptional returns that outshine routine market performance.

Based on the discounted earnings model, my estimated long term growth rate for the company stands at 3% with an expected return of 8.5%, aligned with Alibaba’s latest WACC (Weighted average cost of capital). I estimate its intrinsic value to be HKD 175 per share.

As of the time of writing, Alibaba’s latest closing price stands at HKD 84.35, trading at a 52% discount to its intrinsic value. This presents an attractive margin of safety for long-term investors who believe in Alibaba’s ability to navigate competitive challenges and capitalise on its strengths in the years to come.

Alibaba’s unique combination of growth momentum, financial stability, and undervalued market position offers a rare opportunity for portfolios seeking both value and growth in an increasingly dynamic global market.

Trade Alibaba Group Now using HK SDRs

What is an HK SDR?

An HK SDR, or Hong Kong Singapore Depository Receipt, is a financial instrument that allows investors to buy shares of Hong Kong-listed companies through the Singapore Exchange (SGX). HK SDRs can be a convenient and cost-effective way to diversify an investment portfolio with exposure to Hong Kong’s leading companies.

One of the key benefits of using an SDR is the convenience of settling transactions in SGD. Additionally, investors can buy shares in smaller quantities of the underlying shares, making it more accessible for those who wish to invest incrementally.

Beyond Alibaba, investors can also gain exposure to various other industries in China through SDRs, including banking, technology, and electric vehicles.

Zero Brokerage with Trading SDRs on POEMS

You can trade SDRs with zero brokerage from now till 31 March 2025. Learn more here.

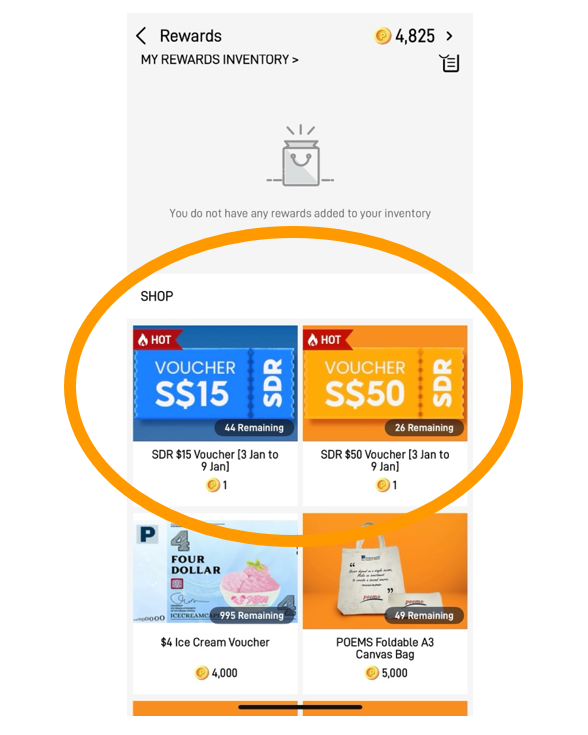

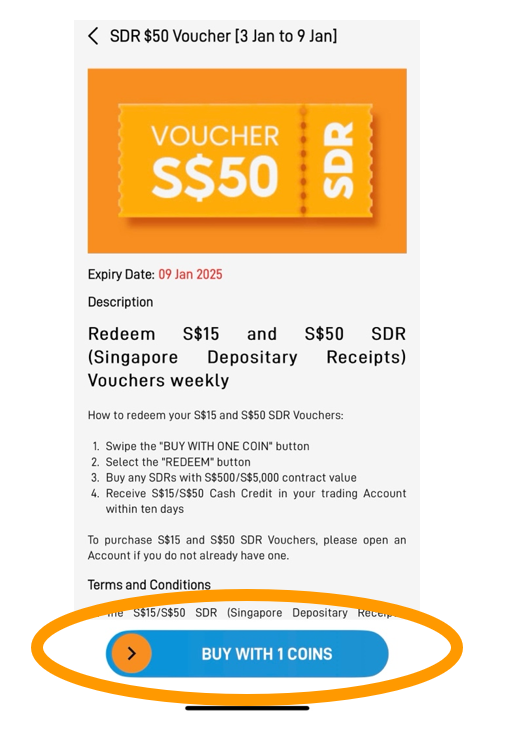

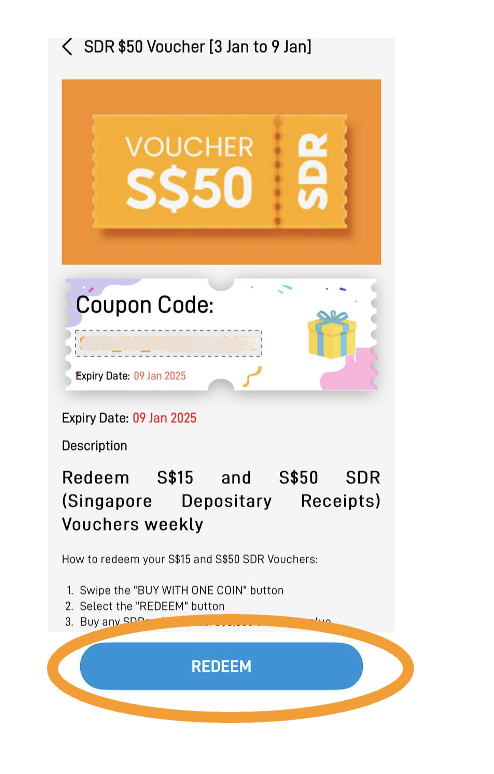

Claim your S$50 and S$15 SDR vouchers now to maximize your trading opportunities.

Steps to Redeem your S$50 and S$15 SDR vouchers:

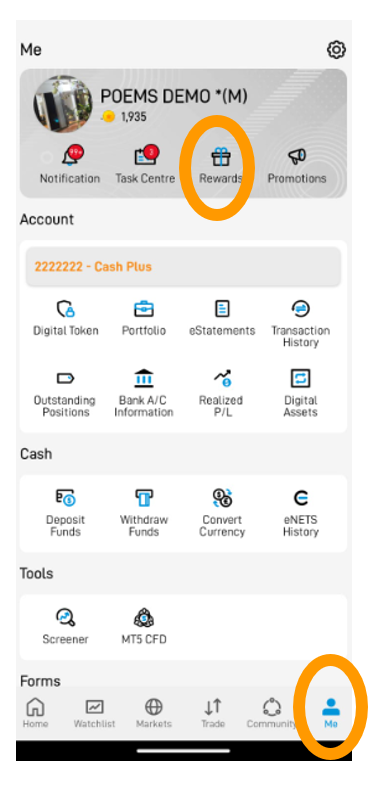

1) You will first need to log in to your POEMS 3 mobile App and go to the rewards section in your ‘Me’ tab.

2) Once you are in the Rewards Page, you will need to redeem the SDR voucher by utilising your POEMS coins

3) Swipe the “Buy with One Coin” button, then select the “Redeem” button, and buy any SDRs with S$500/S$5000 contract value

4) The vouchers can be redeemed upon a successful trade, of which any SDR with a minimum contract value of at least S$500 will be entitled to receive the S$15 cash credit and a minimum contract value of at least S$5000 will be entitled to receive the S$50 cash credit

5) Receive your cash credit in your trading account within ten days

For more information about our SDR promotion you can also visit the link here https://www.poems.com.sg/singapore-depository-receipts-promotion-zero_brokerage/

Reference:

- [1] https://www.investopedia.com/articles/investing/121714/how-does-alibaba-make-money-simple-guide.asp

- [2] https://www.statista.com/statistics/298817/alibaba-revenue-distribution-segment/

- [3] https://chozan.co/blog/inside-the-alibaba-ecosysytem-and-the-alibaba-zoo/

- [4] https://asiafundmanagers.com/us/us-vs-china-comparing-big-tech-from-an-investment-angle/

- [5] https://www.untaylored.com/post/the-business-model-and-revenue-streams-of-alibaba-explained

- [6] https://www.alibabacloud.com/blog/the-evolution-of-online-analytics-from-alibaba-economy-ecosystem-to-the-cloud_597348

- [7] https://stockanalysis.com/stocks/baba/statistics/

- [8] https://alaricsecurities.com/is-baba-stock-a-smart-buy-or-a-pass/

- [9] https://www.gurufocus.com/term/pb-ratio/BABA

- [10] https://finance.yahoo.com/quote/BABA/key-statistics/

- [11] https://www.reuters.com/markets/asia/key-events-during-chinas-regulatory-scrutiny-alibaba-2024-09-02/

- [12] https://www.scmp.com/tech/big-tech/article/3276580/alibabas-antitrust-review-comes-close-after-3-years-government-scrutiny

- [13] https://fastercapital.com/topics/challenges-faced-by-alibaba-in-global-markets.html

- [14] https://finance.yahoo.com/news/alibaba-remain-under-pressure-until-200322350.html

- [15] https://www.reuters.com/technology/alibabas-hong-kong-shares-set-open-up-15-split-up-plans-2023-03-29/

- [16] https://www.linkedin.com/pulse/alibabas-global-expansion-examining-jack-mas-dr-sasidharan-murugan-b3gbc

- [17] https://www.forbes.com/sites/gurufocus/2024/10/15/alibaba-still-has-room-to-run-how-chinas-stimulus-drives-growth/

- [18] https://www.cnbc.com/2024/05/23/alibaba-bets-on-ai-to-fuel-cloud-growth-as-it-expands-globally.html

- [19] https://www.alizila.com/alibaba-cloud-expands-data-center-network-and-global-gen-ai-offerings/

- [20] https://www.linkedin.com/pulse/whats-next-pipeline-alibaba-cloud-why-ai-transform-dreic

- [21] https://seekingalpha.com/article/4725677-alibaba-ai-and-cloud-drives-future-growth-initiate-with-buy

- [22] https://hbr.org/2018/09/alibaba-and-the-future-of-business

- [23] https://finance.yahoo.com/news/why-alibaba-group-holding-limited-160940631.html

- [24] https://www.macroaxis.com/invest/technicalIndicator/BABA/Sortino-Ratio

- [25] https://www.fool.com/investing/2024/08/12/2-reasons-to-be-bullish-about-alibaba-stock/

- [26] https://www.tipranks.com/news/alibaba-stock-nysebaba-exploring-the-value-in-its-diverse-segments

- [27] https://finance.yahoo.com/news/understanding-alibabas-market-position-financial-140004424.html

- [28] https://valueinvesting.io/BABA/valuation/wacc

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Disclaimer

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This material is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

About the author

Joe Wong

Dealer

Joe Wong is a seasoned investor with over 15 years of experience in both the financial markets and entrepreneurial ventures. A Macquarie University alumnus with a Bachelor’s degree in Applied Finance from Australia, Joe is a staunch advocate in the Value Investing approach.

His portfolio management strategy focuses on identifying undervalued companies with strong fundamentals. This disciplined approach has consistently yielded double-digit returns on his own portfolio. Despite his investment track record, Joe maintains a strong appetite for knowledge and remains an avid reader.

Unveiling Opportunity: Exploring the Potential of European Equities

Unveiling Opportunity: Exploring the Potential of European Equities  Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading

Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading  Crude Realities: Understanding oil prices and how to trade them

Crude Realities: Understanding oil prices and how to trade them  Gold at All-Time Highs: What’s Fuelling the 2025 Rally?

Gold at All-Time Highs: What’s Fuelling the 2025 Rally?