- Home

- SDR Promo Aug 2024

Zero Brokerage with Singapore Depository Receipts (SDR) from

1 Aug 2024 to 31 Mar 2025

Zero Brokerage with Singapore Depositary Receipts (SDR) from

1 Aug 2024 to 31 Mar 2025

Click on the logo or the counter name to read more about the company.

Don’t have an Account?

Alternatively, visit any of our Phillip Investor Centres or contact your trading representives.

Frequent Asked Questions

Singapore Depository Receipts (SDR) are instruments issued by the depository which represent beneficial interest of an underlying security listed on an overseas exchange. SDR facilitate investments into overseas listed companies without having to deal with the complexities of cross-border trading and settlement.

SDR provide investors beneficial interest in an overseas listed security without having to purchase the security directly on an overseas exchange. SDR is issued by the depository and each SDR is represented by a specific number of underlying securities, held with a custodian in the home market on trust for SDR holders.

Currently, there are SDR issued on Non-Voting Depository Receipts (NVDR) on shares of a company listed on the Stock Exchange of Thailand (SET). An NVDR is an instrument issued by the Thai NVDR Co., Ltd (Thai NVDR), a subsidiary of the SET, to facilitate trading by reducing barriers of foreign ownership limits. Generally, NVDR share the same prices and benefits as its underlying shares but do not carry any voting rights.

SDR are classified as Excluded Investment Products (“EIP”) and are generally for investors who expect low to moderate likelihood of loss of principal investment amount, with generally smaller potential returns. Investors who invest in this product should have a basic understanding of financial instruments with standardised terms and no unusual or complicated features.

Investors should refer to the SDR programme disclosure document provided by the depository for the features, and characteristics including a description of how corporate actions or distributions will be handled, as well as risks and other information. The SDR programme disclosure document is provided on https://www.singaporedr.com/.

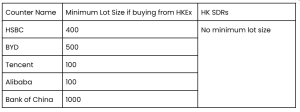

Trading HK SDRs offers several advantages over buying HK stocks directly.* There is no minimum lot size, allowing for greater flexibility. You can manage all positions on a single platform, trading alongside other SGX-listed HK DLCs, structured warrants, and ETFs, all in SGD during SGX trading days and hours. Additionally, SDRs are custodised with CDP, with dividends paid in SGD. You’ll benefit from lower brokerage fees, no FX charges, and no custody fees for direct CDP accounts. Finally, SDR trading allows you to trade ahead of the Hong Kong market opening, with overlapping hours for US pre-market trading.

*Minimum lot size for individual counter

For more FAQs, you might refer here.

Terms & Conditions

- This promotion offers a commission rebate to trade Singapore Depository Receipt (“SDR”) with 0 brokerage from 1 Aug 2024 to 31 March 2025.

- SDR trades must be executed on our suites of the POEMS platform.

- Customers will be required to pay the prevailing SGX clearing fee, SGX access fee and other related fees, and the associated GST.

- Eligible Accounts used for trading of SDRs must be Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts.

- The rebate will be paid to your Trading Account in February 2025 when you trade before 31 Dec 2024; the rebate will be paid to your Trading Account in May 2025 when you trade between 1 Jan to 31 Mar 2025.

- The following persons are not eligible to participate in those promotions unless approved by the management of Phillip Securities Pte Ltd (“PSPL”):

a. PSPL institutional Customers and Corporate Customers

b. PSPL Account holders whose Accounts have been suspended, canceled or terminated - Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

For more information about Singapore Depository Receipts (SDR), please refer here.