Why Trade Foreign Shares July 18, 2018

Make the world your oyster

Investing in international markets may seem intimidating to you. Challenges include language barriers, unfamiliarity with market conditions overseas, exposure to foreign currencies and many more.

A portfolio with global exposure comes with added risk. However, during times when market activity in Singapore slows down, what exactly are you missing out on?

1. Diversification

When it comes to investing, the saying goes: “don’t put all your eggs in one basket.” A way to diversify is to invest in companies across varied sectors. However, do note that stock markets don’t always move in tandem. When Singapore’s market is bearish, there may be markets elsewhere that are seeing opposite conditions.

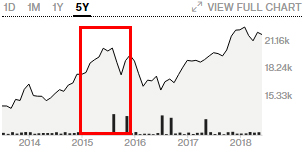

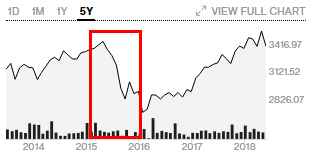

Source: Bloomberg (Japan Nikkei 225 Stock Market Index & Straits Time Index)

In 2015, Singapore stocks took a 15% tumble[1] (Straits Time, 2015) while Nikkei 225 rose to the highest[2] since 2000 (Bloomberg, 2015) before China announced the Yuan’s devaluation.

Stock markets don’t always rise and fall in tandem. So by spreading your investments across different global markets (after conducting your personal due diligence checks), you can reduce your portfolio’s variance and eliminate any diversifiable risk. Remember, diversification is key!

2. Opportunities for growth

Currently, the New York Stock Exchange (NYSE) has a market capitalization of $19.6 trillion[3], Hong Kong Stock Exchange (HKEX) at $3.37 trillion and London Stock Exchange (LSE) at $3.61 trillion. Singapore Exchange (SGX) constituents on the other hand, have a market capitalization of $0.91 trillion. The numbers clearly show the attractiveness of global investment opportunities.

By excluding global stocks in your investment portfolio, you may be missing out on more than 90% of opportunities to invest in quality companies in the global market. Investing in the international markets allows you to pursue strategies such as buying shares in companies with new technologies that are uncommon in Singapore, or buying popular IPO stocks that are typically issued on the NYSE, NASDAQ or HKEX.

3. Higher Liquidity

Liquidity refers to the ability to convert your assets into cash, which points to how “easily” you can sell your investment assets. According to the PWC Global Financial Markets Liquidity Study[4], “financial markets liquidity facilitates the efficient allocation of economic resources through a number of channels”. Within the equity market, higher liquidity essentially indicates a more efficient market where investors can effectively manage their risks and returns.

Major stock exchanges such as the NYSE are examples of a liquid market where millions of shares may change hands between buyers and sellers daily.

Given the sizeable market cap for these global markets, investors can expect higher trading volumes as a whole. When trading volume increases, the intraday price movements of the counters will also be more erratic. Such market conditions are best suited for day traders.

Hurdles you may face

Investing in foreign markets exposes investors to foreign exchange risks, since you are buying shares that are denominated in the respective markets’ currencies. An appreciation or depreciation in currency will directly affect the returns of your investments and so, it can be viewed as a double-edged sword where you potentially receive better or worse returns due to foreign currency fluctuations. In addition, brokerage fees for respective foreign markets will vary and in this digital age, investors pay discounted commission rates for trades executed online.

Stepping into foreign markets may seem daunting at the beginning, but as you remain prudent and monitor your portfolio closely and diligently, benefits can potentially outweigh the costs. To begin your global investment journey, you may wish to check out two of the hottest markets in the United States (NYSE, NASDAQ, AMEX) or Hong Kong (HKEX).

There are also many other exchanges such as in China (MSCI announced 234 China A shares to be added to stock indexes[5]), and neighbouring bourse – the Kuala Lumpur Stock Exchange (KLSE) which may be more familiar should you decide to take that step into overseas markets!

Reference:

- [1] https://www.straitstimes.com/business/companies-markets/singapore-stocks-headed-for-15-tumble-in-2015 (Straits Time, 2015)

- [2] https://www.bloomberg.com/news/articles/2015-02-19/nikkei-225-heads-for-15-year-high-as-japanese-stocks-rise-on-fed

- [3] https://www.stockmarketclock.com/exchanges/nyse

- [4] https://www.pwc.se/sv/pdf-reports/global-financial-markets-liquidity-study.pdf

- [5] https://www.cnbc.com/2018/05/14/msci-announces-234-china-a-shares-to-be-added-to-equity-indexes.html

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Evelyn Soh

CFD Dealer

Evelyn is currently providing dealing services to over 40,000 trading accounts and is part of POEMS Dealing, the core in-house dealing department of Phillip Securities Pte Ltd. Evelyn is a CFD specialist with over 3 years of experience who is proficient in the usage of Contract for Differences (CFD) as a trading tool in moments of market volatility. She believes that opportunities do not exist only in only bull markets, and investors should use CFD’s to hedge against market volatility and to profit in bear markets. Evelyn is also actively engaged in monitoring positions for her clients. She provides technical and fundamental analysis for her clients and conducts regular trading seminars for them.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile