Why You Should Consider Dividend Investing May 6, 2022

What this Report is about:

- Discussion and exploration of Dividend Investing

- Pros, Cons of Dividend Investing

- The power of compounding

- What to consider in Dividend Investing?

- Singapore REITs example

- Covered call strategy and example

Dividend Investing as an investment strategy

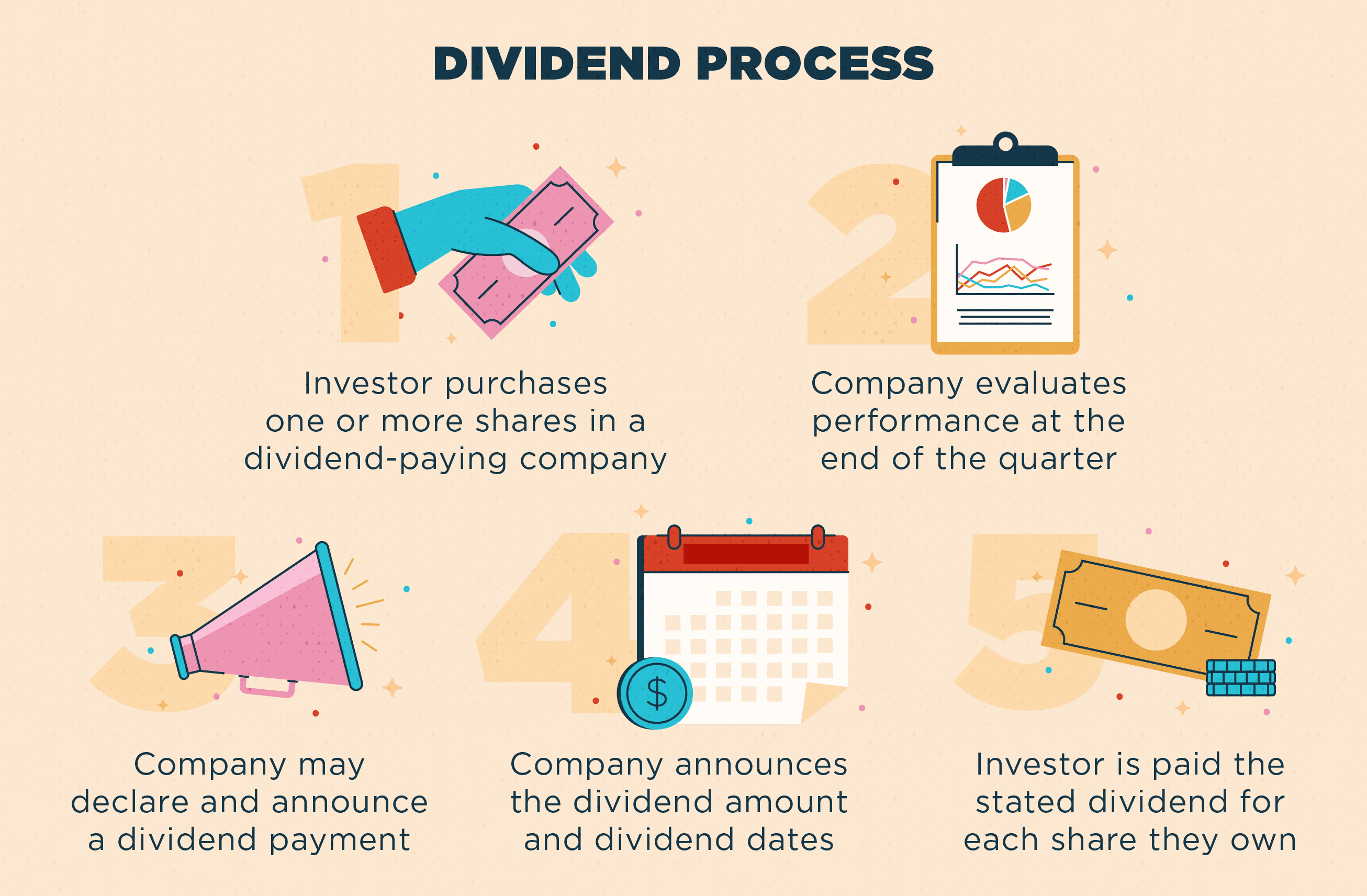

Source: Intuit Mint [1]

Source: Intuit Mint [1]

Dividend Investing is an investing strategy where the main focus of the portfolio is to generate a regular dividend income stream on top of any capital gain. As a shareholder, you are one of the owners of the company and entitled to the profits. Companies usually have 2 main ways of giving back to their investor – either through dividends or share buybacks.

Companies that pay dividends tend to make stable profit and hence, pledge a certain portion of the dividend to investors [2]. This is referred to as the pay-out ratio, and the higher the ratio, the larger the proportion of the profits will be given to investors in the form of dividend.

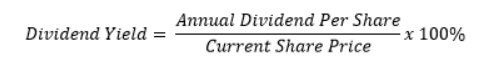

Dividend payment usually has a distribution frequency ranging from monthly to yearly (with most dividend paying companies distributing it quarterly). Dividend yield is usually used as a measure of how much dividend a company is paying with respect to its share price.

The higher the dividend yield, the more dividend the investor can expect to receive for his or her investment.

Advantages of Dividend investing

Realise gains without sale of assets

By using Dividend Investing, investors are able to realise returns through dividend payment, without the sale of the asset[3], as compared to realising gains/returns through capital gain where the sale of assets is required.

Getting “Paid” to hold stock

Dividends reward investors who hold the stock for long periods of time as compared to companies that derive returns purely from capital gains. In a way, for dividend stock, you are getting “paid” for holding the stock, resulting in the potential to earn from both capital gain and dividends received.

Source: AZ Quotes [4]

Source: AZ Quotes [4]

Compounding “Interest” Effect

Dividend stocks can provide a certain level of flexibility as dividend can be compounded by reinvesting it into the stock. It can also be used to purchase other assets, or even be used as income. Dividend stocks are sought by retirees and retirement funds for their steady stream of income and as way to diversify an income stream.

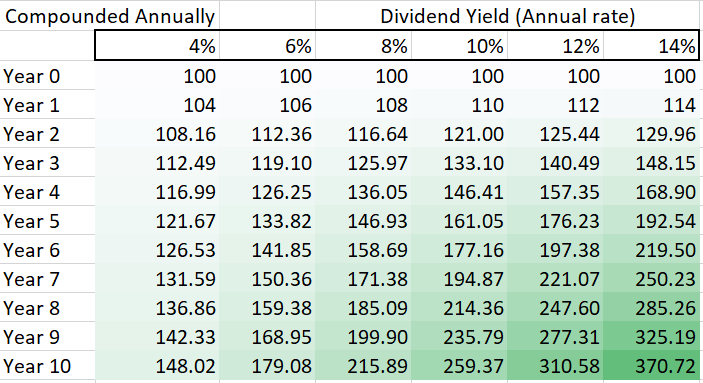

Here is an illustration to showcase the power of reinvesting dividends

If you start off at year 0 with $100 with a 10% dividend yield, you will have $259.37 by the end of year 10, a return of 159.37%. This is on the assumption that the dividend yield remains the same throughout and there is no change in the share price.

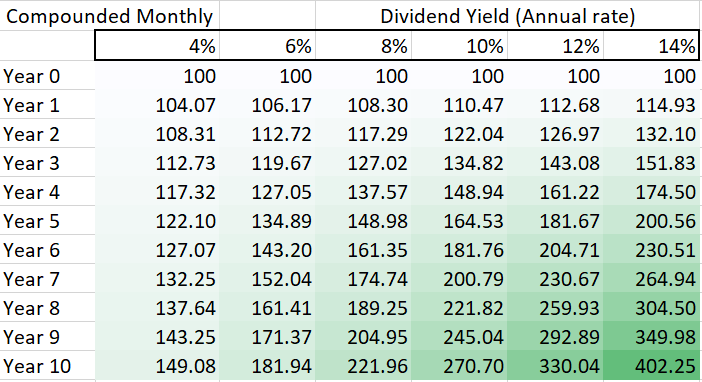

In this illustration, you have the same starting capital of $100, and the same 10% dividend yield but the stock gives out dividend on a monthly basis, allowing for additional compounding. Ending with a sum of $270.70 by the end of year 10, a return on 170.70%. Here, it can be seen that more distribution increases returns on a compounded basis.

Disadvantages of Dividend Investing

Dividend is not guaranteed

Dividend is not guaranteed and can be decreased or even halted during times of financial distress. If a stock is known for giving a constant and increasing dividend, any decrease or suspension of dividend sends a negative signal to the market, taking the stock price down. This may lead funds that focus on dividend yielding stocks (like pension funds) to shift their funds elsewhere.

For example, Shell dropped its dividend by 66% (from 47c to 16c) for first quarter of 2020, the first time since World War II[5]. The stock price plunged 13.13% from 36.8 USD to 31.97 USD[6] on the same day.

Dividend Yields may be misleading

Dividend yields may be misleading as dividend yields are calculated using the current share price. Thus, a significant drop in the share price may falsely boost dividend yield. Not all high dividend yield investments are good. Furthermore, companies may be facing financial difficulties or even giving out dividends in excess of profits they earn, resulting in an unsustainable dividend yield. Thus, investors should conduct their own research when considering high dividend yield counters.

Taxes

Dividend investing is also subjected to tax. Depending on the country the company is based in, taxes will apply. For example, all dividend paid by US companies have a 30% withholding tax for foreign shareholders [7]. Taxes affect the effective dividend yield when they involve foreign companies, making companies with lower or no dividend taxes more attractive.

Dividend Vs Growth

Dividend paying companies have a payout ratio. The dividend payout ratio is the percentage of net income that the company pledges to pay out as dividends. Therefore, when the dividend payout ratio is high, investors get a large portion of the profits as dividend. But this also signals to the market that the company has less retained profits to invest in future growth and new projects. As a result, the expected growth rate of high dividend payout companies can be lower than non-dividend paying companies.

Dividend Investing Strategies

Investing in dividend stocks and ETFs with the aim to diversify an income stream is a good way to go for investors of all ages. Who wouldn’t want to receive a “second pay” that is growing and compounding and in a way, making your investments work for you. With that in mind, we have identified some essential elements that a good dividend investing strategy should have.

High Dividend Yield

High dividend yield is essential to get the most dividend income for every dollar you invest. Therefore, we will be focusing on companies/ REITS/ ETFs with dividend yields of at least 5% (roughly taking approximately 15 years to double your investment, given that there are no changes in share price or dividend growth and it is compounded yearly).

Positive Dividend Growth

Dividend growth is the increase in dividend paid out over a period of time. Positive dividend growth sends a positive signal to the market that the company is strong financially and stable. A company/ REIT/ ETF that pays increasing dividends every year is ideal.

Sustainable Dividend

Investors need to ensure that the company / REIT/ ETF is able to sustain its dividend and have a good track record. Investors should expect dividend payments even when the broader market is in a downtrend.

Frequency of Distribution of Dividend

The higher the frequency of distribution, the more times the dividend can be compounded, increasing the effective dividend yield (subject to reinvestment risk). Most dividend companies pay quarterly dividends while ETF payments range from monthly to yearly.

Low Risk

Companies face different dimensions of risk, but as investors want stable, predictable and high dividend yields, the dividend portfolio must aim to reduce individual company risk (also known as diversifiable risk / unsystematic risk). Therefore, a diversified portfolio of revenue streams like REITs and ETFs can have lower risk compared to buying the shares of individual companies

Opportunities in Singapore REITs listed on SGX

The Singapore stock market is known for its low volatility, high emphasis on value stocks, investor friendly tax codes, dividend paying stocks and real estate investment trust (REITs). Singapore listed REITs offer investors a low risk, wide selection of exposure and tax incentives (no dividend and capital gain tax for local investors). REITs generally have high dividend yield as in order for a REIT to enjoy tax transparency, the REIT must distribute at least 90% of its taxable income to the unit holders the same year as the income is derived [8]. REITs have sustainable dividend through their diversified property portfolio, with contracts to secure long-term occupancy and predictable cash flows. After taking in to account all the factors of dividend investing, the following Singapore REIT is a great example.

Ascendas REIT (SGX: A17U)

Price (13/4/2022) = $2.87 SGD

12-Month Trailing Yield = 5.34%

Distribution Yield (Yearly) = 5.29%

Distribution Frequency = Semi-Annual

5 Year Dividend Growth = 3.04%

Ascendas REIT has a market cap of 12 billion SGD and has a portfolio of properties in Singapore, Australia, UK/ Europe and the United States. It has a wide range of customers, ranging from life sciences to logistics service providers. Ascendas REIT ha a 5-year dividend growth of 3.04%. A dividend yield of more than 5% allows investors to combat inflation and lets them reinvest to enjoy the compounding effect.

Further Opportunities

For investors who do not have a lot of capital, ETFs are a great option. ETFs allow investors to gain exposure to a large amount of assets at a much lower price, achieving diversification at lower cost. After considering all the elements that are essential to dividend investing, we have identified 3 ETFs that set themselves apart, Global X Nasdaq 100 Covered Call ETF (QYLD), Global X Russel 2000 Covered Call ETF (RYLD) and Global X S&P 500 Covered Call ETF (XYLD). All three ETFs use a covered call strategy.

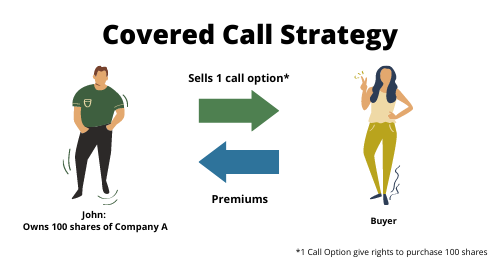

Covered Call Strategy

A covered call strategy involves first holding shares then writing and selling call options on the shares. If the buyer of the call option exercises the option, the seller just needs to hand over the shares from their portfolio and is not forced to purchase them from the market. Therefore, this is called a covered call strategy and is different from a naked call strategy where the seller of the call options does not own the shares. By selling the call options, the proceeds become dividend income that is passed on to the investor regardless of whether the call option is exercised or not. Making covered calls is a great strategy for dividend income-focused investors. However, the covered call strategy has limited exposure to an increase in share prices, as the call options will get exercised, limiting upside exposure [6]. A covered call strategy is used to maximise dividend payouts at the cost of potential capital gain.

A covered call strategy also ensures that as long as the call options are sold, premiums that are paid as dividends are sustainable. The 3 covered call ETF mentioned above have underlying portfolios of highly liquid markets, the Nasdaq 100, S&P500 and Russel 2000 index. A highly liquid options market and price transparency ensures a low cost of writing and selling of options. Here, we will look at QYLD, as QYLD offers the most attractive dividend yield opportunity due to higher Covered Call option premiums compared to RYLD and XYLD.

Nasdaq 100 Covered Call ETF (QYLD)

Price (13/4/2022) = $21.01 USD

12-Month Trailing Yield = 15.25%

Distribution Yield (Yearly) = 12.47%

Distribution Frequency = Monthly

Total expense ratio = 0.60%

5 Year Dividend Growth 10.50%

QYLD is seen as the gold standard among high dividend ETFs as it has extremely high dividend yield (>10%) with monthly distribution, sustainable dividend through premiums collected from covered call strategy, positive dividend growth of 10.50% for 5 years and low risk (exposed to a broad index Nasdaq 100). Furthermore, QYLD holds all components of the Nasdaq 100, and underwrites and sells call option on a monthly basis.

However, the potential capital gain of QYLD is severely capped and limited in exchange for monthly premiums. QYLD is for investors who want dividend monthly, are more defensive and want peace of mind. This means that regardless of volatility, investors can still expect stable monthly dividends. QYLD can also be incorporated into a sophisticated investor’s portfolio as a defensive position and is a great alternative to holding cash in a bank account.

QYLD has a relatively high expense ratio of 0.6% as compared to passive ETFs that have expense ratios of ~0.1%. The higher expense ratio is due to the covered call strategy that requires the QYLD management to write and sell call options. Giving investors a hassle-free exposure to a covered call strategy that comes with a cost.

QYLD is a US-listed ETF and is subject to the US dividend withholding tax of 30% [9]. This will affect the dividend yield and potential returns. This is a tax that other dividend stocks/ETFs/REITS may not have, such as Ascendas REIT.

Key Takeaway

Investors need to conduct their own due diligence to ensure that dividend investing is suitable for them. Furthermore, one has to understand the risks and rewards for the different dividend investing strategies through the factors explored here.

Dividend investing allows investors to enjoy and utilize the power of compounding but requires discipline, consistency and patience. There are dividend investing opportunities in every market, depending on accessibility and possible tax implications. But investors should be aware of possible value/dividend traps by examining the company financials and assessing the sustainability of dividend payouts. There are a lot of investing strategies to create long-term wealth and we believe that dividend investing is one that all investors regardless of age and investment objectives should be aware of and consider.

How to get started

As the pioneer of Singapore’s online trading, POEMS’ award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges.

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here. T&Cs apply.

We hope that you have found value reading this article! If you do not have a POEMS account, you may visit this link or scan the QR code below to open one with us today!

Open a POEMS account within minutes and trade instantly!

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

For enquiries, please email us at cfd@phillip.com.sg. If you are interested in active discussions, you can also join our Telegram community here.

Reference:

- [1]https://mint.intuit.com/blog/investing/what-are-dividends-5225/

- [2]https://www.thebalance.com/what-is-dividend-investing-357437#:~:text=Dividend%20investing%20is%20a%20method,or%20other%20holdings%20gain%20value

- [3]https://www.fidelity.com/learning-center/investment-products/stocks/why-dividends-matter

- [4]https://www.azquotes.com/quote/364319

- [5]https://www.reuters.com/article/us-shell-results-idUSKBN22C0TK

- [6]https://www.shell.com/investors/information-for-shareholders/share-prices/historical-share-prices.html

- [7]https://www.iras.gov.sg/media/docs/default-source/e-tax/e-taxguide_income-tax-treatment-of-reits-and-approved-sub-trusts.pdf?sfvrsn=69897e04_0

- [8]https://www.fidelity.com/learning-center/investment-products/options/why-use-a-covered-call#:~:text=A%20covered%20call%20is%20a,stock%20that%20was%20purchased%20previously

- [9]https://taxsummaries.pwc.com/united-states/corporate/withholding-taxes

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Sam Hei Tung

Dealing

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile