Why you should Consider Trading Crude Oil August 22, 2022

Objective

This article, aims to provide essential information regarding the Crude Oil Market (the two benchmarks), discuss factors affecting oil prices (supply, demand, geopolitics, seasonality and key oil prices) and how you can use Oil CFDs to gain exposure and hedge.

Introduction to Crude Oil Market

Ever since crude oil was discovered, it has gone on to become an essential product, crucial to our everyday lives. There has always been a certain allure to the commodity “Crude Oil” also known as “Black Gold”. Yet many do not have much of an idea who the main players are and how they interact in the Crude Oil market. There are two main crude oil grades, the West Texas Intermediate (WTI) and the North Sea Brent Crude (Brent), both grades serve as pricing benchmarks for the majority of the global oil supply [1]. WTI is the benchmark for light sweet crude and is excavated from oil fields across the United States; most of the oil exploration is done on land. While Brent is a relatively light crude oil and is drilled out of the North Sea adjoining the UK and Norway [2]. Crude Oil is a commodity tightly linked to the global economy, as it powers electricity production and is used to produce items ranging from vehicles and plastics to medical products [3]. This article aims to explore the two Crude Oil benchmarks and provide essential information investors need to know before gaining exposure to Crude Oil.

Key Differences between WTI and Brent

Settlement

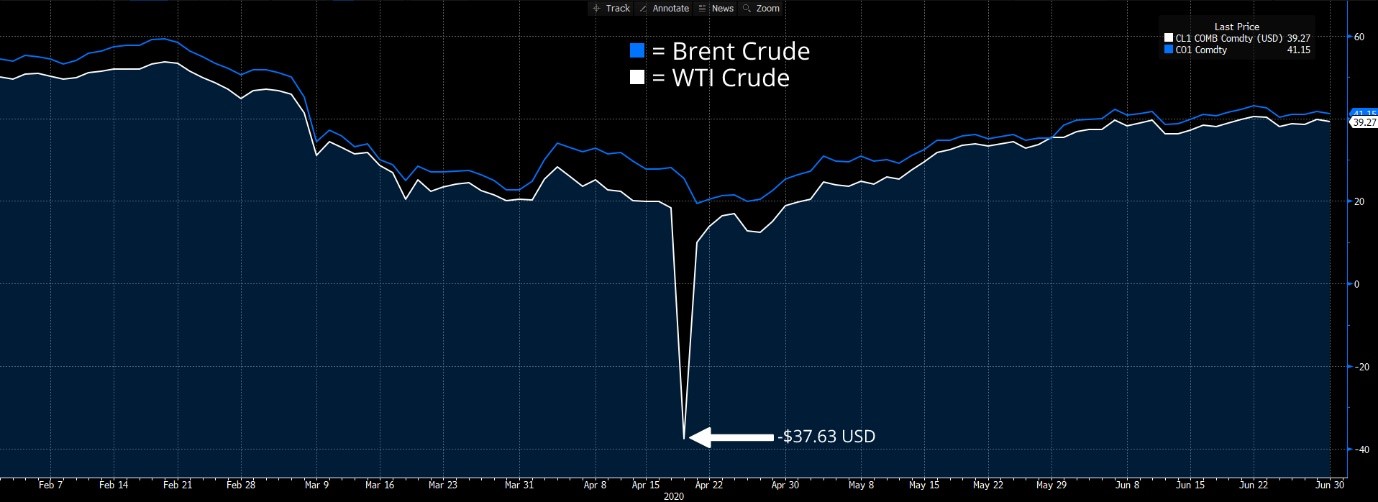

WTI futures are settled with physical barrels while Brent is cash settled [4]. This created a rare situation that caused WTI prices to go negative (-USD37.63 per barrel) on 20 April 2020. As WTI futures contract holders are given two choices when the expiry date of their contracts comes close, they can either opt for physical delivery of crude oil (not preferred by traders as they do not have oil storage facilities) or sell the contract to someone else. As most oil storage facilities were running near maximum capacity, some oil producers were even renting tankers to store excess supply [5]. At that time, about 108 million barrels of contract positions were still open, traders were dumping their contracts in order to avoid the physical delivery of the barrels and the storage costs involved [4]. This reached a point where traders were willing to pay others to take the physical barrels off them, causing the price of WTI to crash to -USD37.63, for first time in the history of the oil market. Below is a graph highlighting the severity of a price crash.

Source: Bloomberg

Source: Bloomberg

However, Brent Crude prices remained positive, as contracts were cash settled and thus did not face the problem of physical delivery of barrels. Traders who want to short Crude Oil may consider WTI over Brent for this reason.

Trade Volume

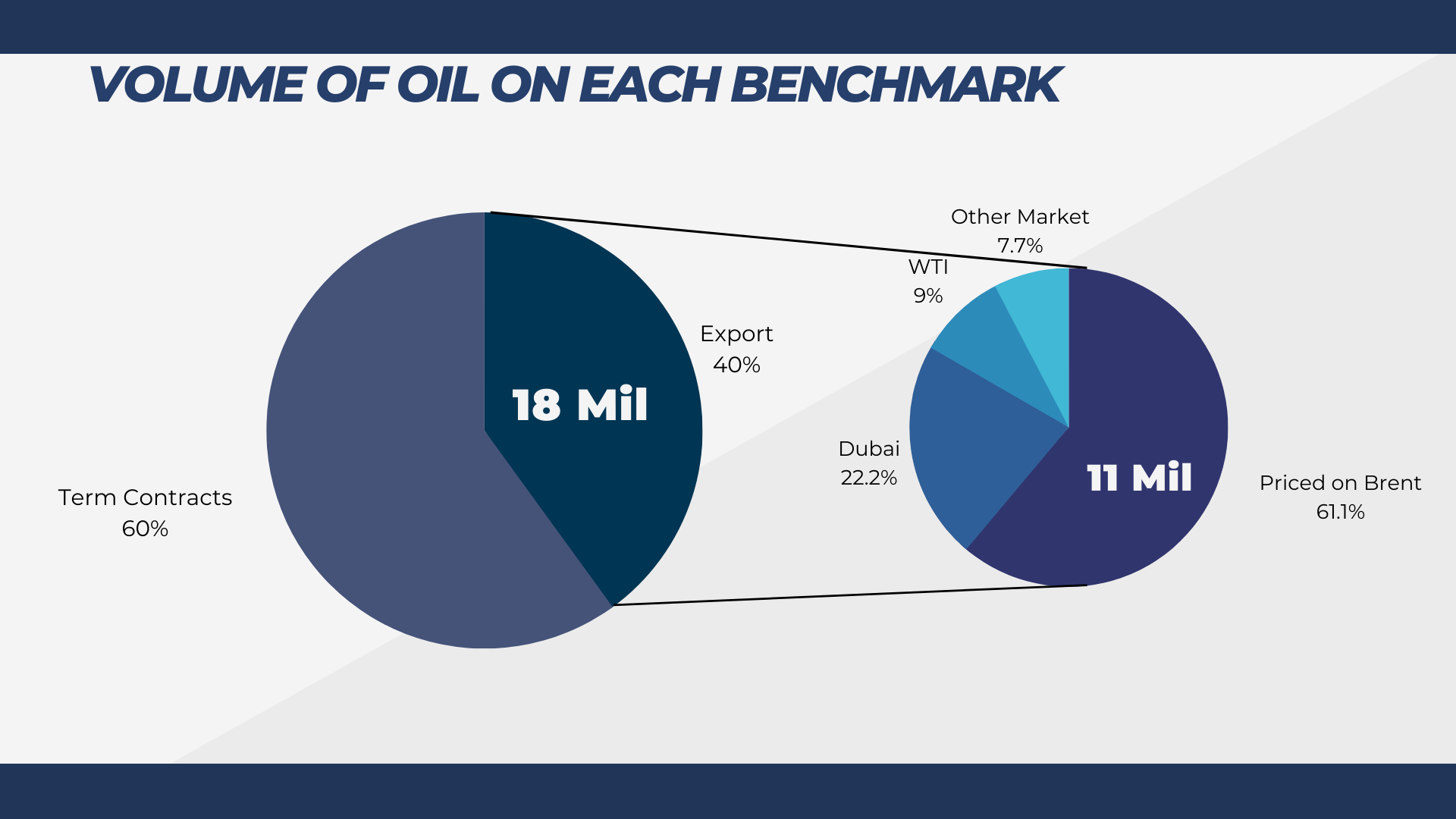

The oil market produces about 80 million barrels of crude oil every day, with about 45 million barrels being exported. Out of the 45 million barrels, 27 million barrels are sold under term contracts. For the remaining 18 million barrels, Brent is used to price 11 million barrels while the rest is priced with WTI and Dubai standards [6]. The diagram below shows how majority of the trades in the crude sport export market uses Brent crude oil prices, while WTI as a benchmark represents a small proportion of the trades.

The paper market trade volume for WTI and Brent futures total 2.8 billion barrels of oil (2.8 million contracts per day) [7]. As commodities trading has a physical underlying (Barrels of Oil to ounces of Gold), most traders prefer trading on the paper market (which is cash settled and no physical commodity is exchanged), causing the paper market to have significantly more volume than the physical market. The liquidity in the physical market creates a solid base for the paper trading market. Brent is seen as a better benchmark for the global oil market as compared to WTI through the sheer number of barrels priced on Brent vs Crude (As seen in the diagram above).

Cost of delivery

As Brent crude oil drills and facilities are near the ocean, shipping and logistics through sea is the main way of export. Most physical oil producers and physical oil refiners use Brent as the benchmark as Brent has access to global shipping capacity, port capacity, storage capacity and vessels. Therefore, Brent prices are able to reflect the global oil market fundamentals better than benchmarks with constraints [8]. WTI is highly landlocked in the US Midcontinent, which has limited storage capacity and is less convenient in terms of logistics. Furthermore, the cost of delivery from a landlocked location is much higher than that of a waterborne location.

The Price between WTI and Brent

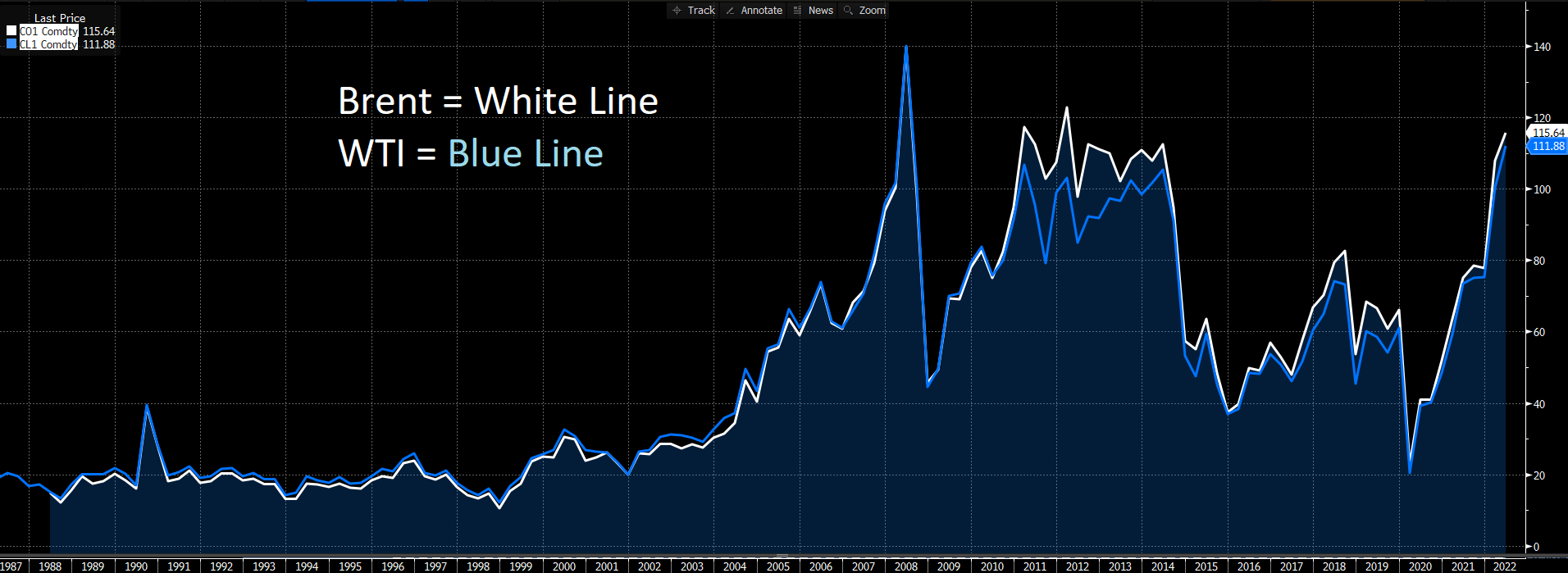

The chart below illustrates Brent Vs WTI prices from 1987 – 2022

Source: Bloomberg

Source: Bloomberg

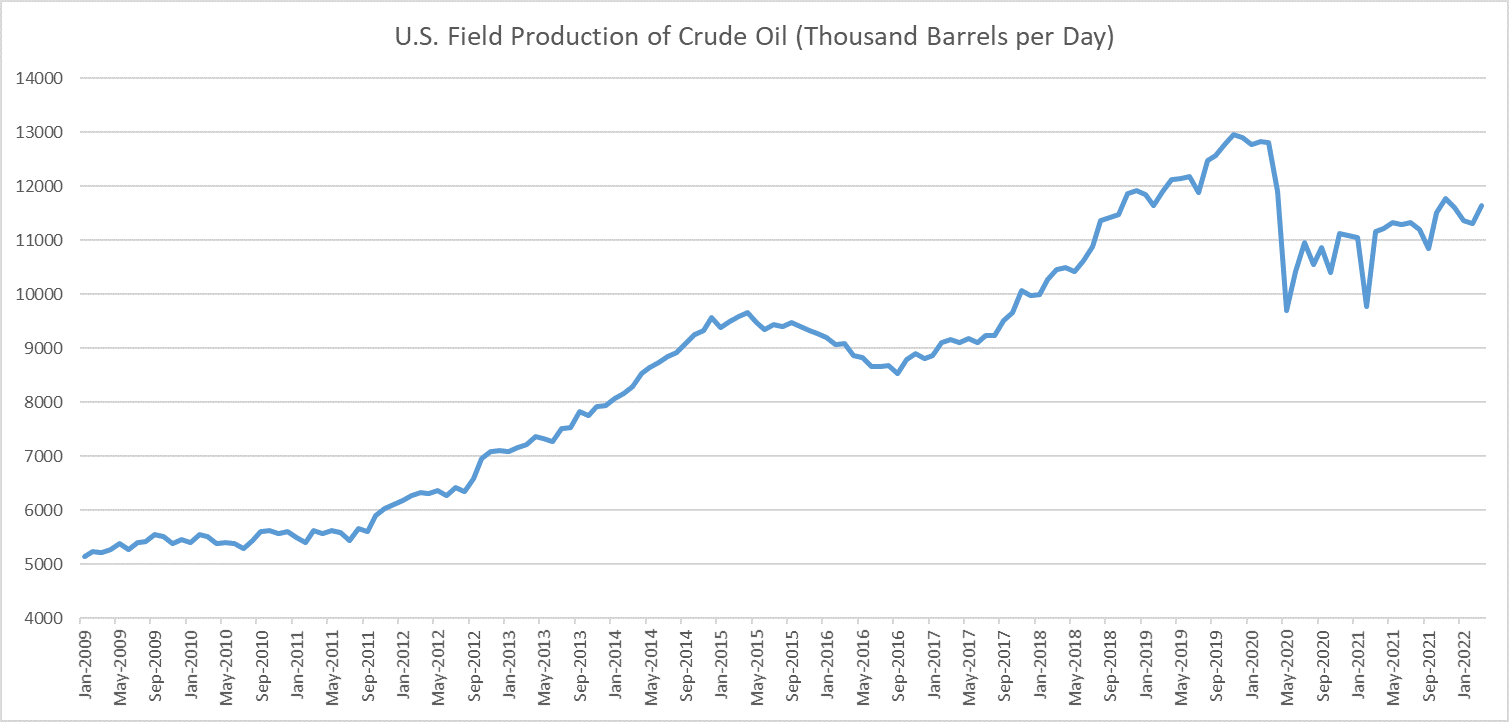

It can be seen that WTI (Blue Line) was more expensive than Brent (White Line) from 1987 to about 2010. After 2010, it can be seen that Brent is more expensive than WTI. This is mainly due to the increase in US Crude oil production levels from 2009 to 2022 as shown below.

Source: U.S. Energy Information Administration

Source: U.S. Energy Information Administration

US Crude oil production levels doubled from late 2009 to 2020, to 13 million barrels a day. This increase of production is one of the key factors that caused WTI to trade at a discount compared to Brent. The increased production also changed the US, from a net importer of oil products into a net exporter of oil products in November 2019 [9].

Factors affecting the crude oil price (both WTI and Brent)

Supply

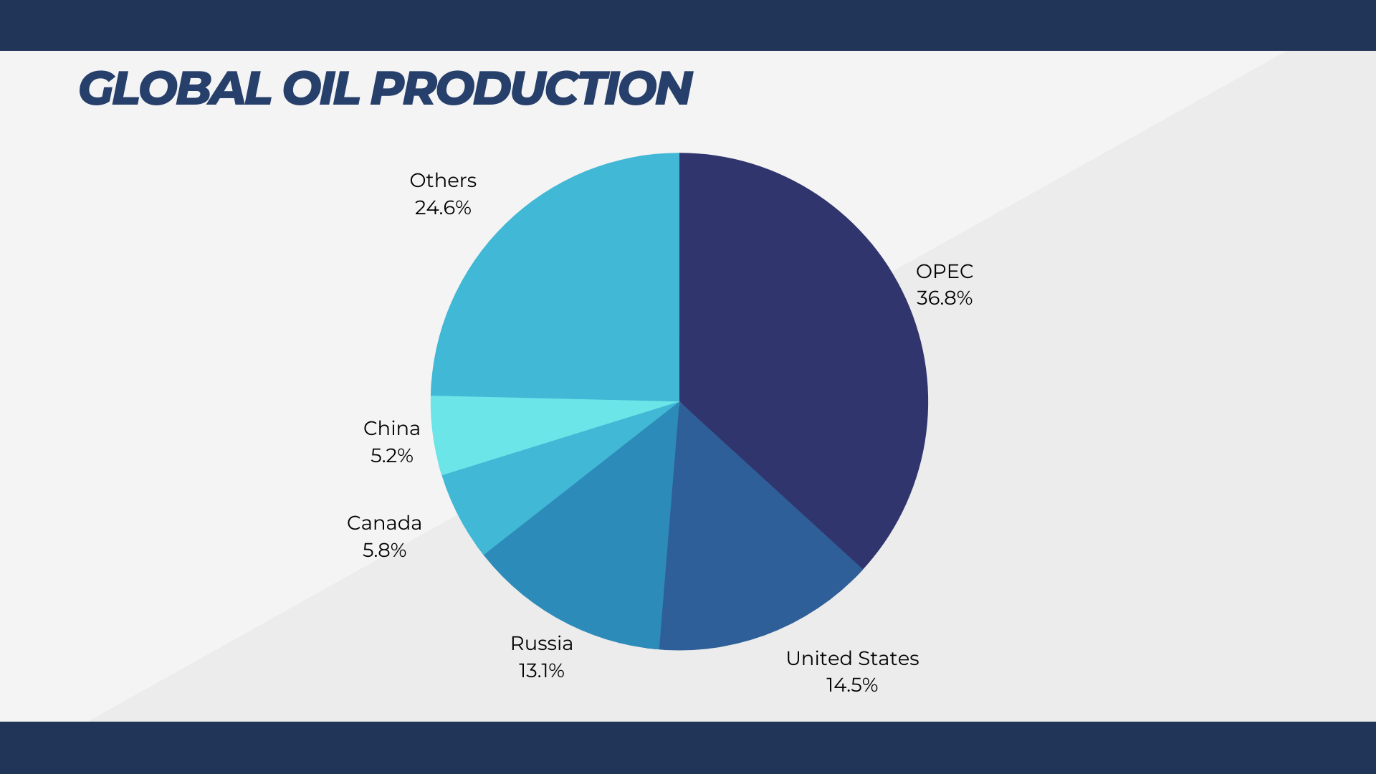

As a commodity, the Crude Oil supply has a huge influence over the price. As of 2021, the top 6 countries with the highest production of crude oil are: 1) United States; 2) Russia; 3) Saudi Arabia; 4) Canada; 5) Iraq and 6) China. However, if we consider all countries that are a part of The Organization of the Petroleum Exporting Countries (OPEC) as a single entity, OPEC will be by far the largest producer of crude oil amounting to 35-40% of the global oil production [10].

OPEC, currently has 13 members with Saudi Arabia as the largest producer of Crude Oil. OPEC has monthly meetings (Depending on the volatility of the Oil market and macro environment) to decide on target production quotas of each member country, which will greatly influence the supply of Crude Oil in the global market and ultimately affect prices. The objective of OPEC is to ensure the stabilisation of price in the international oil markets and to minimise harmful and unnecessary fluctuations [11]. OPEC has in recent history worked with Russia (which produces ~10% of the global crude oil supply) as an OPEC + member to influence the global oil market further. OPEC + Members are an informal group of non-OPEC members such as Russia that occasionally collaborate with OPEC members to stabilise and influence global oil markets.

Traders and investors should also take note of the supply of Crude Oil from the US, through the shale oil revolution. Over 2010 – 2012, with the advancement of technology and use of fracking methods, the US was able to increase production significantly [12]. However, the supply of crude oil in the short run is fixed, as the exploration of crude oil is highly capital intensive and time consuming, causing the supply of crude oil to be inelastic. Even when crude oil prices rise, the suppliers of crude oil are unable to increase production in the short run.

Demand

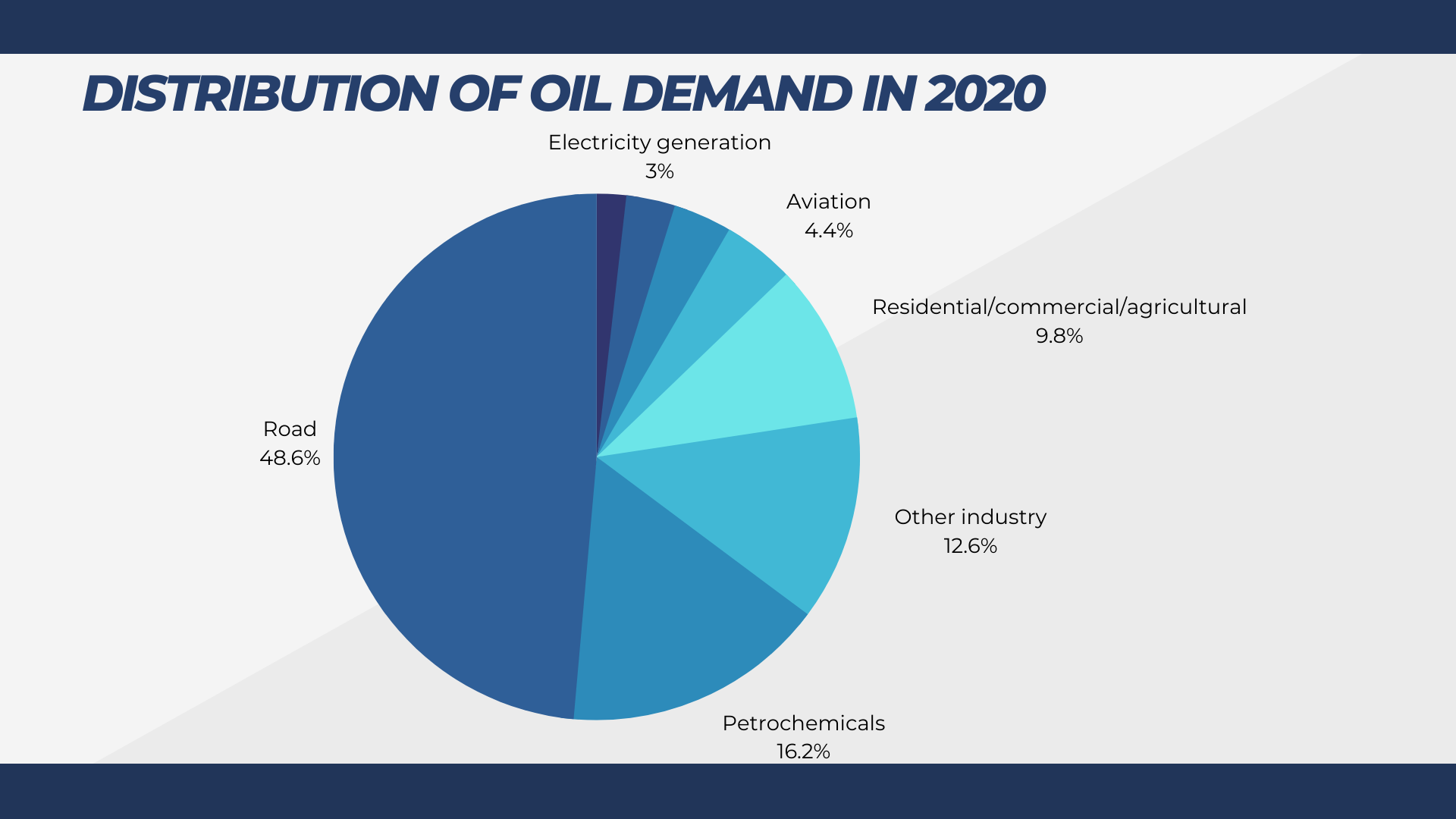

The demand for crude oil is mainly driven by economic activities and the need for energy. Below shows the distribution of oil demand in 2020.

It can be seen that majority of crude oil is consumed by motor vehicle usage, ranging from private cars to land-locked logistic chains. The demand of oil is highly dependent on the economic activities of the major economies in the world. The table below shows the Top 5 leading countries by oil consumption in 2020 [13].

| 1 | U.S | 17,178,000 |

| 2 | China | 14,225,000 |

| 3 | India | 4,669,000 |

| 4 | Saudi Arabia | 3,544,000 |

| 5 | Japan | 3,268,000 |

Source: Statista

With the US and China being the top 2 largest economies in the world, it is not surprising that their crude oil consumption combined contributes to ~45% of the world’s daily crude oil consumption. Any demand shock from the US or China such as lockdowns or economic slowdowns will greatly affect the demand and price of crude oil.

There is huge reliance on crude oil to power our economies, at least for the short run, causing the demand to be inelastic. Even when oil prices increase, economies still require barrels of oil to maximise production and economic activities.

Geopolitical & Weather

Geopolitical events such as war, sanctions, tensions between countries, civil unrest and more will affect trade relations, supply, demand and sentiment of the crude oil market. For example, the Russia-Ukraine conflict saw Western nations impose sanctions on Russian Crude Oil, greatly limiting the world’s supply of crude oil. Throughout history, when there is war, crude oil prices tend to rise.

This is due to crude oil’s role as a major asset that fuels the vehicles and machines required for war. Furthermore, wars can restrict waterways essential to the logistics of Oil Tankers.

In March 2020, Russia and OPEC (led by Saudi Arabia) had a disagreement over proposed oil-production cuts during the COVID-19 pandemic, which resulted in Russia backing out.

The demand for crude oil has a seasonal element, where crude oil demand is higher in the summer as compared to the winter. From historical crude oil price data, it can be observed that demand for crude oil products peaks during summer due to increase in travel and industrial activities (agriculture & logistics) [14].

Law and Regulations changes

Governments of countries around the world recognise that the crude oil industry from the exploration stage to the use of crude oil produce harmful chemicals that cause air pollution and global warming. Therefore, there is an increasing amount of regulations and goals set to reduce and potentially remove the consumption of crude oil products, such as the restriction of the sale of vehicles that use petrol / diesel. Furthermore, stricter rules such as the Clean Air Act (CAA) aims to reduce and limit the pollution from the emission of methane gas in the crude oil industry [15].

Singapore plans to phase out petrol and diesel vehicles by 2040 [16], while other countries like Canada, Netherlands, Ireland and UK and more plan to phase out the use of petrol and diesel cars by 2030. With governments around the world aiming to decrease emissions, this will put a downward pressure on the demand for crude oil in the future. Structural changes and more regulations on the crude oil industry will affect the supply as well as the barrier of entry into the industry, causing existing players to rethink if they should continue to invest.

Key Oil price Levels

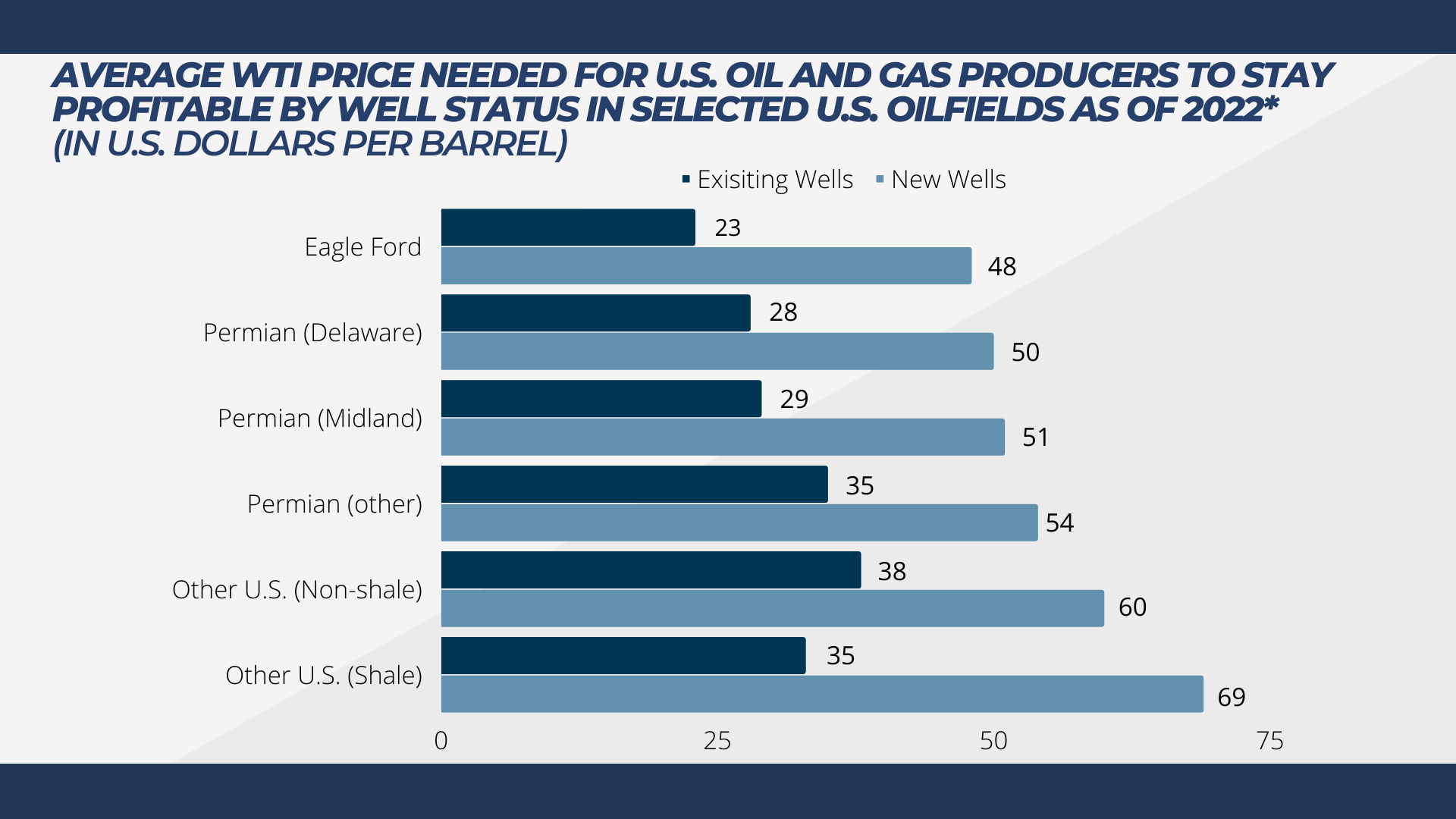

There are some key crude oil price levels traders and investors need to take note of. The chart below shows the price crude oil needs to be at for the US oil and gas producers to be profitable.

Source: https://www.statista.com/statistics/748207/breakeven-prices-for-us-oil-producers-by-oilfield/

Source: https://www.statista.com/statistics/748207/breakeven-prices-for-us-oil-producers-by-oilfield/

The key crude oil price level for existing oil wells are between USD 23-38 as a break-even price, while new oil wells will need the crude oil price to be at around USD 48-69 to break even. These price levels are essential to the survival of oil wells in the US, especially the smaller oil wells that do not have large amounts of capital to weather a sustained period of low crude oil prices.

During the 2020 COVID-19 pandemic, OPEC and Russia had a price war, which pushed prices of crude oil below USD50 a barrel for about a year, over 100 Oil exploration and downstream companies filed for bankruptcy due to this [17].

As prices of crude oil are at multi-year highs, if they remain at the USD110+ range demand destruction will slowly come in to play. High and sustained oil prices will push customers to consume less oil and find alternative energy sources, resulting in lower demand[18].

Key Takeaway

Crude oil trading, which features both physical traders and speculators in the market, is not for everyone. Any news at any time can shift the markets violently (Oil Contract For Differences trade 20 hours a day), which is more than most traders are willing to stomach. The Crude Oil markets are highly volatile and sensitive to many factors, ranging from geopolitical to supply and demand shocks. Economic data that are released weekly such as the American Petroleum Institute Crude Oil Stock reports are used by analysts to forecast economic activity and net changes in supply & demand in the US.

Crude oil prices have huge indirect impact in our lives, such as increase in delivery cost, higher energy prices and even cost of food. Traders and investors can hedge against higher oil prices through instruments like Contract for Differences (CFDs), which offers both long and short positions. CFDs allow market participants to benefit from a bull or bear market in crude oil prices, and take advantage of the volatile markets. However, as they are traded on margin, they could significantly increase profits and losses at the same time, effectively a double-edged sword. Traders and investors need to have proper risk management in place to fully benefit from using CFDs.

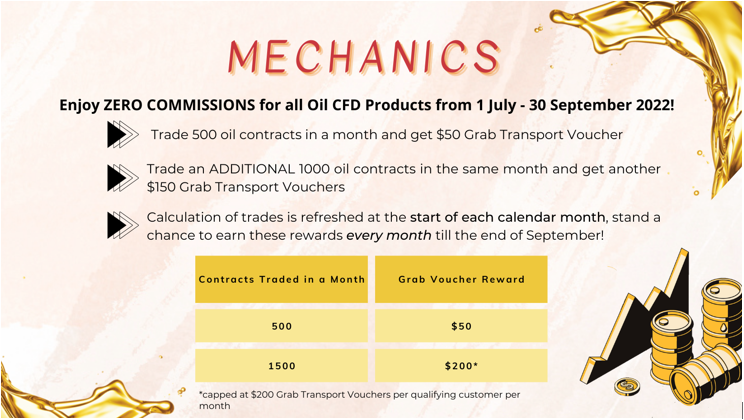

Currently, Phillip CFD is having an Oil CFD Promotion! The recent volatility in oil prices may present a great opportunity for traders. Receive up to S$600 worth of Grab Transport Vouchers when you trade Oil CFDs! Furthermore, you can enjoy ZERO COMMISSION for all Oil CFD products! With leverage, you can deposit as low as USD20 for 1 Oil CFD contract!

Eligible Oil Products to trade with ZERO COMMISSION:

- UK Oil USD 1 CFD

- UK Oil USD 100 CFD

- US Oil USD 1 CFD

- US Oil USD 100 CFD

Start trading on the price movements of the oil market with Oil CFDs now!

Reference:

- [1] https://www.indiainfoline.com/article/general-blog/eight-questions-on-brent-crude-versus-wti-crude-121061800208_1.html#:~:text=the%20global%20benchmarks.-,Brent%20is%20oil%20that%20is%20drilled%20out%20of%20the%20North,(WTI)%20as%20the%20benchmark

- [2] https://www.investopedia.com/ask/answers/052615/what-difference-between-brent-crude-and-west-texas-intermediate.asp

- [3] https://www.iogp.org/blog/news/uses-of-oil-and-gas-in-the-medical-field/

- [4] https://energy.economictimes.indiatimes.com/news/oil-and-gas/why-brent-oil-wont-follow-u-s-wti-futures-below-zero/75291341

- [5] https://www.bbc.com/news/business-52350082

- [6] https://www.theice.com/global-crude-benchmarks-brent-sets-the-standard

- [7] https://www.theice.com/why-the-world-needs-benchmarks-and-characteristics-of-benchmarks#:~:text=The%20WTI%20and%20Brent%20contracts,2.8%20billion%20bbl%20of%20oil

- [8] https://www.theice.com/insights/market-pulse/brent-the-worlds-crude-benchmark

- [9] https://www.eia.gov/todayinenergy/detail.php?id=42735

- [10] https://www.eia.gov/international/rankings/world?pa=173&u=0&f=A&v=none&y=01%2F01%2F2021&ev=false

- [11] https://www.opec.org/opec_web/static_files_project/media/downloads/publications/OPEC_Statute.pdf

- [12] https://www.strausscenter.org/energy-and-security-project/the-u-s-shale-revolution/#:~:text=The%20%E2%80%9CShale%20Revolution%E2%80%9D%20refers%20to,total%20U.S.%20crude%20oil%20production

- [13] https://www.statista.com/statistics/271622/countries-with-the-highest-oil-consumption-in-2012/

- [14] https://www.danielstrading.com/2020/05/01/summer-seasonality-and-wti-crude-oil-pricing

- [15] https://www.epa.gov/system/files/documents/2021-11/proposal-ria-oil-and-gas-nsps-eg-climate-review_0.pdf

- [16] https://www.reuters.com/article/us-singapore-economy-budget-autos-idUSKBN20C15D

- [17] https://www.ogv.energy/news-item/over-100-oil-and-gas-companies-went-bankrupt-in-2020#:~:text=More%20than%20100%20oil%20and,worst%20downturn%20in%20a%20generation

- [18] https://www.businessinsider.in/stock-market/news/oil-prices-could-hit-150-a-barrel-or-more-with-demand-destruction-likely-by-the-end-of-the-year-says-global-commodities-trader-trafigura/articleshow/92068321.cms#:~:text=commodities%20trader%20Trafigura-,Oil%20prices%20could%20hit%20%24150%20a%20barrel%20or%20more%20with,says%20global%20commodities%20trader%20Trafigura&text=Oil%20prices%20could%20reach%20%24150,Trafigura%20’s%20CEO%20said%20Tuesday

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Sam Hei Tung

Dealing

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Unveiling Opportunity: Exploring the Potential of European Equities

Unveiling Opportunity: Exploring the Potential of European Equities  Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading

Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading  Crude Realities: Understanding oil prices and how to trade them

Crude Realities: Understanding oil prices and how to trade them  Gold at All-Time Highs: What’s Fuelling the 2025 Rally?

Gold at All-Time Highs: What’s Fuelling the 2025 Rally?