World Earth Day: How To Analyse ESG factors and Identify Potential Companies to invest in April 19, 2022

What On Earth is World Earth Day?

World Earth Day, which falls on April 22, 2022, seeks to educate and activate the public to drive positive action for our planet Earth [4]. This year, World Earth Day’s theme is investing in our planet [5].

And if you take a long term view of things, doing business in a sustainable manner, and doing it right will allow a business to last long and prosper.

But what has Earth Day got to do with investing? The answer is Change.

A study of SGX-listed companies in 2017 showed that a company’s account of how it dealt with environment, social, and governance (ESG) factors was positively related to the firm’s market value, regardless of the sector or firm’s status (government-linked or family business) [2].

The account is known as a sustainability report where SGX requires firms to report about environmental, social and governance (ESG) factors, the risk and opportunities from it and how it is managed for future returns.

The sustainability report complements the financial reports of the listed companies allowing investors to make a more informed decision with regard to the company’s financial prospects and quality of management [3].

Before we look at how to use ESG factors to screen for good businesses for investment, let us understand why having a proper framework for analysing a company’s ESG efforts is crucial rather than just believing a company’s green PR and marketing efforts.

Greenwashing

Companies with high ESG ratings tend to do well over the long run. And this attracts investors in the hope that their investments will do well.

So, in a bid to attract investors, some companies resort to greenwashing by giving a false impression that they are environmentally sustainable, when in actuality little has been done to minimize the environmental and social impacts of their business operations or portfolios.

Some common tactics by companies engaged in greenwashing are:

- Renaming, rebranding or repackaging of products

- Using press releases and commercials to tout their green initiatives.

But not all companies are involved in greenwashing and there are companies that are making meaningful commitments to being green. Hence, it is important for investors who are interested in ESG investing to know how to avoid investing in a greenwashed stock.

How to Avoid “Greenwashed Investments”

Greenwashing exploits retail investors’ environmental, social and governance concerns and limits their ability to make informed decisions. For years, ESG data and information disclosed was wide-ranging, fragmented and often difficult to compare.

And even today, the collection, reporting and assurance of data and information is still not standardised across industries, markets and jurisdictions. So, we are trying to provide a systematic guide for you to navigate the plethora of ESG data and information, so you do not become a victim of greenwashing and have a head start when it comes to making informed investment decisions.

Here, we focus on listed companies on the SGX and this guide covers two aspects – quantitative and qualitative – to provide you with a holistic approach in your ESG investing journey.

Quantitative Analysis

Quantitative ratings allow sustainability benchmarking across and within sectors, and offer comparability across time using historical ratings. This allows investors and listed companies to gain a more in-depth insight into their ESG profiles.

To do this, SGX has partnered with leading rating providers to provide ESG ratings showing how well SGX listed companies manage ESG issues that are most material to their businesses. The ESG ratings are consolidated into a table as shown below and you can access it via this link on the SGX website.

Source: SGX [7]

Source: SGX [7]

The table shows you that the companies are not rated based on just one or two ratings, but five ratings from five different rating providers, ensuring that you are able to narrow down on a few companies that have been holistically assessed based on different models and guidelines of the different rating providers. The five rating providers are:

1. FTSE

2. MSCI

3. Sustainalytics

4. S&P Global

5. V.E

For details on how the ratings are done and the methodology, you can check the SGX website via this link.

The table on SGX’s website shows there are a number of ways to narrow down your favourites before moving on to the qualitative analysis of the company.

1. Filter sector you prefer > Sort companies based on their ratings across the five providers.

2. Sort companies based on their ratings across the five providers (if you do not have a particular sector you want to look at).

Qualitative Analysis

After narrowing down the companies from the SGX screener, you should have at least 3-5 companies that you would want to analyse further. This is where you can dive deeper into the businesses by reading their sustainability reports, which is a mandatory requirement by SGX for listed companies. Similarly, the listed companies’ sustainability report can be found on SGX website via this link.

The sustainability report covers the ESG factors affecting the company and how a company manages them. As prescribed by SGX, the report must contain five primary components:

1. List of material ESG factors

2. Report on policies, practices and performance

3. Set annual targets

4. A sustainability framework

5. Include a board statement

Each report can be more than 100 pages and in the sea of words, it can be difficult to determine if the company has a clear idea of what they are doing in terms of sustainability. Hence, we suggest you simplify the analysis into 3 key components.

*The three key components are recommended based on SGX’s “Investor Guide to Reading Sustainability Reports”. You can find the full guide here.

The three components are:

Component 1: Chairman/CEO statement

Details to look out for:

Investors can look at the chairman or CEO statement in the report as it is an indication of the amount of leadership support for ESG-related opportunities and risks and how this translates down the management chain.

It is also important to note if the management of ESG risk is integrated with other risks faced by the company as part of its disclosure on the overall risk management of the company.

Component 2: Material ESG factors and Company Actions

Details to look out for:

Look out for key material ESG issues of the business as this lets you understand the risks the company faces. For example, in the agriculture sector, product traceability and human rights are likely to be key material issues. The omission or misstatement of these risks could be a red flag.

Usually along with key material ESG issues, the company will also include related policies and processes that show how the company is managing its ESG risks and opportunities. Look for any omission or misstatement of these risks and opportunities as it could be a red flag.

Component 3: Annual targets and performance

Details to look out for:

This component gives you an ongoing view of the company and builds up your understanding of ESG in relation to its performance and strategies. It is even better if the company provides short, medium and long term strategies, targets and metrics. Explanations of over- and under-performance also provide indications of how forthright and transparent the company is.

After going through the three components, you may have questions about the company’s sustainability report. To address that, you can visit the company’s website to try and find those answers or even attend their AGMs and ask questions.

Example on the Implementation of the Framework

Quantitative Analysis

After understanding the process on how to avoid being greenwashed and sieve out the companies which are committed to their ESG efforts, try and put this into practice.

Start with the SGX ESG stock screener which provides you with ESG ratings from five leading rating providers.

Even though SGX has consolidated the companies and ratings in a table on their website, you need to do some work since the five rating providers have different types of rating formats.

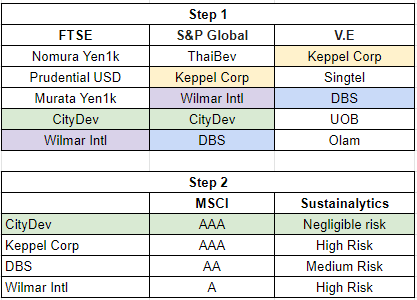

But we suggest a simple way to sieve out the top companies that you can look at in the table below.

Source: POEMS

Source: POEMS

If you look at the ratings by the providers, you can see that the ratings by MSCI and Sustainalytics are of a narrower range.

As such, we have split the filtering process into two steps. First, we identify the top five companies based on the ratings from FTSE, S&P Global and V.E, and then sieve out companies that have appeared at least twice.

Then, we further sieve out this group of companies based on MSCI and Sustainalytics ratings. Based on this two-step approach, we have a clear winner which is City Development Limited.

After conducting the quantitative analysis, you will need to dive in deeper into the selected company by doing a qualitative analysis to develop a more comprehensive view of the company’s prospects and to make an informed decision for your ESG investing journey,

So, move on to the qualitative analysis of City Development Limited (CDL).

Qualitative Analysis

You don’t have to go through the factors step by step as long as you go through all 3. Remember, the purpose of going through these factors is to assure yourself that the screener is giving you the right company to look at.

Component 1: Chairman/CEO statement

Read the Chairman/CEO statements and see what they have done and their plans going forward. This helps investors understand if the management of ESG risk is integrated with other risks faced by the company as part of its disclosure on the overall risk management of the company. This can usually be found in the first section of the reports.

For CDL’s 2022 sustainability report, the Chairman and CEO’s statement can be found on page 8 and 10 of the report respectively.

Reading through the statements gives investors an idea on whether the Chairman/CEO is optimistic and able to tackle whatever challenges that lie ahead.

Component 2: Material ESG factors and Company Actions

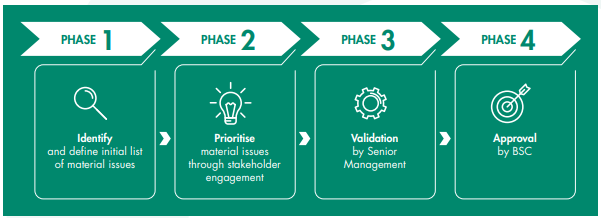

In the sustainability report, you are able to find City Development’s approach to conducting their materiality assessment where they determine the key ESG issues that are important to their stakeholders. For example, the infographic below is extracted from their sustainability report which illustrates their approach to materiality assessment.

Source: City Development Limited [6]

Source: City Development Limited [6]

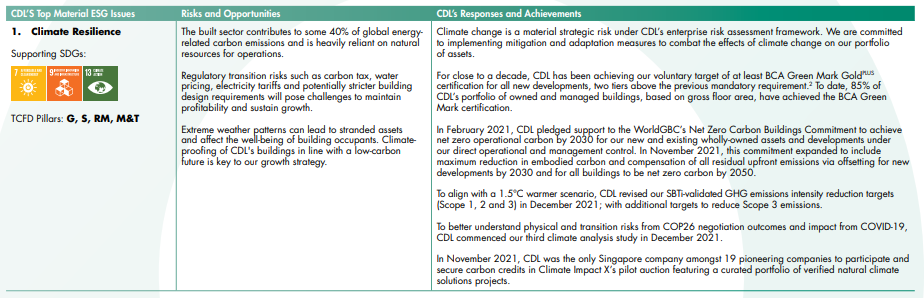

After the assessment, you find the top material ESG issues that CDL has identified, the risks and opportunities of it as well as its responses and its achievements.

In its 2022 sustainability report, CDL has identified its top 17 material ESG issues and one of them is shown below, as extracted from the report.

Source: City Development Limited [6]

Source: City Development Limited [6]

Component 3: Annual targets and performance

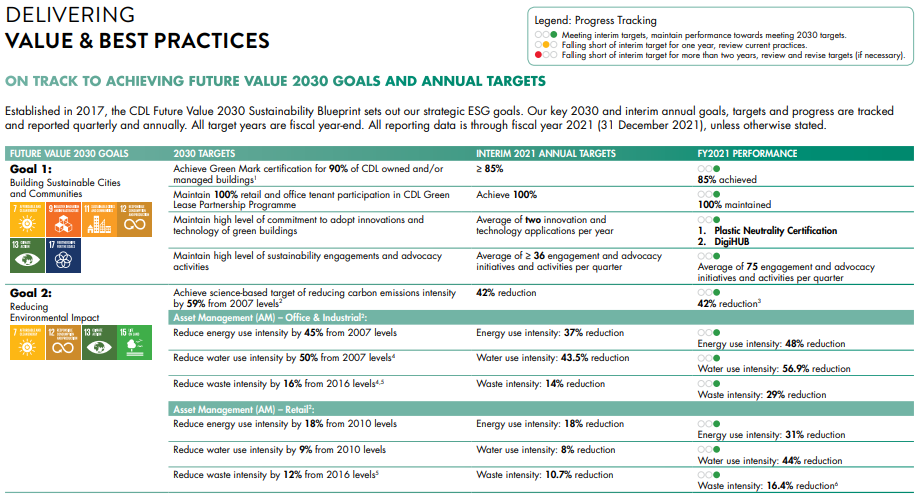

In 2017, CDL set out their strategic ESG goals in its “CDL Future Value 2030 Sustainability Blueprint” and in its 2022 sustainability report, we see that they included its key 2030 and interim annual goals, targets and progress which are tracked and reported quarterly and annually as shown below.

Source: City Development Limited [6]

Source: City Development Limited [6]

Just as a good tree bears good fruit, a company with a focus on sustainability reports and with their shareholders in mind will produce good works.

CDL has produced easy-to-understand infographics for both factors thus far.

This tells investors that the company knows what it is doing and how it is meeting its ESG targets.

Conclusion

After assessing these 3 factors, if you are confident that the screener has served you well and reinforced your understanding of the company’s sustainability report, you are ready to add these companies to your portfolio.

There are many ways to invest and to diversify, but ESG investing is the sensible strategy that is focused on addressing issues that have a material impact on investment value over longer term horizons. It is a strategy, that if well integrated, can influence change through the channeling of funds to where it matters – companies that are transitioning to a low-carbon, nature-positive and circular economy.

If you want more information on this, join our telegram channel, which aims to equip investors with the know-how. Share this telegram channel with your friends.

How to get started

POEMS’ award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges. Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us. Find out more here. T&Cs apply.

If you do not have a POEMS account, visit this link or scan the QR code below to open one.

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

For enquiries, please email us at cfd@phillip.com.sg. If you are interested in active discussions, you can also join our Telegram community here.

In consultation with Phillip Capital Management ESG.

Reference:

- [1]https://www.earthday.org/

- [2]https://www.mdpi.com/2071-1050/9/11/2112

- [3]https://www.sgx.com/regulation/sustainability-reporting

- [4]https://www.earthday.org/about-us/

- [5]https://www.earthday.org/earth-day-2022/

- [6]https://ir.cdl.com.sg/static-files/10dac0e1-206f-429b-a655-0d63dd39f23d

- [7]https://www.sgx.com/sustainable-finance/stock-ratings

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Jeremy Chua (Dealing) & Chua Minghan (Assistant Manager, Dealing)

Jeremy graduated from Nanyang Technological University with a Bachelor’s Degree in Business and is a member of the largest dealing team in Phillip Securities. He strongly believes in the importance of staying invested in the financial markets and evaluates stocks using fundamentals to make informed investment decisions.

In his free time, he enjoys researching on market events and disruptive investment themes to generate new investment ideas for the short and long term.

Chua Minghan graduated from the National University of Singapore with a Bachelor’s degree in Economics. He is passionate about education and went on to get a post-grad Diploma in teaching. His vision is to educate clients to make informed decisions for their trading and investments.

Minghan enjoys learning fundamental analysis, technical analysis, and strives to use data analysis to improve his trading skills.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile