Phillip Leveraged and Inverse (L&I) Products: Leading The Way to Equip Traders with Another Powerful Tool

Amplify or Hedge investment returns with the first Leveraged and Inverse Products on the local Exchange!

The Phillip MSCI Singapore Daily (2X) Leveraged Product and the Phillip MSCI Singapore Daily (-1X) Inverse Product provide investors with:

- Leveraged or Inverse exposure to the MSCI Singapore Index which represents approximately 85% of Singapore large & mid cap equities

- Daily reset of Leverage and Inverse Exposures

- No daily margin monitoring as it is managed by professional fund managers

- An effective tool for amplifying investment returns in a Bull Market or for hedging investment risks in a Bear Market

Key Information

| Listing Date: | 01 December 2021 |

| Minimum Quantity: | Minimum 1 Units |

| Instrument Type: | Exchange Traded Product (“ETP”) |

| Benchmark Index: | MSCI Singapore Index |

| Exchange Listing: | SGX-ST |

| EIP / SIP Classification | Specified Investment Product (SIP). Investors can trade SIP with a Customer Knowledge Assessment (CKA) |

| Trading Currency: | Singapore Dollars (S$); US Dollars (US$) |

| Dividend Distribution Frequency: | Leveraged Product: Yes, Annually Inverse Product: NO |

| Management Fee | Currently 0.90% p.a Max of 1.20% p.a |

| Manager: | Phillip Capital Management |

For more information about ETFs, please visit https://www.poems.com.sg/products/etf/

A Powerful Leveraging/Hedging Tool

Investors should understand that L&I Products are not designed to be traded where the market is moving sideways in volatile markets or to be held for more than one day without close monitoring and active management (please refer to the illustrations). Ideally, investors should use Phillip L&I Products to tactically increase leveraged exposure or to hedge their positions in the Singapore market; depending on what views they hold of the market.

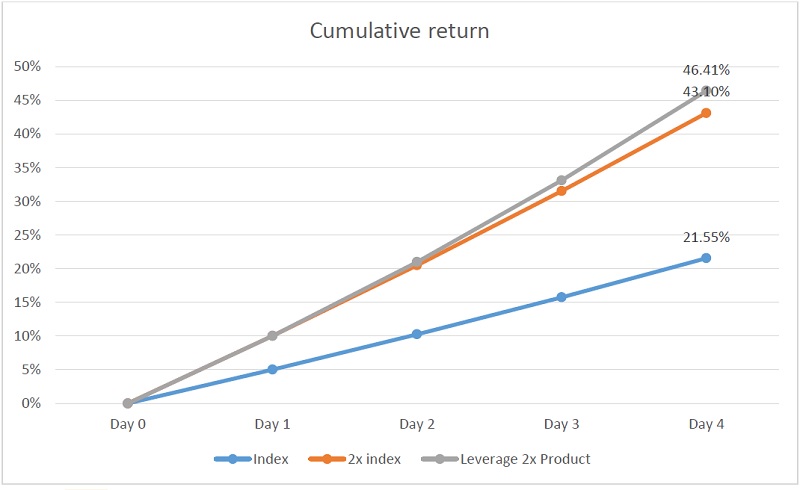

Example 1: Leveraging Returns

For instance, when an investor holds a bullish view on Singapore equities market, he can hold position in the Phillip MSCI Singapore Daily (2X) Leveraged Product in his Singapore portfolio to accelerate returns.

Example 2: Hedging Against Uncertainties

Conversely, when an investor holds a bearish view on Singapore equities market, he can hedge his investment in Singapore equities with Phillip MSCI Singapore Daily (-1X) Inverse Product to minimise the downside investment risk on his portfolio (because the Inverse Product delivers the opposite of the performance of the MSCI Singapore Index).

In both cases, the use of Phillip L&I Products would be more capital-efficient because it offers exposure at lower capital requirement compared to buying up all the underlying stocks themselves or using other financial derivatives.

L&I products typically are designed to achieve their stated exposure objectives on a daily basis. For holding period longer than 1 day, returns will be compounded.

In our case, the Phillip MSCI Singapore Daily (2X) Leveraged Product’s published leverage factor is 2 times and will apply to returns for the particular day only.

To illustrate the daily reset feature and its compounding effect, consider the following example in a bullish and upward-trending market:

| Index | Leveraged 2X Product | |

| Day 1 start | 100 | $10 |

| %change | 5% | 10% |

| Day 1 close | 105 | $11.00 |

| Day 2 start | 105 | $11.00 |

| %change | 5% | 10% |

| Day 2 close | 110.25 | $12.10 |

| Day 3 start | 110.25 | $12.10 |

| % change | 5% | 10% |

| Day 3 close | 115.76 | $13.31 |

| Day 4 start | 115.76 | $13.31 |

| % change | 5% | 10% |

| Day 4 close | 121.55 | $14.64 |

| Cumulative Return | Index | 2X of Index | Leveraged 2X Product |

| Day 0 | 0% | 0.0% | 0% |

| Day 1 | 5.00% | 10.00% | 10.00% |

| Day 2 | 10.25% | 20.50% | 21.00% |

| Day 3 | 15.76% | 31.52% | 33.10% |

| Day 4 | 21.55% | 43.10% | 46.41% |

Source: PCM; For illustration purpose only

From the illustration above, should an investor hold a position in a Leveraged (2X) product till day 4, he would have made a cumulative return of 46.41%, more than 2 times the performance of the underlying Index of 21.55%.

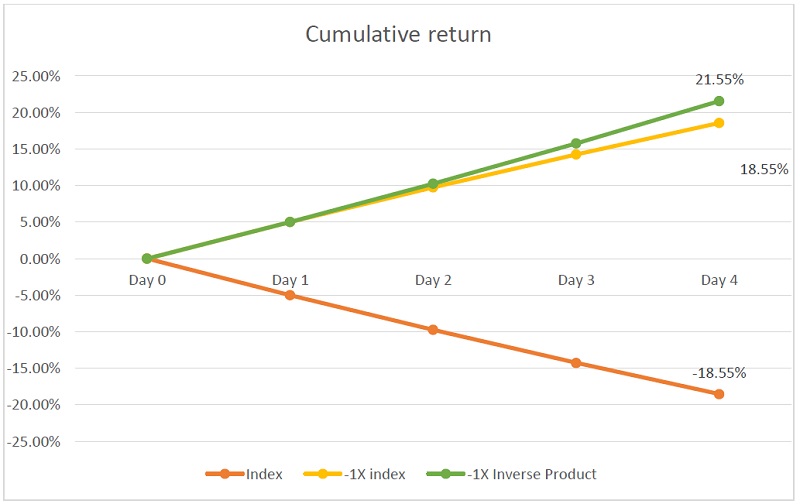

An inverse product conversely delivers the opposite of the daily performance of the underlying Index. That means investors can make money when the market or the underlying Index declines, but without having to sell anything short.

Nonetheless, the daily reset process and its compounding effect work in a similar way for holding periods longer than 1 day. Due to the daily reset feature at the end of each trading day, the performance of the underlying Index and Phillip MSCI Singapore Daily (-1X) Inverse Product will be also measured from the closing levels recorded on the previous trading day.

In other words, subsequent performance is calculated based on the performance achieved the day before. Thus, over a period of more than 1 day, returns are compounded. For illustrative purpose, consider the following example of a -1X Inverse Product in a downward-trending market:

| Index | -1X Inverse Product | |

| Day 1 start | 100 | $10 |

| %change | -5% | 5% |

| Day 1 close | 95 | $10.50 |

| Day 2 start | 95 | $10.50 |

| %change | -5% | 5% |

| Day 2 close | 90.25 | $11.03 |

| Day 3 start | 90.25 | $11.03 |

| % change | -5% | 5% |

| Day 3 close | 85.74 | $11.58 |

| Day 4 start | 85.74 | $11.58 |

| % change | -5% | 5% |

| Day 4 close | 81.45 | $12.16 |

| Cumulative return | Index | -1X of Index | -1X Inverse Product |

| Day 0 | 0.00% | 0.00% | 0.00% |

| Day 1 | -5.00% | 5.00% | 5.00% |

| Day 2 | -9.75% | 9.75% | 10.25% |

| Day 3 | -14.26% | 14.26% | 15.76% |

| Day 4 | -18.55% | 18.55% | 21.55% |

Source: PCM; For illustration purpose only

From the illustration above, should an investor hold a position in a -1X Inverse Product till day 4, he would have made a cumulative return of 21.55% while the cumulative return of the underlying Index is at negative 18.55% and the cumulative return of the underlying Index at an inverse factor of -1X is at positive 18.55%.

Although L&I Products can generate favourable returns in a one-directional market as illustrated above, returns may not be favourable in volatile market conditions. This is because, inherent to daily reset feature, basing subsequent performance to that achieved the day before also means that L&I Products progressively also compound prior gains or losses with the leveraged factor to derive the value of the closing position.

Illustration of Leveraged 2X Product in A Volatile but Flat Market

| Index | Leveraged 2X Product | |

| Day 1 start | 100 | $10 |

| %change | -2% | -4% |

| Day 1 close | 98 | $9.60 |

| Day 2 start | 98 | $9.60 |

| %change | 2% | 4% |

| Day 2 close | 99.96 | $9.98 |

| Day 3 start | 99.96 | $9.98 |

| % change | 1% | 2% |

| Day 3 close | 100.96 | $10.18 |

| Day 4 start | 100.96 | $10.18 |

| % change | -1% | -2% |

| Day 4 close | 99.95 | $9.98 |

| Cumulative return | Index | 2X of Index | Leveraged 2X Product |

| Day 0 | 0% | 0.0% | 0% |

| Day 1 | -2.00% | -4.00% | -4.00% |

| Day 2 | -0.04% | -0.08% | -0.20% |

| Day 3 | 0.96% | 1.92% | 1.80% |

| Day 4 | -0.05% | -0.10% | -0.20% |

Source: PCM; For illustration purpose only

In a volatile but flat market, the Index returned a flat performance of -0.05% by day 4 while the Leveraged 2X Product underperformed the 2X of the Index’s return, posting a performance of -0.20% in day 4.

Illustration of Inverse -1X Product in a Volatile Market

| Index | Inverse -1X Product | |

| Day 1 start | 100 | $10 |

| %change | 3% | -3% |

| Day 1 close | 103 | $9.70 |

| Day 2 start | 103 | $9.70 |

| %change | -3% | 3% |

| Day 2 close | 99.91 | $9.99 |

| Day 3 start | 99.91 | $9.99 |

| % change | -1% | 1% |

| Day 3 close | 98.91 | $10.09 |

| Day 4 start | 98.91 | $10.09 |

| % change | -2% | 2% |

| Day 4 close | 96.93 | $10.29 |

| Cumulative return | Index | -1X of Index | Inverse -1X Product |

| Day 0 | 0% | 0.0% | 0% |

| Day 1 | 3.0% | -3.00% | -3.0% |

| Day 2 | -0.09% | 0.09% | -0.1% |

| Day 3 | -1.09% | 1.09% | 0.9% |

| Day 4 | -3.07% | 3.07% | 2.9% |

Source: PCM; For illustration purpose only

In this case scenario, should an investor hold a position in an Inverse -1X Product till day 4, he would have underperformed the -1X of the Index’s return.

Disclaimer

This publication and the information herein is provided by Phillip Capital Management (S) Ltd (“PCM”), the Manager, for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in the Phillip MSCI Singapore Daily (2X) Leveraged Product (“Leveraged Product”) and the Phillip MSCI Singapore Daily (-1X) Inverse Product (“Inverse Product”) mentioned herein (the “L&I Products”) that are structured as listed collective investment schemes. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for important information of the Products and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the Products. A copy of the Prospectuses and PHSs of the Products are available from PCM or any of its Participating Dealers (“PDs”).

The Leveraged Product tracks the performance of a leveraged position of the MSCI Singapore Index (“Index”) on a daily basis whereas the Inverse Product tracks the performance of a short position of the Index on a daily basis. The Leveraged & Inverse (“L&I”) Products are only suitable for sophisticated trading-oriented investors who constantly monitor the performance of their holding on a daily basis, and are in a financial position to assume the risks from investing in futures. The L&I Products may not be suitable for all investors. The L&I Products are designed to be used as short-term trading tools for market timing or hedging purposes and are not appropriate for long term (longer than one day) investment. The performance of the L&I Products, when held overnight, may deviate from the leveraged performance or inverse performance of the Index due to the effect of “path dependency” and compounding of the daily returns of the Index.

The Inverse Product will completely use futures-based synthetic replication strategy to move in the opposite direction from daily performance of the Index. The Leveraged Product uses a combination of direct investments into the underlying securities of the Index, and invest in SGX MSCI Singapore Free Index Futures (“SiMSCI Futures”) as synthetic replication strategy for the purpose of optimizing returns and efficient portfolio management.

The 2X leverage exposure of the Leveraged Product and the -1X inverse exposure of the Inverse Product will be reset at the end of each trading day, thus the positive or negative returns will be compounded daily. When held more than one day, the cumulative performance of the Leveraged Product may deviate from 2X while the Inverse Product may deviate from -1X of the Index’s cumulative performance. When the value of the Index decrease, 2X leverage exposure will trigger an accelerated decrease in the net assets value (“NAV”) of the Leveraged Product as compared to the Index. Investing in the L&I Products may suffer substantial losses during periods of high volatility or you may still suffer a loss on your investment even if the value of the Index increases or is flat.

Investments are subject to investment risks. It is possible that entire value of your investment could be lost. In the extreme scenario where the Index falls 50% for the Leveraged Product or rises 100% for the Inverse Product in a given day, maximum loss for the L&I Products may exceed principal amount invested. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future performance. There can be no assurance that investment objectives will be achieved.

PCM does not intend to hedge any foreign currency exposure that the L&I Products may have and may engage in securities lending or repurchase transactions for the Leveraged Product.

Any regular dividend distributions, either out of income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the NAV of the Leveraged Product. Upon launch of the Leveraged Product, please refer to

MSCI had announced that foreign listings will become eligible for the MSCI Singapore Index. As Index constituents listed on foreign exchanges have different trading hours, this may lead to an increase in the tracking error and imperfect correlation between the value of the Index and the L&I Products’ performance.

Exchange-traded L&I Products are not like typical unit trusts as the units of the exchange-traded L&I Products (the “Units”) will be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectuses of the L&I Products for more details.

The L&I Products are classified as Specified Investment Products and Capital Markets Products Other Than Prescribed Capital Markets Products.

The information herein is not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The L&I Products are not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the L&I Products or related thereto. The L&I Products may invest in ETFs or unlisted funds managed by the Manager.

This publication has not been reviewed by the Monetary Authority of Singapore.

The L&I Products are not sponsored, endorsed, sold or promoted by MSCI, any of its affiliates, any of its information providers or any other third party involved in, or related to, compiling, computing or creating any MSCI Index (collectively, the “MSCI Parties”). The MSCI Indexes are the exclusive property of MSCI. MSCI and the MSCI Index names are service marks of MSCI or its affiliates and have been licensed or use for certain purposes by the L&I Products. None of the MSCI Parties makes any representation or warranty, express or implied, to anyone regarding the advisability of investing in funds generally or in the L&I Products particularly or the ability of any MSCI Index to track corresponding stock market performance. MSCI or its affiliates are the licensors of certain trademarks, service marks and trade names of the MSCI Indexes which are determined, composed and circulated by MSCI without regard to the L&I Products or the issuer or owners of the L&I Products or any other person or entity. None of the MSCI Parties has any obligation or liability to the issuer or owners of the L&I Products or any other person or entity in connection with the administration, marketing or offering of the L&I Products.