DAILY MORNING NOTE | 03 October 2022

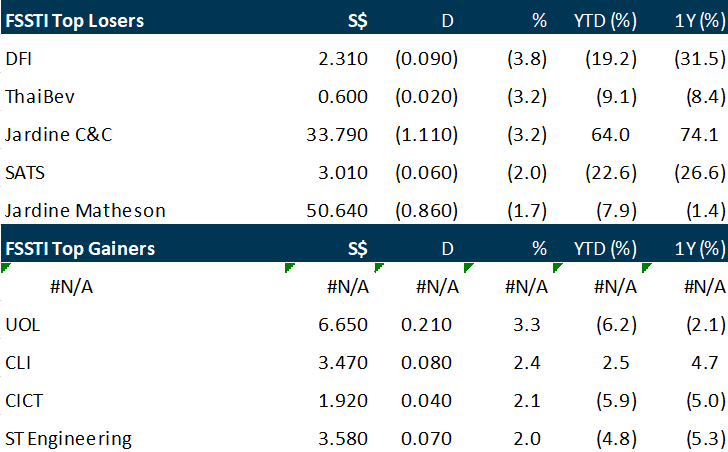

Singapore stocks broke a 5-day streak of declines to close up on Friday (Sep 30) amid a mixed showing among Asian markets. The Straits Times Index (STI) rose 0.5 per cent or 15.16 points to close at 3,130.24. Across the broader market, gainers narrowly beat losers 268 to 261 after 1.51 billion shares worth S$1.69 billion were traded. UOL was the biggest gainer, rising 3.3 per cent or S$0.21 to close at S$6.65. The trio of banks were also in the black. DBS gained 1.4 per cent or S$0.46 to close at S$33.39, while OCBC gained 1 per cent or S$0.12 to close at S$11.83 and UOB gained 0.1 per cent or S$0.03 to close at S$26.16. DFI Retail Group was at the bottom of the table, falling 3.8 per cent or US$0.09 to close at US$2.31.

Wall Street stocks ended decisively lower on Friday to conclude another difficult week defined by worries over inflation and the worsening Russia-Ukraine conflict. A closely-watched measure of US inflation released on Friday showed the annual pace of price increases slowed slightly in August compared with the prior month. However, the inflation rate still exceeded analyst expectations, a dynamic that will likely keep the Federal Reserve on its current path to hike interest rates aggressively. The yield on the 10-year US Treasury note, a proxy for interest rates, rose closer to 4 per cent. The broad-based S&P 500 finished at 3,585.62, down 1.5 per cent for the day and almost 3 per cent for the week. The Dow Jones Industrial Average shed 1.7 per cent to close at 28,725.51, while the tech-rich Nasdaq Composite Index dropped 1.5 per cent to 10,575.61.

SG

The manager of CapitaLand Ascendas Reit, formerly known as Ascendas Reit, has inked an agreement with a biotech company in California to convert a San Diego office property into a life sciences property at US$40 million. When completed in Q4 2023, the redeveloped 2-storey property – located in the Sorrento Mesa neighbourhood, a life sciences submarket in the US – will serve as Crinetics Pharmaceuticals’ new global headquarters. The 94,230 sq ft property will be outfitted with new mechanical, electrical and plumbing systems, roof, windows and interior improvements including laboratories, office and vivarium spaces, the manager of the real estate investment trust (Reit) said in a bourse filing on Friday (Sep 30). The energy-efficient building will have solar panels as well as extensive indoor and outdoor spalike amenities to improve employee well-being. It will be gold-certified under the US Green Building Council’s LEED (Leadership in Energy and Environmental Design) rating system. The conversion to a life sciences space will enable the trust to ascribe a higher base rent with an annual escalation of 3 per cent and a net property income yield pick-up of approximately 9 per cent when completed, the manager said. It added that the triple-net lease commitment of 11.5 years, with an option to extend 2 additional 5-year terms, by Crinetics Pharmaceuticals will provide the Reit with a stable income stream. William Tay, chief executive officer of the Reit’s manager, said this projection is expected to increase the proportion of the Reit’s life sciences properties to S$1.3 billion – or about 8 per cent of assets under management – on a pro forma basis. Units of CapitaLand Ascendas Reit ended Friday up 1.5 per cent at S$2.69.

ESR-LOGOS real estate investment trust will not redeem the outstanding securities of its S$150 million, 4.6 per cent perpetual securities, the trust’s manager said on Friday (Sep 30). Instead, the distribution rate would be reset on Nov 3, its first reset date, to a rate equivalent to the prevailing Swap Offer Rate (SOR), plus the initial rate of 2.6 per cent per annum. The 6-month SOR stood at 3.28 per cent as at Sep 23, going by figures from the Association of Banks in Singapore. This new distribution rate would be applicable for 5 calendar years from Nov 3. Given the current interest rate environment and capital market conditions, it is not in E-Log’s interest, from a cost perspective, to issue new perpetual securities to redeem the outstanding securities, the manager said. It added that although E-Log has “ample committed debt facilities” it can draw from to redeem these securities, doing that will increase leverage and reduce debt headroom available for acquisition opportunities, asset enhancement initiatives, and/or redevelopment opportunities during a market recovery. The perpetuals were issued in October 2017. Distributions are payable semi-annually in arrear on May 3 and Nov 3 of each year.

The global Reits sector was among the least performing sectors in the third quarter of 2022, amid a rising interest rates environment. For the quarter, Singapore’s Reits and Property Trusts (S-Reits) sector declined 7 per cent in total returns, slightly outperforming the 10 per cent decline of the broader FTSE EPRA Nareit Developed Index. Across the sub-sectors, industrial S-Reits saw the least declines, averaging -3 per cent total returns during the quarter, while office S-Reits saw the most declines, averaging -16 per cent total returns. In terms of net fund flows, the S-Reit sector saw S$360 million of net institutional outflows but received S$504 million of net retail inflows. There were five S-Reits that received net inflows from both institutional and retail investors. They are CapitaLand Ascendas Reit, Mapletree Pan Asia Commercial Trust, Mapletree Logistics Trust, Lendlease Global Commercial Reit and Digital Core Reit. CapitaLand Ascendas Reit (CLAR), which was recently renamed from Ascendas Reit, received net inflows of S$25 million and S$8 million from institutional and retail investors respectively. The Reit noted that while supply chain disruptions, inflation and rising interest rates could have some impact on tenants’ businesses as well as on CLAR’s operating costs, it is optimistic that structural trends such as expansion of logistics capacities by companies and digitalisation of the economy could drive demand for CLAR’s logistics and data centre segments.

US

Tesla Inc. vehicle deliveries rebounded strongly in the most recent quarter, though the record performance still leaves the company requiring a further increase in the final three months of 2022 to meet annual growth objectives. Tesla on Sunday said it had delivered 343,830 vehicles to customers in the three-month period ended in September, up from about 255,000 in the prior quarter that was dented by a temporary shutdown of its factory in China. Deliveries were up roughly 42% from last year’s third quarter, when Tesla handed over 241,000 vehicles. Tesla has been ramping up output to keep pace with surging demand and to recover from the idling of the Shanghai factory, its largest, because of local Covid-19 restrictions earlier this year. Tesla also had trouble getting its new factories in Germany and Texas up to speed. To keep pace with customer orders, Tesla has boosted production capacity across its plants in the U.S., Europe and China. The company produced 365,923 vehicles in the third quarter, up from about 238,000 in the year-earlier period. Tesla’s record deliveries are expected to help the company post its highest ever quarterly sales and a record profit of $3.34 billion when it reports third-quarter results, topping the $3.32 billion first quarter profit. Quarterly results are scheduled for Oct. 19, Tesla said.

Nike Inc.’s quarterly results highlight how some U.S. brands have too much inventory at home and in markets like China, where the companies have placed big financial bets.The sneaker giant on Thursday said revenue from China in the August quarter fell 16% to $1.65 billion, citing Covid-19 lockdowns in different cities hurting store traffic. The announcement came as the company posted weaker quarterly profit and soaring inventory levels, two developments that helped send its shares down about 13% Friday. In recent months, the company, which has operated in the country for 40 years, has been discounting merchandise and canceling orders from manufacturers to reduce its inventory. China accounted for about 13% of its sales and 29% of its earnings before interest and taxes in the August quarter. Frequent lockdowns across Chinese cities have companies guessing how long the disruptions will last and the impact they will have on sales. The lockdowns and a recent heat wave have disrupted companies’ production plans and slowed deliveries, affecting such goods as sneakers, cosmetics and apparel. In addition, elevated inflation, shifts in foreign investment and a downturn in the housing market have hurt China’s economic growth and weakened the yuan.

Disney has reached a deal with activist investor Dan Loeb’s Third Point, which includes adding former Meta executive Carolyn Everson to its board of directors, the companies said on Friday. The deal comes weeks after Third Point took a new stake in Disney representing about 0.4% of the company and urged the media company to spin out its sports property, ESPN. Third Point’s 6.35 million shares of Disney are worth about $600 million as of Friday’s closing. On Friday, Disney said in a public filing that, with Third Point’s support, it would add Everson to its board ahead of its board meeting in November. “We are pleased with our productive and ongoing dialogue with Bob and Disney’s management team,” Loeb said in the release on Friday. As part of the deal, Third Point agreed to customary standstill and other provisions, including that it wouldn’t take a stake in Disney that’s larger than 2% and that it wouldn’t solicit proxies or present proposals. Third Point, which also won’t get involved in board nominations, has agreed to the stipulations through Disney’s 2024 annual shareholder meeting, according to the filing. Disney shares were slightly up in after-hours trading.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

iX Biopharma Ltd – Journey taking longer but progressing

Analyst: Zane Aw

Recommendation: BUY (Maintained); TP: S$0.25

Last Done: S$0.131; Analyst: Paul Chew

• Annuity stream from milestone and royalty payments of Wafermine is on track, with out-licensing partner Seelos Therapeutics (SEEL US, Non-Rated) planning Phase 2 trials for Complex Regional Pain Syndrome (CRPS) in 2QFY23.

• iX Biopharma has expanded its pipeline of drugs by developing a sublingual wafer containing dexmedetomidine to treat multiple indications including Alzheimer’s disease-related agitation.

• Near-term developments include expanding markets for the distribution of cannabis to the United Kingdom and United States. We expect FY23e revenue from Xativa and nutraceuticals. We lowered our DCF target price to S$0.25 (prev. S$0.355) due to the delays in capacity expansion and drug trials, and have nudged up our WACC assumption. iX Biopharma is re-purposing active ingredients into higher efficacy drugs using its sublingual Waferix. Targeted treatments include acute pain, CRPS, acute agitation in dementia, male erectile dysfunction, vaccine delivery and medicinal cannabis.

Spotify Technologies S.A. – Leading global platform with pricing power

Recommendation : BUY (Initiation); TP: US$117.00, Last Close: US$86.30

Analyst: Jonathan Woo

• Revenue spiked >3x in last 5 years, with the company also adding 300mn users. Incremental conversion of Monthly Active Users (MAU) and increasing prices (ARPU) to drive revenue growth of 54% over the next 2 years.

• Recurring revenue business model, around 90% of revenue is recurrent from ~190mn premium subscribers growing at 30% p.a. over last 5 years, churn levels improving YoY.

• The faster growing advertising revenue from podcasts and audiobooks will be a boost to gross margins.

• Initiate coverage with a BUY recommendation and DCF-based target price (WACC 7.5%, g 3.0%) of US$117.00.

Upcoming Webinars

Guest Presentation by MeGroup Ltd [NEW]

Date: 5 October 2022

Time: 12pm – 1pm

Register: https://bit.ly/3RSOTXY

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Research Videos

Weekly Market Outlook: Adobe PropertyGuru TechnicalPulse FOMC SG Weekly Top Glove Emperador

Date: 26 September 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials