DAILY MORNING NOTE | 10 November 2025

Recent Podcasts:

Semiconductor 2Q25 Update

Shopify Inc. – Growth momentum to continue, but stock overvalued

Grab Holdings – Super-app strategy delivering scale efficiently

Week 46 equity strategy: All three banks reported 3Q25 earnings last week. Operating earnings (before provisions and tax) fell 5% YoY, dragged mainly by a 5% decline in net interest income, as falling interest rates squeezed margins. The bright spot was fee income with a growth of 18% YoY, led by wealth management jump of around 34% YoY. Low interest rates have supported robust inflows in net new money and a shift in customer deposits to investment products.

UOB results were dismal. Operating earnings declined 16% YoY, and headline profit plunged 72% YoY to S$443mn. The biggest talking point was the 176% YoY spike in provisions to S$1.9bn. But, why the sudden jump? We think the trigger was the disposal of several office assets (collateral) – in New York and Hong Kong – at roughly 10% below their internal valuations. Consequently, UOB had to recognise more non-performing loans (NPLs) in Greater China (~S$180mn) and the US (~S$100mn). NPLs were even forming in Thailand (~S$60mn) and Australia (~S$80mn). UOB bit the bullet and provided an extra S$615mn in general provisions. Singapore’s loan quality was stable. UOB said its provisions will stabilise from 4Q25 onwards.

OCBC delivered the best performance with net income stable YoY at S$1.97bn (DBS -2% YoY). The bank has done extremely well in wealth management. It attracted S$12bn in net new money, far exceeding the prior quarters’ 5bn and even DBS’s S$4bn. We get nervous when banks invest outside their core markets. The new growth area for all three banks is data centres in the US, Malaysia, Thailand and Australia.

We remain positive on DBS due to its certainty in dividends till 2026. OCBC could surprise on the upside. Their capital remains the highest at 15% with a target of 14%. UOB looks more interesting to us closer to S$30, where the dividend yield will be conservatively around 6%.

Paul Chew

Head Of Research

paulchewkl@phillip.com.sg

Singapore shares bucked the regional trend to end higher on Friday (Nov 7), on the back of gains by OCBC and Singtel. The local benchmark rose 0.2% or 7.25 points to close at 4,492.24.

The Nasdaq Composite closed lower Friday, pressured by more losses in artificial intelligence stocks, to post a losing week as new economic data added to investors’ fears of a slowdown. The tech-heavy index shed 0.21% to finish at 23,004.54. In contrast, the S&P 500 and the Dow Jones Industrial Average inched into the green. The broad-based index gained 0.13% to close at 6,728.80, while the 30-stock index added 74.80 points, or 0.16%, to settle at 46,987.10. At their lows of the day, the Nasdaq had pulled back 2.1%, while the S&P 500 and Dow had fallen 1.3% and more than 400 points, or roughly 0.9%, respectively.

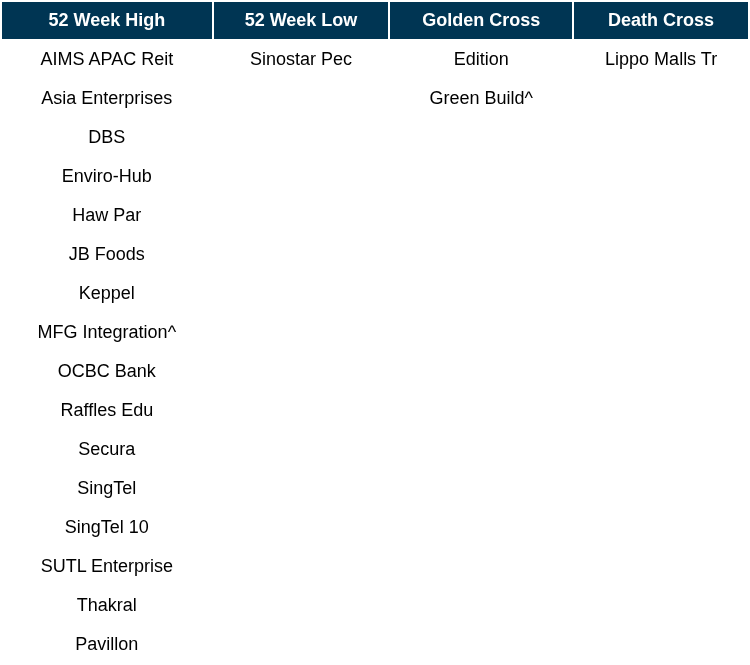

Singapore Technical Highlights

* ^ denotes companies placed on SGX Watch-list

* ^ denotes companies placed on SGX Watch-list

TOP 5 GAINERS & LOSERS

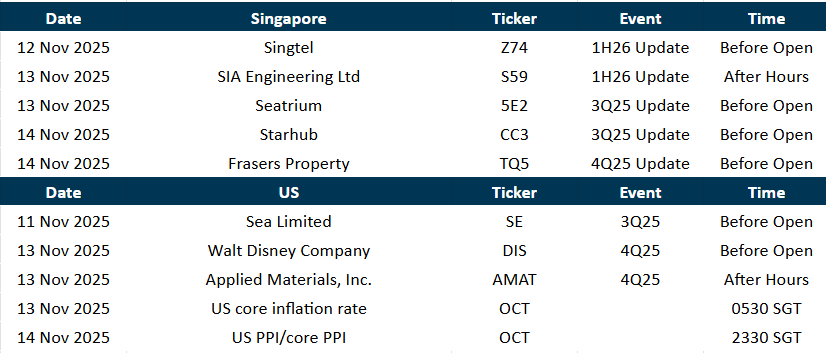

Events Of The Week

SG

Singtel has sold 0.8% of its direct stake in Indian telecommunications company Bharti Airtel for about S$1.5 billion. The local telco sold 51 million of its Airtel shares at 2,030 rupees a share, through its indirect wholly owned subsidiary Pastel. This is the second time this year that Singtel has reduced its stake in the Indian telecommunications company. In May, it sold about 1.2% of its direct stake in Bharti Airtel. It also sold portions of its stake in Airtel in 2022 and 2024, raising a total of around S$3.5 billion from the progressive sales.

Cybersecurity company AvePoint has posted a 396.8% increase in net profit to US$13 million for its third quarter ended Sep 30, from US$2.6 million in the corresponding period in the year before. This came on the back of a 23.6% rise in total revenue to US$109.7 million, driven by growth in its software as a service (SaaS) and services segments. AvePoint logged an EPS of US$0.06 for Q3, up from US$0.01 in the year-ago period, but falling short of the expected EPS of US$0.074 for the quarter.

The manager of Frasers Logistics & Commercial Trust on Friday (Nov 7) posted a distribution per unit (DPU) of S$0.0295 for the second half of FY2025 ended September. It was down 11.1% from S$0.0332 for the previous corresponding period. This was in line with capital DPU being steadily reduced to S$0.0026 in H2, and consistent with the real estate investment trust’s (Reit) approach to preserve debt headroom for growth while supporting near-term distribution stability.

Boustead announced that its engineering and construction business has won a design-and-build contract comprising additions and alterations works to reconfigure an existing semiconductor material manufacturing plant. The total value of new contracts secured since the start of FY2026, including this, is approximately S$193 million.

Luxury watch retailer Cortina posted a 10% rise in net profit to S$30.5 million for the six months ended Sep 30, up from S$27.8 million a year ago. This was partly driven by a 13% increase in revenue from the retailer’s South-east Asia market (excluding Singapore) to S$201.6 million, from S$178.2 million. In comparison, revenue from Singapore rose by 12% to S$191.1 million, from S$170.9 million.

UMS Integration on Friday (Nov 7) reported a 1% year-on-year rise in net profit to S$10.5 million for the third quarter ended Sep 30, on the back of an improved gross margin. The mainboard-listed group’s revenue dipped 9% to S$59.3 million, as sales in the semiconductor and aerospace segments fell by 8% and 16%, respectively. Earnings per share rose to S$0.0147 for Q3 FY2025, from S$0.0146 for the corresponding quarter a year earlier. UMS also announced that, because of its stronger performance for the first nine months of FY2025, the board has proposed a 1-for-4 bonus share issue and a third interim dividend of S$0.01 per share.

Sri Trang Gloves’ net loss for the third quarter ended September widened to 106 million baht (S$4.3 million) from 86.5 million baht for the corresponding period in 2024, as the allowance for impairment of buildings and machinery and losses on financial derivatives weighed on profitability. The steeper net loss came as its top line decreased 5.6% year on year to 6.1 billion baht, even as sales volume rose by 4.9% to more than 10 billion gloves. The average selling price, however, dropped 8.6% on the year due to intense competition in the industry and the appreciation of the baht against the US dollar by 7.2%.

Sri Trang Agro-Industry fell into the red with a net loss of 841.9 million baht (S$33.8 million) for the third quarter ended Sep 30, reversing from a net profit of 517.3 million baht for the corresponding period a year earlier. Revenue for Q3 fell 31.8% year on year to 21.6 billion baht, from 31.6 billion baht previously. Sri Trang Agro-Industry said this was due to lower average selling prices of its products and weighed down by prolonged uncertainty over US tariffs.

CapitaLand Investment Ltd is exploring options including carving out its assets in China as part of a potential merger with fellow Singaporean real estate asset manager Mapletree Investments Pte Ltd. About 35% of CapitaLand’s $136 billion (US$104 billion, or RM434.36 billion) real estate assets under management were in China as of the end of 2024, according to its annual report. Singapore state investor Temasek Holdings Pte Ltd owns 54% of Capitaland and 100% of Mapletree.

Singapore Post has posted net profit of $18.4 million for 1HFY2026 ended Sept 30, 17.1% lower y-o-y. The decline was largely due to contributions from the divested Australia business in the prior period, which offset the exceptional gains in 1HFY2026. The board has declared an interim dividend of 0.08 cents per ordinary share for the six months ended Sept 30. SingPost says its target dividend policy payout ranges from 30% to 50% of its underlying net profit.

US

Pfizer has agreed to buy the weight-loss drug startup Metsera in a deal that could be worth more than $10 billion, besting Novo

Nordisk following a heated bidding war. Under the terms of the cash deal, Pfizer will pay $65.60 a share upfront and a contingent value right worth up to $20.65 a share. In September, Pfizer had agreed to buy Metsera for up to $7.3 billion. But Novo Nordisk then took the unusual step of trying to outflank Pfizer, setting off a bidding war.

Airbnb logged another quarter of sales growth, as travelers felt more confident about making future vacation plans. Travel demand strengthened in the third quarter and continued to do so in October. Customers are booking travel further in advance, a contrast from earlier in the year when many were waiting to plan trips amid economic uncertainty. Revenue rose 10% to $4.1 billion. Analysts surveyed by FactSet forecast revenue of $4.08 billion. Gross booking value was $22.9 billion, ahead of the $21.9 billion expected.

Comcast’s Sky is in talks to buy the broadcasting arm of Britain’s ITV for $2.1 billion, including debt, in a move that would expand the U.S. media giant’s footprint in Europe. The proposed acquisition would expand Comcast’s European footprint and could face regulatory scrutiny due to its existing U.K. Presence.

Six Flags said it plans to invest in high-performing parks and could sell some less popular ones, steps that come as the amusement park company contends with declining revenues and activist pressure. The company on Friday reported a drop in third-quarter revenue, with attendance ticking up slightly but spending at parks declining.

Monster Beverage’s third-quarter sales increased 17% to $2.2 billion, surpassing analyst forecasts. Profit rose to $524.5 million, or 53 cents per share, compared to $370.9 million, or 38 cents per share, a year earlier. Increased demand for energy drinks, driven by diverse offerings and affordability, contributed to robust growth.

Wendy’s plans to close a midsingle-digit percentage of its approximately 6,000 U.S. restaurants through next year. Third-quarter revenue decreased by 3% to $549.5 million, and same-restaurant sales fell by 3.7%. Net income for the third quarter was $44.3 million, or 23 cents a share, down from $50.2 million last year.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, The Edge Singapore, PSR

RESEARCH REPORTS

CapitaLand Investment Limited – Increasing fundraising momentum

Recommendation: BUY; TP S$3.65; Last close: S$2.6800; Analyst Darren Chan

- 9M25 revenue came in at S$1.57bn (-25% YoY), slightly below expectations (70% of FY25e forecast). The decline was mainly due to CLAS deconsolidation. Excluding this, total revenue rose 2% YoY. Real Estate Investment Business (REIB) revenue fell 12% YoY (ex-CLAS) due to asset divestments, while the Fee Income-related Business (FRB) revenue grew 7% YoY, supported by higher event-driven fees from listed funds management and contributions from SC Capital Partners (SCCP).

- Fundraising momentum picked up with S$3.7bn in equity raised YTD (FY24: S$3.3bn), comprising S$2.1bn for private funds with continued interest in regional thematic and country-focused funds, and S$1.6bn for listed funds, including the successful listing of CapitaLand Commercial C-REIT (CLCR), which opened trading 20% above its IPO price.

- Maintain BUY with an unchanged SOTP-TP of S$3.65. Our FY25e estimates are unchanged. We continue to favour CLI for its robust, growing recurring fee income streams (54% of revenue) and asset-light strategy, which support resilience amid macro uncertainty. A lower interest rate environment is expected to improve fundraising momentum and transaction activity, driving FRB growth.

Oversea-Chinese Banking Corp Ltd – Earnings steady, future capital return unclear

Recommendation: NEUTRAL; TP S$17.00; Last close: S$17.7800; Analyst Glenn Thum

- 3Q25 earnings of S$1.98bn were slightly above our estimates as a surge in WM fees provided a boost to fee income. 9M25 PATMI was 77% of our FY25e forecast. OCBC has reiterated its S$2.5bn capital return which will end in FY25 (special dividend equivalent to 10% dividend payout ratio and ~S$1bn share buyback). It did not provide guidance if it will continue in FY26 and beyond.

- NII dipped 9% YoY as loan growth of 7% was offset by NIM declining 34bps YoY to 1.84%. Total non-interest income rose 15% YoY from a 53% surge in WM fees and a recovery in insurance income, while allowances declined and expenses inched up. OCBC has lowered its FY25e guidance for NIM to around 1.90% (prev. 1.90-1.95%) and for NII to decline by mid to high single digits, offset by lower credit costs of around 20bps (prev. 20 to 25bps), while maintaining guidance of mid-single digit loan growth.

- Maintain NEUTRAL with a higher target price of S$17.00 (prev. S$16.50) as we raise our FY25e earnings estimate by ~3% from higher fee income estimates. We assume a 1.29x FY25e P/BV and a 12.8% ROE estimate in our GGM valuation. We expect FY25e earnings to be flat YoY, as higher fee income will be offset by continued compression in NIM and a decline in NII. OCBC did not provide any guidance on the continuation of its capital return plan and is the only local bank with a capital return policy set to end in FY25. However, we believe OCBC can exceed the minimum dividend payout ratio and continue the special dividend (an additional 10% dividend payout ratio) for at least 2 more years (until FY27), as it still has the highest CET1 ratio among local banks (3Q25 fully phased-in CET1: 15%).

SG Bonds – Week 46 : SGS Curve Remains Stable

Recommendation: REDUCE; TP S$; Last close: S$; Analyst Phillip Research Team

- UST yields were volatile last week amid shifting supply and policy expectations.

- SGS yields were broadly stable over the week, with the 10-year closing at 1.84% (-1 bp WoW) and the 30-year at 1.98% (-3 bps WoW).

- Market direction remains dependent on upcoming U.S. inflation and labour data ahead of the December FOMC meeting.

Stoneweg Europe Stapled Trust– No refinancing requirements until 2030

Recommendation: BUY; TP S$1.86; Last close: S$1.5700; Analyst Darren Chan

- 3Q25/9M25 DI of €20.9mn/€57.6mn (+0.6%/-4.6% YoY) was in line with our estimates, representing 28%/76% of our FY25e forecast. The stronger 3Q25 performance was driven by higher rents, contributions from completed redevelopments, and a one-off income of €2mn comprising service charge reconciliation and other items, partially offset by higher interest expenses. Excluding divestments and redevelopments, 3Q25 NPI increased 5.9% YoY, supported by a 6.5% increase in NPI in the logistics/light industrial sector.

- Portfolio occupancy rose 110bps QoQ to 93.5%, driven by an 80bps increase in the logistics/light industrial sector to 95.2% and a 200bps rise in the office portfolio to 88.2%, attributed to higher occupancy in the Netherlands and the divestment of an underperforming asset in Poland. Following the issuance of a 7.3-year €300mn green bond at a reoffer yield of 4.203% in October 2025, SERT has no refinancing requirements until 2030.

- Maintain BUY with an unchanged DDM-derived TP of €1.86. Our forecasts remain unchanged. SERT’s portfolio is c.8% under-rented, providing scope for further positive rent reversions. The data centre exposure through AiOnX also offers long-term NAV upside potential. SERT continues to deliver an attractive 8.7% dividend yield on 103 properties (93% freehold) and trades at a compelling 0.77x P/NAV. Additionally, 3.75mn units have been bought back YTD, which should positively impact DPU.

Airbnb Inc – Average daily rates growth accelerates

Recommendation: NEUTRAL; TP US$127.00; Last close: US$; Analyst Alif Fahmi

- 9M24 revenue and PATMI met our expectations at 79%/83% of our FY25e forecasts. In 3Q25, revenue rose 10% YoY to US$3.7bn, mainly driven by a 5% YoY acceleration in average daily rates (ADR) across all regions.

- For 4Q25e, Airbnb expects revenue to rise 9% YoY to US$2.69bn, supported by a modest ADR increase and single-digit growth in booking volumes.

- We maintain our NEUTRAL recommendation with an unchanged target price of US$127.00. Our FY25e revenue estimates remain unchanged. Expansion markets growth remains small to offset the group revenue deceleration. Airbnb is pursuing organic growth beyond its core short-term rental business, with Airbnb Services revenue contribution expected to remain immaterial until at least FY26e.

Grab Holdings- Product-led strategy gaining momentum

Recommendation: BUY; TP US$7.00; Last close: US$; Analyst Helena Wang

- Both 3Q25 revenue and PATMI met our estimates. 9M25 revenue/PATMI were at 72%/60% of our FY25e forecasts. We expect PATMI to be backloaded in 4Q25 as the company turns more profitable.

- Revenue growth remains strong, +22% YoY to US$873mn in 3Q25. Growth was propelled by strong performances in both On-Demand services (+20% YoY) and Financial Services arm (+41% YoY).

- We increase our FY25e/FY26e revenue and PATMI by 1%/1% and 2%/3% to account for higher growth prospects and expanding margin for both on-demand and financial services. We decrease our beta to 0.98 as Grab turns profitable and business volatility has come down. We maintain our BUY recommendation and increase our DCF target price to US$7.00 (prev.US$5.80), with a WACC of 7.4% and terminal growth rate of 3.5% Grab’s product-led strategy is helping it drive share gains in both mobility and delivery.

DBS Group Holdings Ltd – Capital return dividends until FY27

Recommendation: ACCUMULATE; TP S$58.00; Last close: S$54.9800; Analyst Glenn Thum

- DBS’ 3Q25 earnings of S$3bn were slightly above our estimates, with 9M25 earnings at 77% of our FY25e forecast. 3Q25 DPS raised 39% YoY to 75 cents (comprising 60 cents ordinary dividend and 15 cents capital return dividend).

- NII dipped 1% YoY despite loan and deposit growth as NIMs fell 15bps YoY to 1.96%. A surge in WM fees led fee income growth of 22%. DBS will continue its capital return plan until FY27, paying out a total of S$5bn in dividends over three years (60 cents/share until FY27). Management provided FY26e guidance for NII to be slightly below 2025 levels, non-interest income growth in the high single digits, credit costs to normalize at 17-20bps, and PATMI below 2025 levels from the lower interest rate environment.

- Maintain ACCUMULATE with a higher target price of S$58.00 (prev. S$52.00) as we raise the terminal growth rate to 3.2% (from 2%) and increase our FY25e earnings estimate by 3% from lower provisions estimates. We assume a 2.34x FY25e P/BV and a 17% ROE estimate in our GGM valuation. We expect non-interest income to be the main growth driver, as heightened volatility will benefit trading income, and continued WM growth will stem from the shift in investor sentiment and AUM inflows. However, higher provisions and the global minimum tax would hurt PATMI in FY25. We prefer DBS among the Singapore banks given its continued capital return plans (until FY27) and its fixed dividend per share policy, which offer greater visibility and stability compared to its peers, which follow a floating payout ratio tied to earnings performance.

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Corporate Insights by Prime US REIT [NEW]

Date & Time: 12 November 25 | 12.30PM-1.30PM

Register: poems-20251112-132944

Corporate Insights by Wee Hur Holdings [NEW]

Date & Time: 10 December 25 | 12PM-1PM

Register: poems-20251210-133186

Corporate Insights by Marco Polo Marine [NEW]

Date & Time: 11 December 25 | 12PM-1PM

Register: poems-20251211-133188

Research Videos

Weekly Market Outlook: Tesla, META, Alphabet, AMZN, SSG, Keppel Ltd, Tech Analysis, SG Weekly & More

Date: 3 Nov 2025Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials