DAILY MORNING NOTE | 18 November 2022

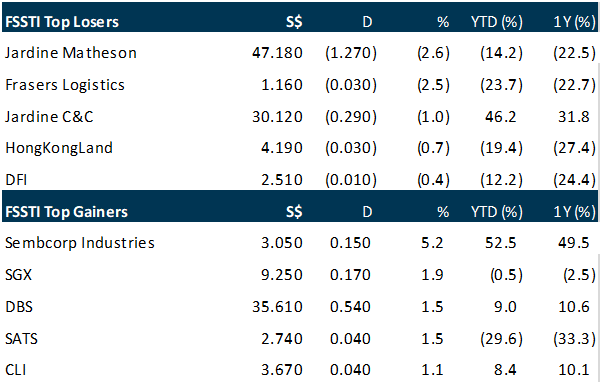

Singapore stocks rose despite other regional markets falling into the red on Thursday (Nov 17), with the Straits Times Index (STI) climbing 0.6 per cent or 19.87 points to 3,286.04. Across the broader market, gainers beat losers 274 to 273 after 1.4 billion securities worth S$1.3 billion changed hands. On the STI, Sembcorp Industries was the best performer. The counter gained 5.2 per cent or S$0.15 to close at S$3.05. Meanwhile, Jardine Matheson Holdings was at the bottom of the table, shedding 2.6 per cent, or US$1.27 to close at US$47.18. The trio of banks were also in the black. DBS gained 1.5 per cent or S$0.54 to close at S$35.61, while UOB gained 1.1 per cent or S$0.32 to close at S$30.16 and OCBC gained 0.4 per cent or S$0.05 to close at S$12.47.

US stocks slipped for a second consecutive day, ending mostly lower on concerns the Federal Reserve could trigger a US recession, as more central bankers said interest rates have to rise further to contain inflation. The Dow Jones Industrial Average was essentially flat, closing at 33,546.32, but the broad-based S&P 500 slipped 0.3 per cent to 3,946.56, while the tech-rich Nasdaq Composite Index fell 0.4 per cent to finish at 11,144.96. Investors also were digesting mixed quarterly results, with Cisco Systems shares jumping around five per cent after earnings exceeded expectations, but others like chip company Nvidia struggling amid ongoing issues facing the semiconductor industry. Meanwhile, St Louis Fed president James Bullard was the latest in a string of central bankers saying more rate hikes will be needed because the benchmark lending rate is not yet “sufficiently restrictive”. The Fed has moved aggressively to douse red-hot inflation, raising the benchmark lending rate six times this year to cool demand. Kansas City Fed president Esther George on Wednesday (Nov 16) cautioned that it is unclear how policymakers can tamp down inflation “without having some real slowing, and maybe we even have contraction in the economy”.

SG

Sembcorp Industries is buying a stake in a renewable energy company in China. This will enable the Singapore-listed energy and urban solutions provider to enter into a partnership with the world’s largest renewables player. Sembcorp announced on Thursday (Nov 17) that wholly-owned subsidiary Sembcorp Energy (Shanghai) is acquiring a 45.3 per cent interest in Hunan Xingling New Energy for 1.1 billion yuan (S$204 million) from Wuling Power. Wuling Power is an affiliated company of Chinese state-owned enterprise State Power Investment Corporation (SPIC). The transaction will result in Xingling New Energy becoming a joint venture between Sembcorp and Wuling Power, with the SPIC affiliate holding the remaining 54.7 per cent stake in Xingling New Energy. “SPIC is the largest renewables player in the world with over 80 gigawatts of installed capacity. Sembcorp is privileged to partner them,” said Wong Kim Yin, Sembcorp Industries’ group president and chief executive officer. The acquisition will push Sembcorp’s gross renewables capacity globally to 9.4 GW – one step closer to its target of reaching 10 GW of gross installed renewables capacity by 2025. Sembcorp said the transaction, which is expected to be completed in the first half of 2023, will be funded through a mix of internal cash resources and external borrowings. It added that, upon completion, the acquisition is expected to be accretive to earnings. Shares of Sembcorp closed 5.2 per cent or S$0.15 higher at S$3.05 on Thursday, before the announcement.

CSE Global reported 22.0% higher revenue y-o-y of $141.1 million for 3QFY2022 ended September. This was attributed to growth in project, time and material revenues across all geographic regions. Higher revenues in the Asia Pacific region were mainly attributable to higher mining and minerals and infrastructure project revenue in Australia. Also, higher revenues from the Americas were driven by both the energy and infrastructure sectors, says the company in a Nov 17 press release. Revenue improved across all three business sectors in 3QFY2022. Revenue in the Energy segment increased by 7.1% y-o-y to $72.4 million in 3QFY2022, mainly attributed to more project and time and material revenues recognised in the Americas. Infrastructure revenue improved by 44.8% y-o-y from $37.0 million in 3QFY2021 to $53.6 million in 3QFY2022, mainly driven by higher revenue contributions across all key geographies in Australia, Singapore, United Kingdom and USA. Mining & Minerals revenue increased by 37.7% y-o-y, as projects are progressing as compared to delays in project execution in 3QFY2021. About 52.6%, or $86.8 million, of new orders were secured by the Group’s Energy sector in 3QFY2022, as compared to $73.8 million in 3QFY2021, representing a 17.7% increase. This was mainly due to higher field services orders in the Americas. In 3QFY2022, new orders for the Group’s Infrastructure sector rose by 53.2% y-o-y to $55.1 million. This was due to several wastewater and industrial project orders secured in the Americas region arising from increased infrastructure spending. The Mining & Minerals Sector clinched S$23.0 million worth of new orders in 3QFY2022, compared to $10.6 million in 3QFY2021, mainly a result of a steady pipeline of orders for radio communication network projects from mining customers in Australia. With these new orders, the Group closed 3QFY2022 with an order book of $412.8 million. CSE Global announced a $33.4 million rights issue in October. In a Singapore Exchange filing on Oct 10, the company says it intends to issue over 102.4 million new ordinary shares at 33 cents per share. Shares of CSE Global then closed 12.04% down on Oct 11. Shares in CSE Global closed 1 cent higher, or 2.9% up, at 35.5 cents on Nov 17.

Legend Logistics is exploring an initial public offering (IPO) in Singapore to raise as much as S$200 million, according to people with knowledge of the matter, in what would be the largest IPO in the city-state in nearly a year. The logistics firm is working with financial advisers on the potential first-time share sale, said the people. A listing could take place as soon as 2023, said the people, who asked not to be identified as the process is private. Deliberations are ongoing and the size and timing of the IPO could still change, the people said. Representatives for Legend Logistics did not immediately respond to calls or emails requesting comment. The offering would boost the first-time share sale market in Singapore, which has hosted only US$348 million worth of IPOs this year, down 15 per cent from the same period a year earlier, according to data compiled by Bloomberg. At US$146 million (S$201 million), Legend’s offering would be the biggest in the city-state since Digital Core Reit Management raised US$647 million in an IPO in November 2021. Founded in 2012, Legend is a one-stop logistics provider for heavy haulage, bulk liquid, dry commodities, perishable products and oversized cargos, according to its website. The Singapore-headquartered company operates in 10 countries and has regional offices in Asia, Oceania and Europe.

US

The US dollar rose on Thursday (Nov 17) as investors digested mixed US economic data, while the British pound fell as the UK government unveiled its latest budget update. The greenback has tumbled in recent weeks as inflation data and comments from Federal Reserve (Fed) officials have suggested that the central bank can soon slow the pace of its punishing interest rate hikes. Yet the US dollar climbed on Thursday after US retail sales data for October, released on Wednesday, came in stronger than expected. The euro was down 0.63 per cent against the US dollar at US$1.033 at 1340 GMT, after hitting its highest level since July at US$1.048 on Tuesday. The US dollar index, which measures the currency against six major peers, rose 0.66 per cent to 106.98. The index has fallen more than 6 per cent since hitting a 20-year high in September, although it remained 11 per cent higher for the year on Thursday. St Louis Fed president James Bullard said on Thursday that even under a “generous” analysis of monetary policy the central bank needs to continue raising interest rates probably by at least another full percentage point. The Fed has already hiked interest rates from next to zero in March to a range of 3.75 per cent to 4 per cent. Bullard’s comments came after San Francisco Fed president Mary Daly – until recently one of the most dovish officials – added to doubts about a change of direction from the Fed by saying a pause was off the table on Wednesday. The greenback rose 0.49 per cent against the Japanese yen on Thursday to 140.28 after falling earlier in the session. It plunged 3.7 per cent on Thursday last week when US consumer inflation data for October came in lower than expected.

US upscale department store chain Macy’s Inc raised its annual profit forecast on Thursday (Nov 17) on resilient demand for high-end suits, gowns and beauty products as wealthier shoppers were undeterred by inflation. Luxury goods sales have held up relatively well for Macy’s as higher-income shoppers, eager to get back to social events after the pandemic, splurge their savings on pricier handbags, perfumes and clothing. Rival Kohl’s Corp, however, withdrew its 2022 sales and profit forecasts, as the company, which caters to more lower-income customers and stocks fewer luxury goods, took a hit from weakening demand due to rising prices. Shares of Macy’s rose 8 per cent in pre-market trading, while Kohl’s shares fell 4 per cent, with the company also blaming the sudden departure of top boss Michelle Gass as a reason for pulling the forecasts. Macy’s inventory levels were just 4 per cent higher, thanks to heavy discounts to clear the excess stocks of cheaper, casual and athleisure apparel. In contrast, Kohl’s inventories were 34 per cent higher in the third quarter. Macy’s said it expects fiscal 2022 adjusted profit of US$4.07 to US$4.27 per share, compared with its previous forecast of US$4 to US$4.20. Excluding items, it earned 52 US cents per share in the quarter ended Oct 29, beating estimates of 19 US cents, according to Refinitiv data.

Hasbro, which has been weighing options for its Entertainment One (EOne) media division, has decided to put most of the business up for sale. The maker of GI Joe action figures and Transformers toys has appointed JPMorgan Chase and Centerview Partners to steer the process after receiving takeover interest from potential bidders, according to a statement on Thursday (Nov 17). The assets Hasbro is selling generated sales of close to US$1 billion last year, or about 16 per cent of the company’s total, Bloomberg reported earlier, citing people familiar with the matter. They include virtually all of the EOne businesses geared to adults, including film and TV production and a library of about 6,500 titles. Those include Naked and Afraid and a distribution arm for popular shows such as The Walking Dead. Hasbro said it intends to retain EOne assets that it considers crucial to its ambitions in entertainment, including the Peppa Pig children’s brand. Hasbro will also retain a team of EOne employees to work on animation, short digital films, as well as feature-length movies and TV series. Shares of Hasbro fell less than 1 per cent to US$55.70 at 9.32 am in New York. In August, Bloomberg reported that Hasbro was considering a sale or restructuring of EOne, which it acquired for about US$4 billion in 2019. The entire business generated US$1.15 billion in sales last year. Chief executive officer Chris Cocks said at an investor event in October that the company will roughly triple its spending on media content based on its brands over the next three years. Thoroughbreds in Hasbro’s stable include the Dungeons & Dragons board games, which the company has adapted into Dungeons & Dragons: Honor Among Thieves, a film that will be released in March. Last year, the company sold EOne’s music business to private equity firm Blackstone for US$385 million.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Q & M Dental Group Ltd – Expansion cost starts to bite

Recommendation: BUY (Maintained); TP S$0.52 Last close: S$0.345; Analyst Paul Chew

• 3Q22 earnings were below expectations. YTD22 revenue and PATMI were 77%/61% of our FY22e forecast. Employee expenses were higher than expected due to Acumen losses, software development expenses and higher opex from new clinics.

• Sharp 62% drop in earnings due to the absence of COVID-19 test revenue from Acumen. Acumen swung from PAT of S$4.4mn to an estimated S$0.1mn loss.

• We cut our FY22e PATMI by 30% to S$22mn. Expenses are running higher than expected. We expect employee expense to revenue to trend downwards as new clinics start to ramp up visitations. Our target price is lowered to S$0.52 (prev. S$0.60). We value core dental operations at 25x PE FY22 earnings, in line with industry peers. Listed associate, Aoxin Q & M Dental (S$0.169, Not Rated), is valued at market price with a 20% discount.

Upcoming Webinars

Guest Presentation by NIO [NEW]

Date: 23 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3hLLptJ

Guest Presentation by KTMG Limited [NEW]

Date: 24 November 2022

Time: 1pm – 2pm

Register: https://bit.ly/3TGIgbC

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc [NEW]

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Guest Presentation by Sabana Industrial REIT [NEW]

Date: 8 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UIuyXl

Guest Presentation by iWoW Technology [NEW]

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: PayPal, CLI, SATS, PropNex, Singtel, Starhub, Technical Analysis & More…

Date: 14 November 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials