DAILY MORNING NOTE | 2 February 2023

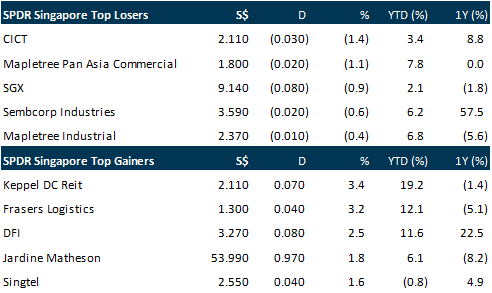

Singapore shares closed higher on Wednesday (Feb 1), tracking overnight gains on Wall Street as investors anticipated that the Federal Reserve would ease its rate-hike path. Gainers outnumbered losers 331 to 182 on the local bourse, after 1.3 billion securities worth S$1.1 billion changed hands. The Straits Times Index (STI) rose 0.4 per cent or 11.98 points to close at 3,377.65. Indices in the region largely ended Wednesday higher. The Nikkei 225 Index was up 0.1 per cent, the Hang Seng Index rose 1 per cent, and the Kospi Composite Index climbed 1 per cent. The FTSE Bursa Malaysia Index bucked the trend, slipping 0.9 per cent. In Singapore, the top gainer on the STI was Keppel DC Reit, which gained 3.4 per cent to close at S$2.11. The real estate investment trust (Reit) on Tuesday posted a 4.8 per cent year-on-year increase in distribution per unit (DPU) to S$0.05165 for the half-year ended Dec 31, 2022. The index’s biggest loser was CapitaLand Integrated Commercial Trust (CICT), which lost 1.4 per cent to end at S$2.11. Earlier on Wednesday, CICT posted a DPU of S$0.0536 for the second half of last year, up 2.7 per cent year on year.

The S&P 500 and Nasdaq rallied on Wednesday after the Federal Reserve enacted a smaller interest rate hike, pointing to progress in its fight against inflation. All three major indices finished higher, led by the tech-rich Nasdaq Composite Index, which jumped 2.0 per cent to 11,816.32. The Dow Jones Industrial Average rose less than 0.1 per cent to 34,092.96, while the broad-based S&P 500 advanced 1.1 per cent to 4,119.21. The US central bank announced a quarter-point hike to the benchmark lending rate, taking the rate to a target range of 4.50-4.75 per cent and opting for a more traditional hike after a series of larger increases. Fed Chair Jerome Powell said the central bank will need “substantially more evidence” to be confident that inflation is on a sustained downward path as the central bank signaled more hikes would be needed.

SG

Member of Parliament Tin Pei Ling has joined ride-hailing and technology giant Grab as its Singapore director of public affairs and policy. Tin, who is the MP for MacPherson, joined the Nasdaq-listed company in January, Grab confirmed on Wednesday (Feb 1). Her appointment was made public after the 39-year-old made an appearance that day at a Chinese New Year lunch that was hosted by Grab for about 750 private-hire drivers at a restaurant at Singapore Expo. Tin was at the event alongside Grab Singapore’s managing director Yee Wee Tang and Senior Minister of State for Transport Amy Khor, who was the guest of honour. Grab said in a statement: “Pei Ling has deep on-ground understanding of digital economy and Smart Nation policy, and close ties with the local community. She will build partnerships and programmes to harness the positive potential of technology to create impact in Singapore.”

Ride-hailing operator Grab has been finding ways to recruit more drivers and improve productivity in Singapore as it attempts to ramp up a supply that is only at 70 to 80 per cent of pre-pandemic days. A wave of drivers across South-east Asia left the ride-hailing industry from 2020 onwards, after Covid-19 restrictions caused a sharp drop in ridership and earnings. While ridership in Singapore across all platforms has returned to 80 per cent of pre-pandemic levels, higher than 74 per cent in 2021, the supply of drivers has not been able to meet demand. To increase driver productivity, Grab has been experimenting with a new feature that navigates drivers to high demand areas, and matches them with passengers more efficiently.

Singapore and the European Union (EU) have signed a digital partnership that will strengthen connectivity and interoperability between both digital markets, enabling people and businesses to transact digitally more seamlessly and at lower costs. The EU-Singapore Digital Partnership (EUSDP) was signed by Singapore’s Minister-in-charge of Trade Relations S Iswaran and European Commissioner for Internal Market Thierry Breton in Brussels on Wednesday (Feb 1). The EUSDP will serve as an overarching framework for all areas of bilateral digital cooperation between the EU and Singapore. These include areas in the cross-border digital economy such as digital trade facilitation, trusted data flows, electronic payments, as well as standards and conformance. It will also pave the way for cooperation in new and emerging areas such as artificial intelligence (AI), digital identities, and 5G/6G. On top of that, the partnership will support the digital upskilling of workers, as well as the digital transformation of businesses and public services.

Oxley Holdings reported on Wednesday (Feb 1) a sharp decline in net profit for its first half on the back of lower revenue and higher finance costs. Net profit for the six-month period ended Dec 31, 2022 fell to S$277,000 from S$23.5 million in the corresponding period a year ago. The group said in the bourse filing that the lower profits were due to “lower revenue streams coupled with higher finance costs resulting from rising interest rates and lower mark-to-market fair-value gain on derivative financial instruments”. Revenue fell 13 per cent on year in the first half of FY23 to S$438.4 million, mainly due to the absence of a one-time sale of land parcels in Australia of S$97.1 million in H1 FY22. This was partially offset by higher revenue contribution from Singapore development projects and hotels in H1 FY23.

Frasers Logistics & Commercial Trust recorded over 239,500 square metres (sq m) of leasing across its portfolio for its first quarter ended Dec 31, 2022, the real estate investment trust’s (Reit) manager said in a Wednesday (Feb 1) business update. The Reit maintained a 100 per cent occupancy for its logistics and industrial (L&I) portfolio, while its commercial portfolio recorded an 89.8 per cent occupancy rate. Overall occupancy came in at 95.9 per cent. Aggregate leverage stood at 27.9 per cent as at end-December, up 0.5 percentage points from end-September; meanwhile, its cost of borrowings stood at 1.7 per cent for the quarter, up 0.1 percentage points from end-September. The Reit has an average weighted debt maturity of 2.7 years, with total gross borrowings at close to S$2 billion as at end-December.

US

The Federal Reserve raised its target interest rate by a quarter of a percentage point on Wednesday, yet continued to promise “ongoing increases” in borrowing costs as part of its still unresolved battle against inflation. “Inflation has eased somewhat but remains elevated,” the US central bank said in a statement that marked an explicit acknowledgement of the progress made in lowering the pace of price increases from the 40-year highs hit last year. Russia’s war in Ukraine, for example, was still seen as adding to “elevated global uncertainty,” the Fed said. But policymakers dropped the language of earlier statements citing the war as well as the Covid-19 pandemic as direct contributors to rising prices and omitted mention of the global health crisis for the first time since March 2020. Still, the Fed said the US economy was enjoying “modest growth” and “robust” job gains, with policymakers still “highly attentive to inflation risks.” “The (Federal Open Market) Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 per cent over time,” the Fed said. Fed Chair Jerome Powell wasted little time emphasising that recent progress on inflation – while “gratifying” – is still insufficient to signal an end to the rate hikes.

Meta Platforms reported better-than-expected sales during the holiday quarter, fuelled by strong demand for advertising as it attracted more users to its Facebook social network. Revenue for the fourth quarter was US$32.2 billion. That compared with Wall Street estimates of US$31.6 billion. Shares jumped more than 18 per cent in extended trading. Chief executive officer Mark Zuckerberg said Meta is making progress with its investments in artificial intelligence, particularly for improving the videos it shows users on Facebook and Instagram. “Beyond this, our management theme for 2023 is the ‘Year of Efficiency’ and we’re focused on becoming a stronger and more nimble organisation,” he said in a statement on Wednesday (Feb 1). The company is recovering from the worst year for its stock in history. Meta faced a decline in advertiser demand due to weakness in the broader economy, amid inflation and an ongoing war in Europe, as well as a change in iPhone privacy rules. Meta cut 11,000 jobs, or 13 per cent of the workforce, in November in its first-ever major layoff. Those cuts came during a quarter that was otherwise positive for the company. Facebook, Meta’s flagship social network, is still growing and now has more than 2 billion daily users, up more than 70 million from a year ago.

Morgan Stanley’s private equity arm that focuses on middle-market companies said on Wednesday (Feb 1) it had acquired environmental services and consulting firm Apex Companies. Morgan Stanley Capital Partners said the current owner of Apex, Sentinel Capital Partners, will retain a minority stake in the company after the deal closes. Rockville, Maryland-based Apex offers water infrastructure and environmental, social and governance (ESG) consulting and other services. Wall Street has sharpened its focus on ESG segment following investor pressure to cut financing to sectors that contribute to fossil-fuel use.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Keppel Corporation – SMM announce EGM on 16 Feb 2023

Recommendation: BUY (Maintained), Last Done: S$7.64, Target price: S$8.95

Analyst: Terence Chua

– Sembcorp Marine (SMM) will hold an extraordinary general meeting (EGM) on 16 Feb 2023, to vote on its proposed acquisition of Keppel offshore & marine.

– The independent financial adviser (IFA) for the deal saw its terms as fair and reasonable, and had advised the independent directors to recommend shareholders to vote in favour of the deal.

– We believe the better clarity on the deal time-line and future management team will reduce overhang on the stock. The new enlarged Group will also be able to better capitalise on the energy transition.

– Maintain BUY with unchanged SOTP TP of $8.95. We valued the Group based on the four new segments unveiled during Vision 2030 to better reflect the Group’s reporting segments going forward. Our TP translates to about 1.2x FY22e book value, a slight premium to its historical average as the Group’s transformation plans gain traction and ROE expands to 8.8%. Catalysts are expected from approvals obtained for the transaction.

Spotify Technology S.A. – Margin expansion on the horizon

Recommendation : ACCUMULATE (Downgraded); TP: US$128.00, Last Close: US$118.14

Analyst: Jonathan Woo

– 4Q22 revenue/PATMI in line with expectations. FY22 revenue at 98% of our FY22e forecasts, with net loss EUR140mn less than our FY22e forecasts.

– Total MAUs/Premium Subscriptions both beat guidance, up 20%/14% YoY respectively. Premium ARPU was up 3% YoY.

– 25.3% gross margin beat guidance by 0.8%, primarily due to lower content spend. Operating loss ahead of guidance by EUR69mn, expected to improve materially in FY23e.

– We downgrade to ACCUMULATE with a raised DCF target price of US$128.00 (prev. US$111.00) to account for stock price performance. We cut FY23e revenue forecasts by 8% on expected slowing of FX tailwinds, while increasing gross margin assumptions from 26.5% to 26.8%, resulting in a reduction in FY23e net profit by EUR330mn. We maintain a WACC of 7.5% and terminal growth rate of 3%.

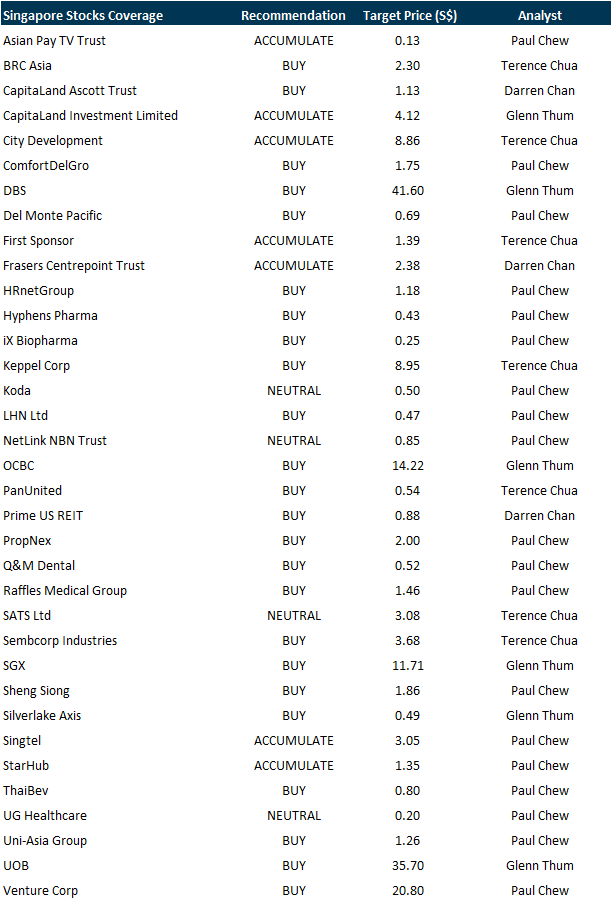

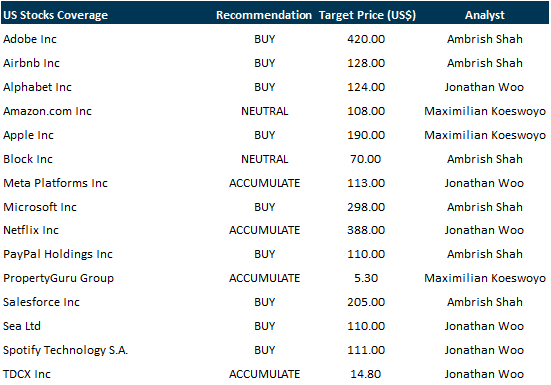

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by LMS Compliance [NEW]

Date: 8 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3IX0pAr

Guest Presentation by Prime US REIT [NEW]

Date: 9 February 2023

Time: 1pm – 2pm

Register: http://bit.ly/3HmEzUI

Guest Presentation by Paragon REIT [NEW]

Date: 17 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3ZNn4W0

Guest Presentation by Keppel DC REIT [NEW]

Date: 17 February 2023

Time: 3pm – 4pm

Register: https://bit.ly/3CYgrGr

Guest Presentation by First REIT Management Limited [NEW]

Date: 23 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3GY2tp8

Research Videos

Weekly Market Outlook: Microsoft Corp, Netflix Inc, Technical Analysis, SG Weekly & More

Date: 30 January 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials