DAILY MORNING NOTE | 27 September 2022

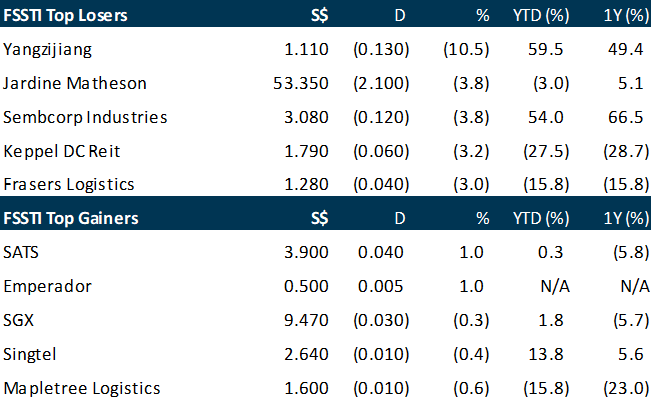

The Straits Times Index (STI) shed 1.4 per cent or 45.13 points to close at 3,181.97 on Monday (Sep 26), tracking regional declines as markets continue to reel from signs of further economic pain ahead. In the broader market, losers beat gainers 413 to 194, with 1.56 billion securities worth S$1.70 billion traded. IG market strategist Yeap Jun Rong noted that in addition to the declines posted by the various indices in the United States, US short-term rates ticked higher as well. “The inversion of the yield curve at a new low since 1981 reflects increased risks of recession, which may bode the question of whether economically sensitive sectors could bear the brunt of the next leg of sell-off if economic conditions were to reveal further signs of weakness over the coming months.” he said. Across the region, major market indices were in the red. South Korea’s Kospi composite index declined 3 per cent, Japan’s Nikkei 225 fell 2.7 per cent, both the Jakarta composite index and the Kuala Lumpur composite index shed 0.7 per cent while Hong Kong’s Hang Seng index edged down 0.4 per cent. Inflight caterer and ground handler Sats and liquor company Emperador were the only counters on the STI to remain in the black on Monday. Sats gained 1 per cent or S$0.04 to close at S$3.90, while Emperador gained 1 per cent or S$0.005 to close at S$0.50. On the other hand, Yangzijiang Shipbuilding was at the bottom of the table, falling by 10.5 per cent or S$0.13 to close at S$1.11. This comes after heavy trading in the counter prompted a query from the Singapore Exchange Regulation last Friday. In response, Yangzijiang said media reports in connection to its Sep 8 announcement about a new licence agreement that would allow it to start constructing large liquified natural gas (LNG) vessels could have led to the earlier rise in its share price.

Wall Street stocks fell again on Monday as major indices slumped to their lowest level of 2022 amid market fallout from central bank policy pivots to address inflation. “Financial markets are a mess,” said Oanda’s Edward Moya, alluding to turbulence in the foreign exchange markets that has boosted the dollar. “Wall Street is realising that we won’t be seeing a significant sign that inflation is easing fast enough in the next couple of months and that should make it tough to buy the dip just yet.” After last week’s rout, US indices climbed early in the session before falling. The Dow Jones Industrial Average finished down 1.1 per cent at 29,260.81. The broad-based S&P 600 shed 1.0 per cent to 3,655.04, while the tech-rich Nasdaq Composite Index declined 0.6 per cent to 10,802.92. Monday was the lowest close of 2022 for both the Dow and S&P 500. The S&P 500 also dropped nearly 5 per cent last week after the Federal Reserve announced another big hike in interest rates, spurring rate moves from the Bank of England and other central banks. The aggressive moves by central banks have weighed on equities, with many investors now seeing increased odds of a recession. Still, some analysts consider the stock market to be “oversold” in the short-run.

SG

An offer from Silkroad Nickel’s executive director to privatise the Indonesia-based nickel ore miner has turned unconditional, with the total number of shares owned, controlled, or agreed to be acquired by offeror Horowitz Capital and its concert parties amounting to 90.2 per cent of total shares. This translates to 235.5 million shares as at 6pm on Monday (Sep 26). Valid acceptances of the offer from the offeror’s concert parties stood at 63.2 per cent, while valid acceptances from other shareholders stood at 27 per cent. The offer was declared unconditional in all respects on Monday, and the closing date for the offer will be extended to 5.30pm on Oct 25, from the same time on Oct 10 previously. Horowitz Capital has also garnered enough valid acceptances to cross the 90 per cent shareholding threshold for a compulsory acquisition, and it intends to exercise this right. Horowitz Capital’s sole shareholder is Silkroad Nickel’s executive director Nasser Aljunied. Nasser is one of 3 members sitting on the board of Horowitz Capital, along with Silkroad Nickel chief executive Hong Kah Ing and Lester Tay Lee Chye. The privatisation offer was launched on Aug 29 at an offer price of S$0.42 per share. Horowitz Capital then pointed to the low trading liquidity of the counter, adding that the offer is an opportunity for shareholders to realise their investment at a premium to market price. Silkroad Nickel units ended Monday flat at S$0.415.

Singapore Exchange is set to launch its first lithium and cobalt contracts, adding to efforts by commodity exchanges to get battery materials companies and investors interested in using futures. SGX is due to kick off trading in 2 lithium and 2 cobalt contracts on Monday (Sep 26). The London Metal Exchange (LME) and CME Group already offer futures for both metals, although trading liquidity is still far below established commodities contracts. Demand for battery minerals is expanding rapidly as the global auto industry accelerates a push towards electric vehicles (EV), triggering big price swings. A global index of lithium prices has more than quadrupled in the past year, while Chinese lithium carbonate just hit a fresh record last week. While unprecedented price spikes have sparked calls for greater transparency in pricing, analysts have pointed to hurdles for contracts to gain traction – from the relative complexity of the markets to a greater reliance on long-term supply deals that contrain spot trading. “In the case of lithium, miners and lithium converters often tie their volumes to long-term contracts,” said Leah Chen, an analyst at S&P Global Commodity Insights. “Without the physical delivery of cargoes, it will be a paper market and there may be the risk of it falling into the space of speculation without providing the security from hedging.” The SGX is launching 4 contracts on Monday: battery-grade lithium carbonate and lithium hydroxide, plus cobalt metal and cobalt hydroxide. Open interest on both the CME and LME lithium hydroxide contracts was at zero as of Sep 22. As higher raw materials prices raise battery costs and threaten the pace of EV adoption, automakers and battery manufacturers have been trying to lock in future supplies of minerals amid fears of a deepening shortage. That includes offtake deals and multi-year supply partnerships between upstream and downstream companies. “The benefit of this over futures contracts for miners is that it increasingly results in direct equity investment in extraction operations,” said Martin Jackson, senior analyst at CRU Group. “As long as that spot market remains the minority of traded material, liquidity will limit the potential of futures trading.”

Singapore’s factory output expanded by 0.5 per cent on the year in August, down from a revised 0.8 per cent growth in July, according to data from the Singapore Economic Development Board (EDB) on Monday (Sep 26). The month’s figures, while an 11-month low, outperformed median estimates of a Bloomberg poll of private-sector economists, who had expected a 0.7 per cent contraction. However, excluding the volatile biomedical cluster, factory output shrank by 1.2 per cent, compared to a 3.1 per cent increase in the preceding month. August’s ex-biomedical reading is “the first negative print since November 2020 … reinforcing our view for a softer industrial production growth for the whole of this year”, said RHB senior economist Barnabas Gan. These figures came as declines were recorded in the key electronics cluster and chemicals cluster. They are the latest in a weakening manufacturing outlook, with Singapore’s purchasing managers’ index having fallen in August to the 50.0 border between expansion and contraction, similarly dragged down by electronics.

US

Apple said Monday it is assembling its flagship iPhone 14 in India as the U.S. technology giant looks to shift some production away from China. “The new iPhone 14 lineup introduces groundbreaking new technologies and important safety capabilities. We’re excited to be manufacturing iPhone 14 in India,” the company said in a statement. Apple’s main iPhone assembler, Foxconn, is manufacturing the devices at its Sriperumbudur factory on the outskirts of Chennai. The Cupertino, California, giant has been manufacturing iPhones in India since 2017 but these were usually older models. This time with the iPhone 14, Apple is producing its latest model in India for the first time, close to the device’s launch. Apple introduced the iPhone 14 earlier this month. Apple will sell India-produced phones locally but also export them to other markets globally. Customers in India will begin receiving the locally manufactured devices in the next few days. JPMorgan analysts said in a note this month that Apple will move 5% of its global production for the iPhone 14 to India by late 2022. Apple could also make 25% of all iPhones by 2025 in India, JPMorgan said. Apple’s focus on manufacturing in India highlights the tech giant’s desire to diversify production away from China and boost customers in India, which is currently a small market for the company. Apple still relies heavily on China for the majority of iPhone production. But Beijing has persisted with a strategy of lockdowns to control Covid resurgences even as most of the world looks to open their societies. The zero-Covid policy has disrupted production at factories across China where lockdowns take place and highlighted some potential weak spots in Apple’s supply chain. India has looked to boost local manufacturing of electronics through incentives.

Netflix said Monday it will be opening an internal game studio in Finland. This is the company’s first push into internal game development since streaming giant entered the mobile gaming space in November 2021. The company has already purchased three external game studios over the past year. Netflix bought Next Games, which is also based in Finland, for about $72 million. Netflix already has a cache of over 20 mobile games available for download to Netflix subscribers, and the company plans to have 50 by the end of the year. The catalog includes “Stranger Things: 1984” and “Queen’s Gambit Chess,” which are based on Netflix series. The streamer’s foray into gaming is in its early stages, but, as of August, not many Netflix subscribers were playing. Less than 1% of Netflix’s 220 million subscribers engaged with the games daily, according to Apptopia. Netflix didn’t immediately respond to a question about its game engagement. The company, which has lost overall subscribers during recent quarters, touted the newly announced studio as a place for Netflix to internally develop games alongside its existing subsidiary studios, which also include Night School Studio and Boss Fight Entertainment. “It’s still early days, and we have much more work to do to deliver a great games experience on Netflix,” read a statement Netflix VP of Game Studios Amir Rahimi. “Creating a game can take years, so I’m proud to see how we’re steadily building the foundation of our games studios in our first year.” The company said that its games will have no ads no in-app purchases. Currently users can see the games offered within the Netflix app, but the games themselves download as individual apps.

A measure of fear in stocks just hit the highest level in three months amid mounting worries over rising rates, a possible currency calamity and a recession. The Cboe Volatility Index, known as the VIX, jumped nearly 3 points to 32.88 on Monday, hitting its highest level since mid-June when the stock market last reached its bear bottom. The VIX, which tracks the 30-day implied volatility of the S&P 500, hasn’t closed above 30 since June 16. The index looks at prices of options on the S&P 500 to track the level of fear on Wall Street. The jump latest jump in the VIX also comes in the midst of currency market turmoil and the dollar continuing to climb to a 20-year-high. Investors started dumping risk assets as the Federal Reserve vowed to tame inflation with aggressive rate hikes, risking an economic slowdown. The Dow Jones Industrial Average on Friday notched a new low for the year and closed below 30,000 for the first time since June 17. The S&P 500 capped its fifth negative week in six, falling 4.65% last week. The Dow and the S&P 500 fell again in morning trading Monday. With investor fears now reaching extreme levels occurring during the last bear market bottom, it could also be a sign that stocks are nearing a turning point this time.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Upcoming Webinars

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Guest Presentation by MeGroup Ltd [NEW]

Date: 5 October 2022

Time: 12pm – 1pm

Register: https://bit.ly/3RSOTXY

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Research Videos

Weekly Market Outlook: Adobe PropertyGuru TechnicalPulse FOMC SG Weekly Top Glove Emperador

Date: 26 September 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials