DAILY MORNING NOTE | 30 May 2025

Recent Podcasts:

BRC Asia Ltd – Still record order book

Singapore Airlines – Better-than-expected FY25 DPS of 40cents

Singapore Equity Strategy Week 21 2025

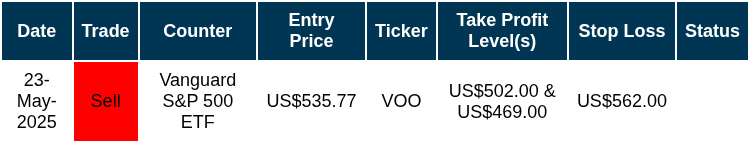

Trades Initiated in Past Week

Singapore stocks ended higher on Thursday (May 29), after a US trade court on Wednesday blocked US President Donald Trump’s “Liberation Day” tariffs from going into effect. In Singapore, the benchmark rose 0.1 per cent or 4.92 points to 3,916.84.

Wall Street stocks finished modestly higher on Thursday following strong earnings from Nvidia as a judicial ruling added to uncertainty about President Donald Trump’s tariffs. The Dow Jones Industrial Average finished up 0.3 per cent at 42,215.73. The broad-based S&P 500 climbed 0.4 per cent to 5,912.17, while the tech-rich Nasdaq Composite Index jumped 0.4 per cent to 19,175.87.

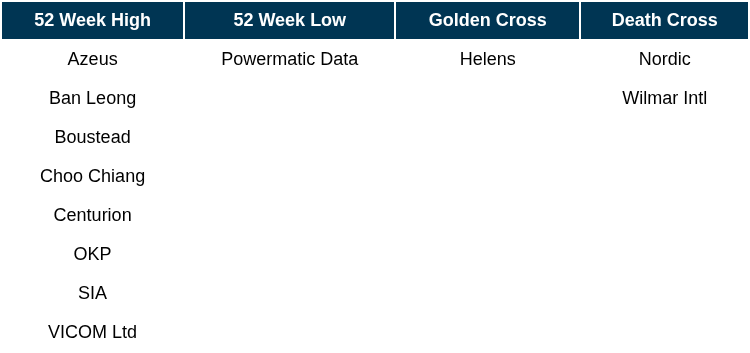

Singapore Technical Highlights

* ^ denotes companies placed on SGX Watch-list

* ^ denotes companies placed on SGX Watch-list

TOP 5 GAINERS & LOSERS

Events Of The Week

SG

Integrated healthcare operator IHH Healthcare on Thursday (May 29) posted a 33 per cent fall in net profit to RM514 million (S$156.3 million) for its first quarter ended Mar 31, from RM768 million the year before.

Seatrium recorded net order book wins amounting to S$21.3 billion as at end-March, comprising 26 projects with delivery dates till 2031.

CapitaLand Ascendas Real Estate Investment Trust (Clar) has raised S$500 million from a private placement of 202.4 million units, priced at S$2.47 per unit.

Sembcorp Industries’ wholly owned renewables subsidiary, Sembcorp Green Infra, was awarded a solar-energy storage hybrid project by SJVN, an Indian state-owned power company.

US

US corporate profits fell sharply in the first quarter and could continue to be squeezed this year by higher costs from tariffs that are threatening to undercut the economic expansion. Profits from current production with inventory valuation and capital consumption adjustments dropped to US$118.1 billion last quarter.

Oil prices fell on Thursday, retreating from earlier gains, after the International Energy Agency’s director warned of weaker demand in China, while the market also watched for potential new US sanctions curbing Russian crude flows and an Opec+ decision on hiking output in July.

Toyota Motor’s sales hit a record for the second month in a row as a strong showing in the US and Japan was boosted by customers making last-minute purchases before US President Donald Trump’s tariffs took effect.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, The Edge Singapore, PSR

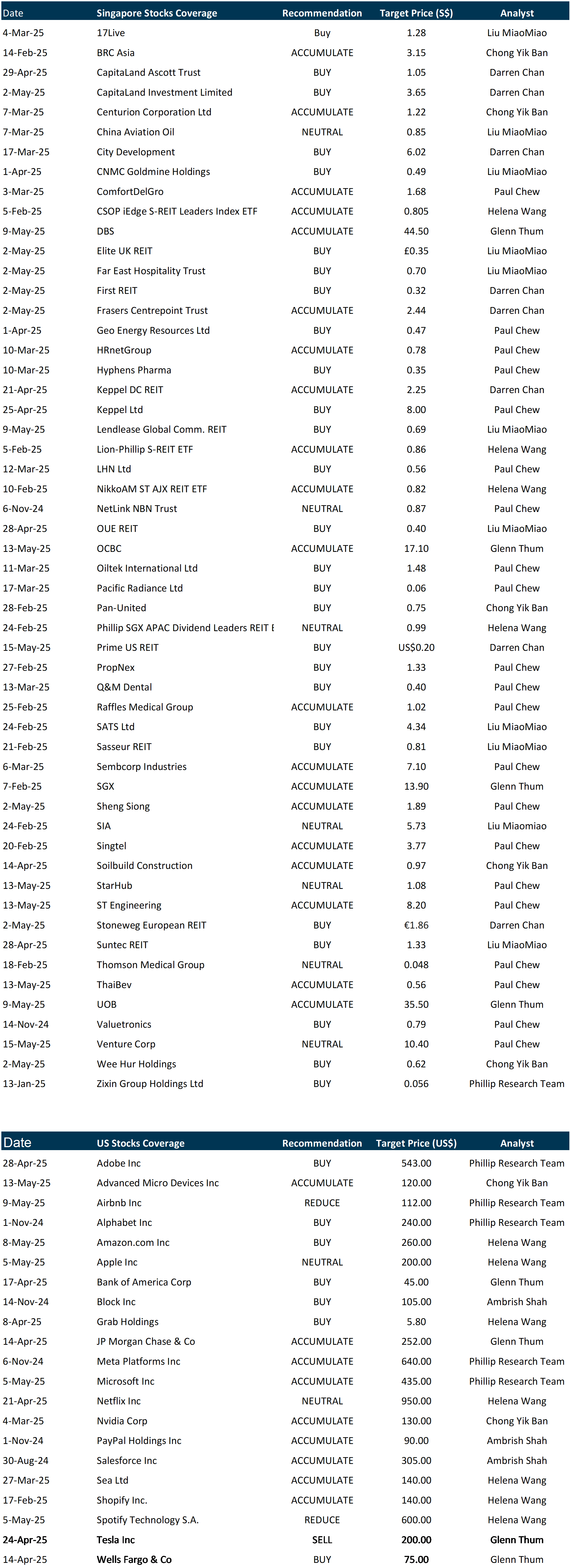

RESEARCH REPORTS

China Aviation Oil – Increasing trading volume

Recommendation: ACCUMULATE; TP S$0.90; Last close: S$0.8300; Analyst Liu Miaomiao

- International air traffic surged 32% YTD in Apr25, and we expect profit from associates (SPIA) to rise at least 12% YoY in FY25e, supported by the continued recovery of inbound leisure and business travel.

- We expect a pickup in trading volume in 1H at the low teens, driven by rising jet fuel and Sustainable Aviation Fuel (SAF) demand. The EU mandates a 2% SAF blend in 2025, increasing to 70% by 2050. As SAF volumes grow, this should support margin improvement for the oil trading business.

- We upgrade CAO from NEUTRAL to ACCUMULATE with a higher DCF-TP of S$0.90 (prev: S$0.85), reflecting recent share price performance and improving financial metrics. While we maintain our FY26e/27e PATMI forecast at US$82mn/83mn, we expect at least high single-digit YoY PATMI growth in 1H25. CAO currently holds US$500mn in cash, representing over 90% of its market cap. Re-rating catalysts include a better-than-expected dividend payout ratio and increasing contribution from SPIA.

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Corporate Insights by LHN Ltd

Date & Time: 3 June 25 | 12PM-1PM

Register: poems-20250603-120456

Corporate Insights by Manulife US REIT (MUST)

Date & Time: 5 June 25 | 12PM-1PM

Register: poems-20250605-120808

Corporate Insights by Zixin Group Holdings Ltd [NEW]

Date & Time: 6 June 25 | 12PM-1PM

Register: poems-20250606-121556

Research Videos

Weekly Market Outlook: Sea Ltd, CDL, SATS, Singtel, BRC Asia, Tech Analysis, SG Weekly, SG REITs….

Date: 26 May 2025Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials