DAILY MORNING NOTE | 6 November 2025

Recent Podcasts:

Semiconductor 2Q25 Update

Shopify Inc. – Growth momentum to continue, but stock overvalued

Grab Holdings – Super-app strategy delivering scale efficiently

Local shares ended Wednesday (Nov 5) lower, on the back of a sharp sell-off overnight of tech and artificial intelligence (AI) stocks on Wall Street. In Singapore, the benchmark fell 0.1% or 5.6 points to close at 4,417.12. Yangzijiang Shipbuilding was the biggest decliner on the index, falling 2.9% or S$0.10 to S$3.33 after BlackRock sold 37.8 million shares. Local telco Singtel was the top blue-chip gainer, rising 0.7% or S$0.03 to S$4.27.

US stocks rebounded on Wednesday as jitters over inflated tech stock valuations abated and upbeat earnings and better-than-expected economic data fueled investors’ risk appetite. The Dow Jones Industrial Average rose 225.76 points, or 0.48%, to 47,311.00, the S&P 500 gained 24.74 points, or 0.37%, at 6,796.29 and the Nasdaq Composite climbed 151.16 points, or 0.65%, to 23,499.80.

Singapore Technical Highlights

* ^ denotes companies placed on SGX Watch-list

* ^ denotes companies placed on SGX Watch-list

TOP 5 GAINERS & LOSERS

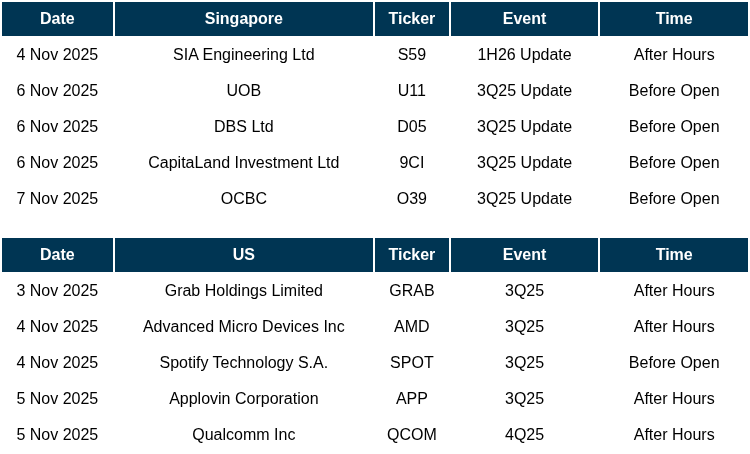

Events Of The Week

SG

UOB’s 3Q25 earnings of S$443mn were below our estimates, with 9M25 earnings at 56% of our FY25e forecast. NII fell 8% YoY to S$2,265mn as loan growth of 5% YoY cushioned NIM decline of 23bps to 1.82%. Fee income fell 2% YoY as growth in loan-related, wealth and card activities was offset by card rewards expenses. Earnings took a hit from a spike in provisions to S$1.4bn (3Q24: S$304mn) from pre-emptive provisioning to strengthen coverage against macroeconomic uncertainties and sector-specific headwinds, alongside higher specific allowance for a few non-systemic corporate accounts. Resultantly, credit costs spiked 100bps YoY to 134bps. UOB will maintain their dividend policy (50% payout ratio) and have committed to their share buyback programme. They provided FY26e guidance for NIM of 1.75-1.80%, low single digit loan growth, high single to double digit fee income growth and credit costs to normalise at around 25-30bps.

DBS’ 3Q25 adjusted earnings of S$3bn were slightly above our estimates, with 9M25 earnings at 77% of our FY25e forecast. 3Q25 DPS raised 39% YoY to 75 cents (including 15cents capital return). Highlights include stable net interest income of S$3.58bn (-1% YoY) despite NIMs declining to 1.96% (-15bps YoY) as loans grew 5% YoY. Fee income rose 22% YoY from continued growth in wealth management fees, while markets trading income surged 33% YoY from higher equity derivative activity. Credit costs inched up 1bps YoY to 15bps as total provisions fell 5% YoY. DBS has provided FY26e guidance of PATMI growth to be slightly lower YoY from lower NII offset by high single digit growth in commercial book non-interest income, cost-to-income ratio around the low-40% range and credit cost at around 17-20bps with potential for GP writebacks.

Glenn Thum

Research Manager

glennthumjc@phillip.com.sg

Coliwoo Holdings, The initial public offering (IPO) of co-living operator was 8.2 times oversubscribed. Priced at 60 cents per share, the over 75 million placement shares to institutional, accredited and retail investors was 7.3 times subscribed, while the 5.3 million public offer shares were 20.7 times subscribed.

Maybank Securities is the issue manager and global coordinator for the offering.

United Overseas Bank has made a pre-emptive move to make an additional general provision of $615 million, in a prudent move given macro uncertainties plus sector-specific headwinds. This one-off line, plus industry-wide trends of lower rates, has caused UOB to report a 72% y-o-y drop in net profit to $443 million.

DBS Group Holdings has reported earnings of $2.95 billion for its 3QFY2025, a slight dip of 2% y-o-y, but up 5% q-o-q. This showing beat expectations of $2.786 billion. As expected, the bank is starting to feel the impact of lower rates, but was able to offset this industry-wide trend with hedging and strong deposit growth.

Stoneweg Europe Stapled Trust has reported gross revenue of EUR163.5 million ($245.5 million) for the 9MFY2025 ended Sept 30. Net property income (NPI) for the period was up by 3% y-o-y to EUR102.9 million.

Manulife US REIT’s (MUST) aggregate leverage has fallen to 56.2% as at Sept 30, down from 57.4% at June 30. According to results for 3QFY2025 ended Sept 30 released on Nov 5, MUST’s occupancy similarly fell slightly to 68.2% at the end of the quarter, down from 68.4% at end-June.

AIMS APAC REIT (AA REIT) reported a 1.6% y-o-y rise in distributions to unitholders to $38.6 million and 1.1% rise in distribution per unit (DPU) to 4.720 Singapore cents for 1HFY2026, for the six months to end-Sept.

Parkway Life Reit has raised its third-quarter distribution per unit (DPU) by 2.3 per cent to S$0.1156 from S$0.113 in the previous corresponding period.

Bukit Sembawang Estates’ net profit for the half-year ended September fell 25 per cent year on year to S$47.2 million, primarily due to a plunge of 61 per cent in revenue from its property development segment.

Lendlease Global Commercial REIT (LREIT) has announced that it will acquire a 70% indirect stake in PLQ Mall via the acquisition of 70% of the total issued units in PLQM Trust, which holds 100% of PLQ Mall. The vendor is an unrelated third party understood to be Abu Dhabi Investment Authority (ADIA) hence no EGM is required.

Wee Hur Holdings’ subsidiary has been awarded the tender for the land parcel at Upper Thomson Road by the URA at a sale price of $614 million. Wee Hur’s subsidiary, Wee Hur Property, was awarded the tender together with GSC Holdings. The land parcel has a lease term of 99 years.

A wholly-owned subsidiary of PropNex and two other defendants are being sued for at least S$586,172, allegedly over a breach of duty of care as well as negligent misrepresentation by one of its salespersons.

Fuxing China Group has proposed the placement of 3 million new ordinary shares at 41.5 cents per share to raise $1.245 million.The placement shares represent about 17.44% of the existing issued and paid-up share capital of the company which comprises 17,205,438 shares.

CapitaLand Investment announced the final close for its value-add lodging private fund On Nov 5, CapitaLand Ascott Residence Asia Fund II (CLARA II), securing over US$650 million ($850 million) in total equity commitments and co-investments across the fund and associated vehicles.

US

US Transportation Secretary Sean Duffy said on Wednesday that he would order 10 per cent of flights at 40 major US airports to be cut starting on Friday unless a deal to end the federal government shutdown is reached.

US President Donald Trump met with executives from Switzerland and announced additional trade talks, as the European nation’s private sector enters the fray in seeking to reduce a tariff rate that ranks higher than any other developed nation.

Employment at US companies increased in October, signalling some stabilisation in the job market after two straight months of declines. Private-sector payrolls increased by 42,000 after a revised 29,000 decline a month earlier, according to ADP Research data released Wednesday.

Apple is planning to use a 1.2 trillion parameter artificial intelligence (AI) model developed by Alphabet Inc.’s Google to help power its long-promised overhaul of the Siri voice assistant.

Google and Epic Games Inc, the maker of the popular Fortnite game, reached a settlement in their long-running antitrust fight over how developers distribute and monetise apps on Android phones, according to a court filing.

Amazon.com Inc is suing Perplexity AI Inc to try and stop the startup from helping users buy items on the world’s largest online marketplace, setting up a showdown that may have implications for the reach of so-called agentic artificial intelligence.

OpenAI is releasing its Sora social video app on Android devices, one month after the artificial intelligence (AI) company launched the popular — and controversial — service on iPhone.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, The Edge Singapore, PSR

RESEARCH REPORTS

First REIT – Earnings stability tempered by FX

Recommendation: ACCUMULATE; TP S$0.31; Last close: S$0.2700; Analyst Darren Chan

- 3Q25/9M25 DPU of 0.52/1.65 Singapore cents (-10.3%/-7.3 YoY) was slightly below our estimates, forming 23%/73% of our FY25e forecast. The YoY decline in DPU was due to depreciation of the IDR and JPY against the SGD, partially offset by higher rental income in local currency terms.

- Rental income for 9M25 from Indonesia and Singapore grew 5.5% and 2% respectively in local currency terms, while Japan remained stable. On 17 October, FIRT announced the proposed divestment of Imperial Aryaduta Hotel & Country Club (IAHCC) for Rp.322.2bn (S$25.9mn), representing a 22% premium over its original purchase price and 0.65% above the latest valuation.

- We downgrade from BUY to ACCUMULATE with an unchanged DDM-derived target price of S$0.31 due to the recent share price performance. FY25e/26e DPU estimates are trimmed by 4%/2% to reflect the weaker Indonesian Rupiah and Japanese Yen. The strategic review of Siloam’s letter of intent (LOI) to acquire FIRT’s Indonesian hospital assets remains ongoing, with no material updates as of 3Q25. In the meantime, organic growth will be driven by more Indonesian hospitals transitioning to performance-based rent (currently three). FIRT trades at an FY25e DPU yield of 7.8%.

Microsoft Corp – US$35bn CAPEX exceeds expectations

Recommendation: ACCUMULATE; TP US$540.00; Last close: US$514; Analyst Alif Fahmi

- 1Q26 revenue/PATMI met our expectations at 24%/26% of our FY26e forecasts. Total revenue grew 18% YoY, driven by cloud services, with Azure revenue up 40% YoY.

- The Microsoft–OpenAI new agreement reinforces Microsoft’s Cloud and AI leadership, supported by IP rights through 2032 and a US$250bn Azure commitment. RPO backlog surged 51% YoY to US$392bn, fuelled by 112% YoY growth in Commercial bookings.

- We maintain ACCUMULATE recommendation at a lower target price of US$540 (from US$550). For FY26e, we raised PPE purchases paid in cash from US$80bn to US$83bn following CAPEX exceeding expectations. Net income remains slightly lower due to elevated OPEX from higher CAPEX, but is partially offset by higher M365 margins and workforce reductions.

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Corporate Insights by Keppel Infrastructure Trust (KIT)

Date & Time: 6 November 25 | 12PM-1PM

Register: poems-20251106-132232

Corporate Insights by Prime US REIT [NEW]

Date & Time: 12 November 25 | 12.30PM-1.30PM

Register: poems-20251112-132944

Corporate Insights by Wee Hur Holdings [NEW]

Date & Time: 10 December 25 | 12PM-1PM

Register: poems-20251210-133186

Corporate Insights by Marco Polo Marine [NEW]

Date & Time: 11 December 25 | 12PM-1PM

Register: poems-20251211-133188

Research Videos

Weekly Market Outlook: Tesla, META, Alphabet, AMZN, SSG, Keppel Ltd, Tech Analysis, SG Weekly & More

Date: 3 Nov 2025Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials