DAILY MORNING NOTE | 9 February 2023

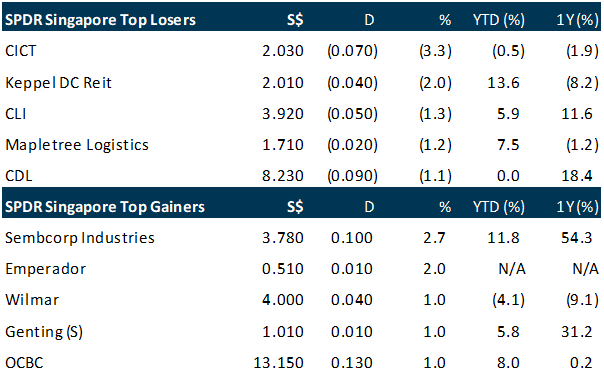

The local stock market edged higher on Wednesday (Feb 8) as investors mulled over the latest remarks from US Federal Reserve chairman Jerome Powell. The Straits Times Index inched up by 0.2 per cent or 7.68 points to finish the day at 3,388.52. In Singapore, banks were among the biggest gainers on Wednesday. UOB came out on top, adding 1 per cent or S$0.30 to S$30.84. DBS rose 0.6 per cent or S$0.20 to S$36.19, while OCBC advanced 1 per cent or S$0.13 to S$13.15. Best World International was one of the biggest losers on Wednesday. The stock lost 10.7 per cent or S$0.27 to finish at S$2.26. StarHub was another loser, shedding 6.3 per cent or S$0.07 to close at S$1.04 after it released a disappointing set of H2 results on Tuesday.

Wall Street stocks dropped on Wednesday on concern about the deteriorating corporate earnings outlook amid worries the Federal Reserve will overdo its effort to counter inflation. The Dow Jones Industrial Average dropped 0.6 per cent to 33,949.01. The broad-based S&P 500 shed 1.1 per cent to 4,117.86, while the tech-rich Nasdaq Composite Index slumped 1.7 per cent to 11,910.52.

SG

Prime US REIT has reported a distribution per unit (DPU) of 3.03 US cents (4.01 cents) for its 2HFY2022 ended December, down 12.2% y-o-y on lower income and higher interest costs. DPU for the FY2022 declined 3.5% y-o-y to 6.55 US cents, mainly attributable to the full year contribution from Sorrento Towers and One Tower Center — both acquired in July 2021. Gross revenue for 2HFY2022 at US$81 million was 4.1% lower y-o-y, mainly on account of termination income received in 2HFY2021 and a tenant departure at Reston Square in 2QFY2022, post its acquisition by another firm. For FY2022, the REIT’s gross revenue increased 4% y-o-y to US$163 million. Prime US REIT’s portfolio occupancy remained resilient at 89.1% with a weighted average lease expiry of 4.1 years as at Dec 31. Leasing activities remain strong with 142,800 sq ft of leases executed at a positive rental reversion of 20.2% in 4QFY2022. For all of 2022, 646,000 sq ft of leases were executed at a positive rental reversion of 11.4%.

BRC Asia has reported a profit after tax of $11.7 million for the 1QFY2023 ended Dec 31, 2022. During the period, its revenue came in at $341.3 million, while gross profit stood at $23.4 million. Cash and cash equivalents stood at $112.7 million as at end-December. The group’s sales orderbook stood at around $1.4 billion as at end-December with the duration of projects ranging up to five years. To the group, the continued recovery of the demand in the local construction industry “bodes well” for its supply chain, which includes reinforcing steel. That said, the industry faces short-term challenges in terms of escalating costs, in particular for labour and energy. Slower-than-usual site progress, resulting in lower-than-usual contractual offtake are also another one of the challenges faced by the industry at the moment. The slower offtake is also driving more competition for new contracts, thereby compressing margins with firms striving to overcome the shortfall in delivery volumes.

Straco Corporation is expecting to report a “substantial net loss” for the FY2022 ended Dec 31, 2022, compared to the net profit in the FY2021. This is due to the lower revenue from the group’s China attractions during the year due to the additional Covid-19 measures such as lockdowns within the country. The net loss was also attributed to the material exchange losses due to the weaker renminbi (RMB) against the Singapore dollar (SGD) in the FY2022. Other reasons include the lack of land lease relief and government grants from job support schemes and tourism vouchers in the FY2022 compared to FY2021, as well as a decrease in other income due to a one-off arbitration award for an insurance claim that was received in FY2021.

Private equity firm Northstar Group is considering the sale of Singapore’s Innovalues in a deal that could value the precision machine parts maker at over S$500 million, two sources with knowledge of the matter told Reuters. The Singapore headquartered firm is talking with at least one advisor to explore the potential sale and gauge interest, the sources added, declining to be named as the matter is private. Discussions are at an early stage and a decision is yet to be made, one of the sources said. Northstar Group said it is unable to comment on the matter. Innovalues did not respond to a request seeking comment.

Zhongxin Fruit has posted earnings of RMB1.7 million ($331,700) in 1HFY2023 ended December, a 95.1% decline y-o-y from the RMB34.2 million reported in the previous corresponding period due to operational challenges. For the period, earnings per share (EPS) stood at RMB0.16 on a fully diluted basis. The company’s decreased production volume has resulted in lower sales volume in 1HFY2023. As a result, the Zhongxin Fruit recorded lower revenue of RMB52.8 million in 1HFY2023, down 35% y-o-y. On the back of the lower revenue, gross profit also decreased to RMB12.6 million in 1HFY2023. In its filing, the company says the average selling price (ASP) of concentrated fruit juices increased by approximately 33% in 1HFY2023 as compared to 1HFY2022 due to higher raw material costs.

Chip Eng Seng says it expects to report a net loss for the 2HFY2022 in its profit guidance released Feb 8. The loss is attributable to higher-than-expected foreign exchange losses as well as higher-than-expected provisions to be made in respect of certain of the company’s construction projects. However, the net loss incurred by the company in its 2HFY2022 will be smaller than the net loss incurred in its 2HFY2021 at $31.6 million, it clarifies. The company expects to report an overall net profit for its FY2022. Further details will be published in its unaudited consolidated financial results for 2HFY2022, which will be released in the second half of February.

US

Smaller subscriber losses and a beat on the top and bottom lines were the highlights of Disney’s fiscal first-quarter earnings report. While the company’s linear TV and direct-to-consumer units struggled during the period, its theme parks saw significant growth year-over-year. Disney reported earnings per share of 99 cents per share, adjusted vs 78 cents per share expected, revenue of $23.51 billion vs $23.37 billion expected and total subscriptions of 161.8 million vs 161.1 million expected. With CEO Bob Iger back at the helm, Disney is seeking to make a “significant transformation” of its business by reducing expenses and putting the creative power back in the hands of its content creators. During the call Iger announced that the media and entertainment giant would reorganize, cut thousands of jobs and slash $5.5 billion in costs.

Apple has expanded an internal test of its upcoming “buy now, pay later” service to the company’s thousands of retail employees, a sign the long-awaited feature is finally nearing a public release. The tech giant contacted retail staffers this week to offer them a test version of the service, according to Apple workers who asked not to be identified. The offering, called Apple Pay Later, lets shoppers split the payment for purchases into instalments. The company previously rolled out a test for corporate employees.

Uber Technologies Inc on Wednesday set its sights on delivering profits this year after rounding off 2022 with blow-out earnings as a surge in demand for airport and office rides helped the company rebound from pandemic lows. Uber forecast adjusted EBITDA between $660 million and $700 million for the first quarter, well above the average analyst estimate of $593.06 million, according to Refinitiv data. Uber, which operates in over 70 countries and 10,000 cities, said new rideshare products such as pre-booking, shared rides, car rentals and car-sharing was also boosting revenue. Chief Executive Khosrowshahi said active drivers on the platform reached an all-time high in the fourth quarter and continued to grow in January, putting behind worries of a shortage of drivers signing up as demand jumped.

CVS Health reported fourth quarter results that beat average analyst estimates. CVS posted an EPS of $1.99 on revenue of $83.85 billion, beating the consensus for earnings of $1.92 per share on revenue of $76.33B. Revenue increased by almost 10% year-over-year (YoY), led by an 11% increase in Pharmacy Services revenue. The company said it processed just over 600 million pharmacy claims, up over 18M from a year-ago period. “Last year was defined by outperformance across our foundational businesses, robust cash flow from operations and meaningful progress against our value-based care delivery strategy. 2022 was a year of progress, and we continue to build on that momentum with bold moves that will improve the health care experience,” said Karen Lynch, CVS Health President, and CEO.

Yum Brands on Wednesday reported quarterly earnings and revenue that topped analysts’ expectations, fueled by strong same-store sales growth at Taco Bell. Overall, the restaurant giant saw strong U.S. demand for its food, but weak sales in China once again weighed on KFC’s and Pizza Hut’s results. Yum reported fourth-quarter net income of $371 million, or $1.29 per share, up from $330 million, or $1.11 per share, a year earlier. Net sales rose 7% to $2.02 billion. The company’s global same-store sales increased 6% in the quarter, driven by diners’ strong appetite for Taco Bell.

Beijing-based Li Auto unveiled an extended-range electrified sport utility vehicle (SUV) it wants to rival cars like Tesla’s Model Y. The L7, introduced during an online event on Wednesday (Feb 8), has a starting price of 319,800 yuan (S$62,486.2) and a maximum driving range of 1,315 kilometres (817 miles). The five-seater can cover about 210 kilometres purely electric but also has a four-cylinder petrol engine to provide additional power for greater range.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

CapitaLand Ascott Trust – On the right track

Recommendation: BUY (Maintained); TP: S$1.26, Last Done: S$1.10

Analyst: Darren Chan

– FY22 DPU of 5.67 cents (+31%) was in line with our forecast, supported by new acquisitions and the recovery of travel.

– 4Q22 portfolio RevPAU rose 78% YoY to S$155, reaching pre-pandemic 4Q19 levels on continued improvement in portfolio occupancy (78% vs 60% in 4Q21) and average daily rates (ADR).

– Maintain BUY, DDM-TP raised from S$1.13 to S$1.26. FY23e-FY25e DPU is raised by 1-3% on the continued recovery for hospitality and the reopening of China. Our cost of equity decreased from 8.34% to 7.96% as we roll forward our forecasts. CLAS remains our top pick in the sector owing to its mix of stable and growth income and geographical diversification. The current share price implies a FY23e dividend yield of 5.9%.

Alphabet Inc. – Focusing on reducing expense base

Recommendation : BUY (Maintained); TP: US$131.00, Last Close: US$107.64

Analyst: Jonathan Woo

– 4Q22 results was within expectations on both revenue and earnings. FY22 revenue/PATMI is at 99%/95% of our FY22e forecasts. Adj. PATMI (excl. unrealised losses) is at 100% of our forecasts. Revenue was dragged by 2% YoY decline in ad revenue, and 6% FX headwinds.

– Cloud momentum is still strong with 32% YoY growth for 4Q22. But there was a -US$480mn operating loss. Cloud accounts for only 10% of total revenue.

– Slowing FY23e expenses growth with 12,000 job cuts in 1Q23e, reducing office facilities, and more prudent investments. Guidance for FY23e CAPEX is roughly in line with FY22.

– We cut our FY23e revenue forecast by 9% to account for continued weakness in digital advertising demand, while reducing CAPEX spend by 20% to reflect a general slowdown in expenses. Our FY23e EBITDA forecasts are also cut by 17% to reflect slower-than- anticipated margin expansion due to expected US$2.3bn severance-related charges. We maintain BUY with a raised DCF target price of US$131.00 (prev. US$124.00) due to potential upside from increasing YouTube Shorts monetisation, continued strength in Cloud, and margin expansion in FY24e from the slowing pace of expense growth as a % of revenue, with a WACC of 7.3% and terminal growth of 3.5%.

StarHub Limited – Another year of heavy investments

Recommendation: NEUTRAL (Downgraded); TP S$1.08, Last close: S$1.05

Analyst Paul Chew

– Revenue and EBITDA were in line with expectations at 101%/102% of our FY22e estimates. 4Q22 revenue growth of 23% was supported by mobile and broadband acquisition. EBITDA halved due to DARE+ transformation and one-off expenses. FY22 dividends are down 22% YoY to 5 cents.

– Guidance is for another weak year of EBITDA margins for FY23. Service EBITDA margins to be maintained at 20% with revenue growth of 8-10%.

– Around 35% or S$75mn of the planned S$310mn DARE+ has been spent. From the remaining S$235mn to be spent, we expect S$180mn to be used in FY23e. Bulk of the DARE+ transformation cost is in EPL content and IT software and services. We maintain FY23e revenue but lowered EBITDA by 4%. Our target price lowered to S$1.08 (prev. S$1.15), pegged at 6.5x FY22e EV/EBITDA, in line with other mobile peers. We downgrade our recommendation to NEUTRAL. We do not find the dividend yield attractive as investors weather another year of weak earnings.

Amazon Inc. – Longer term remains attractive

Recommendation : ACCUMULATE (Upgraded); TP: US$117.00, Last Close: US$100.05

Analyst: Maximilian Koeswoyo

– Revenue was in line with expectations at 101% of our FY22 forecast; while earnings were a slight miss with normalized PATMI at 96%, excluding a pre-tax valuation loss of US$12.7bn from Rivian Automotive, due to higher-than-expected operating expenses.

– 4Q22 revenue grew 8.6% YoY, beating top-end company guidance with advertising continuing to buck the industry’s declining trend. AWS remains the fastest growing segment but growth is expected to decelerate to mid-teens in 1Q23.

– We upgrade to ACCUMULATE with a raised DCF target price of US$117.00 (prev. US$108.00) using a WACC of 6.4% and terminal growth rate of 5%. We expect near-term challenges for revenue growth as consumers are more selective in their discretionary spending and AWS customers opt for lower-cost products. However, we expect growth to reaccelerate in FY24e, particularly for AWS as Amazon increases its client base and customers scale up their computing demand as macro improves.

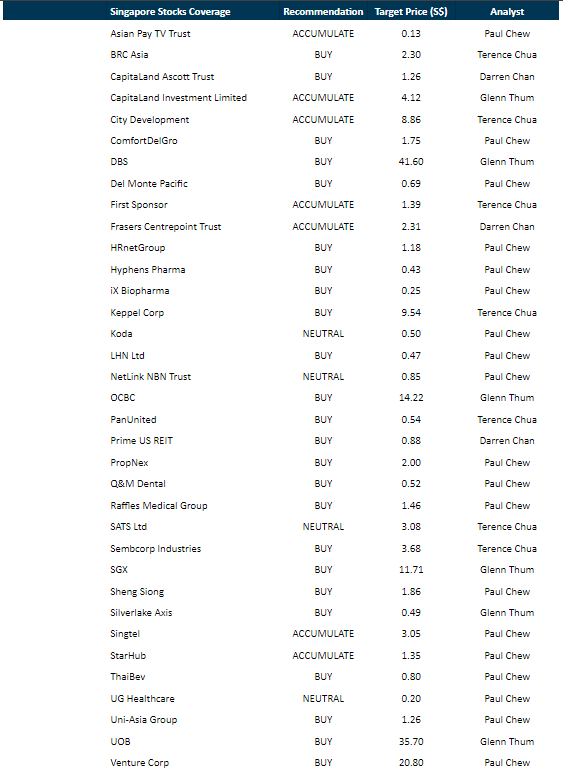

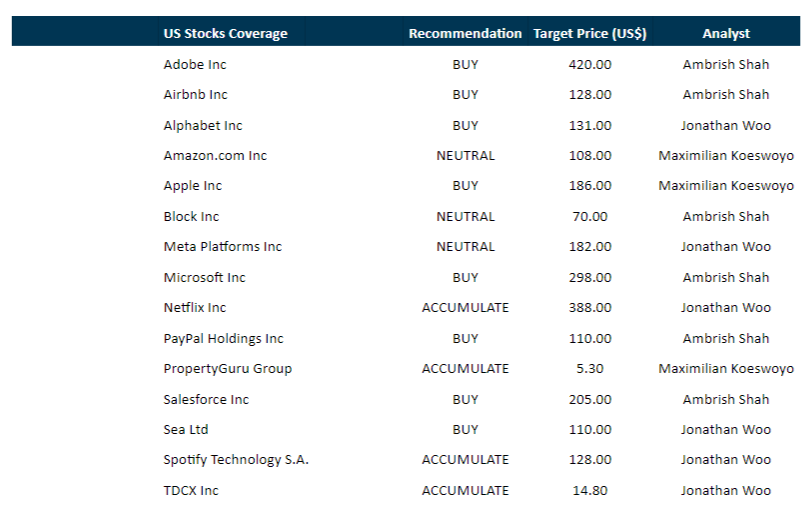

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Prime US REIT [NEW]

Date: 9 February 2023

Time: 1pm – 2pm

Register: http://bit.ly/3HmEzUI

Guest Presentation by Paragon REIT [NEW]

Date: 17 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3ZNn4W0

Guest Presentation by Keppel DC REIT [NEW]

Date: 17 February 2023

Time: 3pm – 4pm

Register: https://bit.ly/3CYgrGr

Guest Presentation by First REIT Management Limited [NEW]

Date: 23 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3GY2tp8

Research Videos

Weekly Market Outlook: Spotify, Apple Inc, SG Banking Monthly, Technical Analysis, SG Weekly & More

Date: 6 February 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials