Apple Inc - Stock Analyst Research

| Target Price* | 194.00 |

| Recommendation | NEUTRAL› NEUTRAL |

| Market Cap* | - |

| Publication Date | 7 Feb 2024 |

*At the time of publication

Apple Inc. - Weak demand for products continues

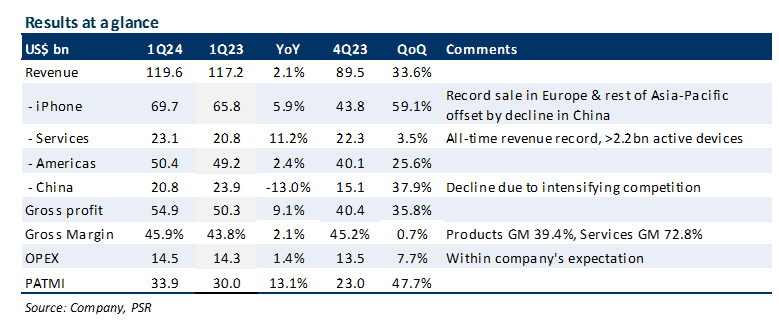

- 1Q24 results were within our expectations with 1Q24 revenue/PATMI at 30%/33% of our FY24e forecasts. Historically, 1Q revenue/PATMI accounts for 31%/34% of the fiscal year forecast. Services growth of 11.2% YoY remains the standout, with AAPL’s installed base climbing to 2.2bn.

- Gross margin delivery came in at 45.9%, the high end of its guided 45-46% range, up 70 basis points sequentially due to higher iPhone Pro and services revenue. Products and service gross margin were at 39.4% and 72.8% sequentially.

- Weak demand for products remains a drag, with a 13% YoY revenue contraction from China also a concern due to increasing competition from domestic brands like Huawei.

- We downgrade to a NEUTRAL rating from ACCUMULATE due to recent share price gains. Our target price remains unchanged at US$194, a WACC of 6.5%, and a terminal growth rate of 3%. There is no change of forecast. As product sales remain muted, we expect Services to continue being the main drivers of growth.

The Positives

+ Strong gross margin delivery. AAPL recorded 1Q24 gross margins of 45.9%, coming in at the high end of its guided 45-46% range. Product margin expansion is driven by a higher mix of the pricier Pro version of iPhone, while the Services margin is driven by a record installed base of more than 2.2 bn. We expect a sustained growth in gross margin due to the recent robust performance of Services (11.2% YoY). The margin could expand further as the revenue mix shifts towards this more profitable segment. (The Services gross margin was at 72.8%, almost twice of that of Products gross margin of 39.4%).

The Negatives

– Weak outlook for China. Revenue from China contracted 13.0% YoY in 1Q24 due to increased competition and FX headwinds. AAPL is struggling to battle local competitors like Huawei, who are edging into the high-end market that Apple has traditionally dominated. China represents roughly 20% of iPhones. We believe the continued weakness in China market will remain a drag on Product growth, especially when iPhone accounts for 58% of AAPL’s total revenue.

– Weak demand for products remains a drag. Product revenue remain flat in 1Q24. iPad and Wearables saw revenue declines 26% and 11% YoY due to different product launch times and muted demand. iPhone revenue saw a 5.9% YoY increase, despite the weak demand in the China market. AAPL has guided flat growth of iPhone in 2Q24e while expecting iPad and Wearables to decelerate further. We believe the continued weakness in demand for AAPL’s other products will remain a drag on Product growth.

About the author

Helena Wang

Research Analyst

PSR

Helena covers Hardware/Marketplaces/ETF. Helena graduated with a master degree in Financial Technology from Nanyang Technological University

About the author

Helena Wang

Research Analyst

PSR

Helena covers Hardware/Marketplaces/ETF. Helena graduated with a master degree in Financial Technology from Nanyang Technological University

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)