Airbnb - Stock Analyst Research

| Target Price* | USD 150 |

| Recommendation | NEUTRAL› NEUTRAL |

| Market Cap* | - |

| Publication Date | 20 Feb 2024 |

*At the time of publication

Airbnb Inc - Slowdown in booking volumes

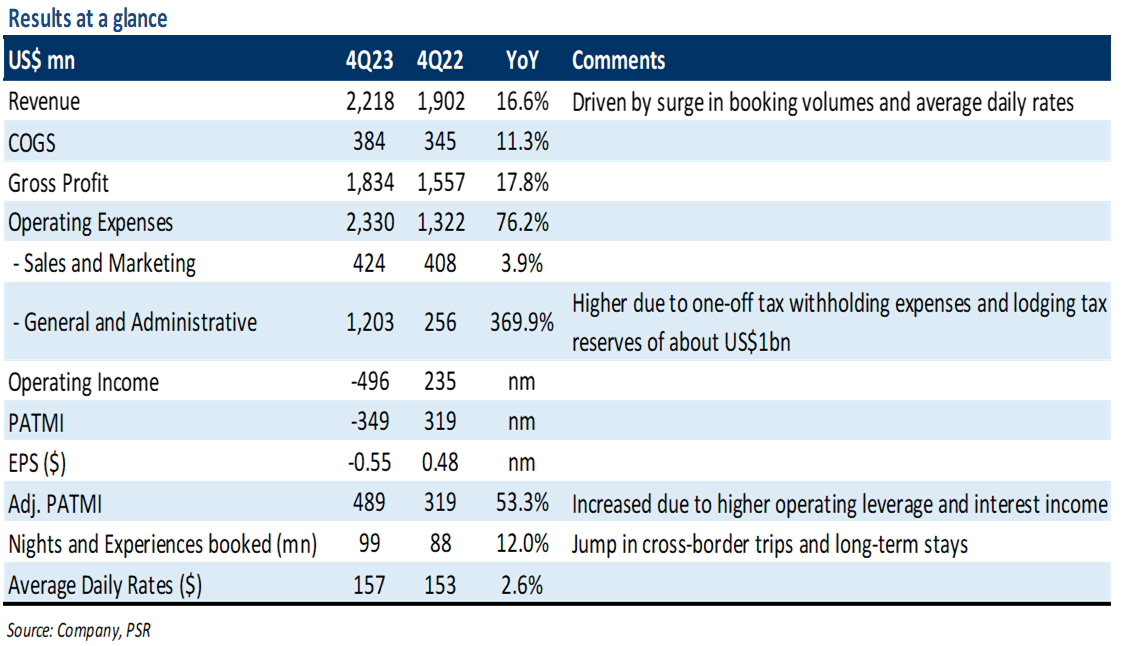

- FY23 revenue/adj. PATMI met our expectations at 101%/103% of our forecasts. 4Q23 revenue grew 17% YoY to US$2.2bn led by a 12% YoY surge in booking volumes. Adj. PATMI (excl. one-off tax items of US$1bn) grew 53% YoY to US$489mn on higher operating leverage and interest income.

- For 1Q24e, Airbnb expects revenue to rise 13% YoY to US$2.05bn. The booking volume growth rate is expected to further decelerate to high-single digits due to tough comparisons. For FY24e, Airbnb expects adj. EBITDA margins of at least 35% compared to 37% in FY23 as it plans to invest in product development and marketing.

- We downgrade to NEUTRAL from BUY recommendation after the recent jump in its stock price. We lower our DCF target price to US$150.00 (prev. US$157.00) with an unchanged WACC of 7% and terminal growth rate of 4%. We lower our FY24e revenue/adj. PATMI estimates by 1%/14% to account for moderation in travel demand and higher expenses.

The Positives

+ Revenue boosted by international and long-duration bookings. 4Q23 revenue grew 17% YoY to US$2.2bn, 2% above the top end of its own revenue guidance (US$2.17bn). This outperformance was led by a 12% YoY increase in booking volumes to 99mn, 3% YoY improvement in the average daily rates to US$157, and a 3% FX tailwind. Cross-border nights booked grew 13% YoY (strength in the Asia-Pacific and Latin America regions) and represented 44% of total nights booked, while urban nights booked increased by 11% YoY. Meanwhile, long-term stays of 28 days or more accounted for 19% of total gross nights booked, led by the flexibility granted by remote work environments.

+ Supply continues to expand. Active listings on the platform grew by 18% YoY to more than 7.7mn. The supply growth was in double-digits across all regions, with the highest growth in the Asia Pacific and Latin America regions. We believe strong supply growth was led by continued product enhancements (The Listings tab, Airbnb Rooms, and pricing tools) and marketing to attract new hosts. Airbnb reported that it now has more than 5mn hosts worldwide.

The Negative

– Further deceleration in booking volume growth. Airbnb guided 1Q24e revenue to be in the range of US$2.03bn to US$2.07bn (12%-14% YoY growth), representing a decline in topline growth. The slowdown is mainly because the YoY growth rate of nights booked is expected to further decelerate relative to 12% in 4Q23 (vs 19% in 1Q23) due to tough comparisons following the Omicron-fueled pent-up demand seen in 1Q23.

Outlook

Airbnb witnessed stable demand at the start of the year, but management noted that 1Q24e would face tough comparables. For 1Q24e, Airbnb expects total revenue to grow by 13% YoY to US$2.05bn, taking the midpoint (Figure 1). Management noted that the timing of Easter will have a positive 1% to 2% impact on 1Q24e revenue growth as holiday-related stays are pulled forward to 1Q24e. Airbnb expects the booking volume growth rate to moderate relative to 12% in 4Q23, though it expects average daily rates to be flat to slightly up compared to 1Q23.

Airbnb expects to deliver adj. EBITDA (excluding stock-based compensation expense) growth on a nominal basis in both 1Q24e and FY24e. The company also expects 1Q24e adj. EBITDA margin to expand YoY mainly due to the timing of expenses. For FY24e, Airbnb expects adj. EBITDA margins of at least 35% compared to 37% in FY23 as it plans to invest in product development and marketing. Additionally, the company announced a new share repurchase authorisation of up to US$6bn shares.

Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)