Adobe Inc. - Solid start amid the challenging environment

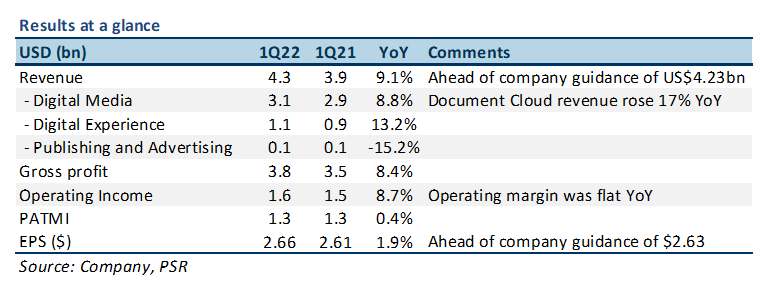

29 Mar 2022- 1Q22 results in line with expectations. 1Q22 revenue/PATMI at 24/25% of our FY22e forecasts.

- Document Cloud remains Adobe’s fastest growing segment with 17% YoY revenue growth, driven by paper-to-digital transition. Document Cloud segment ARR (annual recurring revenue) was US$2.0bn, up 29% YoY.

- Adobe revealed its intention to increase prices on its Digital Media offerings, which we expect will strengthen 2H22 ARR growth in Creative Cloud.

- We maintain a BUY recommendation with a reduced DCF target price from US$658.00 to US$602.00. Valuations based on DCF with a WACC of 6.4% and terminal growth of 4.0%. We reduced our FY22e PATMI by 2% due to an estimated US$75mn revenue hit from the business disruption associated with Russia’s invasion of Ukraine.

The Positives

+ Document Cloud continues to be Adobe’s fastest growing segment. Document Cloud revenue grew 17% YoY to US$562mn and Document Cloud ARR grew 29% YoY to US$2.0bn. Much of the Document Cloud revenue growth was supported by strong customer demand for Acrobat subscriptions; momentum in AdobeSign, with significant YoY increase in e-sign transactions within Acrobat; and high demand for PDF solutions on mobile devices.

+ Strong operating margins. Strong margins have been an important aspect of our Adobe investment thesis, and 1Q22 was no exception. The company posted operating margin of 37% in 1Q22, which was in line with 1Q21. Margins benefitted from lower travel/facilities costs amid a peak in Omicron cases in December and January.

+ Price increase for Creative Cloud products. Adobe has revealed its intention to increase pricing of its Digital Media products late in the second quarter. This could boost Creative Cloud revenues in 2H22 as price hikes take effect at renewal for existing customers and for new customers. Adobe believes that it has delivered significant value to customers by introducing several platform innovations and products, including mobile and web-based Creative Cloud Express offerings. While no specifics are available, the last price rise was announced in 2017.

The Negatives

– War in Russia and Ukraine impacts Digital Media segment. Adobe has stopped selling products and services in Russia and Belarus due to the ongoing Russia-Ukraine conflict. The company has announced that it is decreasing its Digital Media ARR balance by US$87mn, consisting of US$75mn relating to sales in the Russia/Belarus region and an additional US$12mn pertaining to Ukraine (although the company will continue to provide Digital Media services to the latter). Further, Adobe’s FY22 sales will be reduced by US$75mn due to these adjustments.

– Higher tax rate. In 1Q22, Adobe reported tax rate of 18% compared to the company’s guidance of 16%. This was mainly because of the lower-than-expected tax benefits related to stock-based compensation. Further, the tax rate outlook for 2Q22 increased to 20%. Assuming everything else is constant, the increased tax rate reduces EPS by US$0.06 each quarter.

Outlook

Adobe expects 2Q22 revenue of US$4.34bn and earnings of US$2.44 per share. The company expects Digital Media net new ARR of US$440mn. Additionally, Adobe anticipates revenue growth of 13% and 15% for the Digital Media and Digital Experience segments, respectively.

Adobe did not provide an update to its FY22 prior guidance. For FY22, Adobe expects earnings of US$10.25 per share on total revenue of US$17.9bn. Among the other guidance metrics are 14% as-reported revenue growth for Digital Media and Digital Experience segments.

Maintain BUY with lower TP of US$602.00 (prev. US$658.00)

We lower our FY22e PATMI by 2% to reflect an estimated US$75mn revenue hit from the business disruption associated with Russia’s invasion of Ukraine. Digital media creation tools and cloud document management systems are in high demand globally across several industries. Despite the war-based revenue reductions, we maintain BUY with a lower target price of US$602.00. Valuations based on DCF with a WACC of 6.4% and terminal growth of 4.0%.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)