Adobe - Stock Analyst Research

| Target Price* | 465.00 |

| Recommendation | REDUCE› REDUCE |

| Market Cap* | - |

| Publication Date | 19 Mar 2024 |

*At the time of publication

Adobe Inc - Revenue growth to decelerate

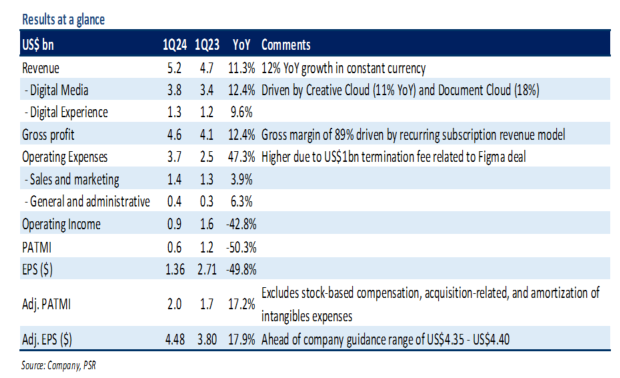

- 1Q24 revenue/adj. PATMI was in line with expectations at 24%/25% of our FY24e forecasts. Adj. PATMI increased 17% YoY to US$2bn due to higher operating leverage.

- For 2Q24e, Adobe expects adj. EPS of US$4.38 (up 12% YoY) on revenue of US$5.3bn (up 9% YoY). Digital Media segment revenue will grow 11% YoY led by higher subscription sales for its Creative Cloud and Document Cloud apps.

- Maintain REDUCE recommendation with an unchanged DCF target price of US$465 (WACC 7.3%, g 4%). No change to our forecasts, except for a one-off US$1bn termination fee related to the Figma deal. Adobe faces headwinds from increased competition and tough comparisons due to pricing actions. In addition, Firefly AI tools are unlikely to boost revenues until the end of this year as Adobe is currently focusing on enhancing customer engagement instead of immediately monetising generative tokens.

The Positives

+ Revenue beat top-end of guidance. In 1Q24, Adobe’s total revenue rose 11% YoY to US$5.2b, which came 1% ahead of the top end of company guidance. Revenue from the Digital Media segment grew 12% YoY to US$3.8bn, with Creative Cloud revenue growing to US$3.1bn (up 11% YoY) and Document Cloud growing to US$0.8bn (up 18% YoY). This growth was mainly fueled by continued demand for its photography and video editing applications (Photoshop and Illustrator) and Acrobat PDF and e-signature solutions. Management highlighted that Acrobat Web’s monthly active users, or MAUs, spiked 70% YoY and surpassed 100mn users in the quarter.

+ Margins continue to improve. Gross and adj. net profit margins expanded by 80bps and 200bps YoY, respectively. The margin improvement was mainly due to top-line upside and higher operating leverage, including careful sales and marketing spend. Adj. PATMI increased by 17% YoY to US$2bn.

The Negative

– Soft 2Q24e revenue guidance. For 2Q24e, Adobe expects total revenue to grow 9% YoY to US$5.3bn. Management highlighted that the slowdown is mainly because of tough comparisons as price increases over the last two years has started to roll-off. Meanwhile, the new pricing for Creative Cloud apps with Firefly AI tools would become a tailwind towards the end of FY24e as it hits larger customer base at renewals. In addition, Adobe faces increasing competition from startups such as Midjourney and OpenAI’s Dall-E, which offer gen-AI services similar to Adobe’s Firefly like generating images from text prompts.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU