Amazon - Stock Analyst Research

| Target Price* | 215.00 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 15 Feb 2024 |

*At the time of publication

Amazon.com Inc. - Improving efficiency through regionalization

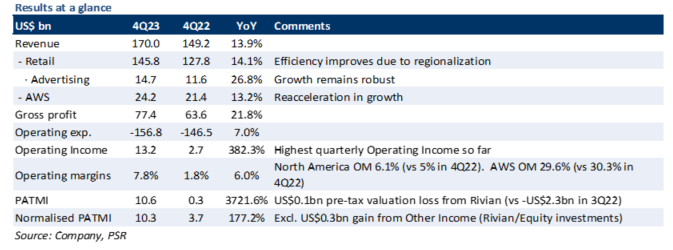

- 4Q23 revenue was in line with our expectation, while PATMI exceeded. The PATMI outperformance was due to cost efficiencies and higher operating leverage. 4Q23 Adj. PATMI grew ~3x YoY. FY23 revenue/PATMI was at 100%/111% of our FY23e forecasts.

- Operating income for 4Q23 grew ~5x YoY due to the benefits of network regionalisation in the US and strong advertising growth. Operating margin grew to 7.8%, an increase of 6.0% YoY.

- Due to higher operating leverage, we raise our FY24e PATMI by 58%. Our revenue forecast remains unchanged. We roll over an additional year of valuations and maintain our BUY recommendation with a raised DCF target price of US$215 (prev. US$190) to reflect our assumptions. Our WACC/growth rate of 6.4%/5% remains unchanged.

The Positives

+ Retail operating income was driven by regionalization and efficiency. AMZN’s retail operating income improved by 382% YoY. North American/International segment’s operation income increased from -US$0.2bn/-US$2.2bn in 4Q22 to US$6.5bn/-US$0.4bn in 4Q23, primarily driven by cost-cutting and lower transportation rates. North America benefit from regionalisation and expansion of last-mile delivery facilities, increasing same day deliveries by 65% YoY. Improved inventory placement drove faster deliveries and lowered transportation distances (cost to serve declined by >US$0.45 per unit). We foresee revenue growth to continue in the long term as lower costs lowers ASPs, improving affordability. This, together with faster delivery speed, should lead to greater purchase consideration & frequency.

+ Advertising growth remains robust. Advertising revenue grew 27% YoY in 4Q23, primarily driven by sponsored products with higher ads relevancy. AMZN benefits from being able to collect its own first-party data, and has been able to efficiently convert this data into more efficient and relevant ads for consumers, driving up ROI for advertisers. We believe advertising remains AMZN’s great growth opportunity as it has the ability to scale alongside its retail business, advertising only contributes 8% of the company’s total revenue presently.

+ AWS seeing stabilization in growth. AWS revenue was up by 13.2% YoY in 4Q23, compared to 12.3% and 12.2% YoY in 3Q23 and 2Q23. AWS revenue growth has dipped in previous quarters due to customers moderating their spending. The recent acceleration in growth rate suggests that this effect has bottomed out. Accelerated new deals and backlog conversion is expected to drive growth. Management has indicated that the acceleration in growth will continue into FY24, driven by accelerating demand in Gen AI. AWS’ order backlog grew ~40% YoY in 4Q23.

The Negative

– Nil.

About the author

Helena Wang

Research Analyst

PSR

Helena covers Hardware/Marketplaces/ETF. Helena graduated with a master degree in Financial Technology from Nanyang Technological University

About the author

Helena Wang

Research Analyst

PSR

Helena covers Hardware/Marketplaces/ETF. Helena graduated with a master degree in Financial Technology from Nanyang Technological University

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT) Apr 15th - Things to Know Before the Opening Bell

Apr 15th - Things to Know Before the Opening Bell Singapore REITs Monthly – Waiting for interest rate cuts

Singapore REITs Monthly – Waiting for interest rate cuts Apr 12th - Things to Know Before the Opening Bell

Apr 12th - Things to Know Before the Opening Bell