Salesforce Inc - No signs of demand slowing

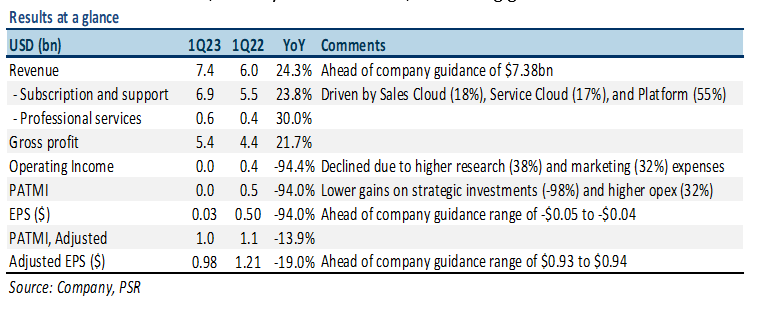

3 Jun 2022- 1Q23 results were in line with expectations. 1Q23 revenue/adjusted PATMI was at 23% of our FY23e forecasts. Total revenue grew 24% YoY to US$7.4bn, due to 18%/17% YoY increases in core Sales Cloud and Service Cloud services that was driven by organic innovations, including revenue intelligence feature.

- Future contracted revenue or remaining performance obligations (RPO) grew by 20% YoY to US$42bn. Multi-cloud adoption continued to increase as the number of deals involving five or more of Salesforce’s clouds grew 21% YoY. The digital transformation related spending by enterprises is driving growth across all Clouds.

- We maintained a BUY recommendation with a DCF target price of US$253.00 (WACC 6.1%, g 4%). We nudge lower our FY23e revenue by 1% due to projected US$300mn incremental foreign exchange headwinds. Salesforce is not experiencing a material impact on its business from macroeconomic challenges as indicated by significant future contracted revenues, healthy Free Cash Flow, and strong guidance for FY23.

The Positives

+ Demand remains robust. Revenue grew 24% YoY to US$7.4bn, beating consensus estimates for its top line by 1%, and was in line with our estimates. The growth was due to strength in both Sales Cloud (18%) and Service Cloud (17%) offerings that was driven by organic innovations. Platform, which includes messaging platform Slack, rose 55% YoY to US$1.4bn – the fastest growth of any segment in 1Q23. This was the fourth consecutive quarter of 45%-plus growth in customers spending over US$100K with Slack annually. Slack generated revenue of US$348mn (25% of Platform) in the quarter compared with the company’s guidance of US$330mn.

+ Leading business indicators remained strong. RPO, which consists of future revenue that is under contract but hasn’t been recognized, grew by 20% YoY to US$42bn. The current portion of RPO (cRPO), which the company expects to be recognized in the next 12 months jumped to US$21.5bn, a 21% YoY increase. This highlights a strong demand environment for its software from companies looking to build better customer relationships to boost retention and sales. Salesforce hasn’t seen any meaningful impact on its business due to continued macroeconomic challenges, including rising interest rates and inflation.

+ Multi-cloud momentum was solid. Multi-cloud adoption continued to increase as the number of deals involving five or more of Salesforce’s clouds grew 21% YoY. This indicates that the demand for the Customer 360 platform remained strong. The Customer 360 platform connects all client data across sales, service, marketing, commerce, and IT departments on one integrated CRM platform. Also, attrition remained at record low levels of 7.0-7.5%.

The Negatives

– FX headwinds impacting revenue growth. Given the stronger USD, Salesforce’s reported growth rates were impacted by foreign exchange headwinds. The company had initially forecasted a negative foreign exchange impact of US$300mn for FY23, but now expects a negative foreign exchange impact of US$600mn, an increase of US$300mn.

Outlook

Salesforce reduced its sales forecast for FY23 while boosting its earnings forecast. The company now expects total revenue to be in the range of US$31.7bn to US$31.8bn compared with the previous guidance range of US$32bn to US$32.1bn, implying 20% YoY growth. The revenue guidance reduction was mostly attributable to a projected US$300mn incremental FX headwinds instead of weakening demand.

Salesforce now expects adjusted EPS to be in the range of US$4.74 to US$4.76, up from the previous guidance range of US$4.62 to US$4.64, mainly driven by a disciplined spending approach and an increased focus on profitability (slower pace of hiring). The company also expects GAAP and adjusted operating margins of about 3.8% and 20.4% respectively for FY23.

Cash flow generation continues to be strong, with the company generating about US$3.5bn in Free Cash Flow, ending 1Q23 with US$6.9bn in cash and cash equivalents.

Maintain BUY with lower TP of US$253.00 (prev. US$258.00)

We reduced our FY23e revenue by 1% due to projected US$300mn incremental foreign exchange headwinds. We maintain BUY with a lower target price of US$253.00. Valuations are based on DCF with a WACC of 6.1% and terminal growth of 4.0%. We believe Salesforce should continue to benefit from its broad product portfolio, customer stickiness, and digital transformation related spending by businesses.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)