Salesforce Inc - Stock Analyst Research

| Target Price* | 323.00 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 7 Mar 2024 |

*At the time of publication

Salesforce Inc - Further margin expansion

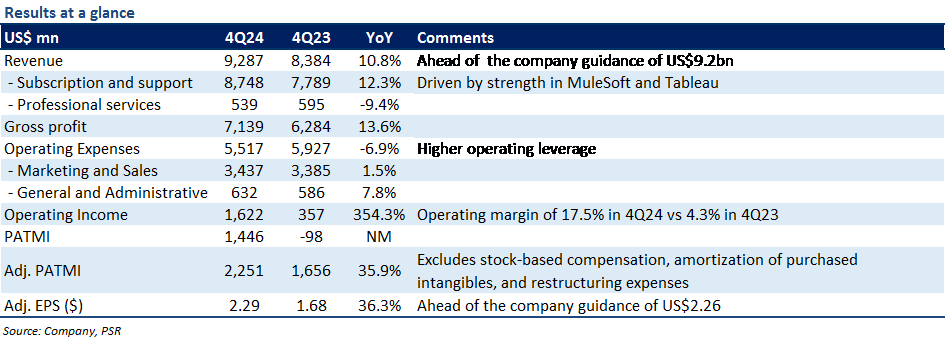

- FY24 revenue/adj. PATMI met our expectations at 100% of our forecasts. 4Q24 adj. PATMI jumped 36% YoY to US$2.3bn driven by higher operating leverage.

- For FY25e, Salesforce expects revenue to grow 9% YoY to US$37.9bn driven by strong momentum in its MuleSoft and Tableau offerings. Adj. EPS expected to grow 18% YoY to US$9.7 led by cost-containment efforts. Salesforce declared its first-ever quarterly dividend of US$0.40 per share and increased its share buyback program by US$10bn.

- We maintain ACCUMULATE with a raised DCF target price of US$323.00 (prev. US$270.00) as we roll over an additional year of valuations. Our WACC/g assumptions remain unchanged at 7%/4%, respectively. We nudge lower our FY25e revenue estimates by 1% to account for FX headwinds and declining professional services revenue, while we increase our adj. PATMI by 3% due to lower expenses. Catalysts include continued margin expansion, focus on maximising shareholder returns, and resilient demand for its Customer 360 cloud offerings as companies look to form a more holistic view of their customer data to provide better customer experiences.

The Positives

+ Multiproduct deals continued to drive growth. 4Q24 revenue grew 11% YoY (10% in constant currency) to US$9.3bn, 1% above the top end of company guidance, driven by higher subscription sales. On a product level, Sales/Service Cloud demand remained resilient with revenues growing by 10%/12% YoY to US$2.0bn and US$2.2bn, respectively. Integration and Analytics revenue delivered robust growth of 21% YoY to US$1.6bn, driven by strength in MuleSoft and Tableau offerings. Management highlighted that the number of large enterprise deals (those greater than US$10mn) grew by 78% YoY, with over 86,000 multiproduct deals. This was mainly driven by continuous product enhancements and its pricing and product bundling strategies. For instance, Salesforce Starter suite bundles Sales, Service, and Marketing tools together in one platform leading to significant surge in average sales price.

+ Margins continue to improve. Gross and operating margins expanded by 200bps and 1,300bps YoY, respectively. Operating income spiked more than 4-fold to US$1.6bn. The margin improvement was mainly due to top-line upside and higher operating leverage (OPEX down 7% YoY) from prudent headcount control and lower sales-related costs. In FY23, Salesforce cut jobs by 10% and closed some offices.

The Negative

– FY25e revenue guidance below our forecast. For FY25e, Salesforce expects total revenue to grow 9% YoY to US$37.9bn at the midpoint, which was below our estimate of US$38.6bn. This was because the company expects foreign exchange currency rates to negatively impact its revenues by US$100mn. In addition, Salesforce’s professional services business (revenue down 9% YoY in 4Q24) is expected to continue to be impacted due to the compression of larger transformation deals.

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83) Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)