CapitaLand Integrated Commercial Trust - Containment measures slowing recovery

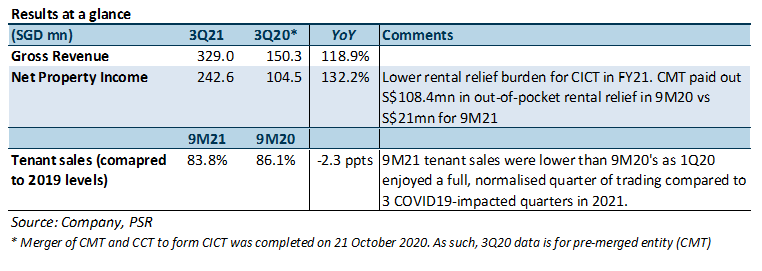

25 Oct 2021- 9M21 revenue and NPI in line at 71.9% and 74.6% of our FY21e forecast respectively.

- Improving tenant sentiment and leasing enquiries, but operating metrics dampened by tightened restrictions in 3Q21, affecting physical viewings and tenant sales.

- Maintain ACCUMULATE and DDM-based (COE 6.27%) TP of S$2.54. Stock catalysts expected from further asset enhancement initiatives and portfolio reconstitution.

+ Positive

+ Tenant sentiment recovering. 9M21 retail reversions improved to -8.0% from -9.6% as at 6M21, -3.8% and -14.3% for suburban and downtown malls respectively. Average incoming vs average outgoing rents have also narrowed QoQ from -4.4% to -3.5%. Tenant sentiment continues to recover, with positive reversions for some suburban leases. New to market/portfolio and expansions account for 65.5% and 34.5% of 3Q21 retail leases, of which F&B and Beauty & Health account for 62.3% and 15.5%. Office leasing enquiries grew 1.3x QoQ, driven by expansion (38%), relocation (32%), consolidation (23%) and new set-up space (7%) enquiries. 5.4%/26.3% of office expiries by GRI remain for FY21/22. CICT has begun renewal discussions for 19.4% of FY22 expiries. CICT continues to sign leases above market rents although 9M21 reversions still in the negative single digits.

– Negative

– Tightened restrictions dampened leasing, depressing occupancy. Softer leasing due to the two-pax group size during the second P2HA and stabilisation phase have reduced physically viewings. Retail occupancy dipped QoQ from 97.0% to 96.4% due to Atrium@Orchard (-2.1ppts), Clark Quay (-2.6ppts) and Bugis+ (-2.8%). 9M21 tenant sales dipped to 83.8% of 2019 levels (6M21 86.3%) due to tightened restrictions. Slight decline in office occupancy QoQ from 93.0% to 92.6% due to downsizing at CapitaGreen (-3.6%) and Asia Square Tower 2 (-1.9%).

Outlook

Leasing continues to recover although dampened by the containment measures. Office physical occupancy remains low at 15.7%. Relaxation of safe management measure and return to office should provide an uplift for tenant sales and carpark revenue.

Committed occupancy at CapitaSpring continues to creep up, landing at 83.1% as at end-Sep21, with another 7.2% of leases under advance negotiation. Majority of tenants are expected to move in and begin contributing to income in 2H22. CICT is repositioning Raffles City to an upscale shopping destination and has garnering good interest from prospective fashion, beauty and lifestyle retailers. AEI works to reconfigure the space previously occupied by Robinsons into smaller units and improved vertical connectivity within the mall are expected to be completed in 4Q22. Plans to reposition Clark Quay are still under discussion.

CICT granted S$19mn in rental rebates for 1H21, equivalent to 0.3months in rent waivers. The management is forecasting another c.$10mn for 2H21. Our FY21e DPU forecast of 10.19 Scnts factors in a more conservative 1 month of rental rebate for FY21 versus the management’s current estimate of c.0.5 months.

Maintain ACCUMULATE and DDM-based TP of S$2.54

No change in our forecasts. Current share price implies 4.8%/5.6% FY21e/22e DPU yields. Catalysts could include stronger-than-expected sales growth, asset enhancement initiatives to unlock value and portfolio reconstitution.

Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained