Del Monte Pacific Limited - Stellar 38% earnings growth

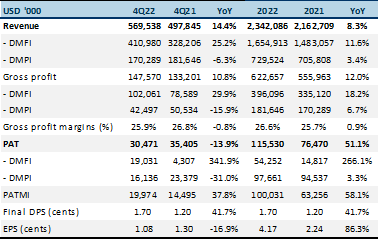

27 Jun 2022- 4Q22 PATMI jumped 38% YoY. The results were better than expected. FY22 revenue and PATMI were 101%/105% of our FY22e forecasts. Despite a one-off US$2mn stock compensation, the 4Q22 earnings beat was from lower operating expenses. Final dividends up 42% YoY to 1.70 cents.

- US subsidiary DMFI registered a 4-fold jump in PATMI in 4Q22 to US$19mn. Gross margins recovered QoQ from 21% to 25% due to higher selling prices and new products contributing 5% to revenue.

- Consumer staples are enjoying a lift in demand as US households dine more at home as food inflation escalates. The Philippines is expected to remain weak with consumers shifting away from less essential canned fruits. EPS will also benefit from lower interest expenses and preference dividends. We maintain our BUY recommendation with a higher TP of S$0.69, from S$0.63. Despite a cut in gross margin assumption, our FY23e PATMI is raised by 9% from lower operating expenses. Our TP is pegged to 10x FY22e P/E, a 30% discount to the industry valuation due to its smaller market cap and higher gearing. Del Monte valuations are attractive at 5x PE FY23e and pay a 6% dividend yield.

Results at a glance

Source: Company, PSR

The Positives

+ Del Monte Foods Inc (DMFI) rebounds in margins and profitability. DMFI revenue jumped 25% YoY to US$411mn. Revenue was supported by a surge in packaged vegetable sales as DMFI expands into new channels, including convenience stores, natural food, club stores and food service. Households are looking for value and quality home meals, replacing their spending on restaurants as inflation picks up nationwide.

+ Refinancing expensive preferential shares and high yield debt. In April 22, US$200mn 6.625% preference shares were refinanced by Del Monte with senior fixed-rate debt (3.75%) and floating-rate loan (3.8%). The estimated savings in dividends is around US$6mn.

In May 22, DMFI raised a US$600mn 7-year term loan at a floating 4.75%. The funds were to refinance US$500mn 11.875% Senior Secured Notes. The early redemption of the high yield notes cost a one-off US$70mn*, to be incurred in FY23. Annual cash savings is US$20mn-30mn.

*US$45mn cash commitment fee, US$24mn non-cash write-off of deferred financing cost and US$1mn commitment fee

The Negatives

– Weakness in the Philippines. Revenue in the Philippines declined 6% YoY with earnings dropping a larger 31%. Packaged or mixed fruit suffered the largest drop, a 31% YoY fall to US$22mn in the Asia Pacific. Consumers are faced with surging inflation in the Philippines. There is a shift in consumer priorities to essential items, away from special occasion or less-essential food such as canned mixed fruit or packaged fruit.

– Elevated capex. Free cash flow generated in FY22 was US$66mn, a decline from prior years’ US$163mn. A large drain in operating cash flow was the additional US$135mn in inventory to stock up on raw materials as a hedge from rising prices. Capex also rose by US$39mn to US$202mn. The higher capex is to expand the planted area for pineapples, increase manufacturing capacity and new packaging capabilities (eg Joyba Bubble Tea multipacks).

Outlook

We see multiple drivers for earnings growth in DMFI, namely new products, more distribution channels, higher prices, cost optimization and food inflation driving more home dining. DMFI has built a broad pipeline of products to suit consumer preferences for value and wellness (Figure 1). The recovery in the Philippines will be slower as inflation shifts consumption patterns to more staples. Recovery will come from convenience and food services channels as foot traffic returns with lockdowns being eased

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)