Del Monte Pac - Stock Analyst Research

| Target Price* | 0.400 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 15 Mar 2023 |

*At the time of publication

Del Monte Pacific Limited - FX and weak festive spend a drag

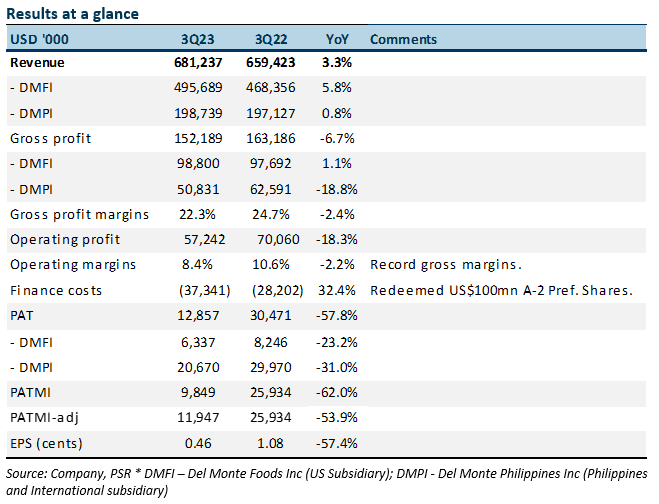

- 3Q23 earnings were below expectations. 9M23 revenue and PATMI was 73%/67% respectively of our forecast. Gross margins contracted much larger than expected.

- The weakness in earnings was due to a 12% decline in the Philippine peso and disappointing festive demand in China and the Philippines.

- We cut our F23e earnings by 18% to adjusted US$101mn. Del Monte remains a market leader in multiple consumer products in the US and the Philippines. Gross margins will remain subdued. Price increases have slowed and higher-priced inventory is hurting margins. The huge inventory post-festive period of $1bn raises the risk of write-offs. We maintain our BUY recommendation and cut our target price to S$0.40 (prev. S$0.67), pegged to 6x FY23e P/E, a 50% discount to the industry valuation due to its smaller market cap and higher gearing. Del Monte valuations remain attractive at 4x PE FY23e and an 8% dividend yield.

The Positives

+ Market shares maintained. Del Monte maintained market share in most product categories. In the US, market share in fruit cup snacks and canned fruits and vegetables was retained at 22-30%. Dominance in the Philippines was unchanged – packaged pineapple (95.7%), tomato sauce (84.6%), canned mixed fruit (74.9%) and RTD juice ex-foil pouches (45.5%).

The Negatives

– Double whammy in Asia. 3Q23 revenue at DMPI was flat YoY. The two factors driving the weakness were; 1) 12% decline in the Philippine peso: In constant currency, revenue rose 13% YoY to PHP11.3bn, but a 12% decline in peso drove down revenue growth; 2) Weak festive sales: Demand for canned tropical fruit in the Philippines and fresh pineapple sales to China were below expectations. The volume bump during the holiday season did not occur. Phillipines suffered from weak consumer demand for discretionary items. The lockdown affected sales.

– Weak gross margins in the US. 3Q23 gross margins for US operations collapsed by 8 percentage points to 20.4%. The decline was a surprise despite price increases. The reason for the weakness was the higher cost inventory of raw materials being sold. For instance, in 1H23 sales, 70-80% of the inventory was procured in FY22. Other costs remain elevated such as energy and fuel.

– Elevated inventory. Del Monte exited the festive period with a record US$1.14bn of inventory as of Jan23. The rise in value was in part due to inflationary pressure but inventory days have jumped to 204 days, compared to 149 days a year ago. We worry there is a risk of provisions with the huge jump in inventory.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Keppel Ltd - A slow quarter

Keppel Ltd - A slow quarter Frasers Centrepoint Trust - Robust operating performance in 1H24

Frasers Centrepoint Trust - Robust operating performance in 1H24 Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU