GOOGLE inc. - Stock Analyst Research

| Target Price* | 154.00 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 2 Feb 2024 |

*At the time of publication

Alphabet Inc. - AI underpinning ad growth

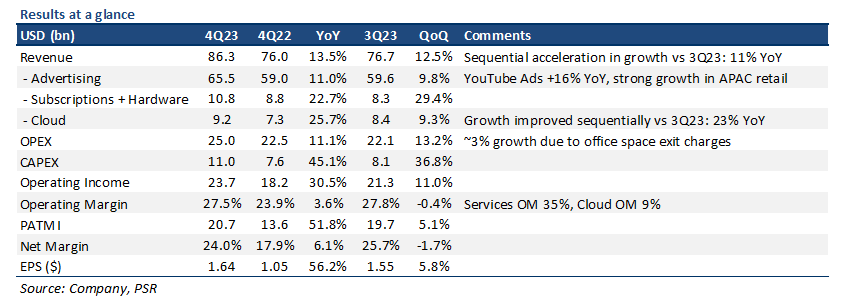

- 4Q23 results were within expectations. FY23 revenue/PATMI were at 100%/98% of our FY23e forecasts. 4Q23 PATMI grew 52% YoY on higher operating leverage.

- Advertising is still on the rebound, with 11% YoY growth improving sequentially for a 4th straight quarter. APAC retail strength was the standout again. FY24e CAPEX levels are expected to be significantly higher vs FY23 as GOOGL continues to scale its technical infrastructure to support AI development.

- We cut our FY24e PATMI by ~5% as a result of increasing R&D investments in AI. Due to recent price action, we downgrade to ACCUMULATE from BUY, but raise our DCF target price to US$154 (prev. US$144) as we roll-over an additional year of valuations, with an unchanged WACC of 7.3% and terminal growth rate of 3.5%. We expect GOOGL to remain the market leader in digital advertising by leveraging AI for product improvements and efficiencies, while also being well positioned to capture more eyeballs through YouTube and connected TV.

The Positives

+ Advertising continued to rebound; growth improved sequentially. Ad revenue in 4Q23 improved sequentially vs 3Q23 (9% YoY) to US$65.5bn (11% YoY), driven largely by Search (+13% YoY) and YouTube Ads (16% YoY). Retail strength in APAC was the standout, with small and medium businesses GOOGL’s fastest-growing channel. AI technology in products like Performance Max and Search Generative Experience continues to also drive higher conversions per dollar for advertisers, and incremental query growth from consumers. We expect AI to continue driving most of the gains in advertising by creating: 1) increasing ROI and value for advertisers; and 2) wider accessibility for customers like SMBs.

+ Monetisation on YouTube improving, with subscription momentum gaining traction. Continuing on from previous quarters, Shorts monetisation has been progressing well as viewership expands. Shorts currently has ~2bn MAUs and ~70bn average daily views. YouTube Music and Premium subscriptions are also scaling well, with an annualised run rate of US$15bn. The first season of NFL Sunday Ticket was the key driver for subscription growth. Although still a very small portion of its business, we anticipate ~20-25% YoY subscription growth in FY24e given the growing user base of YouTube on connected TV.

The Negative

– Significantly increasing FY24e CAPEX for servers and data centres to support AI work. GOOGL ended 4Q23 with US$11bn in CAPEX, a 45% YoY increase. It also expects “notably larger” levels of CAPEX in FY24e as it remains focused on developing its technical infrastructure (servers and data centres) to support AI development. We are modeling for a ~20% YoY increase in CAPEX for FY24e vs our previous estimates of ~6% YoY.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)