Keppel Corporation - Comparison of both offers for SPH

18 Nov 2021- Singapore Press Holdings (SPH SP, Non-rated) (SPH) and Cuscaden Peak (Cuscaden) have entered into an implementation agreement to privatise SPH via a scheme of arrangement, after Cuscaden raised its offer to $2.36-2.40 per share.

- We compared the two offers. Despite offering more certainty of deal completion and the shortest time to payout under Keppel’s offer, we believe SPH shareholders will likely go for Cuscaden’s offer as this provides a higher total consideration value and value certainty.

- Maintain BUY with unchanged SOTP TP of S$7.07. We valued the Group based on the four new segments unveiled during Vision 2030 to better reflect the Group’s reporting segments going forward. Our TP translate to about 1.0x FY22e book value, in-line with its 5-year average. Catalysts expected from SPH resolution and a successful resolution to its O&M unit.

The news

SPH and Cuscaden have entered into an implementation agreement to privatise SPH via a scheme of arrangement, after Cuscaden raised its offer to S$2.36-2.40 per share. Cuscaden’s offer comes with the optionality of a higher total value of the cash and SPH Reit consideration while continuing to participate in the potential future growth of SPH Reit and receive its distributions, or value certainty associated with an all-cash consideration.

Comparison of both offers

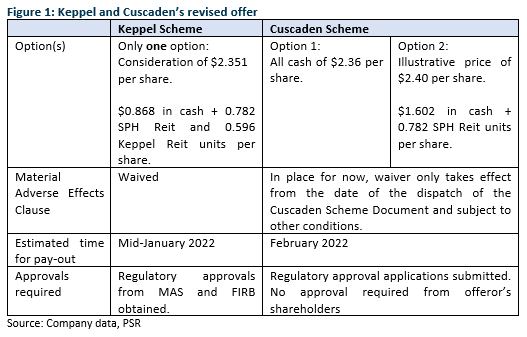

Keppel’s offer provides shortest time to payout. SPH will proceed to hold the Keppel scheme meeting on 8 December for its shareholders to vote on the offer. The scheme meeting to vote on the latest Cuscaden offer can proceed only if SPH shareholders vote against the Keppel scheme. If approved by both set of shareholders, Keppel expect the pay-out to be sometime in mid-January 2022 having obtained regulatory approvals from the Monetary Authority of Singapore and Australia’s Foreign Investment Review Board (FIRB).

Even though Cuscaden has guided for completion some time in February 2022, we note that Keppel took about three months to obtain the requisite approvals, which means that completion of the entire transaction might take slightly longer than the guided timeline.

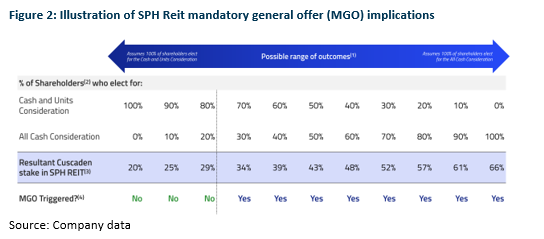

Cuscaden’s offer provides shareholders with more choice. The revised Cuscaden offer gives SPH investors a choice between value certainty with an all cash offer of $2.36 or the opportunity to participate in the potential future growth of SPH Reit with a part cash part share offer of $2.40, based on $1.602 in cash and 0.782 SPH Reit units per share. Depending on the final proportion of SPH shareholders electing to receive SPH Reit units, a chain offer for SPH Reit may

Figure 2 illustrate the different scenarios and represent the possible range of outcomes under the revised Cuscaden proposal. Under the Singapore Code on Take-overs and Mergers, an offeror must make an MGO if it, together with persons acting in concert with it, has acquired 30% of more of the voting rights of the company, whether as a single transaction or a series of transaction. With the cash and units consideration as the default option, this means that if 30% of shareholders elect for all cash consideration, an MGO will be triggered for all SPH Reit units at the minimum price of $0.964 each in cash.

Cuscaden’s offer is higher in value and value certainty. The revised Cuscaden offer is higher than the implied value of the Keppel scheme consideration of $2.351 per SPH share, based on the closing price for SPH Reit ($1.020 per SPH Reit unit) and Keppel Reit (S$1.150 per Keppel Reit unit) on 9 November 2021. Both the Cuscaden scheme consideration and Keppel scheme consideration will not be adjusted for SPH’s FY21 final dividend of $0.03 per share. Cuscaden’s offer will also not be adjusted for the $34mn break fee payable to Keppel.

Our view

Despite offering more certainty of deal completion and the shortest time to payout under Keppel’s offer, we believe SPH shareholders will likely go for Cuscaden’s offer as this provides a higher total consideration value and value certainty. Cuscaden’s offer also provides optionality to shareholders to participate in the future growth of SPH Reit or opt for an all-cash deal.

Outlook

The next catalyst investors should look out for is the proposed merger of Keppel O&M and Sembmarine (SMM SP, Non-rated). The timeline for the parties to reach an agreement has been extended to the 1Q22 from 4Q21. While nothing has been firmed up, we view the discussions positively as it provides better clarity on the fate of its O&M unit. With the overhang removed, along with the planned divestment of its logistics unit, we believe Keppel will be re-rated.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)