Keppel Corporation - Tranforming into asset light recurring income business model

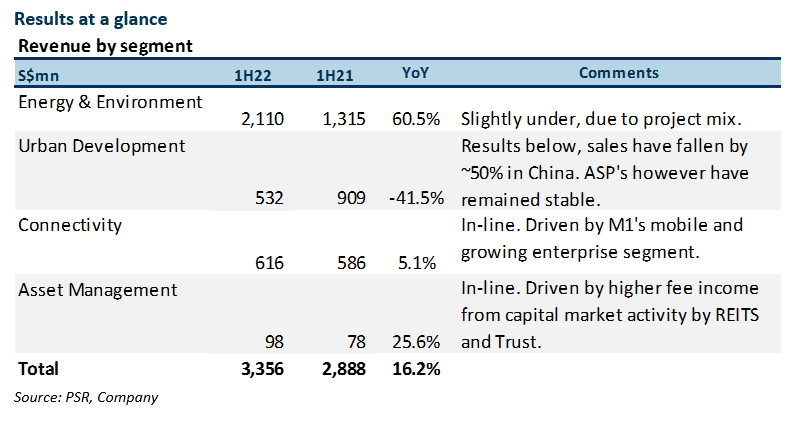

1 Aug 2022- 1H22 net profit below expectations, at 43% of FY22e profit but interim dividend of 15 cents exceeds expectations. Net profit of $498mn (+66% YoY) was slightly under our expectations as Urban Development dragged due to headwinds from China’s property market.

- $710mn of assets monetised YTD, on-track to hit $5bn target by end-2023. However, we expect that the Group will cross the $5bn mark by 1Q23 should the proposed O&M transactions be completed on schedule in 4Q22.

- We welcome the bolder statements made on Keppel Land’s transformation to be asset-light. We believe this will not only crystalise the value of its landbank, but it will also allow the Group to re-invest the proceeds into new growth areas and share some of the gains with shareholders through dividends.

- Maintain BUY with higher SOTP TP of $8.95 (prev.$7.07). We revised our valuation on Keppel O&M (KOM) and Keppel Land after greater clarity on its monetisation path. We valued the Group based on the four new segments unveiled during Vision 2030 to better reflect the Group’s reporting segments going forward. Our TP translates to about 1.2x FY22e book value, a slight premium to its historical average as the Group’s transformation plans gain traction and ROE expands to 8.8%. Catalysts expected from approvals obtained for the transaction.

Positives

+ 1H22 net profit below expectations, at 43% of FY22e profit but interim dividend exceeds expectations. Net profit of $498mn (+66% YoY) was slightly under our expectations as Urban Development dragged due to headwinds from China’s property market. Interim dividend of $0.15, came ahead of our expectations of $0.12, which we believe reflects management’s confidence in FY22’s outlook. We revise FY22e dividend to $0.33 from $0.29 with the payout ratio at 55% of earnings unchanged.

+ $710mn of assets monetised YTD, ontrack to hit $5bn target. The $710mn of assets monetised YTD brings the cumulative amount announced to $3.6bn since October 2020. Management remains confident of exceeding its $5bn target by end-2023. We expect the conclusion of the proposed O&M transactions, still on track for completion by end-2022, to move the Group past its $5bn target.

+ Bolder statement on transformation of Keppel Land. We welcome the management’s bolder statements on its plan forward for its Urban Development business. As part of its asset-light strategy, the Group has set out its plan to accelerate landbank monetisation in China and Vietnam in the next 1-2 years. We believe this can also be done through injections into Keppel-managed funds.

Transformation of Keppel Land into an asset-light urban space solutions provider will accelerate the growth of the Group’s recurring income (40.6% of 1H22 net profit vs. 35% FY19). The move is in line with its asset-light strategy established in Vision 2030. It will also accelerate the growth of the Group’s recurring income closer to our longer-term target of 60% which we have modelled.

Negatives

+ Headwinds in China property market weigh on Keppel Land’s China property sales. Keppel Land’s 1H22 China sales fell by ~69%, which is a steeper drop than most of the largest developers in the market, who have seen an average 50% drop (Figure 2). For FY22e, we do not expect any impairments for its China property business as ASPs have remained stable and the cost of its landbanks are also cheap. ASPs have largely held up as most of its projects are located in key cities across China. Its landbank, which have an average age of seven years, is also at a much lower price than the market value today.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)