Netflix Inc - Stock Analyst Research

| Target Price* | 640.00 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 22 Apr 2024 |

*At the time of publication

Netflix Inc. - Pricing power on display

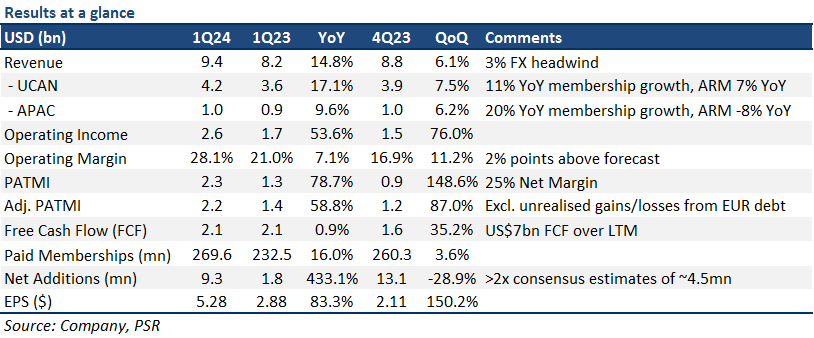

- 1Q24 revenue was in line with our estimates, while PATMI was above due to higher operating leverage. 1Q24 revenue/PATMI was at 25%/33% of our FY24e forecast.

- 1Q24 net additions of 9.3mn were driven by 11%/19% YoY growth in the US/EU, demonstrating NFLX’s ability to raise prices and volume simultaneously. FY24e OM was revised up to 25% (from 24%), with commentary indicating a focus on growing margins.

- We raised our FY24e PATMI by 9% on higher margins due to better-than-expected membership growth and a faster-growing ads business. We maintain ACCUMULATE with a raised DCF target price of US$640 (prev. US$570). NFLX remains our top choice for streaming entertainment given its pricing power, scale, growing membership base, huge advertising opportunity and strong cash flows compared to its peers. Our WACC/growth rate assumptions remain the same at 12.2%/3%, respectively.

The Positives

+ Better-than-expected membership additions despite price hikes. NFLX outperformed consensus expectations with 9.3mn net additions in 1Q24, driven by an 11%/19% YoY growth in its US/EU membership base – reaffirming our investment thesis of its undoubted ability to grow both volume and prices (NFLX increased prices in its US/EU markets mid-4Q23). As a result, revenue growth accelerated to 15% YoY (18% YoY FX neutral). We expect net additions for FY24e to remain fairly resilient (~24mn) due to: 1) continued momentum in Paid Sharing (converting password borrowers) and 2) higher take-up of its lower-priced ads plan. NFLX also translated its subscriber outperformance into a 79% YoY increase in PATMI, showcasing an increase in operating leverage – it beat consensus estimates on its bottom line by ~25%.

+ Rapid scaling of its ads business. NFLX continues to scale its ads business rapidly, growing its ad tier membership base 65% QoQ to ~40mn members (~14% of NFLX’s total membership) in 1Q24. Ad inventory has increased, while engagement and CPMs still remain strong. Its ads business is currently under-monetised due to existing supply-demand dynamics, although we expect this to ease as more advertisers come on board – NFLX’s ads business started in 4Q22.

+ Positive FY24e guidance indicating further margin expansion. NFLX revised its FY24e operating margin target to 25% (prev. 24%), which would be a 4% point increase vs FY23. NFLX’s commentary surrounding margins also suggests that the capital-intensive portion of building out its business is behind them, with a clear focus on margin expansion ahead. We expect the company to manage this by pulling on its three main levers: 1) organic membership growth through more engaging content, 2) increasing pricing, and 3) driving higher margin advertising revenue while maintaining current cash content spend levels.

The Negative

– Nil.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L)