Nvidia - Stock Analyst Research

| Target Price* | USD 970 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 23 Feb 2024 |

*At the time of publication

Nvidia Corp. – More upside from AI demand

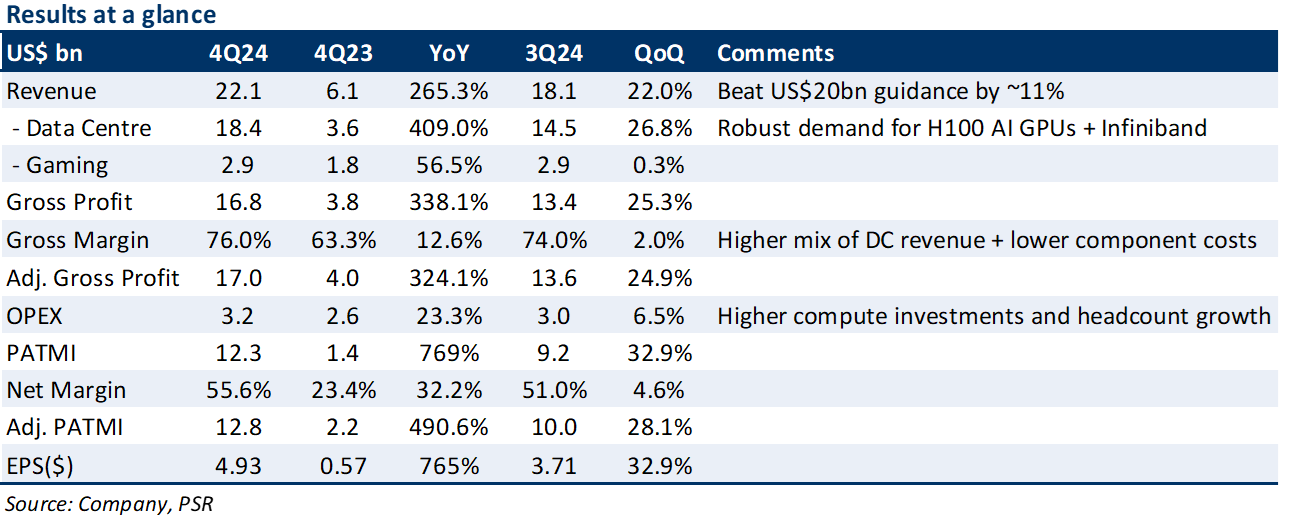

- 4Q24 results exceeded expectations. Revenue beat NVDA’s own guidance by 11%, and PATMI jumped >8x YoY. FY24 revenue/PATMI was at 103%/108% of our FY24e forecasts.

- Data Centre (DC) revenue growth accelerated (409% YoY), driven by: 1) >5x YoY increase in demand for its H100 AI GPUs; 2) 3x YoY increase in network revenue from Infiniband. Forward guidance of 200+% YoY revenue growth and expanding gross margins (76.3%) in 1Q25e, indicating continued strength. We expect 1Q25e DC revenue to surpass US$20bn.

- We raise our FY25e revenue/PATMI by 29%/35% to reflect continued demand for Data Centre products. NVDA dominates (~90% share) AI GPUs that are growing 5x YoY, with demand driven by a global shift to accelerated computing for more intense workloads (Gen AI/LLMs). We maintain a BUY rating with a raised target price of US$970 (prev. US$685) as we roll over an additional year of valuations. Our WACC/g is unchanged (6.8%/4.5%).

The Positives

+ AI demand still exceptional, driving outperformance. Revenue of US$22.1bn beat guidance again by ~11%, with most of the outperformance driven by DC gains (409% YoY). Demand from consumer internet companies (META, GOOGL, etc.), Cloud Hyperscalers (CSPs), and sovereign nations remain robust, with NVDA also seeing growth across various industries – auto, healthcare, and financial services. Supply is improving, although it is still unlikely to meet the excess demand for high-spec AI GPUs anytime soon. Near-term demand remains supported by transition to accelerated computing for Gen AI applications (recommender systems), inferencing LLMs (ChatGPT, Gemini, etc.), expanding sovereign AI infrastructure.

+ Gross margin beat by 150bps, forward guidance pointing to more upside. NVDA’s gross margin (76%) continued to improve for the 6th quarter. Driven by higher-margin DC revenue mix (83% of total revenue) and lower component costs, which are expected to flow into 1Q25e, NVDA guided to a 76.3% gross margin. Prior to FY24, gross margins had historically been ~60%. NVDA also guided 1Q25e revenue to US$24bn +/- 2%, implying a 234% YoY improvement driven predominantly by DC (H100 + Infiniband). We expect DC revenue to easily cross US$20bn as NVDA works through improving supply to fulfill its order backlog.

The Negative

– China is still a question mark. US export restrictions were a significant headwind, with DC revenue from China (incl. Hong Kong) dropping to ~5% of total DC revenue in 4Q24 from ~22% in 3Q24. NVDA began shipping its lower-spec H20 GPU chips for market sampling, although management did not seem too optimistic about competing with local Chinese semicon companies like Huawei, given the ceiling imposed on GPU specifications.

Outlook

Guidance: NVDA guided to 1Q25e revenue of US$24bn (+/- 2%), implying a further acceleration in YoY growth. Gross margins were guided to 76.3%, a sequential 30bps expansion due to a more favourable shift in mix to higher-margin DC products and lower component costs. Gross margins are expected to contract for the rest of FY25e to 73-74% as the benefits from lower component costs fade. Operating expenses are expected to increase 40% YoY.

Outlook: Robust near-term growth expectations look sustainable with demand far outpacing supply. NVDA dominates the AI GPU market (~90% market share) with multiple growth drivers from 1) increasing investments from enterprises for training and inferencing LLMs, deep learning, recommender systems, and generative AI applications; 2) hyperscale CSPs expanding into new market opportunities; 3) sovereign nations building their own AI infrastructure to; and 4) growing AI adoption across multiple industries – auto, healthcare, industrial, telco, etc. In addition, NVDA has a strong product lineup for FY25e (H200, B100, Spectrum-X, etc.), each of which are expected to drive incremental growth in ASPs and margins.

The main risks to growth remain: 1) inability to compete with other Chinese manufacturers on its H20 chips, market share may be permanently lost; 2) insufficient supply to meet the growing demand for high-end GPUs and components as the world transitions towards higher accelerate computing.

RULE OF 40

The “Rule of 40” was first introduced as a benchmark to measure the balance between the growth and profitability of SaaS companies, taking into account both revenue growth as well as profitability (Revenue Growth + EBITDA Margins), with the addition of both metrics needing to exceed the 40% threshold. We have modified this slightly by averaging revenue growth over a

3-year period compared with just a single period growth rate. Adding together NVDA’s 3-year average revenue growth of 54% and its EBITDA margin of 63%, the total of 117% is more than our required threshold of 40% (Figure 2).

Maintain BUY with a raised target price of US$970 (prev. US$685)

We raise our FY25e revenue/PATMI by 29%/35% to reflect continued demand for Data Centre products. NVDA dominates (~90% share) AI GPUs that are growing 5x YoY, with demand driven by a global shift to accelerated computing for more intense workloads (Gen AI/LLMs). We maintain a BUY rating with a raised target price of US$970 (prev. US$685) as we roll over an additional year of valuations. Our WACC/g is unchanged (6.8%/4.5%).

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)