SATS Ltd - Operations bottomed but recovery subdued

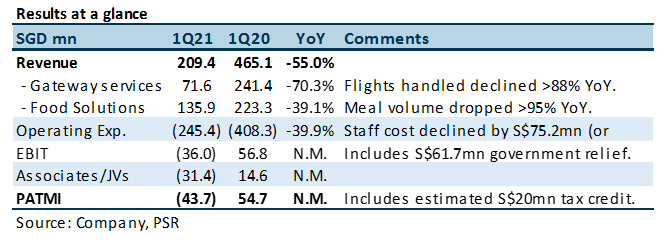

25 Aug 2020- 1Q21 results were within expectations. Revenue declined 55% YoY to S$209mn with a net loss of S$43mn in 1Q21.

- The net loss was after tax credit and government relief of totalling around S$80mn.

- Operationally the airport traffic has bottomed but any recovery will be tepid. We maintain our SELL recommendation with an unchanged target price of S$1.95. Our valuations are pegged to P/B average of 1.35x during the global financial crisis in 2009. The trajectory for any meaningful recovery in air traffic is uncertain and prolonged.

The Positives

+ Restructuring staff cost. Staff cost excluding the S$61.7mn government relief was cut by around 32% YoY in 1Q21. The number of employees has been lowered by 19% YoY to 13,500.

+ Cargo is relatively stronger. Cargo segment has performed relatively better than other segments. Cargo handled declined 51% to 221k in 1Q21, in comparison passengers handled tumbled 99% to 0.2mn.

The Negatives

– Associates a major source of weakness. With government relief, SATS suffered an operating loss of S$36mn. It was comparable to the S$31mn losses by associates and joint venture. China was the largest drag to associates. The closure of Beijing Daxing Airport was a reason for the losses in China.

Outlook

FCF in 1Q21 was a negative $71mn. With a cash balance of S$723mn (net debt: S$152mn), SATS can easily ride out the current downturn or another 10 quarters of the similar level of FCF cash burn-rate. SATS has likely bottomed out operationally but we worry such listless conditions may persist for another three to four quarters.

Maintain SELL with a target price of S$1.95

Without any clarity of a sustainable and material improvement in air travel and net losses to persist for the company, we maintain our SELL recommendation with an unchanged target price of S$1.95. Our forecast is unchanged.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell