Sembcorp Industries Ltd - Surprised losses from SGPL

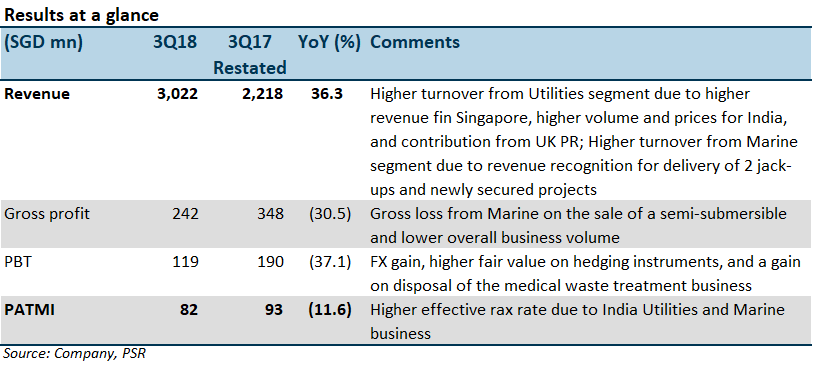

8 Nov 2018- 3Q18 revenue exceeded expectation, but net profit missed due to the widened loss from SMM.

- Utilities China performed well while utilities Singapore suffered from thin spark spread.

- Utilities India was less profitable QoQ due to widened losses from SGPL again.

- Marine segment continued to weigh on the group’s performance.

- We lowered our FY18e EPS from 17.7 SG cents to 17.1 SG cents, due to the prolonged losses from SMM. After incorporating a lower target price of S$1.65 for SMM, based on sum-of-the-parts method, we maintain our call to BUY with a lower target price of S$3.60 (previously S$3.70).

The Positives

+ Utilities’ China operation performed well: In 3Q18, net profit from China arrived at S$21.8mn (+10.1% YoY) due mainly to the contribution of the Changzhi water treatment plant and higher plant load factor (PLF) of SongZao thermal power plant.

The Negatives

– Utilities’ Singapore operation dropped: In 3Q18, net profit from Singapore was S$46.5mn (down 9.3% YoY). According to the management, its wholesale business suffered from negative profit margins due to lower spark spread and higher operating expenses. Its retail division had modest positive margins owing to contributions from steam, water, and waste-to-energy business.

– Utilities’ India remained profitable, but SGPL incurred losses again: In 3Q18, net profit from Utilities’ India operation was S$29mn (2Q18: S$39mn), resulting from the widened losses from SGPL offsetting the outstanding performance of SGIL, see Figure 1. The spurt of net profit in SGIL was due to higher power selling prices and the settlement with O&M contractors (c.S$19mn). In 2Q18, the actual losses from SGPL were $S3mn which was offset by the reversal of costs of S$11mn. However, the widened costs in 3Q18 were attributable to seasonality (higher supply of hydro power) and higher coal prices. The growth of coal prices outpaced that of spot tariff for SGPL. Meanwhile, it is expected that one of the units in SEIL will be shut down for equipment inspection in 4Q18. But the group has business interruption insurance to cover (if the suspension lasts for more than 21 days, it will cover the net profit).

Figure 1: SGPL turned loss-making again

– Marine segment continued to oppress the group’s performance: Sembcorp Marine (SMM) reported net losses of S$29.8mn. The net order book continues to decline (3Q18: S$6.4bn vs FY17 (restated): S$8.4bn). Work volume will remain low, and margins are compressed. Operating losses are expected for a few more quarters.

Outlook

Management guided Utilities’ India will deliver profitable full year results for FY18. However, 4Q18 tend to be a low wind season, and some outages are expected for the upcoming quarter. Therefore, performance from India will be weaker. On the other hand, UK Power Reserve is expected to generate profits in 4Q18 and 1Q19, which can partially offset the integration losses incurred previously. Meanwhile, we do not expect to see a turnaround in profitability from SMM in the near term since market conditions remain soft.

Maintain BUY with a lower target price of S$3.6

We lowered our FY18e EPS from 17.7 SG cents to 17.1 SG cents, due to prolonged weak profitability from SMM. After incorporating a lower target price of S$1.65 for SMM, based on sum-of-the-parts method, we maintain our call to BUY with a lower target price of S$3.60 (previously S$3.70).

About the author

Chen Guangzhi

Investment Analyst

Phillip Securities Research Pte Ltd

Guangzhi graduated from Singapore Management University with a Master degree in Applied Finance and from South China University of Technology with a Bachelor degree in Electronic Commerce.

The current sector coverages include Energy, Utilities, and Mining sectors. He has 3 years experience in equity research in both Hong Kong and Singapore market. He is the mandarin spokesperson for Phillip Securities Research in relation to China-related projects and all mandarin seminars and client events.

About the author

Chen Guangzhi

Investment Analyst

Phillip Securities Research Pte Ltd

Guangzhi graduated from Singapore Management University with a Master degree in Applied Finance and from South China University of Technology with a Bachelor degree in Electronic Commerce.

The current sector coverages include Energy, Utilities, and Mining sectors. He has 3 years experience in equity research in both Hong Kong and Singapore market. He is the mandarin spokesperson for Phillip Securities Research in relation to China-related projects and all mandarin seminars and client events.

Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)