StarHub Limited - Stable with roaming + cybersecurity optionality

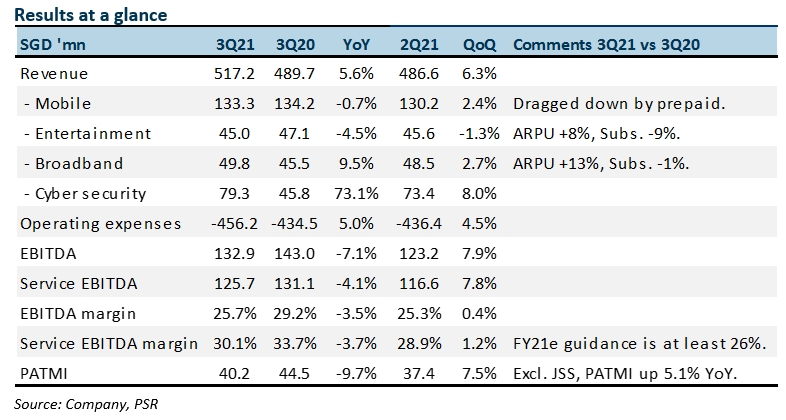

15 Nov 2021- 3Q21 results met our expectations. 9M21 revenue and EBITDA were at 72% and 80% of our FY21e forecasts respectively.

- Broadband and entertainment revenue trending ahead of our estimates due to increase in ARPUs. Mobile remains weak, dragged down by large churn in prepaid subscribers.

- 3Q21 cybersecurity operating profits more than doubled from S$2.8mn to S$5.8mn.

- No change to our forecasts. We maintain NEUTRAL with an unchanged target price of S$1.24. Valuations based on regional peers’ 6x FY21e EV/EBITDA. Starhub pays a stable 4% dividend yield with undervalued optionality in roaming and cybersecurity. There is upside to our target price if borders re-open faster, allowing roaming revenue to return. Another re-rating catalyst is sustained earnings from the cybersecurity operations or a corporate exercise for higher price discovery.

The Positives

+ Surge in operating profit in cybersecurity. 3Q21 revenue jumped 73% YoY to S$79mn. Operating profits spiked from S$2.8mn to S$5.8mn. The quarterly revenue run-rate improved from around S$40mn to S$70mn. There is revenue volatility due to project timing. But underlying demand is secular due to consistent threat intrusions, cyber-attacks and outsourcing of cybersecurity needs to established organizations such as Ensign.

+ Rising ARPU in broadband. ARPU jumped 13% YoY to S$34 on the back of reduced legacy promotions and higher 2GBps data plans with OTT bundles.

The Negative

– Mobile revenue is still soft. The loss of roaming revenue has capped postpaid ARPU at S$29, almost 30% below pre-pandemic S$40 (excluding the impact of SIM-only plans). This quarter experienced a huge 50k churn out of prepaid customers to 458k subscribers.

Outlook

Border re-opening especially in Malaysia and China will be key drivers for roaming revenue to return. Dividend guidance of a minimum of 5 cents per share or at least 80% PATMI is maintained.

Maintain NEUTRAL and TP of S$1.24

Our valuation remains based on regional peers’ 6x FY21e EV/EBITDA.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)