Singapore Banking Monthly – NIM improvement across the board

11 Aug 2022- July 3M-SIBOR was up by 51bps MoM to 2.02%, the highest in 7 years.

- 2Q22 results, banks’ NII rose 17% YoY as NIM improved by 8% with loans growth of 8%. Fee income was a drag, declining 10%. Banks raised their FY22e NIM guidance.

- Hong Kong’s domestic loans declined 2.34% YoY and 0.17% MoM in June. Malaysia’s domestic loans growth increased 5.61% YoY and 0.68% MoM in June.

- Maintain OVERWEIGHT. We remain positive on banks. Bank dividend yields are attractive at 5% with upside surprise due to excess capital ratios. Stable economic conditions and rising interest rates remain tailwinds for the banking sector. SGX is another beneficiary of higher interest rates. Pressure points for the banks will be higher staff costs and a nudge in general provisioning due to weaker economic assumptions.

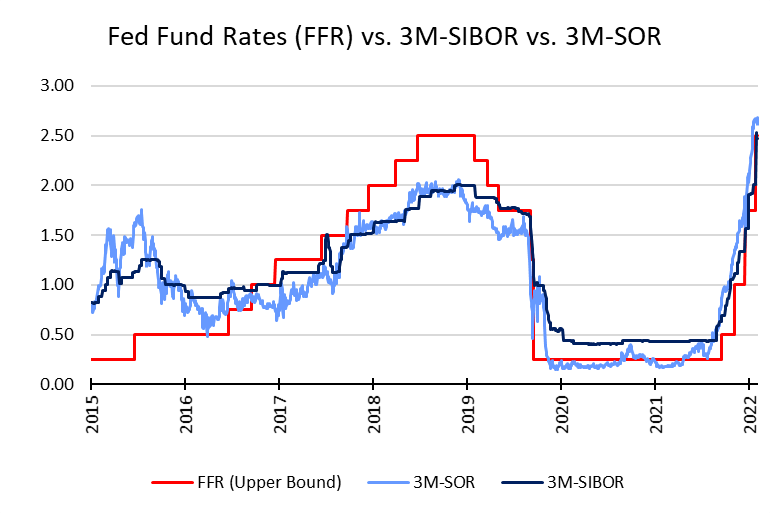

3M-SOR and 3M-SIBOR reach new highs in July

Interest rates continued to increase in July. The 3M-SOR was up 64bps MoM to 2.47%, while the 3M-SIBOR was up 51bps MoM to 2.02%. It is the highest interest rates have been for the past 7 years. The 3M-SOR is 103bps higher than its 2Q22 average of 1.44% and has improved by 228bps YoY. The 3M-SIBOR is 80bps higher than its 2Q22 average of 1.22% and has improved by 159bps YoY (Figure 1).

Figure 1: Interest rates reach new highs in July

Source: Bloomberg, PSR

2Q22 RESULTS HIGHLIGHTS

1.NII and NIM rise across the board

DBS’ 2Q22 earnings of S$1.82bn are in line with our estimates, and 1H22 PATMI is at 47% of our FY22e forecast. 2Q22 DPS is up 9% YoY at 36 cents, above pre-pandemic 33 cents. NII grew 17% YoY to S$2.5bn due to NIM increase of 13bps YoY to 1.53% and continued loan growth of 7% YoY. NIM improvement was mainly due to the rising interest rates as the impact of interest rate hikes was more fully felt. Management has lifted NIM guidance to 1.70-1.75% for FY22e (from 1.58-1.60%).

OCBC’s 2Q22 earnings of S$1.48bn were in line from higher net interest income, non-interest income and lower allowances. 1H22 PATMI is at 47% of our FY22e forecast. 2Q22 DPS rose 12% YoY to 28 cents. NII grew 16% YoY led by loan growth of 8% YoY and NIM improvement of 13bps YoY to 1.71%. NIM expansion was mainly due to asset yields outpacing higher funding costs amid a rapidly rising interest rate environment. OCBC has guided for NIM of 1.70% (from 1.5-1.55%) for FY22e.

UOB’s 2Q22 earnings of S$1,113mn were in line with our estimates due to higher net interest margin and healthy net interest income growth. 1H22 PATMI is 43% of our FY22e forecast. NII grew 18% YoY, led by continued loans growth of 8% YoY, while NIM improved 11bps YoY to 1.67%. Loan growth QoQ was mainly from term and housing loans, while YoY loan growth was broad-based across geographies as business regained momentum. UOB has lowered its guidance to mid-single digit loan growth for FY22e (previously mid to high single-digit).

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell