Japan-Weekly Strategy Report “Higher Japanese stock prices scenario envisioned under incoming BOJ Governor Ueda”

13 Mar 2023Report type: Weekly Strategy

Higher Japanese stock prices scenario envisioned under incoming BOJ Governor Ueda

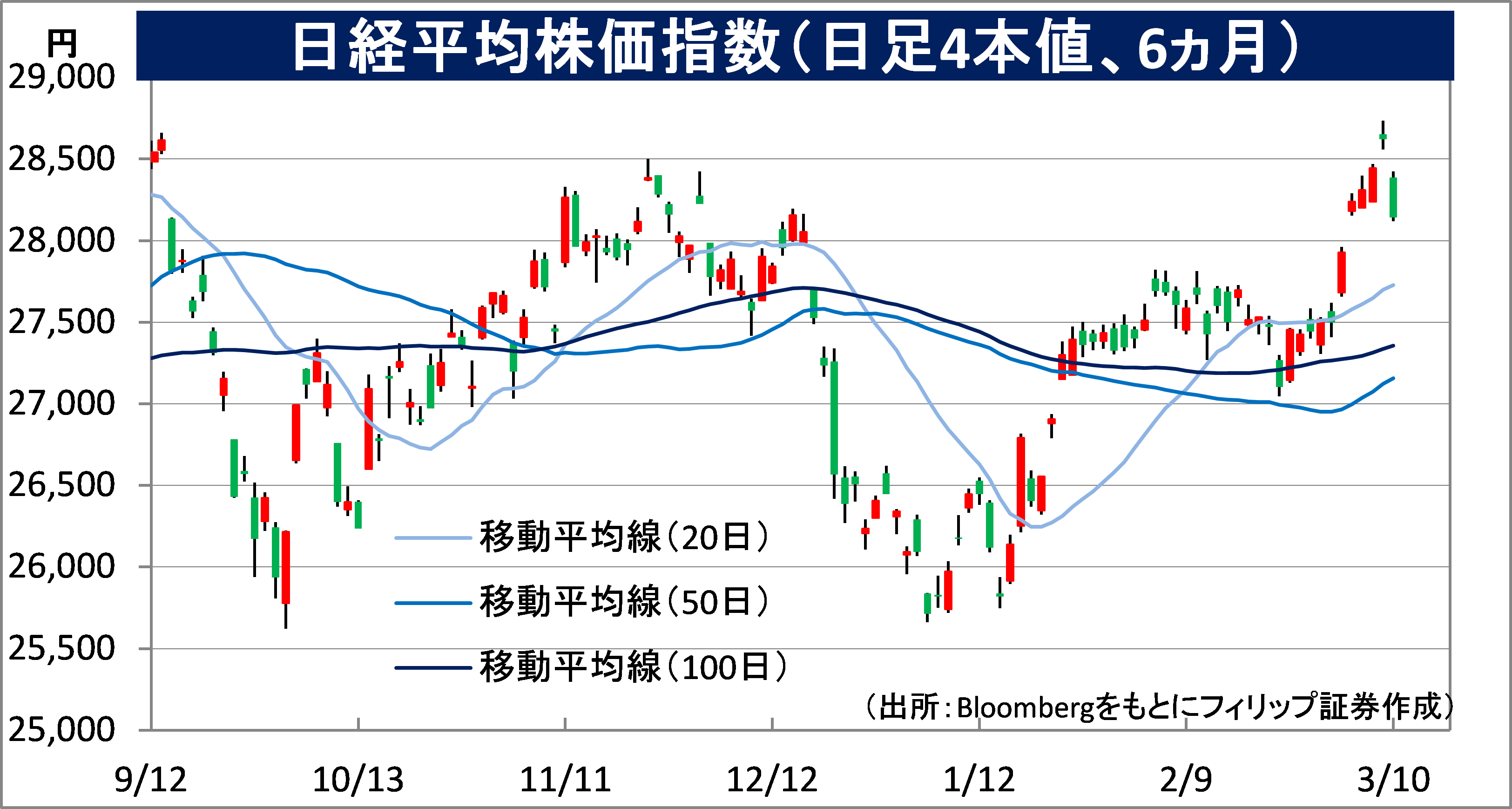

At its Monetary Policy Meeting on 10/3, the BOJ decided to maintain the status quo of its large-scale monetary easing measures centered on the Yield Curve Control (YCC) policy, which manages long- and short-term interest rates, and kept the allowable range of fluctuation in long-term interest rates unchanged at 0.5%. Being the last regular meeting attended by Governor Kuroda, some in the market were speculating about additional “surprise” policy revisions, but it is believed that it would have been difficult to make any decisions that would affect financial institutions’ March earnings.

However, as shown in the February edition of the “Bond Market Survey” released by the BOJ on 1/3, instead of monetary easing, the current YCC policy is bringing about increasingly adverse effects through the dysfunction of the bond market, such as difficulty in issuing and using corporate bonds, and this in effect can actually be seen as monetary tightening. The background to this is that the yield on the 10-year JGB has been sticking to the upper limit of the allowable volatility range due to upward pressure on long-term interest rates against the backdrop of the interest rate differential between Japan and the US.

At present, raising or abolishing the allowable range of fluctuation in long-term interest rates is likely to be viewed as a correction to monetary easing, leading to yen appreciation and stock price depreciation, with the exception of banking stocks, for which there are large impacts on earnings improvement through increased loan/deposit margins. Nevertheless, the market will gradually become aware of the “effective tightening” effect (adverse effect) of the YCC policy, and under the leadership of new Governor Ueda, the market will clearly become aware that the revision of the YCC policy will not lead to a correction of monetary easing. In this context, a day like 10/3 when bank stocks are sold on the “status quo” monetary policy is considered a good buying opportunity. A change in market attitudes toward the YCC policy accompanied by higher long-term interest rates and a stronger yen may lead to a shift towards buying of Japanese stocks.

In a strong yen and weak bonds (rising long-term interest rates) market environment, value stocks with low PBRs are likely to be more sought after than high-tech export stocks and international blue-chip stocks. In addition to the TSE’s strong request effective this spring for disclosure from “companies with persistent PBRs below 1x”, activists (vocal shareholders) are also playing a role in raising the stock price levels. Dai Nippon Printing (7912) announced in February its basic policy for its next medium-term management plan, which aims for a Return on Equity (ROE) ratio of 10% and a PBR of over 1x. The company also announced on 9/3 the outline of its new medium-term management plan for three years starting from March 2024, in which it plans to buy back approximately 300 billion yen of its own shares over a maximum period of five years, with the first buyback up to about 15% of its total outstanding shares taking about one year from 10/3. Elliott Management, an activist hedge fund, is a shareholder in the company. Seven & i Holdings (3382), which was strongly urged by activist US-based ValueAct Capital to spin off its convenience store business, is also poised to proceed with structural reforms, including withdrawal from Ito-Yokado’s clothing business.

In the 13/3 issue, we will be covering Asahi Kasei (3407), NPC (6255), Canon Electronics (7739), and Konami Group (9766).

Asahi Kasei Corp (3407) 973 yen (10/3 closing price)

・A general chemical manufacturer established in 1931. Operates three sectors, namely “Material” handling textiles, chemicals, and electronics businesses, “Homes” handling housing and building materials businesses and “Health Care” handling pharmaceuticals, medical care, and critical care businesses.

・For 9M (Apr-Dec) results of FY2023/3 announced on 8/2, net sales increased by 11.8% to 2.0404 trillion yen compared to the same period the previous year, and operating income decreased by 33.2% to 116.322 billion yen. Sales increased due to the depreciation of the yen and soaring prices of petrochemical products. Operating income decreased due to lingering semiconductor shortages, a slowdown in demand in China, soaring raw material and fuel prices, as well as a decline after a temporary increase in demand in healthcare in the same period the previous year.

・Company has revised its full year plan downwards. Net sales is expected to increase by 11.2% to 2.727 trillion yen (original plan 2.851 trillion yen) compared to the previous year, and operating income to decrease by 38.3% to 125.0 billion yen (original plan 177.0 billion yen). In addition, company announced on 8/3 that net income would fall to a loss of 105.0 billion yen (vs. a profit of 70.0 billion yen in the same period) due to an impairment loss of 185 billion yen in its battery insulation materials business in the US. The insulating materials business for electric vehicle batteries in the US is expected to benefit from the US Inflation Control Act that favors homegrown production.

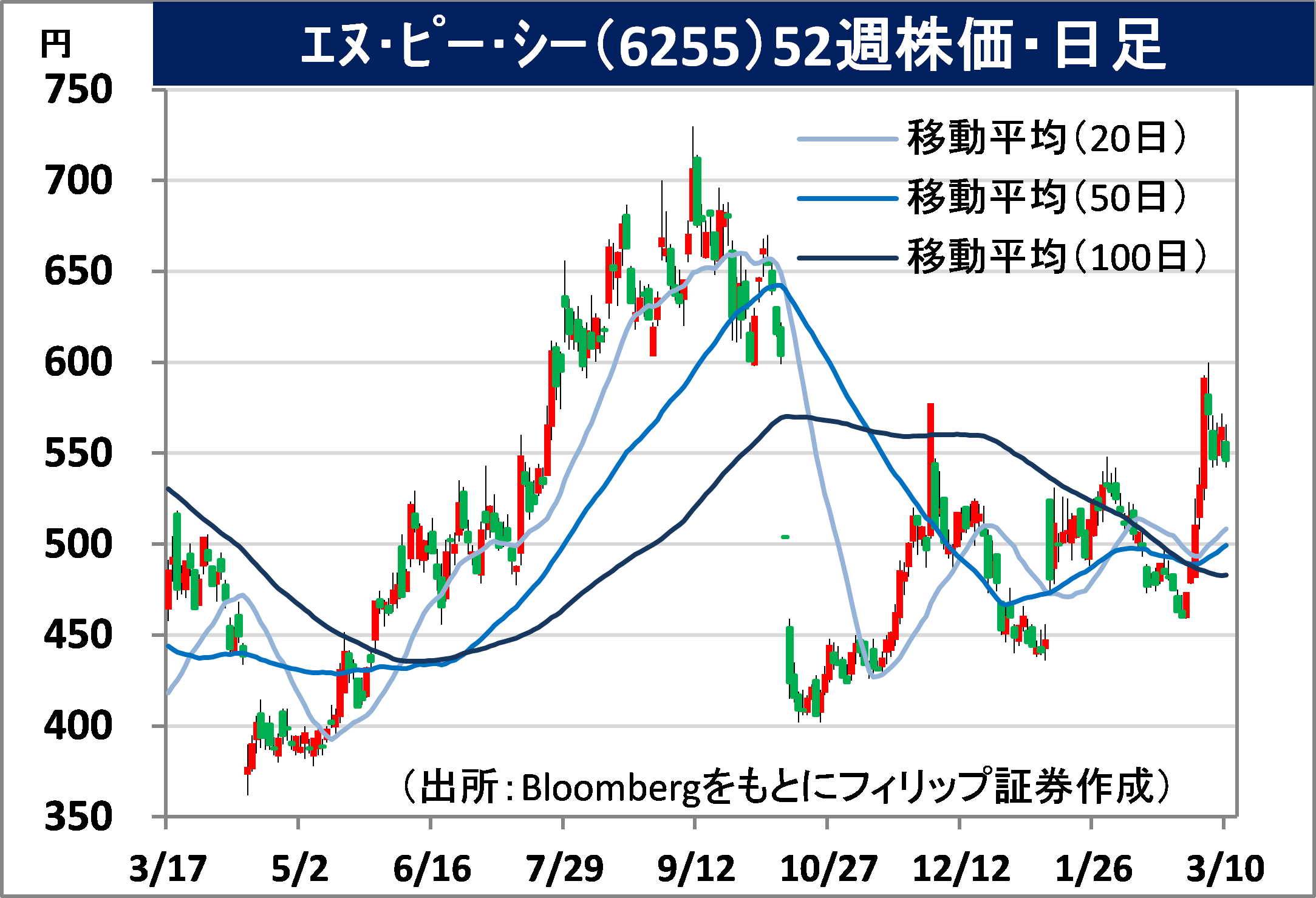

NPC Incorporated (6255) 546 yen (10/3 closing price)

・Established in 1992 as a vacuum packaging machine business. Currently, engaged in the equipment-related business of FA equipment for solar cells, automobiles, displays, and electronic components industries, as well as the environment-related business, which includes everything from solar panel inspection to disposal.

・For 1Q (Sep-Nov) results of FY2023/8 announced on 11/1, net sales increased by 14.7% to 798 million yen compared to the same period the previous year, and operating income deteriorated to a loss of 80 million yen from a loss of 18 million yen in the same period the previous year. Sales of the mainstay equipment-related business rose 24% YoY to 741 million yen due to growth in sales to US solar cell manufacturers. Overall gross profit margin declined 7.5 points YoY to 17.9%.

・For its full year plan, net sales is expected to increase 2.1x to 9.034 billion yen compared to the previous year, operating income to decrease by 44.7% to 342 million yen, and annual dividend to remain unchanged at 2 yen. Solar panel maker First Solar (FSLR) of the US, a major customer, revealed a solid outlook in its FY2023/12 forecast. The US Inflation Control Act allows manufacturers of power generation equipment manufactured in the US to receive tax credits. Moves by the Tokyo Metropolitan Government and others to mandate the installation of solar panels will also be a tailwind.

About the author

Phillip Research Team (Japan)

About the author

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)