Phillip Macro Update – Key Points for February FOMC Meeting

3 Feb 2023Event

The U.S. Federal Open Market Committee (FOMC) concluded its two-day meeting on the 1st of Feburary 2023. The meeting dicussed the Fed’s monetary policy stance and economic projection.

Key pointers to note in this meeting

- Interest rates – The US Federal Reserve (Fed) has increased its benchmark interest rate yet again, but this time by a modest 25bps to a range of 4.5% – 4.75%. This was in line with market expectation and was also being flagged out in the previous few speeches given by the board members. There was no dot plot graph being provided as it is published every quarter. The next dot plot graph will be available in the March meeting.

- Inflation remains elevated – Despite welcome data illustrating that the growth in recent months is starting to taper off, inflation still remains well above the targeted goal of 2%. (December Total PCE rose by 5% Y.o.Y; 0.5% M.o.M while core PCE which excludes food and energy prices rose by 4.4% Y.o.Y; 0.3% M.o.M). The Fed will require more substantial evidence that inflation is trending down sustainably before it could be confident in making any changes to its polices.

- Guidance – In terms of guidance, Fed chairman Jerome Powell said that there will be a couple of more rate hikes before reaching a level which the central bank deems is sufficiently restrictive. This, coupled with the indication of shifting to a slower pace, means that we will be facing a couple more similar-scale hikes in upcoming meetings and interest rates could be reaching a peak soon.

- Firm stands on keeping inflation well anchored – While it appears that the Fed policy actions may have taken effect and market are starting to price in for rate cuts at the later part of the year. We would expect that is it unlikely for a pivot to happen any time soon. As Chairman Powell stated that the disinflationary process is still at an early stage and the full effect of the tightening has yet to be felt, it is no time for complacency. Thus, the committee will be treading cautiously to prevent any premature loosening of policy.

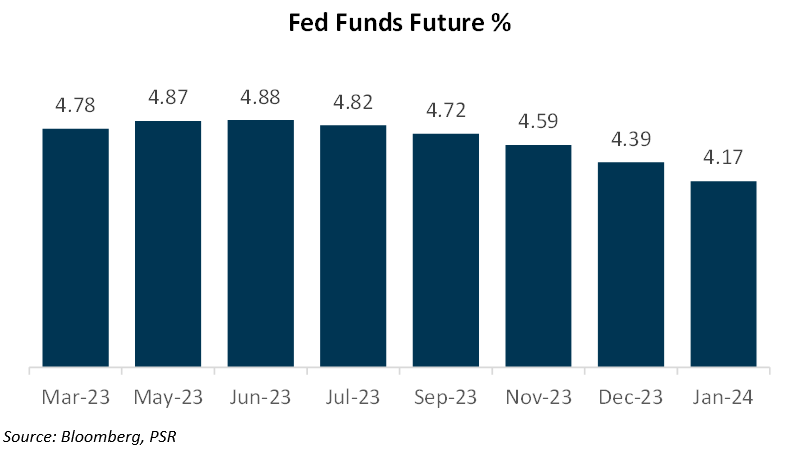

- Market expectation – In Figure 1, it is the Fed’s Fund futures which indicates what the market or speculators are pricing in for future rate hikes. It shows that the market is also expecting the interest rate to peak around the 4.8% region in June 2023, which is lower than what the Fed had projected in its previous meeting.

- Duration over size – At this current juncture, although that the Fed is signalling a less hawkish outlook, the bigger picture would be how long will this high interest rate environemt last rather than how much will the Fed be raising rates in the next meeting. As it seems like the market have ease a little, it may prompt revenge spending by the consumer. This in turn will result in higher inflation becoming entrenched.

Figure 1 : Fed Funds Rate Expected To Peak In June 2023

Point to ponder

As interest rates are coming to a peak very soon, investors who are more prudent may consider locking in their funds into US treasury bills which offer yields of 3.72% for the 20-year bills and 3.47% for the 10-year notes respectively (Yields are indicative as of 1 February 2023). US treasury bills are tradable on our POEMS platform. For more information please visit https://www.poems.com.sg/bonds/.

About the author

Shawn Sng

Research Analyst

PSR

Shawn is a credit analyst who handles bond analysis and research for the fixed income desk. He graduated with a Bachelor of Science in Banking and Finance from the University of London.

About the author

Shawn Sng

Research Analyst

PSR

Shawn is a credit analyst who handles bond analysis and research for the fixed income desk. He graduated with a Bachelor of Science in Banking and Finance from the University of London.

Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)