The Rise of ESG Investing

The Rise of ESG Investing

Investors used to make investments in companies based on financial performance. In the recent years, increasingly they look beyond profits and prefer investing in companies that align with their principles and values.

So… What Exactly is ESG?

ESG stands for Environmental, Social and Governance. The integration of ESG factors into investment policies, processes and practices helps measure the sustainability and ethicality of a company.

Environmental (E) includes climate risks and pollution.

Social (S) includes human capital issues and work place conditions.

Governance (G) includes business ethics and tax transparency.

Simply put, a socially responsible investor will decide to invest in a company based on ESG factors and steer clear of low ESG scoring companies. We believe that ESG factors will help investors assess the overall quality of a company and their financial performance in relation to the changing social and environmental issues.

Table 1: ESG Issues

| Environmental | Social | Governance |

|---|---|---|

| Climate change and carbon emissions | Customer satisfaction | Board composition |

| Air and water pollution | Data protection and privacy | Audit committee structure |

| Biodiversity | Gender and diversity | Bribery and corruption |

| Deforestation | Employee engagement | Executive compensation |

| Energy efficiency | Community relations | Lobbying |

| Waste management | Human rights | Political contributions |

| Water scarcity | Labour standards | Whistle-blower schemes |

Source: CFA Constitute, ESG Issues in Investing (2015)

Take for example, you may not consider investing in the tobacco industry because you have family or friends who developed illnesses due to smoking. In this scenario, you would probably want to invest your money in other industries.

Many investors realise that ESG investing helps to build a more sustainable future and mitigate some of the risks arising from climate change.

According to the 2015 Nielsen Global Corporate Sustainability Report, 66% of global consumers say they are willing to pay more for sustainable brands. How about Singapore? Well, a whopping 80% of Singaporeans stated that they are willing to pay a premium for products that contain environmentally friendly or sustainable materials.

Today, ESG is no longer just another fad, it has become mainstream and forms a core part of investment portfolios.

Creating Value with ESG Factors

“Can I invest responsibly and make money, too?”

In reality, many investors remain skeptical about ESG investing as they believe that it may result in loss of some returns. However, many studies have shown and recognised sustainable investing as a driver of long-term investment performance.

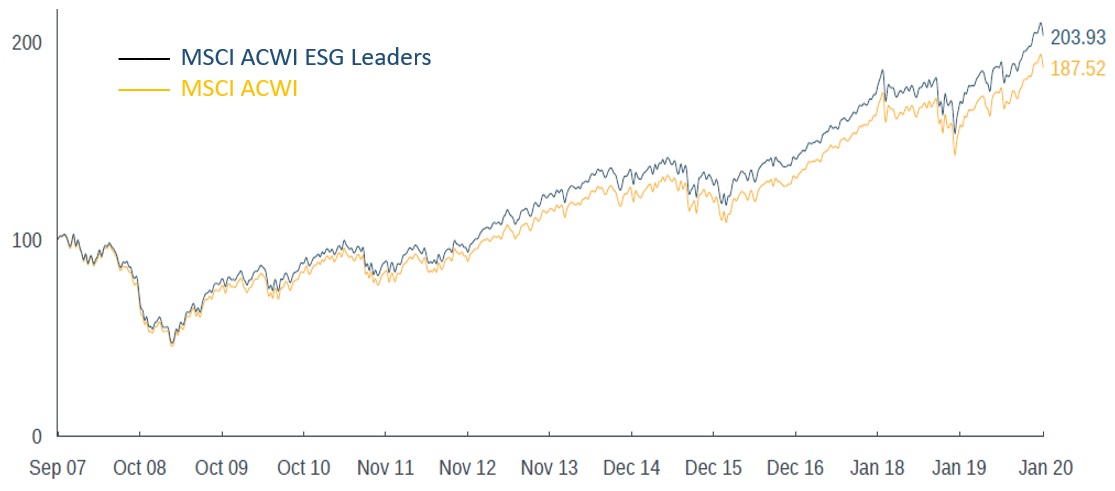

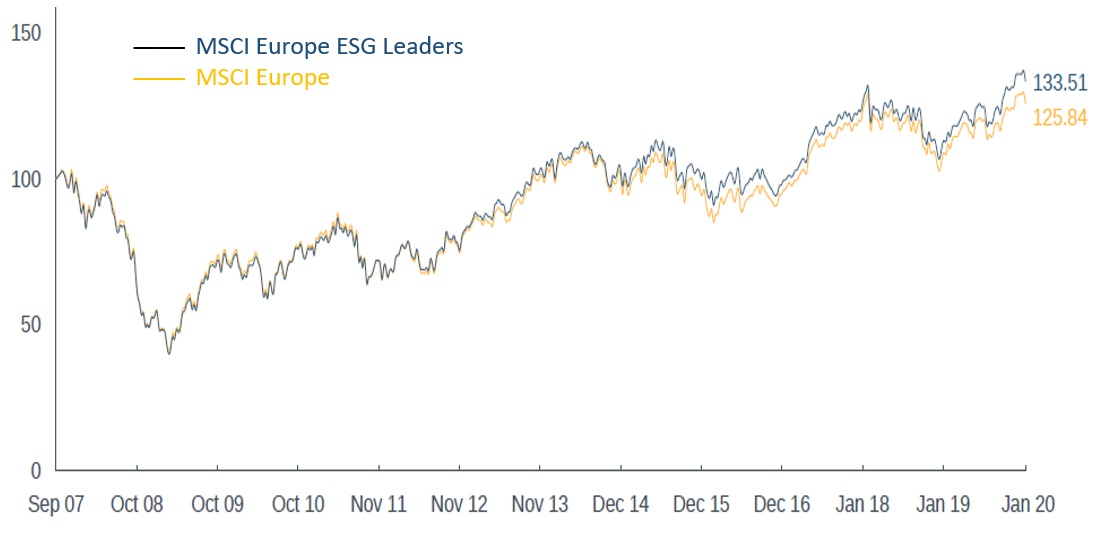

The MSCI ACWI ESG Leaders Index, MSCI Europe ESG Leaders and MSCI EM ESG Leaders, which provide exposure to companies with high ESG performance relative to their sector peers, generated better returns when compared with MSCI ACWI, MSCI Europe and MSCI EM for the period of Sep 2017 to Jan 2020. Thus, it is worth noting that integration of ESG factors into the investment portfolio may potentially enhance portfolio returns.

Chart 1: Cumulative Gross Returns (USD) of MSCI ACWI ESG Leaders and MSCI ACWI (Sep 2007 – Jan 2020)

Source: MSCI ACWI ESG Leaders Factsheet, 31 Jan 2020

Chart 2: Cumulative Gross Returns (USD) of MSCI Europe ESG Leaders and MSCI Europe (Sep 2007 – Jan 2020)

Source: MSCI Europe ESG Leaders Factsheet, 31 Jan 2020

Chart 3: Cumulative Gross Returns (USD) of MSCI EM ESG Leaders and MSCI EM (Sep 2007 – Jan 2020)

Source: MSCI EM ESG Leaders Factsheet, 31 Jan 2020

Strong Momentum Behind the ESG Investing Wave

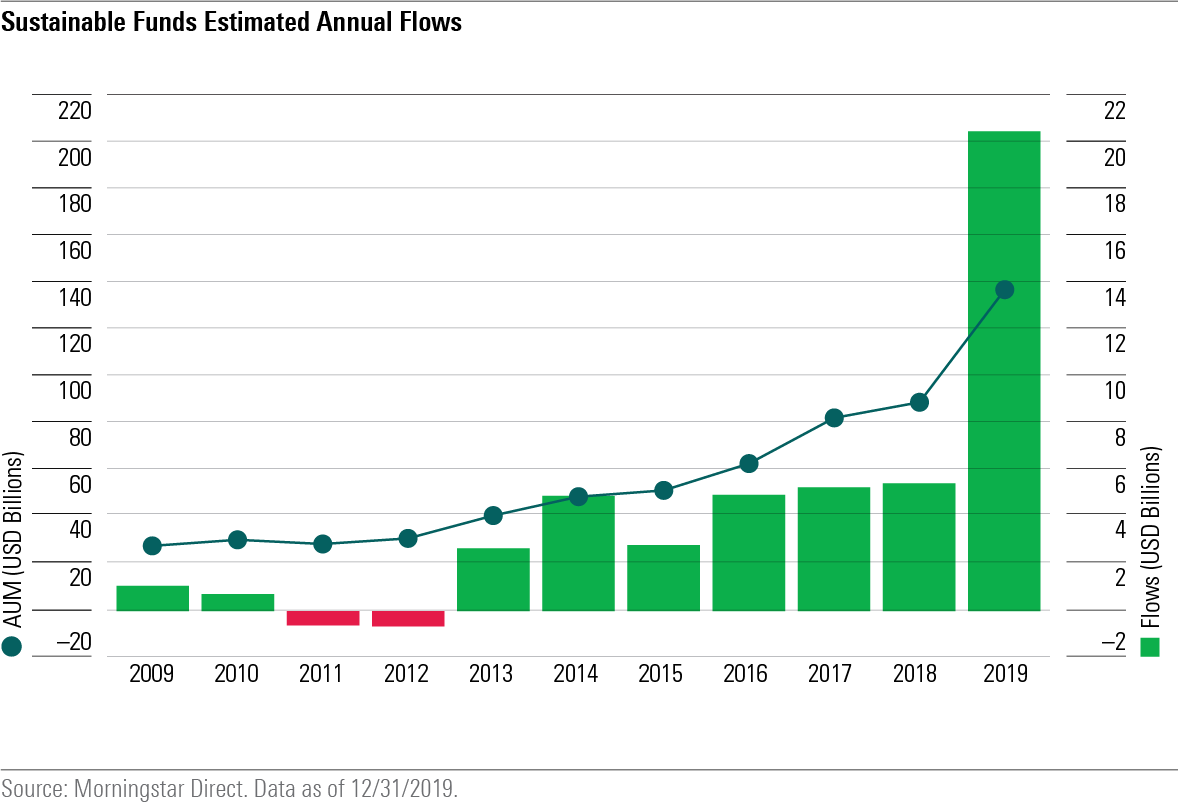

We found that investors have been putting in more money in ESG funds last year.

According to independent research company Morningstar, ESG mutual funds and exchange-traded funds saw a net inflow of $20.6 billion in 2019, which is almost four times higher than 2018.

Chart 4: Sustainable Funds Estimated Annual Flows

Source: Morningstar Article, “Sustainable Fund Flows in 2019 Smash Previous Records”, 10 Jan 2020

An Aspirational Set of Investment Principles

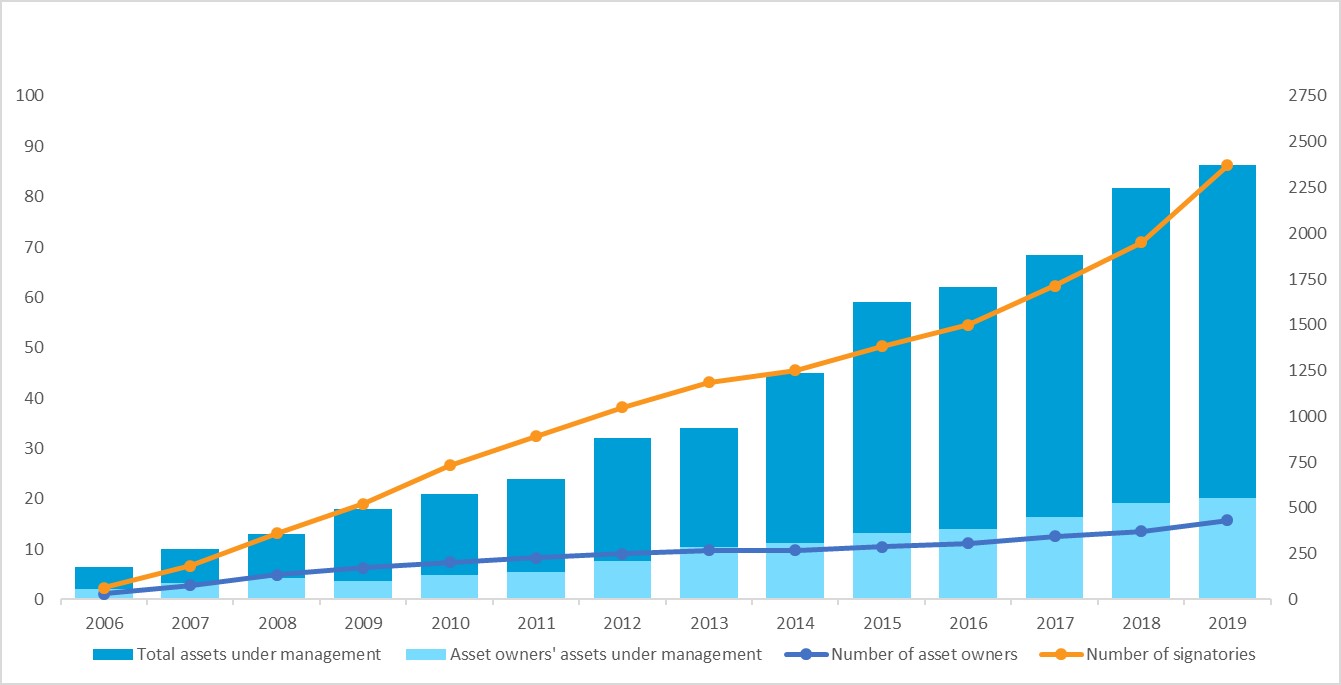

The Principles for Responsible Investing (PRI) is the world’s leading proponent of responsible investment. The UN-supported PRI is an international network of investors working together to put the Six Principles into practice. By joining PRI, investors are committed to incorporate ESG factors into their investments and ownership decisions.

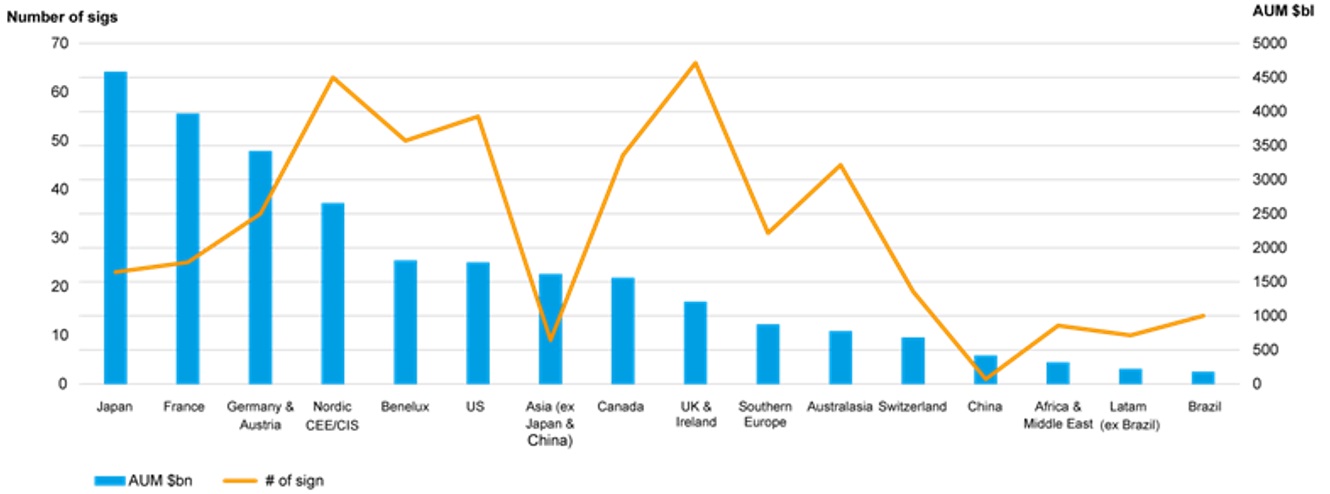

Today, PRI has a total of 2,372 signatories, with a total Asset Under Management (AUM) of USD 86 trillion. The largest asset owners at the PRI by AUM are based in Japan, France, Germany and Austria.

Chart 5: PRI’s Number of Signatories and AUM

Source: PRI Website, Data as of April 2019

Chart 6: AUM by Geography

Source: PRI Twitter, 28 Jan 2020

Beyond ESG

ESG factors not only help assess the competitiveness of a company, but also help investors avoid companies that engage in “irresponsible” activities. Investors mindful of these ESG factors may avoid investing in companies engaged environmentally unfriendly acts such as the BP’s oil spill disaster, Tokyo Electric Power Company’s Fukushima Daiichi nuclear disaster and Volkswagen’s emissions scandal.

Becoming a Better Investor

ESG investing plays an integral role in portfolio construction, risk management and performance attribution. This is accompanied by an increase in interest in companies that care about climate change.

“If we could produce better portfolio returns while being socially responsible, why not?”

If you want to ride on the wave of sustainable investing, investing in mutual funds is one of the most cost-effective ways to build a diverse ESG portfolio as fund houses will help to screen responsible companies according to ESG considerations.

Explore ESG Funds on POEMS!

Currently, we have 15 ESG-themed mutual funds on POEMS for investors who are seeking sustainable investment solutions. So, do check out the links below:

Disclaimer:

These commentaries are provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks including the possible loss of the principal amount invested. Unit trusts distributed by Phillip Securities Pte Ltd (“PSPL”) are not obligations of, deposits in, or guaranteed by, PSPL or any of its affiliates.

The value of the units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in this publication are not necessarily indicative of future or likely performance of any unit trust. You should read the prospectus and product highlights sheet before deciding to subscribe for units in the respective fund. A copy of the prospectus can be obtained from the issuer or PSPL, or online at https://unittrust.poems.com.sg/.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

This editorial has not been reviewed by the Monetary Authority of Singapore.