What are fixed-income funds?

Benefits of investing in fixed-income funds

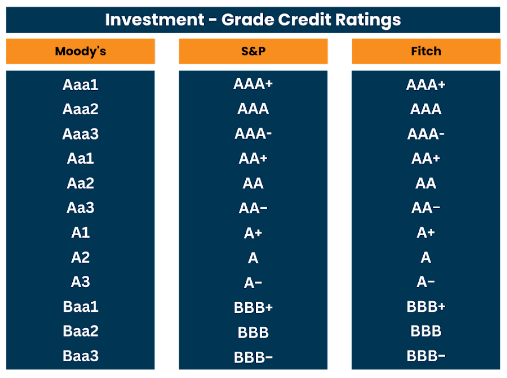

Diversification: Instead of investing in a single bond, a bond/fixed income unit trust gives investors diversification across multiple types of securities and regions. This means that if one of the many bonds in the unit trust defaults (missing an interest or principal payment), your Net Asset Value will not be as severely impacted as if you held onto a single bond. Professional Management: Fixed-income fund managers have the experience and knowledge to properly manage and analyse which assets to invest in. Leaning on these managers to find such investment opportunities saves investors time and effort to do their own research. As such, the reputation and track record of the fund manager should be considered when choosing which fund to invest in. Accessibility: There are some fixed-income tools that normal retail investors do not have easy access to. These could include government treasury bills, fixed income from less accessible markets, or quasi-sovereign bonds. Fixed-income fund managers would have relationships with bond issuers, underwriters, and brokers. These relationships give managers access to unique investment opportunities at better pricing. Income Generation: Fixed-income securities tend to pay a regular dividend, thus generating a regular stream of income for investors. By investing in a fixed income unit trust, investors could enjoy a monthly income stream compared to investing in a single bond. Most bonds only pay an income twice a year. Liquidity: Fixed-income unit trusts offer higher liquidity compared to individual bonds, as investors can typically buy or sell fund units on any business day. This flexibility allows investors to respond more promptly to changing financial needs or market conditions. Here are two features that you might find on the factsheet of a fixed income unit trust: Credit Rating: Credit ratings for a fixed income unit trust is an indicator of the credit worthiness of the overall portfolio of securities within the fund. Ratings or individual fixed income securities are assigned by independent rating agencies such as Moody’s, Standards & Poor’s and Fitch Ratings. Ratings from 'AAA' to 'BBB-' (S&P and Fitch) or 'Baa3' (Moody's) denote securities considered to have a lower risk of default and thus are considered investment grade. Ratings lower than what was stated earlier denote that the security is non-investment grade. The fund manager will then issue an average rating for the overall portfolio.

Duration: Duration for fixed income unit trust is the estimation of how much the price of a bond or a portfolio of bonds is likely to fluctuate in response to an interest rate change. It is expressed as a function of years. The longer the duration, the more likely the price of the unit trust will change when interest rates change.

Credit Rating: Credit ratings for a fixed income unit trust is an indicator of the credit worthiness of the overall portfolio of securities within the fund. Ratings or individual fixed income securities are assigned by independent rating agencies such as Moody’s, Standards & Poor’s and Fitch Ratings. Ratings from 'AAA' to 'BBB-' (S&P and Fitch) or 'Baa3' (Moody's) denote securities considered to have a lower risk of default and thus are considered investment grade. Ratings lower than what was stated earlier denote that the security is non-investment grade. The fund manager will then issue an average rating for the overall portfolio.

Duration: Duration for fixed income unit trust is the estimation of how much the price of a bond or a portfolio of bonds is likely to fluctuate in response to an interest rate change. It is expressed as a function of years. The longer the duration, the more likely the price of the unit trust will change when interest rates change.

Risk of investing in fixed income funds

Interest rate risk: Fixed income securities are sensitive to interest rate changes. When interest rates rise, bond prices typically fall, and vice versa. Fixed income funds holding long-term bonds may be particularly vulnerable to interest rate fluctuations, potentially impacting fund performance and capital. Credit risk: The risk that the issuer is unable to make timely interest payments and/or return the principal at maturity. Investing in funds that hold lower-rated (usually higher-yield) bonds may offer higher returns, but come with increased risk of default. It is important to do your own research and understand the regions and sectors a unit trust invests in, such as by studying the factsheet. Learn more about fixed income at our upcoming event! Hear from our partners, Fidelity International, Manulife Investment Management, and PIMCO, who will share their perspectives on fixed-income markets in 2024. Sign up for the event here! https://tinyurl.com/pz8yu3c5Conclusion

Fixed-income funds represent a fundamental component of a diversified investment portfolio, offering benefits like regular income, reduced risk, and professional management. While they are not devoid of risks, they play a crucial role in balancing portfolio performance across different market conditions. As with any investment, understanding the nuances of fixed-income funds and how they fit within your overall investment strategy is essential for achieving long-term financial success.How to select a unit trust

What life stage am I at?

When you are working, you'll find yourself in one of these three categories:

When you are working, you'll find yourself in one of these three categories:

- New to the workforce: As a newcomer to the workforce, you possess a longer investment runway. This advantage gives you the ability to compound your returns to greater effect. Short-term market downturns such as financial crises or global pandemics may impact your portfolio value, but the compounding effect is likely to compensate for these over time. At this life stage, you can afford to take on more risk and may consider investing in higher-risk unit trusts.

- Wealth accumulators: This is the phase of life where you should be approaching the peak of your earning potential. While you may be earning more as compared to a newcomer to the workforce, a black swan event (an unpredictable event with potentially severe consequences such as the 2001 dot-com bubble) during this phase could impact your overall ability to accumulate wealth or even cause you to dip into your savings. Your runway for wealth accumulation is also shorter by this time. Hence, it is prudent to adopt a more moderate risk level compared to the early stages of your career. to generate greater returns with more capital at hand albeit within a shorter time frame.

- Pre-Retirement/Retirement: It is crucial to assess your portfolio as you approach or enter retirement. Consider shifting your investments into less risky assets. Money market funds are an excellent option to ensure your funds keep up with inflation without undertaking too much risk.

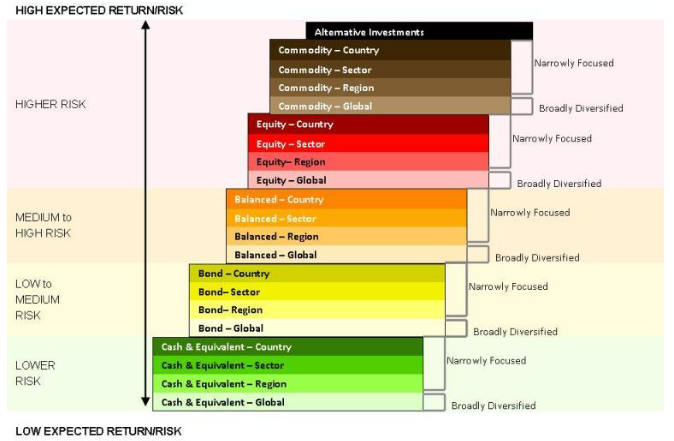

What are considered high risk funds?

The diagram above outlines the various types of funds along with their associated risk levels. This provides a clearer picture of the level of risk involved for each type of fund, allowing you to make informed investment decisions aligned with your risk appetite. However, look into each fund's underlying holdings to get a better sense of what you’re investing in.

An effective strategy to manage risk would be to construct a portfolio of different funds with an overall risk rating that you would be comfortable with in the long run. This topic will be explored in greater detail in an upcoming article.

The diagram above outlines the various types of funds along with their associated risk levels. This provides a clearer picture of the level of risk involved for each type of fund, allowing you to make informed investment decisions aligned with your risk appetite. However, look into each fund's underlying holdings to get a better sense of what you’re investing in.

An effective strategy to manage risk would be to construct a portfolio of different funds with an overall risk rating that you would be comfortable with in the long run. This topic will be explored in greater detail in an upcoming article.

How do I identify a high quality fund?

Past performance: While it is widely acknowledged that past performance is not necessarily indicative of future results, it can provide insights into how a fund manager has performed previously, especially during turbulent periods. Comparing the fund's performance with its benchmark index can reveal if it is delivering value relative to the market index. Additionally, you can also compare a fund against its peers, which will give you insights into the fund manager’s strategy and execution. A fund manager with a good track record over a long period of time could indicate that this fund manager has found a way to consistently outperform the market.

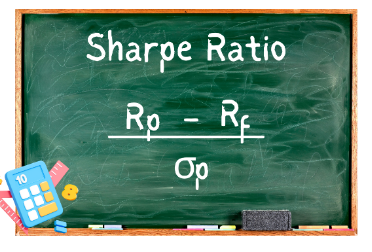

Rp = return of portfolio

Rf = risk-free rate

σp = standard deviation of the portfolio’s excess return

Risk-adjusted returns: The Sharpe Ratio is an excellent metric to measure how well a fund has performed against the risk it is undertaking. It compares the returns of an investment to the risk involved by dividing the returns in excess of the risk-free rate over the risk involved (which is measured by standard deviation). The higher the Sharpe Ratio, the better the fund has performed per unit of risk. However, there may be situations where a fund with a great Sharpe Ratio does not end up having the best overall performance. Consideration should be given to whether the potential for higher returns justifies the additional risk in a unit trust with a lower Sharpe Ratio but better performance. Fees and Expenses: High fees can significantly impact your returns over time. Every fund has an expense ratio, which you can use to compare to its peers. The higher the expense ratio, the more likely fees will erode your returns over a long period of time. Fund manager reputation: With 1194 registered and licensed fund management companies in Singapore, and 144 of them newly registered in 2022, the reputation of fund managers plays a crucial role in the selection process. Thorough research into the management company's reputation is essential. Holdings and Diversification: Fund managers provide factsheets that give investors a quick insight into a unit trust strategy as well as some of the holdings and geographical distribution of its overall holdings. Some even provide a breakdown of the overall type of companies they invest in, splitting them into categories such as IT, infrastructure, healthcare, financials etc. Assess the fund's exposure and ensure it aligns with your investment strategy and comfort level.Conclusion

While it is daunting to choose from the vast array of funds available, applying a thoughtful approach that considers your life stage, risk appetite, and investment goals can help you identify the funds that align with your financial goals. Remember, selecting the right unit trust involves more than just examining past performance or fund ratings. It requires a deep dive into the fund's management style, fee structure, and the diversity of its holdings to ensure it complements your investment strategy. As you explore the vast world of unit trusts, let your financial objectives and a well-researched strategy guide your decisions. Utilise tools like our fund finder to sift through the options and make informed choices. By approaching your investment with knowledge and strategic foresight, you'll be well-equipped to select unit trusts that not only meet your financial goals but also contribute to a stable and prosperous investment journey.Introduction to unit trust

What are unit trusts?

At their core, unit trusts are a form of investment where professional fund managers pool investors' monies together to invest in a diversified portfolio of assets. A typical unit trust consists of a variety of bonds, stocks, and other types of securities. Key terms associated with unit trusts:- Net Asset Value (NAV): Fund managers aggregate the value of all the different types of assets they have invested in and generate a Net Asset Value, or NAV, which signifies the value per unit of the fund. This provides investors with a convenient way to understand how their fund's underlying assets fare.

- Dividends: Many unit trusts distribute earnings to investors in the form of dividends, which can be a source of regular income. These distributions vary in frequency, from monthly to bi-annually and are calculated on a per-unit basis, contributing to the fund's appeal as a passive income generator.

- Investment strategy: Unit trusts employ various investment strategies to meet different investor goals and risk profiles. These strategies can range from fixed income and mixed assets to pure equity, with some funds also focusing on specific themes, such as environmental, social, and governance (ESG) criteria or technology advancements. Each strategy offers a unique approach to asset allocation and risk management, tailored to specific investment objectives.

| Equity Funds | Invest primarily in stocks |

| Bond Funds | Focus on investments in government or corporate bonds |

| Balanced Funds | Combine stocks and bonds for a balanced approach |

| Index Funds | Aim to replicate the performance of a specific market index |

| Specialised Funds | Invest in specific sectors, regions, or themes |

Advantages of investing in unit trusts

There are several advantages of investing in unit trusts, including the following:

- Diversification A key benefit of investing in a unit trust is the ease of investors’ diversification of investment holdings without having to invest in each asset individually. This diversity ensures that the impact of poor performance in any single investment is minimised, as it's offset by better performance in others within the fund.

- Professional management One of the key advantages of unit trusts is the expertise brought by professional fund managers, who dedicate their time researching and strategising the optimum way to generate returns for investors. The success of a unit trust heavily relies on the acumen and performance of its management team. As such, the most effective strategies and superior performance metrics naturally draw a greater number of investors. This dynamic creates a strong incentive for fund managers to continuously innovate and excel in their investment approaches, ensuring their funds remain attractive and competitive in the bustling investment landscape.

- Accessibility A significant advantage of unit trusts is their accessibility, primarily due to the low initial investment requirement. This affordability opens the door to diversified investment portfolios at a minimal cost, enabling investors to partake in a range of financial markets that might otherwise be challenging to access directly. The reduced financial barrier also empowers investors to adopt a consistent investment approach, contributing regular amounts to a fund and thereby leveraging the Dollarost Averaging (DCA) principle.

- Dollar-cost Averaging (DCA) Dollar-cost Averaging reduces price risk when investors buy stocks, ETFs, and unit trusts. Rather than buying only at one price, it involves investing at regular intervals, regardless of the price. This approach is useful for those who do not have the time or expertise to time the market to invest at a low price.

- Liquidity Most unit trusts come with daily dealing pricing, which means that investors typically do not have to worry about being unable to sell their funds. Buying and selling can easily be done on most platforms that offer unit trust as an investment option.

Understanding fees and charges when investing in unit trusts

Investing in unit trusts involves various fees and charges, essential for investors to understand before making an investment. These costs are typically outlined in the product highlight sheet for each fund. Here’s a breakdown of the common fees associated with unit trust investments:| Management fees | The management fee covers the cost of operating the fund and the fund managers’ expertise in managing it. It covers the strategic allocation of assets, ongoing analysis, and decision-making processes that contribute to the fund’s performance. |

| Sales charges | Sales charges are paid to the distributor (e.g., the platform on which you invest in the fund). These can be up to 5% of your investment amount. Enjoy 0% sales charge when you trade unit trusts on POEMS. |

| Performance fee | A performance fee is paid to the investment manager for generating returns above the benchmark. |

| Platform fee | This fee is charged by the trading platform and can range from 0% - 3% of your holdings. Enjoy 0% platform fee on POEMS. |

Understanding the risks involved in unit trusts

Investing in unit trusts, like all investment vehicles, comes with its set of risks that could lead to fluctuations in the value of your investments. Below are some of the risks that investors might face:

Investing in unit trusts, like all investment vehicles, comes with its set of risks that could lead to fluctuations in the value of your investments. Below are some of the risks that investors might face:

| Market risk | Economic downturns, political instability, or global events like pandemics are all examples of events that could lead to potential investment losses. |

| Currency risk | Fund managers invest across geographies and currencies. Hence, the weakening of an underlying currency relative to the investor’s currency can reduce the value of the investment when converted back. |

| Interest rate risk | When interest rates rise, the value of bonds typically drops, and the opposite applies when interest rates drop. These can affect the NAV of fund s exposed to bond and fixed-income instruments. |

| Managerial risk | While fund managers strive to achieve the best possible performance, poor investment choices or strategies still occur. Researching the underlying fund manager’s track record and investment philosophy is important for investors to feel more at ease with parking their funds with a fund manager. |

Conclusion

Unit trusts are a convenient and diversified way for investors to gain access to financial markets. They provide an avenue for individuals to partake in a broad range of investments backed by the expertise of professional fund managers. However, as with any investment, due diligence, a clear understanding of one's financial goals, and an awareness of the associated costs and risks are paramount. For those looking to navigate the investment landscape, unit trusts offer a compelling starting point or addition to a well-rounded investment portfolio. Trade unit trusts on POEMS! Open an account here: https://www.poems.com.sg/open-an-account/Where did the dragon go? A summary on the China market in 2023.

Sign up for the China & Asia: Market Outlook for Q1 2024 event here: http://tinyurl.com/2cast5d7

Phillip Capital Management – Outlook 2021, CIO, Jeffrey Lee

Phillip Capital Management – 1H2020 Review of Phillip Singapore Real Estate Income Fund [INSIGHTS RELEASE]

Overcoming Volatility with Regular Savings Plan

Overcoming Volatility with Regular Savings Plans (RSP)

Other than asking what to invest in and how to invest, investors are also often concerned about having sufficient funds to invest and finding the right time to invest.“As investors, there are times when we are fixated about timing the exact peaks and bottoms of the markets.”

However, timing the market is extremely difficult, especially during such volatile times.Time in the Market is Better than Timing the Market

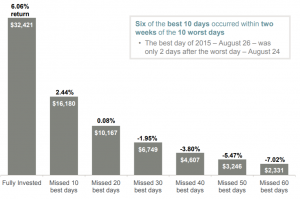

Let us show you why time in the market is important with the example below:

Chart 1: Performance of a $10,000 investment in S&P 500 from 3 Jan 2000 to 31 Dec 2019

Let us show you why time in the market is important with the example below:

Chart 1: Performance of a $10,000 investment in S&P 500 from 3 Jan 2000 to 31 Dec 2019

Source: JP Morgan’s Guide to Retirement 2020

Assuming in year 2000, you had $10,000 to invest.

If you stay fully invested in the S&P 500 for 20 years:

Source: JP Morgan’s Guide to Retirement 2020

Assuming in year 2000, you had $10,000 to invest.

If you stay fully invested in the S&P 500 for 20 years:

- Your portfolio returns would be 6.06%

- Your portfolio value would have increased to more than $32,000 at the end of the 20-year period.

- Your portfolio returns would have reduced to 2.44%

- Your portfolio value would have increased to approximately $16,000 only.

Don’t Let Emotions Affect You

“Then, there are emotions, and emotions are tricky.”

Decisions by emotions are usually impulsive and not based on information gathered. Investment decisions based on emotion – such as fear – is the main reason why many people are buying at market tops and selling at market bottoms instead. Remember, having personal feelings for your investment will not improve your winning probability, but a longer investment horizon will.So, what now?

Fret not!“RSP(s) can help you to overcome these two stumbling blocks -

Time and Emotions.”

Instead of trying to perfectly time the market, you can have time in the market by adopting Dollar Cost Averaging (DCA). Diversify your risk by taking advantage of DCA, buy more unit trusts when prices are low; buy less unit trusts when prices are high. This enables you to smooth out the returns and also reduce the stress in investing as you will not be required to decide whether it’s the right time to invest. Here’s how it works: Assuming Amy and Bob have $300 each to invest. Amy chooses to invest all $300 in January and receives 30 units at $10/unit. Bob however, chooses to invest $100 monthly into an RSP. Here’s the calculations for Bob’s investment:| January | February | March | |

| Amount Invested (a) | $100 | $100 | $100 |

| Price/Unit (b) | $10 | $5 | $8 |

| Units Received (a÷b) | $100 ÷ $10 = 10 | $100 ÷ $5 = 20 | $100 ÷ $8 = 12.5 |

| Amy’s Investment | Bob’s Investment |

| Unit Price: $10/unit | Average Unit Price (Total Price ÷ No of transactions) $(10+5+8) ÷ 3 = $7.67/unit |

| Cost of Investment: $10/unit | Average Cost of Investment (Total Cost ÷ No of Units purchased) $300 ÷ 42.5 = $7.05 |

| Total Units Received: 30 | Total Units Received: 42.5 |